NVE Corp.: Strong Momentum Builds A Buy Case

Summary

- NVE Corporation is a solid investment in the spintronics market, with strong growth potential and a 91% YoY increase in revenue.

- NVEC has a stable balance sheet, with a negative net debt and a total liabilities/cash ratio of 1.3, allowing for potential debt to fuel research and development.

- Despite risks such as competition and supply-demand issues, NVEC's current valuation and strong growth make it a buy for investors seeking exposure to the rapidly growing market.

kynny/iStock via Getty Images

Investment Rundown

NVE Corporation (NASDAQ:NVEC) certainly is a growth company as highlighted by their last earnings report. What NVEC offers is a solid investment into a niche market where they dominate. They have been able to convert their demand to revenue and saw the top line move 91% higher YoY, and Q1 2023 resulted in revenues of $12.8 million, up from $6.72 million a year prior.

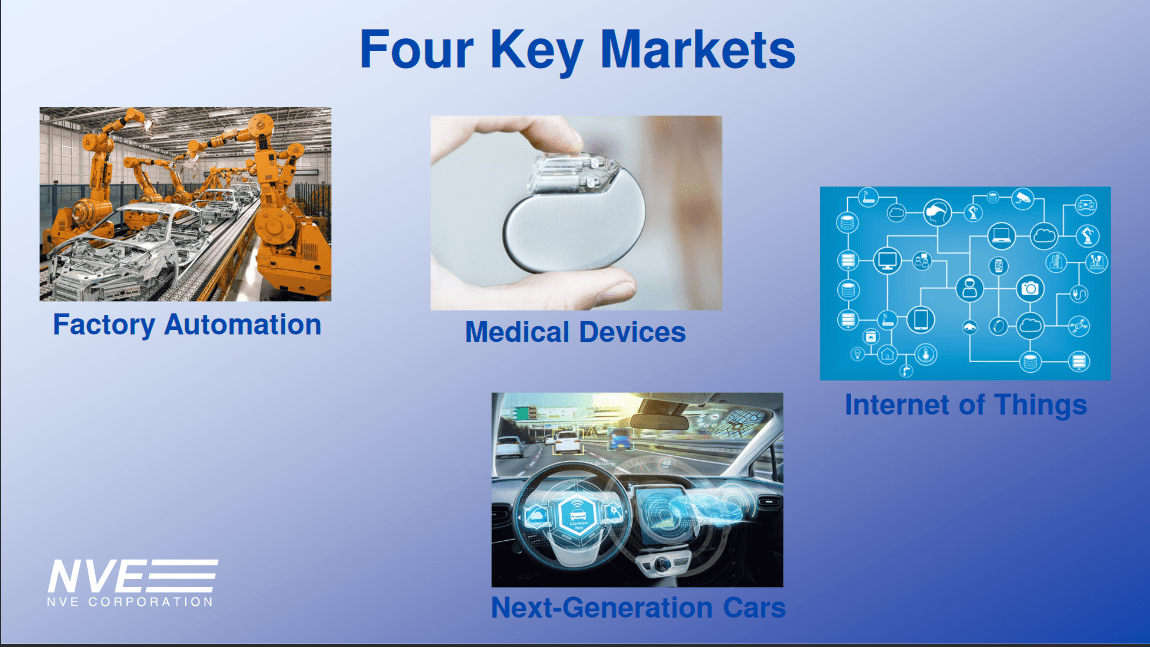

Key Markets (Investor Presentation)

As a leader in the spintronics market, the demand for the company is a direct result of companies wanting better ways of acquiring and transmitting data. With a market value of around $600 million back in 2021, it's expected to reach over $5.5 billion by 2031. With NVEC as a leader in the space, I expect to see strong growth going forward and will be rating it a buy. Paying 19 forward earnings with a company already distributing a dividend supported by positive cash flows feels like too good of an opportunity to pass up on.

Strong Growth Ahead

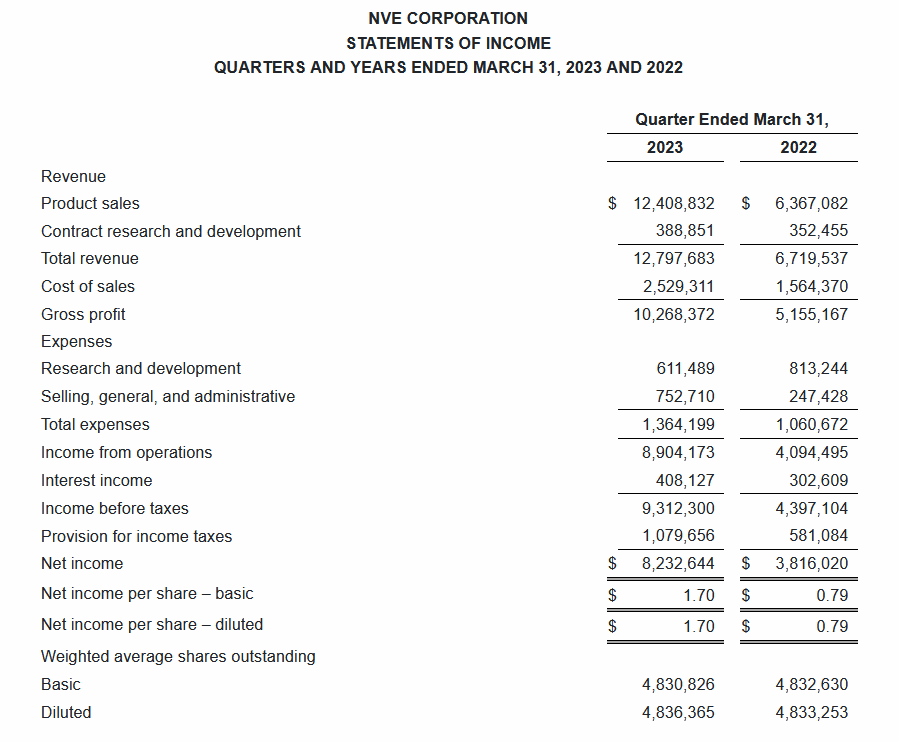

As mentioned before, the growth opportunity right now for NVEC seems great. Growing EPS in the last quarter by 116% is a testament to the demand the industry they are in is actually seeing. This increase resulted in the company also having fantastic margins, with net margins reaching close to 60%, it's not often you see this with small tech companies.

Much of the reason for the growth was that the company grew sales by 95% and actually managed to keep research costs down on a QoQ basis.

Income Statement (Q1 Report)

Research and development costs decreased nearly 20% whilst the revenue grew that much makes me very optimistic and a continuation of margin expansion for the company. What else is great to see here is NVEC buying back shares and announcing a dividend of $1 per share.

Looking at the spintronics market, much of the driving force behind the growth seems to be an increasing demand to automate certain functions in businesses. As noted by NVEC some of the key markets they have is factory automation and medical devices. These industries are rather capital intense and require new innovations constantly to keep strong margins. Which is something that NVEC can help with. Some estimates suggest that spintronics will eventually phase out electronic devices as these are far less power intense, and also offer higher speeds.

The coming quarters will be crucial for NVEC as they need to prove they can continue growing revenue at a strong enough rate to justify the current valuation. Some of the potential risks they might be facing is a supply-demand, just like during the pandemic. Issues with getting their orders and supplies into their factories could result in holdups of orders and in turn cause lower-than-anticipated revenues. Which I think could harm the share price a fair bit.

Financials

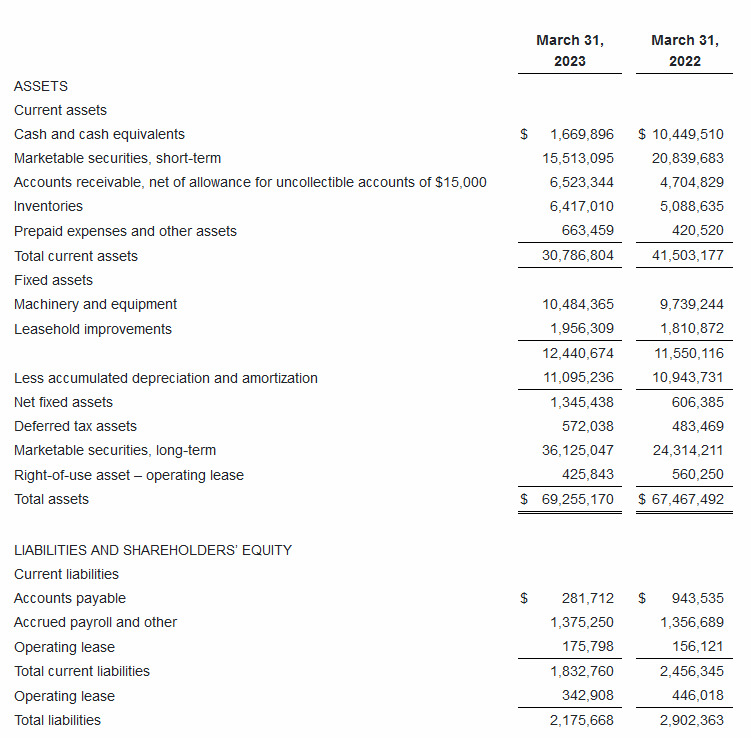

NVE Corporation has so far managed to grow into a financially strong company with enough cash at hand to cover almost all its current liabilities. With no long-term debts to be accounted for, NVEC actually has a negative net debt which further highlights the stability of the balance sheet.

Balance Sheet (Q1 Report)

With a total liabilities/cash ratio of just 1.3, I think the company is in a spot where it can afford to take on more debt to help fuel research. The market they are in is heavily dependent on innovation to get ahead of the curve and competition. The research and development costs came in around $600,000 in the last quarter, with taking on new debt it would be interesting to see the scalability of the business and whether or not that could help catapult them with new growth. Establishing themselves as the spintronic company I think is a target they need to aim for and right now they have the balance sheet to support that goal.

NVEC Valuation

Regarding the valuation of the company, they only sit at a 19x forward earnings base even when they are growing the bottom line at over 100% YoY. Now I don’t think it's very reasonable to assume that they will be able to continue doing this year after year.

With the industry growing at a rapid pace with some suggesting a CAGR of around 14 - 16% between now and 2030, I believe that NVEC will be able to see this growth as well for their top line. But I will keep a more conservative outlook for the bottom line, just as a safety measure for myself.

But with a yearly EPS growth of 10%, in 2027 it would land at $6.8 per share, and with a reasonable multiple of 16, the share price would be around $108. In 4 years' time, that would be an annual return of about 3.9%, but with the dividend yield above 4%, the yearly return would be double that. This example is assuming the company isn't diluting shares and keeping them at the same level. I think it should be said these estimates are really at the low end of what could be possible for NVEC. If demand keeps up I can see the EPS growing at least 15% yearly until 2027. Which would give investors a very strong ROI.

Risks

Where there might be some risks presented is the competitive nature of their industry. It's capital intense and with NVEC still not being that large of a company, they have the underdog position as other more established companies in related industries could enter and take market share. NVEC will have to rely on making a superior product and establishing partnerships, which they seem to be doing so far at a satisfactory rate.

Besides that, the share price has increased by 100% in the last 12 months, and seeing either a slight stagnating period or even a pullback I think is very likely, although that would just mean short-term pain, the long-term still looks solid though.

Final Words

I think that NVEC stock is a buy at these prices. Paying 19x forward earnings for a company that is growing the bottom line at triple digits is fine by me. I think it's even quite undervalued if this momentum keeps up. It's even supported by the company having an over 4% dividend yield, which is sustainable thanks to the strong levered FCF margins of 29%. Demand is strong for the industry and NVEC is setting itself apart by being a leader and a highly profitable company at the same time - creating a solid buying opportunity for investors seeking exposure to the rapidly growing market.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.