Nikola: Sell The Meme Stock Rally

Summary

- After marking a new 52-week low earlier this month, shares of ailing zero-emission transportation start-up Nikola Corporation have become the latest favorite of the momentum crowd.

- At its peak on Thursday, NKLA stock was up by 250% on giant volume before retreating over the course of Friday's session.

- Failure to gather sufficient shareholder votes to double the number of authorized shares appears to have been a major catalyst behind last week's rally.

- A timely change in Delaware General Corporation Law is likely to help the company increase the number of authorized shares, but as a result, equity holders would be facing outsized near-term dilution.

- Given the company's uncertain business prospects and expectations for substantial near-term dilution, investors should consider using the recent momentum rally to exit existing positions and move on.

Tramino

Note:

I have covered Nikola Corporation (NASDAQ:NKLA) previously, so investors should view this as an update to my earlier articles on the company.

After marking a new 52-week low earlier this month, shares of ailing zero-emission transportation start-up Nikola Corporation ("Nikola") have become the latest favorite of the momentum crowd.

At its peak on Thursday, the stock was up by 250% on giant volume before retreating 35% until the end of Friday's session:

The likely catalyst for the rally is almost tragicomical as the company has failed to gather sufficient votes for a proposal to double the number of authorized shares from 800 million to 1.6 billion on the recent annual shareholder meeting.

Please note that this particular proposal is facing high hurdles given the requirement for more than 50% of outstanding shares to vote in favor of the proposal while in most other cases a simple majority of votes would be sufficient.

While more than 77% of shares voted through June 6 have been in favor of the proposal, the required threshold for approval has not been met.

With founder and former CEO Trevor Milton having voted approximately 50 million shares against the proposal, Nikola is facing a similar situation like last year when the company had to adjourn its annual meeting three times before garnering sufficient votes

Consequently, Nikola has decided to adjourn the annual stockholder meeting to July 6 to "allow stockholders additional time to vote FOR Proposal 2".

With the current amount of authorized shares virtually exhausted, Nikola can't raise additional funds by selling newly issued shares under its equity line of credit with Tumim Stone Capital LLC ("Tumim Stone") or directly into the open market by utilizing its equity distribution agreement with Citigroup Global Markets (C).

Given the current absence of open market share sales by the company or Tumim Stone, momentum traders apparently had little problems moving the stock.

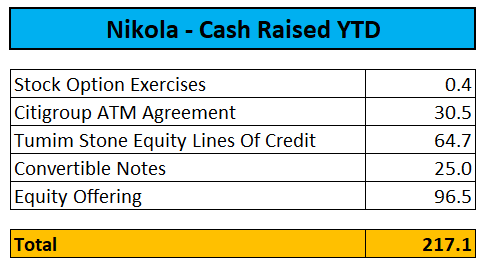

Based on information provided in the company's most recent quarterly report on form 10-Q, Nikola has raised approximately 217.1 million year-to-date mostly by outright selling new shares or issuing equity-linked securities:

Regulatory Filings

As of the end of Q1, remaining unrestricted cash amounted to just $121.1 million. Please note that $96.5 million net proceeds from a recent equity offerings were received subsequent to quarter end.

With projected cash usage of $150 million per quarter, Nikola is about to run out of funds within the next six to eight weeks.

Thankfully, the company is likely to benefit from recent amendments to the Delaware General Corporation Law that would reduce the threshold for approval to a majority of the shares voting on the proposal.

The pending legislation is expected to be effective August 1, 2023. Under the amended law, Nikola would have a sufficient number of votes to secure approval for the proposal.

Consequently, I would not expect the company to file for bankruptcy in the near future.

During the Q1 conference call, management listed close to $500 million in available cash sources assuming shareholders approve the proposed increase in authorized shares:

Q1 Conference Call Transcript

Unfortunately, with equity or equity-linked securities currently the only funding sources available to the company, shareholders remain caught between a rock and a hard place as outsized dilution is likely to continue for the time being.

For example: Based on management's projections for cash usage in 2023, Nikola would have to raise at least $250 to make it into next year.

Assuming the issuance of $50 million in convertible notes and another $200 million in common shares at an average price of $1 per share, outstanding shares would increase by almost 30% to approximately 900 million by year-end.

Even worse, the resumption of open market sales and additional share issuances under the Tumim Stone equity line of credit is likely to put renewed pressure on Nikola's stock price which might require the issuance of even more shares to raise the cash required for keeping the lights on going into 2024.

After the close of Friday's session, Nikola announced a major headcount reduction which is expected to decrease personnel-related cash spend by more than $50M annually:

The reduction affected roughly 150 team members across multiple sites who were previously supporting (in part or in full) the company’s European programs, as well as approximately 120 employees based predominately at the company’s Phoenix and Coolidge, Ariz. sites and previously announced actions from Cypress, Calif.

Based on the numbers disclosed by the company, average annual cash earnings by the discharged employees have been approximately $190,000.

As a result of the headcount reduction and other strategic initiatives, Nikola expects annual cash usage to decrease to under $400 million by next year.

Please note that management already hinted to these measures on the recent Q1 conference call, so investors should not consider Friday's disclosures a major surprise.

Moreover, with last week's rally already faltering going into the weekend, Nikola is not likely to regain compliance with Nasdaq's $1 minimum bid price requirement anytime soon as this would require the closing bid price of the company's common stock to be at least $1 per share for a minimum of 10 consecutive business days at any time by November 20, 2023.

That said, under certain circumstances the company might be eligible for an additional 180-day grace period well into next year.

Bottom Line

Under normal circumstances, Nikola Corporation would literally grab the bull by the horns by selling large amounts of newly issued shares into the open market thus extending its cash runway quite meaningfully.

But with the company lacking a sufficient amount of authorized shares, the company won't be able to take advantage of the massive trading volume and vastly increased stock price.

While an upcoming change in Delaware General Corporation Law should enable Nikola Corporation to secure approval for the much-needed increase in authorized shares, common equity holders will be facing outsized dilution for the foreseeable future.

Even with annual cash usage expected to decrease to below $400 million by 2024, absent of non-dilutive funding sources, Nikola would still need to issue several hundred million new shares at prevailing prices.

Given the company's uncertain business prospects and expectations for outsized near-term dilution, Nikola Corporation's shareholders should consider using the recent momentum rally to exit existing positions and move on.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.