FAT Brands: I'm Building A Highly Speculative Position In The Preferreds

Summary

- FAT's Series B preferred shares offer a $2.0625 annual coupon paid in monthly installments. These are currently swapping hands at a 40% discount to par value.

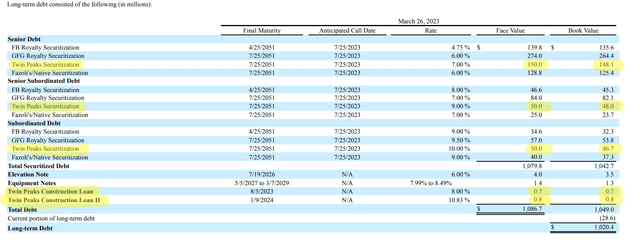

- The company's total debt position increased to $1.25 billion as of the end of its fiscal 2023 first quarter to drive quarterly interest expenses of $25 million.

- FAT's proposed IPO of Twin Peaks could unlock significant value and shift at least $250 million worth of debt at fair value off its balance sheet.

felixmizioznikov/iStock Editorial via Getty Images

I'm buying a small speculative position in the Series B preferred shares of restaurant brand owner FAT Brands (NASDAQ:FAT) (NASDAQ:FATBP). You only have to look through FAT's fiscal 2023 first-quarter earnings to understand why purchasing a typically stable fixed income-like security that pays out a $2.0625 annual coupon in monthly installments has been classed as highly speculative. The company recorded revenue of $105.7 million for its first quarter, up 8.5% over the year-ago comp and a beat by $700,000 on consensus estimates. However, net losses for the quarter at $32.1 million, around $1.95 per share, was a 35% increase from the year-ago period. FAT is unique in that it's one of the few publicly listed companies that pay out a substantial dividend to common shareholders from a broadly unprofitable and cash-burning business operation. The company last declared a quarterly cash dividend of $0.14 per share, in line with its payment and for a 7.5% forward annualized yield.

The dividend payments are made stranger by a total debt position of $1.25 billion as of the end of its first quarter. This was an increase of around $103 million over the year-ago comp and around $41 million sequentially. Critically, it drove quarterly interest expenses of $25 million during the first quarter, up from $19 million in the year-ago period. The argument from bulls here is that the company could enhance its balance sheet and improve its profitability by cutting back on quarterlies to common shareholders. This would save $2.3 million per quarter, around $9.2 million per year, for repaying debt. However, the dividends have no doubt helped the common shares to realize a strong positive total return of 12% over the last year.

The Twin Peaks IPO

FAT is dedicated to maintaining the quarterly with its ex-CEO stating during the first quarter earnings call that paying a consistent dividend is core to their long-term strategy to create value for their shareholders. Hence, the company has taken returning value to shareholders to the extreme as it pushes the organic growth of its restaurant brands and manages its debt outstanding. The company recently announced that it intends to IPO its Twin Peaks chain of sports bars that it acquired in 2021 for $300 million with a mix of cash and stock. The chain recently opened its 100th location, operates in 26 states, and expects to end 2023 with 115 locations. Around 70% of its lodges are franchised with plans to increase this to 80% and 200 lodges over the next few years.

The recent IPO of the Mediterranean fast-casual restaurant chain Cava (CAVA) was likely the catalyst for this move by FAT. Cava, which has around 263 restaurants as of the end of April has had a blockbuster listing, nearly doubling from its $22 IPO price to trade at a market cap in excess of Shake Shack (SHAK), Wendy's (WEN), and Jack in the Box (JACK). FAT might be able to realize a value for Twin Peaks that is higher than its current internal valuation which would allow the company to raise funds required for partial debt repayment. Whilst both companies differ in that Twin Peaks bills itself as a polished casual dining outfit and has franchised locations, there is clearly pent-up market demand for new IPOs after what's been a more than year-long dearth of offerings following ten consecutive interest rate hikes.

The Preferreds Will Be Rendered Less Risky By A Successful IPO

FAT will likely seek to attain a valuation far in excess of the $300 million that it paid for Twin Peaks in 2021. The IPO would strip out a significant amount of current company-level revenue with Twin Peaks forming one of their fast-growing brands. The sports chain currently sports an average unit volume ("AUV") of around $6 million, with some of its locations in Florida recording an AUV of between $9 million and $12 million each with strong margins in tow. Hence, the Twin Peaks IPO would also have the negating effect of stripping the company of one of its highest growth drivers and most profitable brands on a unit level.

FAT Brands Fiscal 2023 First Quarter Form 10-Q

However, the prize here is the preferreds which are currently swapping hands for $15.26 per share, a roughly $9.74 difference or 40% discount to their $25 par value. This comes as adjusted EBITDA rose $4.1 million to $19.2 million during the first quarter. Twin Peaks accounts for $251.5 million of long-term debt at fair value as of the end of the first quarter. This would be shifted at IPO to the new public entity to reduce FAT's total debt burden below $1 billion before other gross IPO proceeds. Whilst the eventual impact on the commons will be highly dependent on the market appetite for Twin Peaks and its eventual valuation, the transaction somewhat de-risks the investment case for the preferreds even as it opens up new risks to FAT's growth without one of its core brands. I'm building a speculative position in the preferreds on the back of this.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FATBP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.