Metalla Royalty & Streaming Ltd.: Development Stage Brings Dilution

Summary

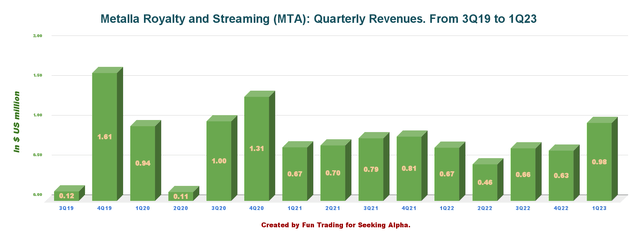

- Revenues for the first quarter of 2023 were $0.98 million, up from $0.67 million in the same quarter a year ago and up from $0.63 million in 4Q22.

- The gold equivalent production was 927 GEOs in 1Q23 at a cash margin of $1,831 per GEO.

- I recommend buying MTA between $4.27 and $4.15 is reasonable, with possible lower support at $4.00.

- Looking for more investing ideas like this one? Get them exclusively at The Gold And Oil Corner. Learn More »

Dcelotti

Introduction

On May 12, 2023, the Vancouver, British Columbia-based Canadian Metalla Royalty & Streaming Ltd. (NYSE:MTA) announced its operating and financial results for the first quarter of 2023.

Note: This article updates my article published on December 27, 2022. I have followed MTA on Seeking Alpha since December 2020.

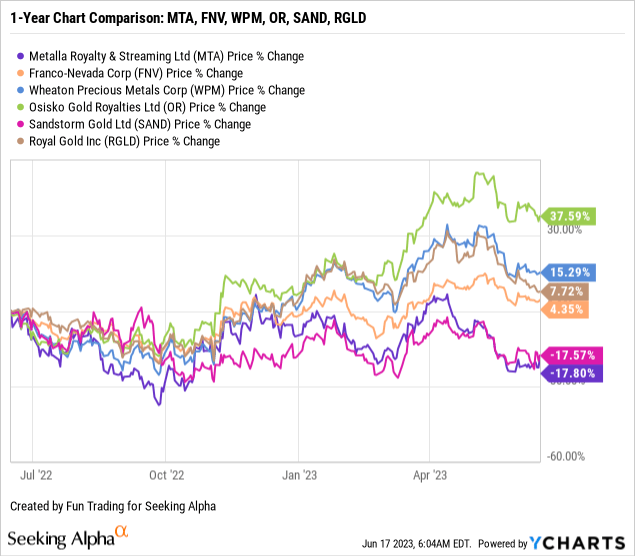

1 - Stock performance

MTA tumbled 18% on a one-year basis and remained with SAND, the two worst performers in the group. The company has utilized its stock to finance its expansion, significantly diluting shareholders in the process. The same strategy has been used at SAND, producing the same effects.

2 - Investment Thesis

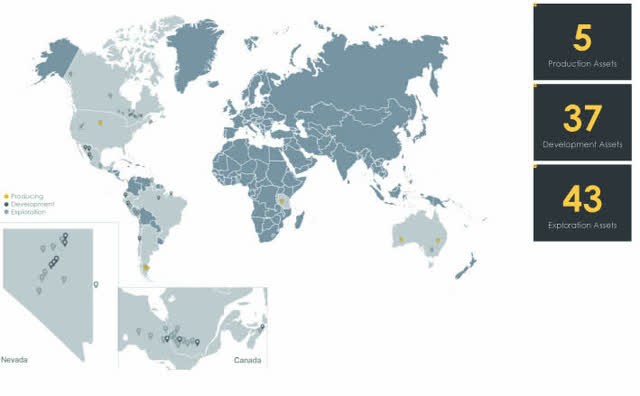

The investment thesis is quite simple. MTA remains in the development stage with 85 assets, and the risk of dilution for shareholders is very high.

MTA is not generating free cash flow and needs financing to expand its assets, producing dilution. MTA shares outstanding diluted increased 14.1% YoY. The development stage will take several years to be sufficiently advanced to stabilize the issue.

MTA Assets Map 1Q23 (MTA Presentation)

Thus, the best way to profit from such a volatile stock is to trade short-term LIFO of about 65%-75% of your total position and use the gain to build up a derisked long-term position expecting a takeover down the road.

Metalla Royalty & Streaming Ltd.: 1Q23 Financial Snapshot History - The Raw Numbers

Note: The numbers are indicated in $US.

| Metalla Royalty | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Total Revenues in $ Million | 0.67 | 0.46 | 0.66 | 0.63 | 0.98 |

| Net Income in $ Million | -2.23 | -1.37 | -2.54 | -4.79 | -1.36 |

| EBITDA $ Million | -1.29 | -0.74 | -1.65 | -4.11 | -0.44 |

| EPS diluted in $/share | -0.05 | -0.03 | -0.06 | -0.10 | -0.03 |

| Operating Cash Flow in $ Million | -0.29 | 0.12 | 0.32 | -0.18 | 0.16 |

| Capital Expenditure in $ Million | 1.00 | 0.00 | 0.12 | 0.35 | 2.82 |

| Free Cash Flow in $ Million | -1.29 | 0.12 | 0.20 | -0.53 | -2.66 |

| Total Cash $ Million | 3.27 | 3.37 | 3.30 | 4.56 | 4.80 |

| Total Long-Term Debt in $ Million | 10.77 | 10.81 | 10.29 | 10.59 | 10.50 |

| Shares Outstanding (diluted) in Million | 44.27 | 44.58 | 44.83 | 45.50 | 50.51 |

| Producing assets | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Gold in GEOs | 724 | 560 | 714 | 683 | 927 |

| GoldCashivalent price realized | 1,835 | 1,844 | 1,714 | 1,715 | 1,836 |

Data Source: The company's financial report

Gold Production and Balance Sheet Details

1 - Revenues were $0.98 million for the first quarter of 2023

MTA Quarterly Revenues History (Fun Trading)

Revenues for the first quarter of 2023 were $0.98 million, up from $0.67 million in the same quarter a year ago and up from $0.63 million in 4Q22. Net loss was $1.36 million in 1Q23.

The three months ended March 31, 2023, and generated an operating cash margin of $1,831 per attributable GEO.

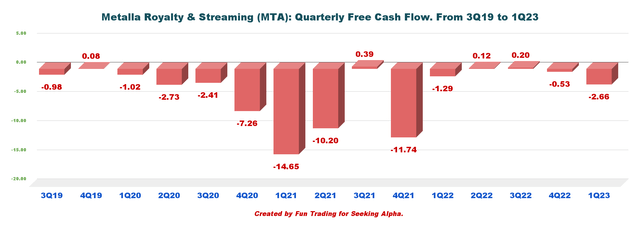

2 - Free cash flow was a loss estimated at $2.66 million for 1Q23

MTA Quarterly Free Cash Flow History (Fun Trading)

Note: Generic free cash flow is the cash from operations minus CapEx.

In my preceding article, I explained that Metalla Royalty & Streaming is in the expansion phase that will probably last several years. Thus, the company is not generating free cash flow on a one-year basis.

During the quarter ending March 31, 2023, free cash flow was a loss of $2.66 million. Trailing 12-month free cash flow is now a loss of $2.87 million.

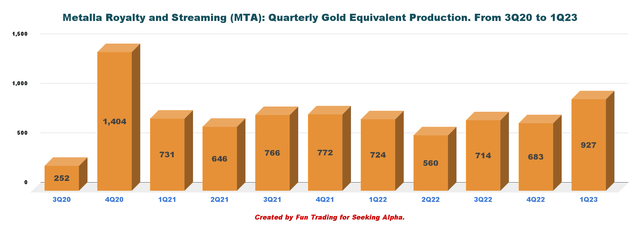

3 - Gold equivalent production details. Total production was 927 GEOs in 1Q23.

MTA Quarterly Production GEO History (Fun Trading)

The gold equivalent production was 927 GEOs in 1Q23 at a cash margin of $1,831 per GEO.

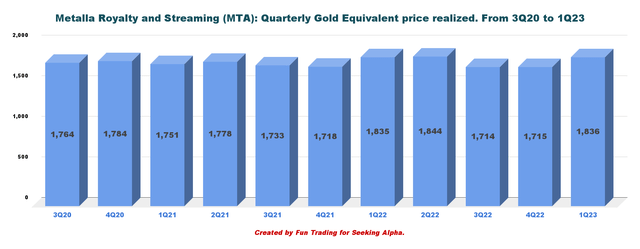

Gold was sold at $1,836 per ounce in 1Q23.

MTA Quarterly Gold Price History (Fun Trading)

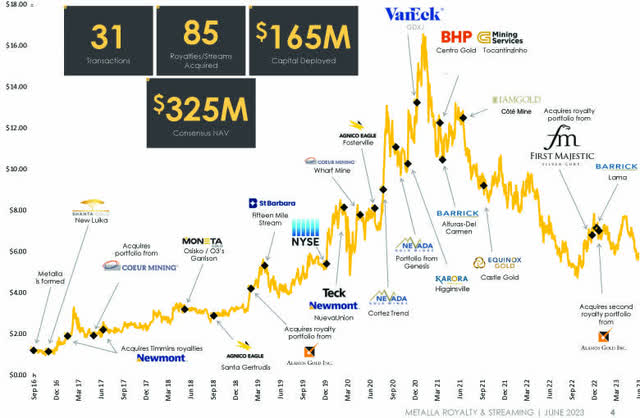

The company increased its royalties and streams portfolio to 85 precious metal assets at the end of March 2023.

MTA Transactions History (MTA Presentation 1Q23)

MTA's last noticeable royalty acquisition was the LAMA gold and silver Royalty from Barrick Gold in Argentina/Peru. Metalla holds a 2.5%-3.75% GP royalty on the gold and a 0.25%-3.0% NSR royalty on all other metals (other than gold and silver) at Lama.

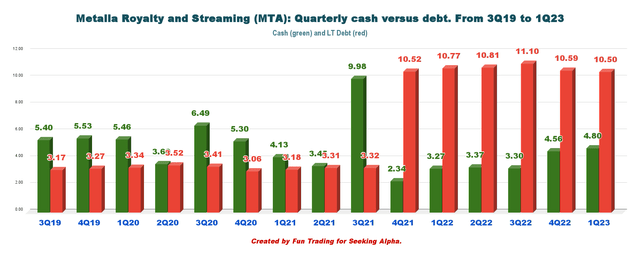

4 - Cash and debt

MTA Quarterly Cash versus Debt History (Fun Trading)

Cash on hand is $4.803 million, and long-term debt was $10.50 million at the end of March 2023, with total financial liabilities of $13,095 million in 1Q23. One recent financing looks very dilutive for shareholders and doesn't push me to invest in this junior streamer.

on May 11, 2023, the Company entered into a second supplemental loan agreement with Beedie, expected to be effective March 31, 2023, to amend the Amended Loan Facility by:

- Extending the maturity date to May 9, 2027;

- Increasing the loan facility by C$5.0 million from C$20.0 million to C$25.0 million, of which C$21.0 million will be undrawn after giving effect to the C$4.0 million conversion described below;

- Increasing the interest rate from 8.0% to 10.0% per annum;

- Amending the conversion price of the Fourth Drawdown from C$11.16 per share to C$8.67 per share, being a 30% premium to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment;

- Amending the conversion price of C$4.0 million of the Third Drawdown from C$14.30 per share to C$7.33 per share, being the 5-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment, and converting the C$4.0 million into shares at the new conversion price. The Company will issue Beedie 545,702 common shares of the Company for the conversion of the C$4.0 million once customary conditions are satisfied;

- Amending the conversion price of the remaining C$1.0 million of the Third Drawdown from C$14.30 per share to C$8.67 per share, being to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment;

Technical Analysis (Short Term) and Commentary

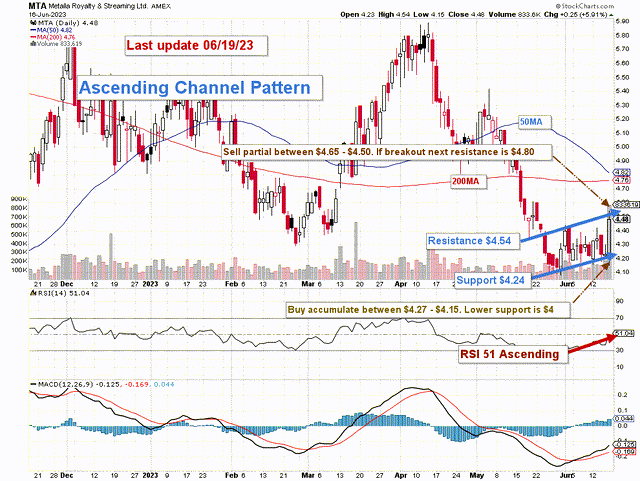

MTA TA Chart Short-Term (Fun Trading StockCharts)

MTA forms an ascending channel pattern, with resistance at $4.54 and support at $4.24.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices, but only after a downside penetration of the lower trend line.

The overall basic strategy that I usually promote in my marketplace, "The Gold and Oil Corner," is to keep a small core long-term position and use about 65%-75% to trade LIFO while waiting for a higher final price target to sell your core position. MTA is a very small streamer and fluctuates wildly, and trading a large part of your position is perfectly adapted to this situation.

I recommend selling a part of your position at $4.50 to $4.65, with a potential higher target of $4.80-$5. I believe buying between $4.27 and $4.15 is reasonable, with possible lower support at $4.00.

Watch gold like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I trade short-term MTA occasionally.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.