Citigroup: Buy This Bargain Before It's Gone

Summary

- Citigroup stock is still undervalued relative to its financial sector peers. It underperformed its peers for many years. However, I gleaned that the tide is potentially turning.

- The bank has made plans for life after the Fed's unprecedented rate hikes, which could see more pressure over its NII growth. However, its astute positioning should mitigate the headwinds.

- Moreover, analysts have already penciled in QoQ declines in revenue before reversing in Q1'24.

- Buyers have consistently defended Citi's steep pullbacks since it bottomed out in October 2022, suggesting a significant improvement in buying sentiment.

- I assessed that investors with no or little exposure in Citi should take the opportunity to add positions before it leaves them behind.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

Michael M. Santiago

Citigroup Inc. (NYSE:C) will head into its second-quarter earnings release in July from a position of strength as dip buyers returned to bolster its buying sentiments after it underperformed its Financial sector (XLF) peers in May.

Citi remains significantly undervalued relative to its sector peers. Seeking Alpha's Quant rated Citi's valuation with a "B+" grade, highlighting its appeal. I also assessed that buyers had returned robustly to support Citi at significant dips since its October 2022 lows, suggesting they aren't expecting things to get worse from here.

As such, I believe Citigroup investors should be assured that market sentiments have improved significantly as CEO Jane Fraser and her team execute the bank's ambitious transformation plans. The recent banking crisis has also corroborated investor confidence, as Citi could leverage the fallout over the regional banks to bolster its position further.

Notwithstanding, Citi's valuation drivers are predicated mainly on the strength of its Institutional Clients Group or ICG. Trefis' sum-of-the-parts or SOTP valuation framework estimates that ICG accounts for more than 80% of its valuation.

However, CFO Mark Mason commented at a conference this week that the bank sees its markets revenue falling by 20%, impacted markedly by the 25% decline in equities revenue. However, investors didn't react negatively, as Citi stayed well above its lows in late May.

Furthermore, Mason reminded investors that the bank is preparing for life after the Fed's rapid rate hikes, as it reduced its "asset sensitivity position, anticipating potential rate decreases in the future." As such, I assessed that investors must be prepared for a lower NII growth environment moving ahead as the Fed nears the end of its rate hikes.

Fed Chair Jerome Powell didn't preclude the possibility of further rate hikes, as the FOMC's median terminal rate increased to 5.6% in its revised projections. However, even if the Fed raised interest rates by another round or two, we are still at the end of the current program. Hence, I'm assured that Citigroup management has prudently configured the bank's strategy for lower rates moving forward.

Despite that, Citigroup remains confident of achieving FY23 revenue of "around $78 billion to $79 billion, excluding the impact of divestitures." Analysts' estimates suggest that Citigroup could exceed Mason's guidance, with Q2's $19.9B potentially marking the upward inflection in its YoY growth cadence. Despite that, analysts have already penciled in QoQ declines in revenue through FQ4'23 before reversing in Q1'24.

As such, I assessed that the market has already priced in these headwinds as Citigroup works toward its medium-term RoTCE target of 11% to 12%. Notwithstanding, it wouldn't be a simple task, given the NII growth headwinds moving ahead, requiring Citigroup to work harder on "bending the cost curve" while requiring "revenue momentum," among other challenges.

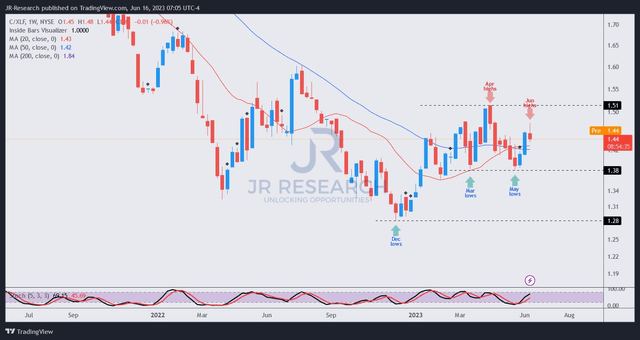

C/XLF price chart (weekly) (TradingView)

From C/XLF's price chart, investors can glean that buying sentiment has improved markedly from the lows in December 2022. As such, it has helped Citi outperform its XLF peers since then, including the banking crisis in March.

Also, the long-term underperformance of C/XLF could be overturned, as the long-term downtrend of C/XLF has reversed, forming a pivotal golden cross in late May.

Notwithstanding, the current price structure suggests that a pullback in C/XLF is looking increasingly likely. However, I assessed that further rotation into Citi relative to its XLF peers seems to be forming, which could attract more value-conscious investors to Citi.

The subsequent pullback from its recent highs will likely determine whether this thesis could work out, but the risk/reward upside looks constructive from a price action and valuation perspective.

Rating: Maintain Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C, XLF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.