S&P 500 Nears 20x Earnings, VOO A Hold As Alternatives Beckon

Summary

- The Vanguard S&P 500 ETF reached a 14-month high, I have a hold rating on the ETF due to stretched US large-cap equity valuations and less favorable seasonality ahead.

- Cash, high-yield credit, domestic SMID caps, and Japan are alternative investment options in light of the richly priced S&P 500.

- Amid an elevated valuation and bullish sentiment, I assert waiting for the usual summertime dips before buying into the market is prudent.

Scott Olson

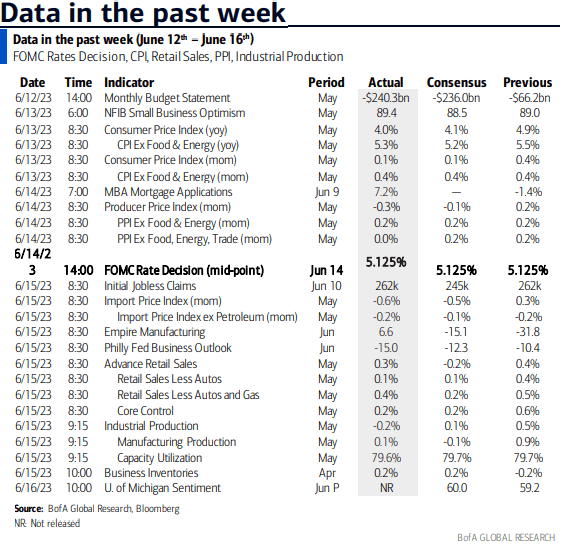

It's time to catch our collective breath following a busy week of economic data. CPI, the Fed, Retail Sales, stealthy elevated jobless claims, and the monthly University of Michigan Consumer Sentiment survey were all key indicators last week. Inflation was tame, the FOMC delivered its widely anticipated hawkish hold, consumer spending was decent, initial claims posted another sizable figure, and confidence inched up as year-ahead inflation feelings eased.

Major Data Taken in Stride Last Week

BofA Global Research

All told, no damage was done. Better yet, the Vanguard S&P 500 ETF (NYSEARCA:VOO) jumped 2.6% to notch fresh 14-month highs. I have a hold rating on the fund, though. Equity valuations have turned stretched while seasonality is less sanguine today compared with earlier in the year. Moreover, as sell side strategists succumb to the reality that their initial end-of-year SPX targets were way too bearish, I see signs that FOMO permeates. Still, a correction is one to be bought as signs of an imminent recession dwindle. Let's dive into the state of the markets and how price action may transpire in the second half.

According to Vanguard, VOO invests in stocks in the S&P 500 Index, representing 500 of the largest U.S. companies. Its goal is to closely track the index's return, which is considered a gauge of overall U.S. stock returns. VOO offers high potential for investment growth and its share value rises and falls more sharply than that of funds holding bonds. The ETF is more appropriate for long-term goals where your money's growth is essential.

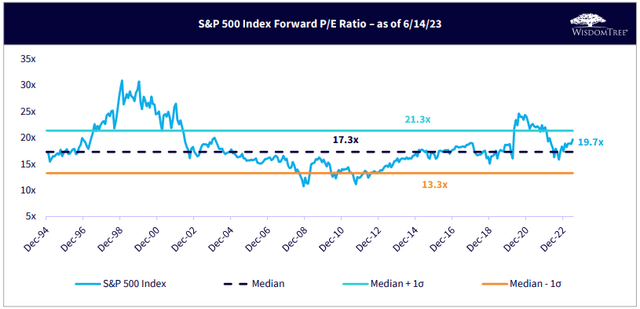

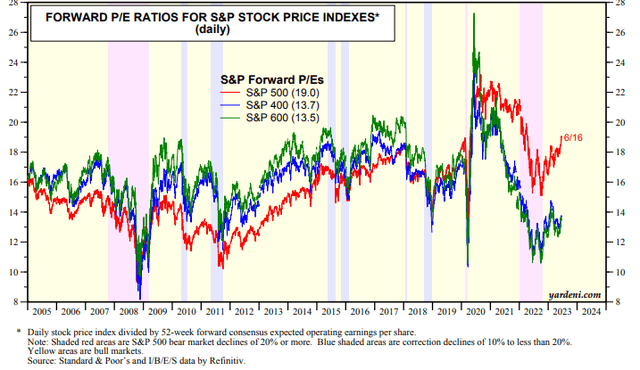

For starters, the S&P 500 trades at 19.7 times forward earnings estimates, according to data from WisdomTree Funds. That is above the 30-year average of 17.3. Making equities even more on the expensive side is that today's 5% to 5.25% Fed Funds target range is well about that of the ZIRP world of 2009 through 2021, so it's arguable that stocks should trade with more modest earnings multiples today versus a few years ago.

SPX Approaches 20x Earnings

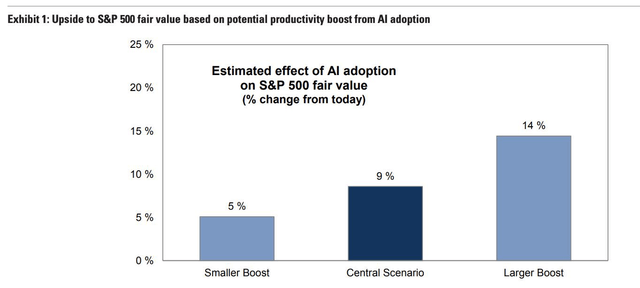

The bulls counter with this punch: The obvious AI boom could lead to a sharp increase in worker productivity over the coming decade, so a higher valuation is justified. Just recently, economists at Goldman Sachs came out swinging with a bold prediction that AI could boost overall productivity growth by 1.5 percentage points annually, leading to a 1.1pp real GDP increase. The result, according to Goldman, is that the market's earnings per share will be 11% higher than the current assumption.

Goldman Bullish on AI

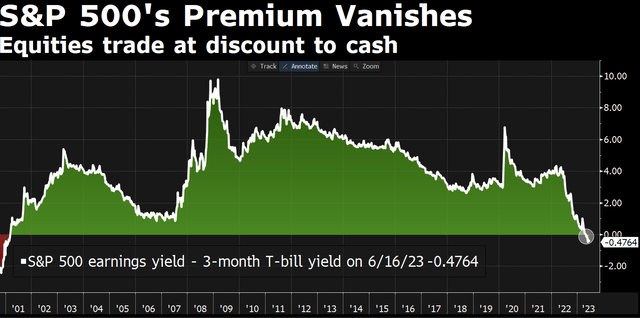

But we must stay grounded in reality. A near 20 forward operating P/E on the S&P 500 means its earnings yield is about 5% (simply the inverse of the P/E ratio). Now, for the first time since early 2001, short-term T-bills offer a better yield. Talk about having an alternative. Despite calls at the onset of 2023 for money markets being a decent parking place for cash compared to risky stocks, it's clear that the picture is more precarious for stocks today.

Cash Increasingly Attractive as Stocks Rise and Inflation Eases

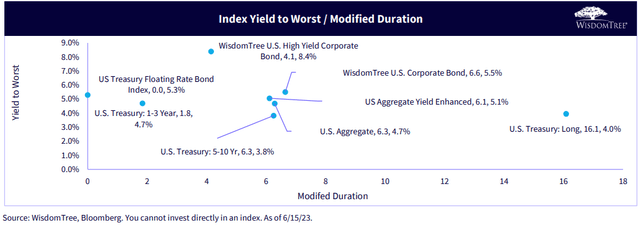

One area where an investor can consider is high-yield credit. Junk bonds sport an average yield-to-worst between 8.5% and 9%. That is much better than the 5% S&P 500 earnings yield. Speculative-grade credit is a somewhat small niche of the global investable universe, so it's not as if shifting a major chunk of your allocation is wise, but having a slice devoted to high-yield fixed income makes more sense today than in years past. Moreover, you can hold those securities (or a basic HY ETF) in a tax-sheltered account to avoid paying relatively higher tax on income compared to capital gains received in equities.

HY YTW > SPX EY

Where else should you consider re-allocating as you lighten up on your VOO stake? Consider domestic small and mid-caps. Even after the broadening out of the 2023 bull market into the SMID space, forward P/E ratios remain attractive. According to Yardeni Research, the S&P SmallCap 600 features a cheap 13.5 multiple while the S&P 500 MidCap 400 is just 13.7 times expected earnings. Even considering the rosy growth outlook and current earnings strength among the Magnificent Seven mega-caps, their forward PEG is by no means cheap.

US SMID Caps Increasingly Cheap Compared to SPX

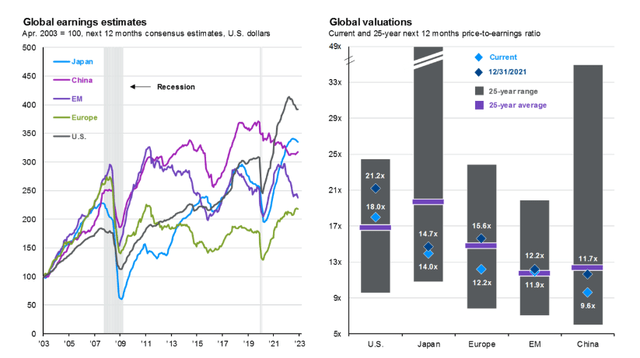

I'm not done. We can look overseas for both value and momentum. Have you heard about what is happening in the Land of the Rising Sun? Japan's Nikkei 225 Index, after 33 long years, has returned to the 33,000 level, leaving it not quite a stone's throw from an all-time high, but certainly just a strong year or two away from finally hitting 40,000 for the first time. With a falling yen and better inflation trends in Japan, there's a fundamental case that the nation's equities could feature more upside ahead. While just 5% of the all-country world index, Japan sports a bashful 14.0 P/E as of the end of May, according to J.P. Morgan Asset Management.

Japan Emerges With Momentum, Still Modest Valuation

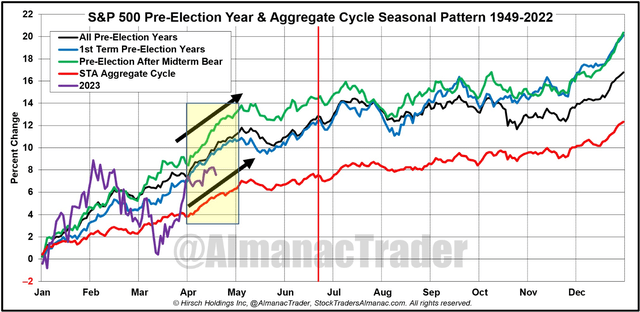

So, my assertion is that cash, high-yield credit, SMID caps, and even Japan are spots that could be overweighted in light of a richly priced S&P 500. I also like to monitor seasonal trends. Right now, a bit of choppiness could be in the cards. Jeffrey Hirsch at Stock Trader's Almanac is the go-to on seasonality assessments. The chart below shows that the early portion of a pre-election year is often very bullish for VOO and other S&P 500 ETFs. The start of the second half, however, has typically featured a pause in bull markets before a late-year surge.

Lackluster Seasonal Trends Heading Into 2H

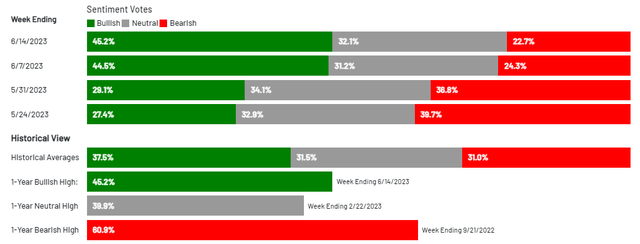

Lastly, while I love VOO for its low cost, high liquidity, modest tax impacts, and straightforward portfolio, investors seem to endear it a bit too much right now. For two straight weeks, the American Association of Individual Investors (AAII) has recorded a high ratio of bulls to bears. After a months-long stretch of bearish sentiment, frothy conditions are back in full swing. Jumping aboard the bull train now could be a mistake. Rather, waiting to buy the usual summertime dips is more prudent.

A Bit Too Much Retail Investor Froth?

The Bottom Line

I have a hold on VOO. I own several Vanguard index ETFs, though VOO is not one of them (I do own VTI). The current valuation is elevated following a bullish sentiment turn. With alternatives in several other asset classes and equity arenas, I would consider trimming profits after the 16% year-to-date total return and re-allocating to other areas that feature both value and, now just recently, momentum.

This week, markets are closed for the Juneteenth holiday Monday, then comes Housing Stats Tuesday morning, FedEx earnings that evening, Jobless Claims on Thursday along with Existing Home Sales before key Manufacturing and Services PMI data for June on Friday.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.