KLA Corporation: Growing Market Share And Cash Flows

Summary

- KLA Corporation is a promising investment opportunity due to its role as a supplier in the growing semiconductor and automotive industries.

- The company has strong financials, with a stable debt-to-cash ratio and increasing free cash flow, allowing for dividends and potential buybacks.

- KLAC's valuation is fair at 19x forward earnings, offering investors exposure to the expanding automation and automotive semiconductor markets.

PhonlamaiPhoto

Investment Rundown

Benefiting from the global demand to automate production and manufacturing is widespread by this point. Sometimes investing in the companies supplying the "picks and the shovels" to the industry will in the long run be the most profitable. KLA Corporation (NASDAQ:KLAC) is such a pick in my opinion. The company has been growing revenues and earnings at a steady rate which has resulted in margin expansions helping improve cash flows, and in the last quarter the company returned over $650 million to shareholders, over two-thirds of the entire FCF generated in the quarter. I think this highlights the long-term potential of KLAC and right now it sits at a good entry point in my opinion to start a position.

Growth Opportunity

The semiconductor industry is seeing strong demand as more and more companies seek to automate and improve many parts of their businesses. What KLAC offers is the opportunity to invest in a company supplying the materials and products to larger companies in the semiconductor space, essentially operating as the "pick and shovel" supplier.

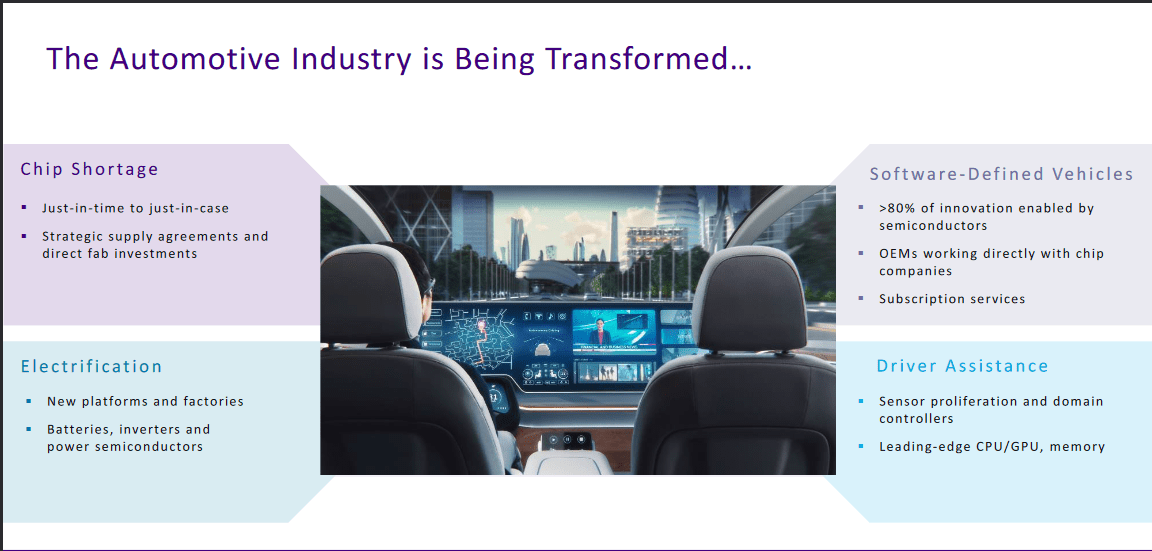

But apart from the demand placed from this side of the semiconductor industry, KLAC is seeing strong demand from the automotive industry as companies seek to revolutionize the way we drive. Driver assistance and smart cars are just a few things developing quickly in the space.

Industry Outlook (Investor Presentation)

In a presentation by KLAC, they see the Auto semi market growing from $63 billion in 2023 to over $116 billion in 2030, nearly doubling in just 7 years. Looking at what KLAC has achieved so far the revenues in the company's KLA auto system have grown an astounding 37% yearly between 2017 and 2023. Highlighting the strong demand placed on companies like KLAC.

Looking at the coming quarters for the company, the guidance suggests a QoQ decrease in both revenue and earnings. Q4 2023 is expected to see revenue between $2.1 - $2.3 billion, a disappointment here could very well lead to the share price sliding. I think most investors right now are looking at KLAC as a growth opportunity and if KLAC can't live up to that the valuation will see a compression naturally.

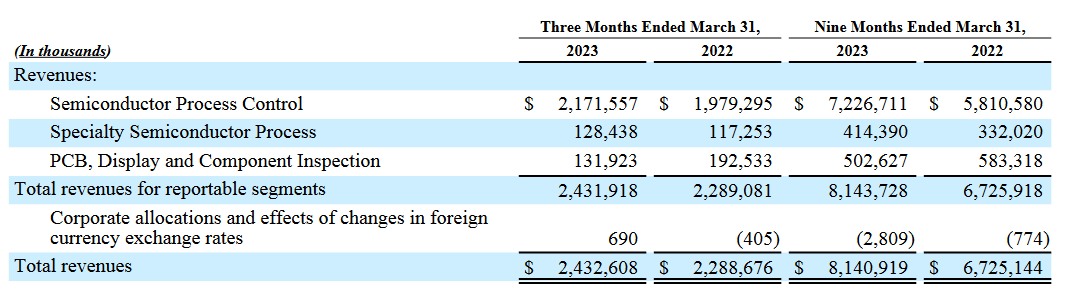

Income Statement (Q1 Report)

KLAC has a segment within the company called specialty semiconductor process which has been growing at a steady rate of 9.4% YoY. Keeping up momentum here I think could prove to be a tailwind for the company.

But perhaps even more importantly, seeing a slowdown or reverse in the PCB, Display, and Component Inspection segment would be very beneficial for the long-term case around KLAC. Revenues dropping over 30% here YoY is not a good sign, and while it's not a major source of revenues for the company, it's still hurting overall margins and results for the company.

Financials

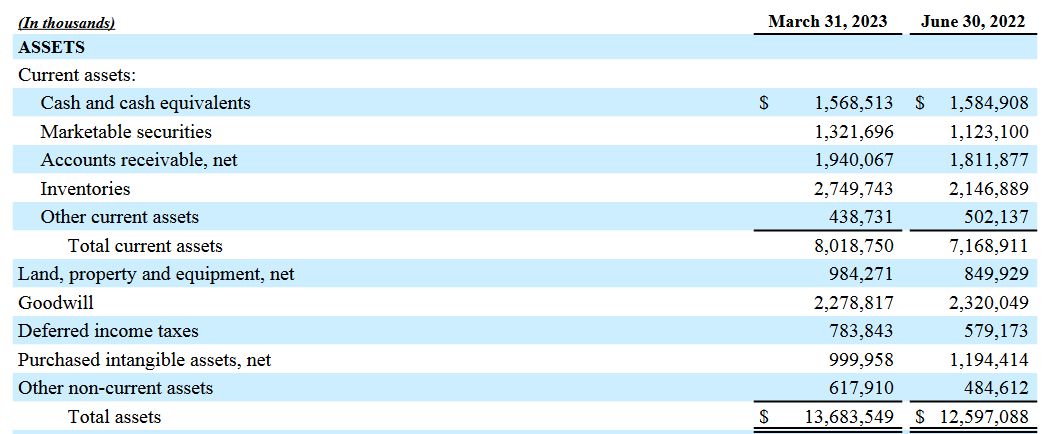

With KLAC you aren't really getting a phenomenal balance sheet. The company has done just fine to develop its financials into what right now I think is rather stable. Cash hasn't seen that much of an increase, even if they could as the FCF was nearly $1 billion for the last quarter.

Assets (Q1 Report)

The debt-to-cash ratio sits at 3.8 right now, which isn't that high. But the numbers look even better when you take into account KLAC could quite easily generate over $3 billion in FCF for 2023 if they keep the same revenues and margins as seen in the last quarter. Then the cash/FCF to debt ratio would be just 1.2. This financial position has made the company able to divert a lot of cash flows to investors instead without risking making debt unmanageable or letting current liabilities get out of hand.

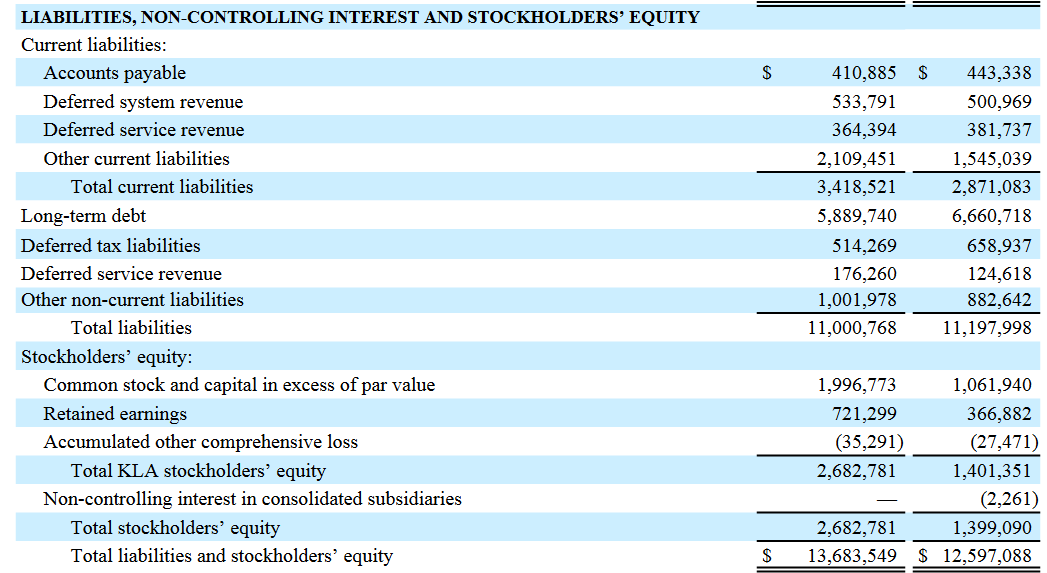

Liabilities (Q1 Report)

The strong cash flows also make KLAC able to distribute a dividend too, something which they have a strong history of doing and also increasing. Right now it seems KLAC could afford to take on more debt if it meant increasing production to satisfy the automotive industry. The scalability of a company like KLAC seems strong and in the long-run investments like these will help grow FCF and shareholder value.

Risks

The main risk with KLAC I think would be a disappointing quarterly report. If there is a clear slowdown in demand that will hurt KLAC a lot given they rely on strong demand to grow their revenues and keep FCF up.

With US auto sales having a tough couple of years the necessity for automotive companies to get new cars on the market using technology that KLAC supplies might not be that strong. Those companies need to also adapt to demand and supply in order to not overextend themselves. Seeing as this industry is one of the main drivers behind the growth KLAC is seeing, a slowdown would be detrimental to the share price.

Valuation

Looking at the valuation for KLAC is seeing an increasing FWD p/e, much because of the softer semiconductor pricing environment right now compared to 2022. But with 18x forward earnings for a company growing revenues at a decent rate it's still a fair price in my opinion and not too high to make the buy case go away.

Margins (Seeking Alpha)

Comparing KLAC to a company like Applied Materials Inc (AMAT) which also supplies specialty materials and products to the semiconductor industry, the main benefit to owning KLAC instead is the superior levered FCF margins of 19% compared to AMAT's 16%. KLAC has already proven itself in that they want to distribute profits to shareholders and using two-thirds of all FCF to that endeavor makes me optimistic about the long-term prospects an investment will have. Where AMAT does win out slightly is the also strong buybacks the company has a history of doing. On a 5-year span, AMAT has decreased their outstanding shares faster than KLAC, but I think given the stronger margins of KLAC in the long-run more buybacks will be had here, which helps contribute to the slightly higher p/e the company has to AMAT.

Final Words

Right now KLAC offers investors a solid opportunity to gain exposure to the semiconductor industry as they help supply the market with materials and products meant to further advance our automation abilities. One noteworthy industry growing quickly is the automotive semi industry, where KLAC has seen 37% 5-year CAGR growth in that part of the company. This opportunity seems to be something KLAC is leaning into and I am hopeful the efforts will be highlighted in coming quarterly reports as a success. Right now, paying around 19x forward earnings for the company seems very fair and KLAC will be a buy from me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.