Cloudflare: Why It's Time To Downgrade The Stock

Summary

- Cloudflare traditionally beats and raises guidance every quarter - but it failed to do that this time.

- Management has blamed certain unproductive sales representatives for the disappointment.

- The near term outlook is unclear, but the company may be able to sustain 30% growth for many years.

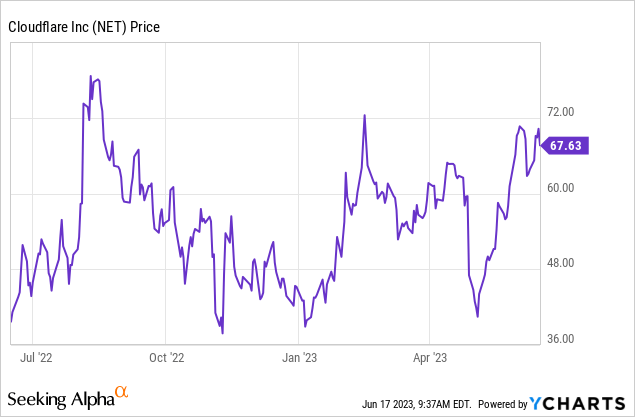

- The stock looks richly valued as it has recovered all of its post-earnings drop - and more.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Noam Galai/Getty Images Entertainment

Cloudflare (NYSE:NET) stock has finally met gravity. NET has typically traded at a rich premium relative to peers on account of both its strong financial profile but mostly due to high investor confidence in the medium-term growth rates. With the company finally lowering full-year revenue guidance, that thesis has been shattered, and analysts are now even wondering if the newly lowered guidance has been “de-risked” enough. I continue to view NET as being a secular growth story on a faster and more secure internet. While I remain confident in the long-term thesis, it is very difficult to recommend buying NET over the simple market index fund.

NET Stock Price

After a complete and thorough beating from all-time highs, NET stock is now trading at where it did in mid-2020. Compared to some peers which are trading at 2018 levels, that still represents some relative outperformance.

I last covered NET in April where I rated the stock a buy but noted my preference for cheaper peers. The stock is up slightly since then in spite offering investors a short-lived buying opportunity following its earnings report.

NET Stock Key Metrics

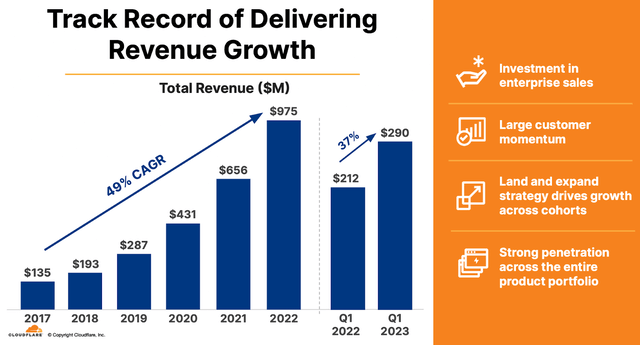

In the most recent quarter, NET delivered 37% YOY revenue growth to $290 million. For most tech companies, such a result would be cheered considering the tough macro environment. The problem is that good is not enough for the richly valued NET stock, and management did guide for $291 million. This is a company that traditionally “beats and raises” on guidance every quarter, making the revenue miss potentially concerning.

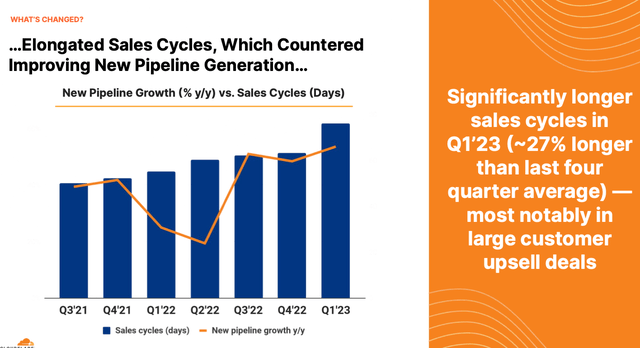

On the conference call, management cited elongated sales cycles, noting that “almost half of the new business closed in the last 2 weeks of the quarter.” At its investor day in May, management quantified the elongation as being 27% higher than average.

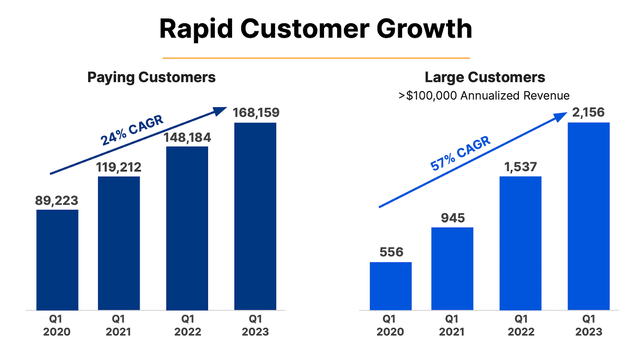

NET has continued to grow its customer base rapidly, including its largest customers.

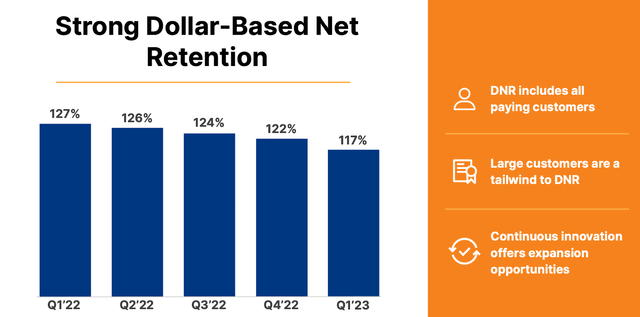

The issue is instead primarily cautiousness from existing customers to increase spending. The dollar-based net retention rate stood at 117%, marking yet another quarter of sequential deceleration.

Management has often noted their determination to bring that metric above 130% over the long term, but investors may be growing impatient in the meantime.

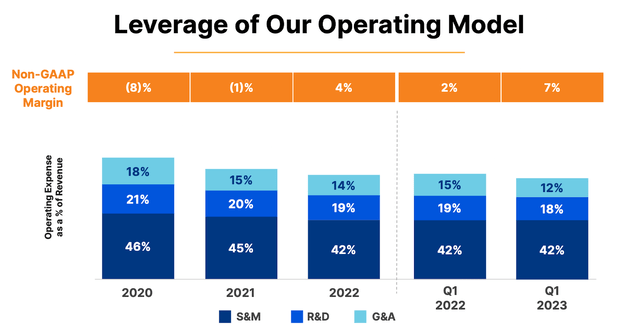

NET did deliver some operating margin expansion, but not nearly enough to offset the disappointment on the top-line.

NET ended the quarter with $1.7 billion of cash versus $1.4 billion of debt. Given management’s reassurance for positive cash flow generation this year, I view their balance sheet position as being sufficiently safe.

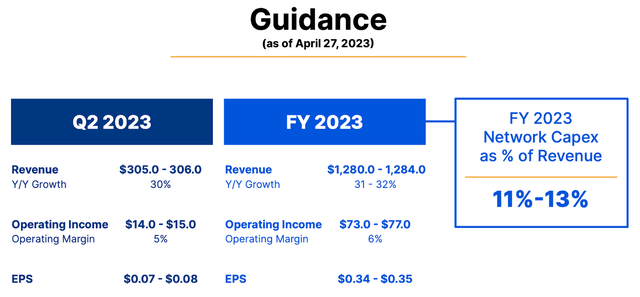

Management lowered the full year guidance to see only 32% growth to $1.284 billion - down significantly from prior guidance of $1.34 billion. As discussed earlier, this is a company which has historically raised guidance throughout the year, making this reduction in guidance notably significant.

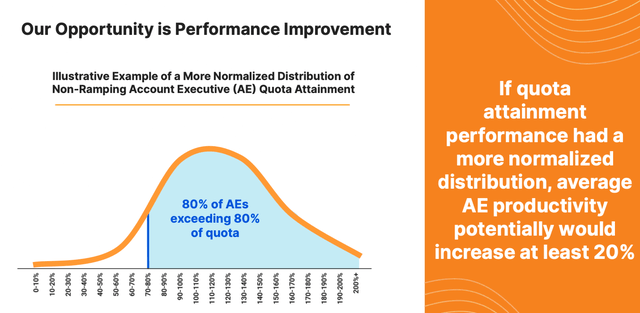

Does management have a plan to fix these execution issues? Management noted that they would undergo a revamp of their sales teams, saying that over the past several years their products were so good that some on their sales teams were able to “succeed largely by just taking orders.”

Management identified more than 100 people who have consistently missed expectations. They expect that by replacing these employees (which accounted for 4% of overall sales), they’ll be able to boost productivity by at least 20%.

Management emphasizes that they are not experiencing elevated churn but that their deteriorating view of macro led to the reduction in full year guidance. Management did not exactly reiterate guidance to reach $5 billion in run-rate revenue within 5 years but seems convinced that these headwinds are near term in nature. Like many other tech stocks, investors have to make the determination of whether they believe growth will eventually accelerate and if the stock price has already priced in any potential disappointment.

Is NET Stock A Buy, Sell, Or Hold?

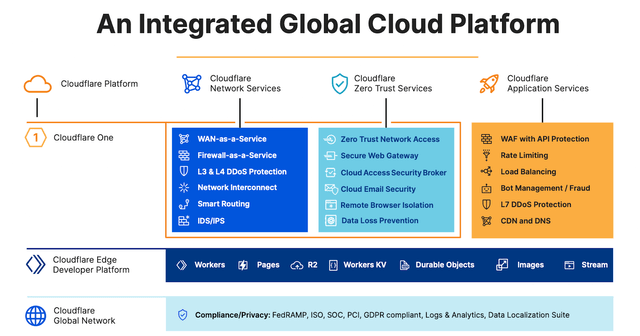

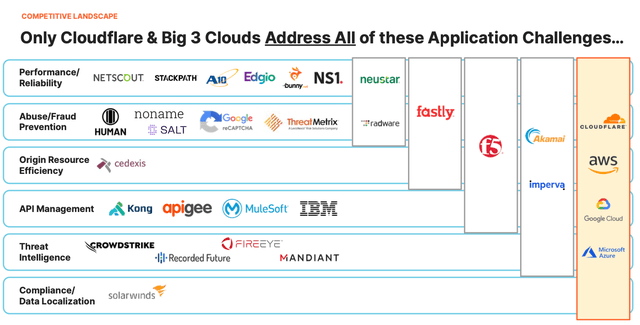

NET is mostly known for being a content distribution network (‘CDN’), but it is positioning itself to be an integrated platform for a faster and safer internet.

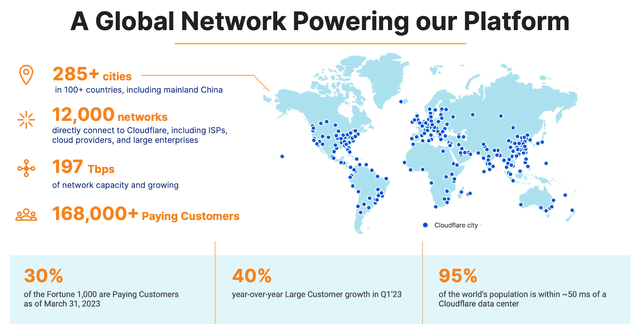

NET benefits from having a wide global network.

NET views itself as being a disruptor in the sector, with its primary competitors being not legacy vendors like Akamai (AKAM) but instead the big 3 cloud vendors. NET believes it offers a more complete offering than these vendors without “lock-in” risk.

NET stock still trades richly relative to peers, though based on consensus estimates the valuation is expected to get more reasonable after several years of hyper-growth.

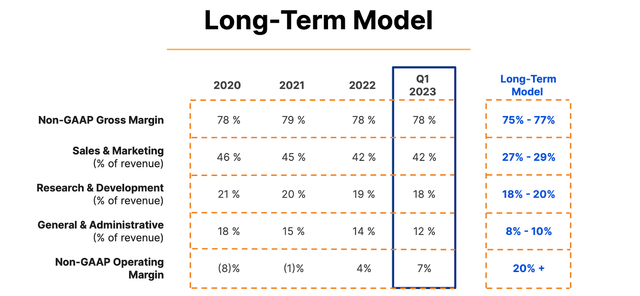

Management has guided for at least 20% operating margins over the long term.

I view that guidance as being conservative as 25% to 30% appears achievable but I’ll use that 20% target in my valuation model. Based on 30% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I can see fair value hovering around 9x sales. Given that the stock currently trades at a material premium of that, it is clear that the stock is pricing in many years of growth. There are still many other stocks in the tech sector that are trading at a discounted valuation relative to this year’s estimates, so investors interested in NET should understand what they are paying for. If the stock traded at a 9x multiple in 2027 then that would imply around 12% annual returns over the next 4.5 years. I view that potential return as being insufficient relative to the broader market index fund and note that the above model is using consensus estimates which look aggressive and there is also a low likelihood that NET can sustain a 30% growth rate exiting 2027.

What are the key risks to the bullish thesis? At this point, the main risk is valuation. NET is subject to the same macro difficulties faced by other tech companies. It is possible that the new guidance is still too optimistic and a future reduction in guidance is likely to come with another round of multiple compression. I can see NET trading down at least 50% if growth were to decelerate to the 15% to 20% range and if the stock were to trade in-line with peers. Compared to many other tech companies, NET has less net cash on its balance sheet. If the business were to turn south, then the downside would be more pronounced due to the potential for greater financial risk. Finally, there remains the risk that this tough macro environment makes customers inclined to work with more well-known operators like the mega-cap cloud titans, which may have a detrimental impact on the stock’s long term growth outlook. I am of the view that barring a huge beat to consensus estimates, NET is not offering sufficient risk-reward, especially relative to both tech peers as well as the simple S&P 500 market index.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.