SoFi Technologies: A Tech-Savvy Banking Giant In The Making

Summary

- SoFi Technologies has experienced significant growth despite recent banking crises and the US government's moratorium on student loan repayments, with its stock price increasing year to date.

- The end of the student loan moratorium in September 2023 is expected to further drive up SoFi's stock price as the company continues expanding its business and experiences a potential increase in refinancing.

- SoFi is incorporating ESG values into their operations, launching the SoFi ESG Committee, and promoting environmental stewardship programs and anti-corruption policies.

Daenin Arnee

Introduction

SoFi Technologies (NASDAQ:SOFI) is a San Francisco-based American fintech company that operates as an online personal finance company and online bank. It offers a range of financial products and services through mobile apps and desktop interfaces. These include student and auto loan refinancing, mortgages, personal loans, credit cards, investing, and banking solutions. Despite recent cases of banking crisis followed up by the US government's moratorium on student loan repayments, SoFi’s stock has seen incredible growth, with its share price increasing 112% year to date. SoFi is rapidly expanding nearly every segment of its business. As a result, SoFi is well-prepared to withstand macroeconomic conditions and maintain a favorable position in the market.

Company Overview

SoFi has four main business sectors. A lending unit, a technology platform featuring the “SoFi” app, a financial services arm that offers various trading and advisory solutions, and an insurance arm. It is important to note that the major source of revenue for SoFi is the lending service. For instance, 99% of revenue in 2019 was from lending. While having lending service at its core, SoFi’s business is trying to attract more customers through its user-friendly, intuitive digital platform.

Industry Overview

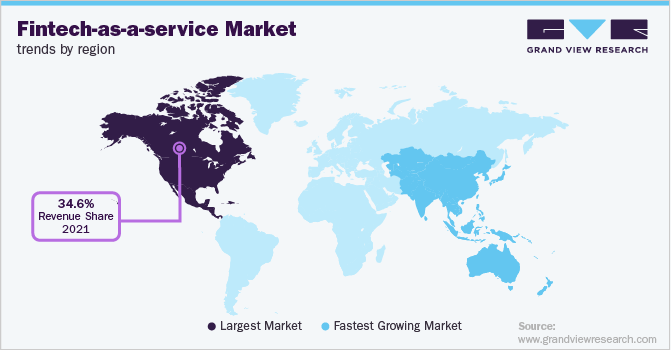

SoFi is in a high growth market, as the global Fintech-as-a-Service (FaaS) market is currently expected to grow at a 17.2% CAGR from 2022-2030, with the US market also growing at a similar 16.4% CAGR. Also, speaking to the technology sector of SoFi directly, the digital banking platform will be a $16.39 billion market in 2030, growing at a 13.8% CAGR.

Grand View Research

Competitive Analysis

SoFi’s most distinctive characteristic is its attempt to challenge the status quo in the financial industry by providing a customer-friendly, attentive digital banking service. It leverages data-driven insights, aiming to meet individual needs and enhance the consumer experience as a whole. SoFi’s strategic approach is to employ a vertically-integrated platform, which not only supports its day-to-day operations but also enables it to deliver superior services to its members. SoFi presents itself in the market as a one-stop shop, which can cater to the evolving needs of its customers, from any age and region.

Financials

SoFi had a relatively great quarter. In 1Q23, SoFi’s net revenue reached $472 million, increasing 43% YoY. For sales, SoFi attracted over 433,000 new members and sold nearly 660,000 new products, its quarter-end total members and products both increasing approximately 46% YoY. SoFi’s substantial increase in its revenue, along with its far more modest 15% YoY increase in operating expenses led to decreased overall loss for the company, falling 70% YoY. Analysts suggest that with increasing revenue and decreasing costs, SoFi is expected to experience a gradual increase in its profitability over the year. The management is expected to be profitable by 4Q23.

Key Catalyst

The potential end of the student loan moratorium in September 2023 is the key catalyst for further driving up SoFi’s stock price. Even under the unstable business environment caused by the combination of anti-bank macroeconomic conditions, the Biden administration’s extension on student loan moratorium, and the recent debt-ceiling deal surge, SoFi’s stock price has risen 15% since the start of June, and it is experiencing approximately 112% year to date increase. Yes, this is a good sign, yet it is important to note that SoFi’s share price continues to experience a decline of around 73% from its peak reached in February 2021.

However, with the end of the moratorium starting in September, the SoFi stock is expected to get closer to its historical high as the company continues expanding its business and experiences a potential increase in refinancing. The return on student loan refinancing has the capacity to generate substantial revenue and EBITDA growth for SoFi, surpassing the predictions of industry analysts. All in all, it is a safe bet that SoFi’s continuous growth would be accelerated by favorable changes in political situations, bringing up SoFi’s revenue and stock price hand-in-hand.

Valuation

SoFi stock has an incredible prospect with the tide of favorable political macroeconomic conditions such as end of student loan moratorium and the potential downward trajectory of interest rate. Analysts expect that SoFi’s revenues will grow at 25.88% CAGR. Yes, according to the consensus, the stock is currently being traded at a relatively steep price of $9.54 with its average price being $7.73. However, considering mid-to long-term, SoFi stock remains a strong buy (if not, still a buy).

ESG

SoFi is moving towards incorporating ESG values into their operations. In 2022, SoFi launched the SoFi ESG Committee, a 10-person body dedicated to serving ESG practices of the company. The company’s most notable ESG program is in its employee demographics. As of 21Q4, approximately 41% of SoFi’s global workforce consisted of female individuals, and in the US, 53% of our workforce comprised individuals who either identify as underrepresented minorities ("URM") or belong to an underrepresented group ("URG").

The company is also making strides for the “E” and “G”, by promoting environmental stewardship programs and publishing anti-corruption policies in all levels of the organization.

Risk

SoFi exhibits promising growth potential in both its banking and technology ventures. However, the company lacks a distinctive element in its offerings that can be viewed as a significant competitive advantage within the financial services sector. For its digital banking platform, it uses a technology platform called Galileo, which other competitors in the industry also have easy access to. In order to mitigate this risk, SoFi must take a more unique approach either in its technology, design, or services to make their product more attractive to consumers.

Additionally, the fintech/digital banking industry features relatively low barriers to entry and limited product differentiation, which is a reality that SoFi acknowledges. This is why SoFi strives to set itself apart by providing superior customer service compared to its competitors. However, this approach may result in fostering long-term relationships with its members, it is simply not sufficient to establish SoFi as a leading industry player in the long run.

Conclusion

SoFi’s growth is promising. Its member and product growth was at 46% in 1Q23, as more people signed up for its lending (up 15%) and financial services (up 51%) products. Yes, the current political and economic conditions might not be favorable, and the company is not yet profitable. However, SoFi managed to triple its revenue without its core student loan product even during the moratorium, which proves SoFi’s strong management capability and adaptability. Even more, with the upcoming end of the moratorium and easing macroeconomic conditions, SoFi’s future seems more than promising. It is a buy with strong expansion potential.

Analyst Recommendation By: Kyeongmook Lee

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.