Investors Should Not Live In Fear Of A Recession

Summary

- The article discusses reasons why investors should stay invested in the stock market despite the potential for a recession in the near future.

- Historical data shows that large-cap stocks can perform reasonably well during a recession, and there are several factors that could push stocks higher even if economic growth turns negative.

- Investors should consider their own risk tolerance and portfolio composition, focusing on quality large-cap, dividend-paying companies that tend to outperform during different economic cycles.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

miniseries/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the broader macro-backdrop with a notable focus on the U.S. economy. This is because most of the readers here are U.S.-oriented, as I am, and have been inundated over the past year (if not longer) of messages/headlines of an impending recession. To be frank, I am not unaware of these risks, which is why I constantly shift to a more risk-on, risk-off mindset as the market swings in both directions.

This is relevant now because looking ahead to the second half of the year there is a growing chorus of voices on the "recession" mantra. While I am not going to proclaim I know when a recession will (if ever) begin and end, I will focus on reasons why investors should stay invested regardless of these expert opinions. The fact is that the U.S. could either avoid a recession all together or experience one in an environment that isn't necessarily terrible for stocks.

While this may sound counter-intuitive, there are a host of reasons why large-cap stocks can actually perform reasonably well during a recession and that is going to be the focus of this review.

Disclaimer - Know Your Own Risk Tolerance

Before getting to the reasons for staying invested, I want to lay a few key points out. One, each individual needs to know their own risk tolerance in these types of situations. For me, it means being roughly 30% cash until we see a marked drawdown, buying in, and then returning to a hefty cash position when prices rebound. This may seem too risk-off for some, but remember that means I am roughly 70% (or more) invested at any given time. That leaves my net worth highly susceptible to market movements, but is the right balance for me personally.

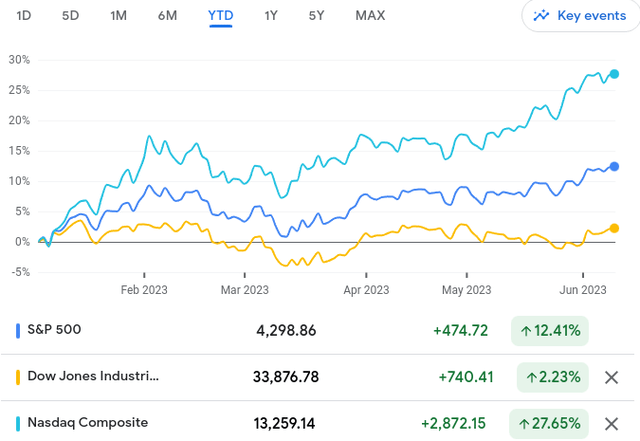

I bring this up because recessions can be quite painful. One would not want to be over-extended if they cannot afford to be wrong and face a disproportionate downward swing. This is especially true since 2023 has already seen some sharp gains. While I will touch on how the "average" recession impacts stocks - there is no telling this one will be average. If gains hold up in the short-term, we are looking at entering a recession when large-cap indices are up YTD:

YTD Index Performance (Google Finance)

What I am getting at here is the markets have been ripe for a fall anyway given how strong these gains have been, especially within the S&P 500 and the NASDAQ. A potential slowdown in growth - real or just predicted - could be the type of catalyst investors need to start taking some profit. Very reasonable assumption, so taking a more risk-off approach makes plenty of sense in this environment.

Still, bull markets often drive more gains, and there are factors that could push stocks higher even if growth turns negative. I will take these in turn below.

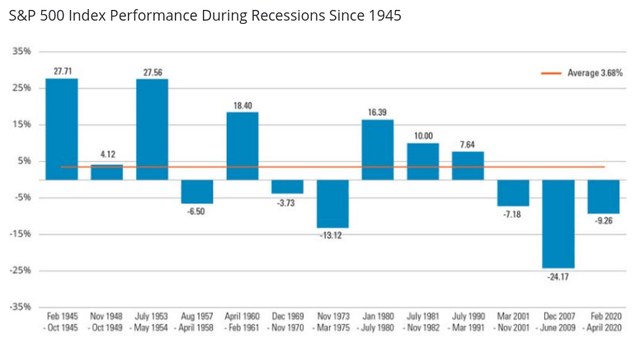

Returns Are Mixed During Recessionary Periods

I will now shift to what to expect during a recession with the S&P 500 as the benchmark. Helping to understand past performance is just one piece of the puzzle. This in no way guarantees future results, and every economic cycle is different. With this understood, it is still illustrative to put past recessions in perspective. This helps to set the expectation for why I do not believe I am off the mark when saying investors should stay the course through this cycle. To understand why, we should note that the average gain for the S&P 500 is over 3.5% during a recessionary period. And the fact is that stocks have actually posted positive returns more often than not:

S&P 500 Performance During Recessions (The Hartford Group)

There are a few key takeaways from this graphic. One, it is clear that selling off to avoid a recession is not always the prudent move. Investors can miss out on some pretty hefty gains. But two, there are some major drawdown periods as well. This is where the risk-reward balance comes in to play. How comfortable are you with your current allocation? Can you handle a decline of 20% (or more) in your positions? Do you have cash on hand to take advantage of those drawdowns? All important questions to deciding whether or not to be mostly (or fully) invested during the upcoming recession.

The point here is that there are clear risks to equity investors when the economic cycle goes negative. But those risks are often outweighed by the potential rewards. Recessions are not an automatic precursor to stock market losses, so readers should at the very least get some confidence from understand this historical exercise.

Why Don't Stocks Drop During Recessions?

I will now focus on the why behind this performance. This is critical because it will help readers decide if the expected 2023/24 recession will indeed be one where we see more equity gains, or if it is going to result in one of those painful drops that investors do fear.

There are a number of reasons why stocks can post gains during economic weakness and I am unlikely to touch on all of them here. But I am going to highlight a few important ones that should give readers a more level-headed mindset for the second half of the year.

1. Stocks already dropped in anticipation

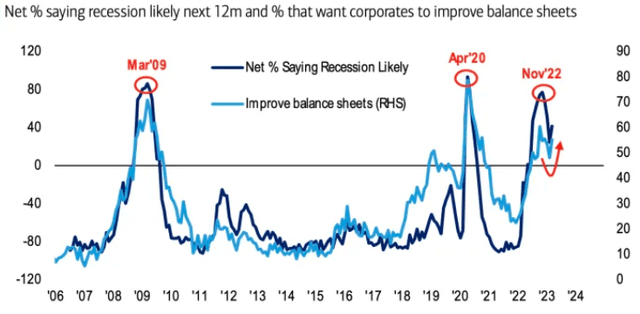

This is one of the most important elements for understand stock performance in my opinion. As we should all know by now, recessions don't just happen by surprise. There is often a lot of chatter in the news media, economists, and among professional investors on the probability of a recession well before it happens. I can certainly attest to this as I have worked in the Financial Services industry since 2008. And this time around is no different, with lots of surveys and models coming out almost daily like the one shown below:

Investor Sentiment Survey (Bank of America)

What this tells me is that investors could be getting recession anxiety well before it happens. This can lead to selling or disproportionate pessimism that pushes stocks down well before an official recession begins. Then, as the recession takes hold, the pain that has already occurred begins to reverse as investors look towards a brighter future.

This is why we often see that buying during the worst of times plays out well. When times are bleak, many have already sold going in to it. Buying then - with a forward outlook - assumes that the investment landscape will improve in the future as it pretty much always does (in the U.S.). Unfortunately, given the gains we have seen in 2023, this may not turn out to be the best example this time around, but it does help explain why a recession does not always translate in to equity losses.

2. Companies cut costs in anticipation

We have to also remember that equity prices are impacted by actual earnings. What I mean is - economic projections and realized GDP moves are important indicators but are no substitute for how much cash companies are actually making. The fact is that cash is king in most cycles - especially difficult ones. Fortunately, when difficult times are so widely telegraphed it gives corporations plenty of time to adjust. We have to also remember that "stock market gains" are referred to as the S&P 500 for most illustrative examples. For the most part these are large-cap companies (all U.S.-based) that have been around a while. They are more time-tested than the average company, have adequate access to capital and liquidity, and are well versed in adjusting to market realities.

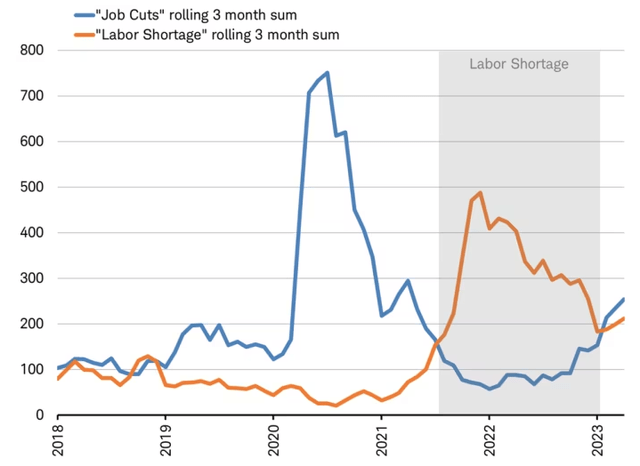

What this sums up to is that many companies have already begun to adapt to tougher times ahead - and that often improves the bottom-line. This can counter-balance a drop in investor enthusiasm by improving the "E" portion of the P/E equation. Perhaps the multiple investors want to pay declines, but if earnings get a boost from cost cutting, that can act as a partial offset. This is relevant to the 2023 recession discussion because we are seeing that play out already across corporate America with job cuts leading the way:

Job Cuts Moving Sharply Higher (Charles Schwab)

Of course, job cuts are not the only way a company can reduce expenses - but it is a big one and one that is ongoing at the moment. This has no doubt helped shore up equity prices in the near term as investors are encouraged by the proactive approach taken by management teams across the country. If a company can head in to a difficult environment with a leaner, more efficient enterprise, they can often ride out the storm. With history as a guide, this seems to be a backdrop I could see playing out again.

3. Flight to quality: That often means U.S. large-caps

My next point concerns what investors want during a challenging time period. What I mean is - money has to go somewhere. Even if one is concerned about economic activity, they are unlikely to go all to cash. They may want to sell some stocks, sure, but which ones? Often they are going to sell the more risky, cyclical, or under-performing areas of their portfolio. Then there is often a flight to quality - this is where large-cap U.S. stocks fit in.

What I mean by this is that large-cap U.S. stocks often are the quality. This is fundamental to understanding why "stocks" go up in recessions. When "stocks" are referred to as the S&P 500 (as the opening graphic showed), we need to put that in perspective. That doesn't include small caps, non-US stocks, or even many newly established companies. To be included in the S&P 500 a company needs to be one of the largest companies listed on stock exchanges in the U.S. - not an easy feat!

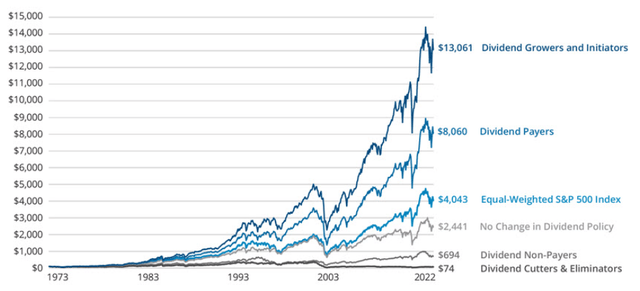

This is why being overly critical on your own portfolio is essential here. Don't get complacent with the "stocks often go up" mantra during recessions if your portfolio is riddled with risky, highly leveraged, or unprofitable companies. This mantra is defined by the S&P 500 - quality companies that often pay dividends. These are companies that tend to out-perform over time regardless of the economic cycle:

Stock Performance By Dividend Characterization (S&P Global)

What I want to drive home here is that readers need to understand what they own versus what the "market does" during different economic cycles. When illustrations show the "market" going up - that "market" may be vastly different than what an individual investors holds! In that vein, understand that equities rising often means large-cap, dividend-paying, and quality companies are the ones that see their stock prices rise.

**I own three dividend ETFs and have been adding to them in anticipation of a recession for precisely this reason. Those funds are the iShares Core Dividend Growth ETF (DGRO), SPDR S&P Dividend ETF (SDY), and Schwab U.S. Dividend Equity ETF (SCHD).

4. Commodities Drop, Supporting Consumer Activity

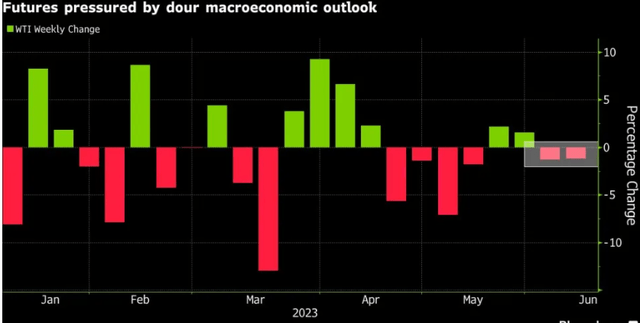

My final thought looks at market developments outside direct corporate performance to help understand why stocks don't always fall in tough times. One reason is that difficult economic circumstances means commodity prices fall. The idea being - if economic growth is going to slow or contract, the use of commodity and energy inputs will similarly decline. This pushes down commodity prices, which is something we are already seeing today as oil has been moving consistently lower over the past two months:

The begs the question - how is this "good"?

The answer isn't that this is truly good, but rather what this can mean for other sectors. Notable mention here is Consumer-oriented areas, with a specific focus on discretionary areas. The logic being that even though economic conditions are difficult, consumer spending can hold up well if commodity prices have similarly dropped and therefore resulted in lower prices for end consumers. With the U.S. economy so heavily dependent on consumer spending, this is not to be ignored.

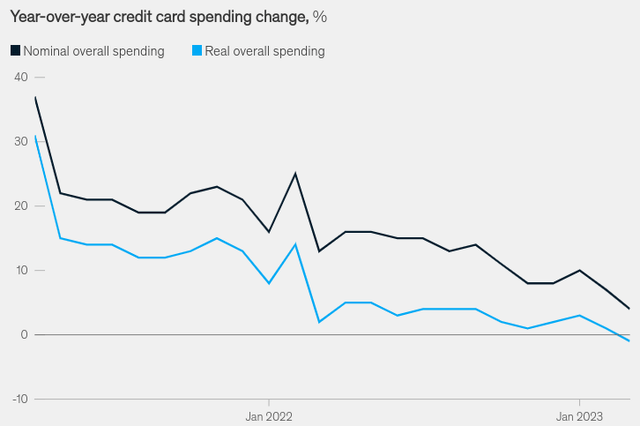

I see this as a big wildcard for the months ahead. This is because we are starting to see inflation and a softening job market catch-up with consumers. Credit card spending has started to contract on a year-over-year basis (in real terms):

YOY Credit Card Spending Change (US) (McKinsey)

My thought here is consumers will need some catalyst to keep driving this economy forward. That could be a shift in tone from the Fed, an improving job market, or a marked drop in inflation - which could be the result of a decline in commodity prices. With oil prices dropping of late, that could show up in consumer prices in the months ahead, providing a tailwind for the sector.

Bottom-line

A recession could very well be on the way but I would make the argument to not make significant moves in anticipation of it. I have always recommended a tilt towards quality - and that is amplified when economic conditions get more difficult. But for those who generally focused on developed (especially U.S.) large-caps that pay dividends, there isn't much to change when recession chatter escalates.

In fact, if anything, quality investors should limit their moves for the time being. Allow those who are short on quality to bid up our existing holdings while they come around to this time-tested strategy. While nobody knows when a recession will begin and what the ultimate impact on stocks will be, we should remember there is plenty of risk to being out of the market as well. Therefore, I reiterate that readers should have some cash on hand in case we see a drawdown, but to mostly remain invested and not get carried away with fear from headlines because history shows us that "steady wins the race".

Consider the Income Lab

This article was written by

I've been in the Financial Services sector since 2008, which unsurprisingly gives me an invaluable insight in how markets can turn. I was a D1 athlete in college (men's tennis), where I studied Finance. I also have my MBA in Finance.

My readers/followers can trust that I won't pump any investment nor discuss a topic I don't genuinely follow and research. In that spirit, I list my portfolio here for transparency

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; KBWB, VFH; XRT, CEF

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, PDO, BBN

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, RSP, DIA, QQQ, SCHD, DGRO, SDY, VDE, IXC, WM, WMT, MCD, DG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.