BDC Weekly Review: Q1 Sector Results Review

Summary

- We take a look at the action in business development companies through the second week of June and highlight some of the key themes we are watching.

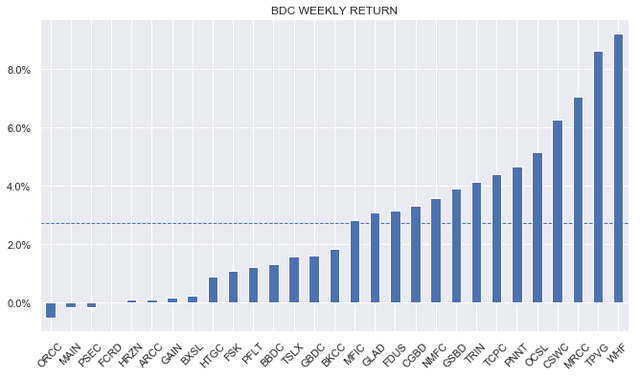

- BDCs had a strong week with a nearly 3% return.

- We sum up the key metrics from Q1 results.

- And highlight the underperformance by BBDC.

- Systematic Income members get exclusive access to our real-world portfolio. See all our investments here »

Darren415

This article was first released to Systematic Income subscribers and free trials on June 10.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company ("BDC") sector from both the bottom-up - highlighting individual news and events - as well as the top-down - providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of June.

Market Action

BDCs had another strong week with a total return close to 3%. In the lead were recent underperformers like TPVG and WHF as well as the long-term underperformer MRCC. This is not quite a "dash for trash" but it's a pattern that's worth watching.

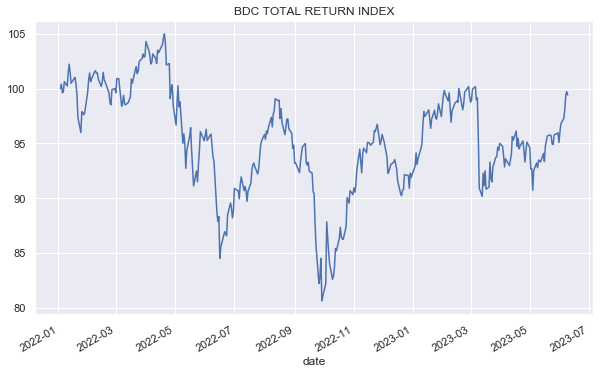

From a total return perspective, the sector is back to its 2022 level which is quite a good result for BDC investors, particularly as this is all due to a valuation rerating rather than portfolio losses.

Systematic Income

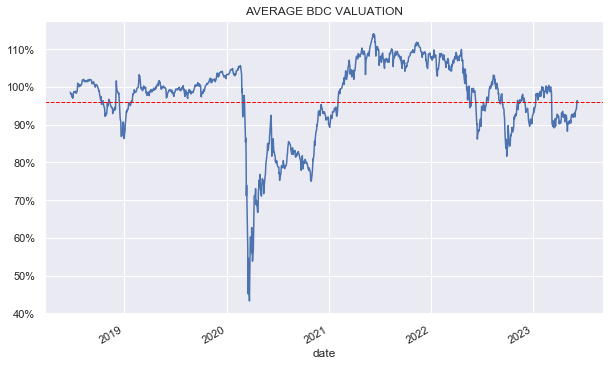

Valuations continue to move higher, after falling in the wake of the bank tantrum. Current valuation is only a few percentage points below its longer-term average level. A high level of income is largely offsetting credit concerns over the medium term as recession worries persist.

Systematic Income

Market Themes

With Q1 reporting now over, we take this opportunity to review the key figures across the sector, defined as the roughly 30 names in our coverage universe.

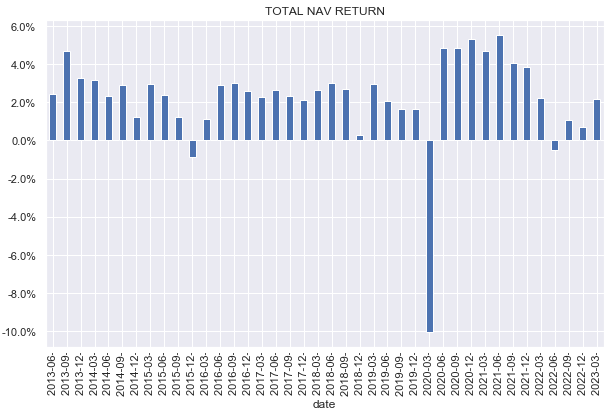

Total NAV return in Q2 was a solid 2%, or roughly 8% annualized and was the third positive quarterly return.

Systematic Income

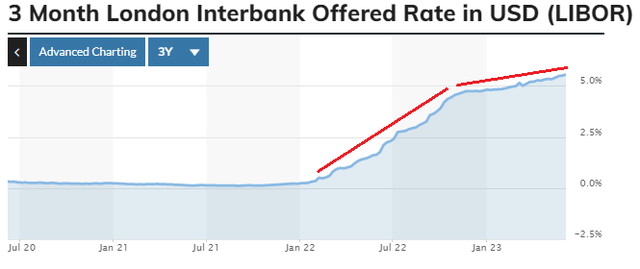

Median net investment income increased by 3.7%. Net income has been rising since around Q2 of last year, after moving through, what we call, the net income valley. The net income valley exists when Libor floors are set predominantly above Libor and short-term rates rise through the floors. This causes interest expense (which has no floors) to increase while loan income remains unchanged. However, when short-term rates moved past the sector average Libor floor level, net income started to increase once again.

The pace of net income rises has slowed down, mirroring the slowdown in the pace of short-term rates. The Fed has signaled they will likely pause to allow the economy to catch up with the cumulative tightening. It's unlikely we will see a return to the double-digit quarterly net income increases we saw in the second half of 2022, however a mid single-digit rise is likely in Q2.

Apart from the sharp rise in short-term rates, the fact that longer-term rates were recently significantly below current levels is another reason why many BDCs are registering record levels of net income. Specifically, many companies were able to refinance longer-term fixed-rate debt in 2021 at very low levels of 2-3%. This meant that leverage costs on a significant level of liabilities is unusually low.

The median level of non-accrual on fair-value increased by 0.3% in Q2. Non-accruals have been rising in the sector over a few quarters (though far from every BDC). Non-accruals on fair-value can sometimes mask the level of distress in BDC portfolios if the non-accrual assets are sold or marked-down heavily. However, gauging non-accruals at cost, realized losses and overall NAV performance shows that the sector is doing just fine in credit terms. Some borrowers have been caught out by a reversal of COVID tailwinds as well as the rise in inflation and supply chain bottlenecks but, by-and-large, most companies are running with pretty strong portfolios.

Overall, BDCs remain in a strong position. Net investment income has grown sharply since 2022 and portfolio quality has held up well. Much depends on whether the Fed decides to tighten the screws or patiently let the cumulative tightening play out.

Market Commentary

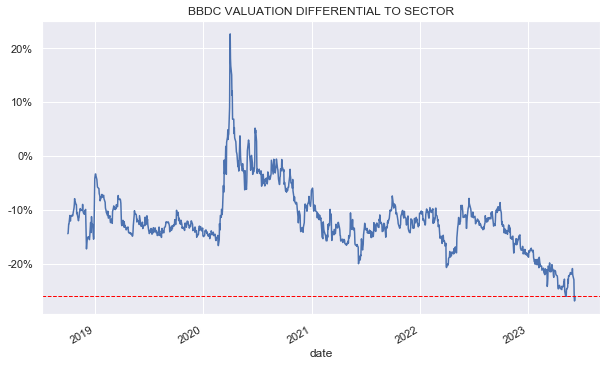

Barings BDC (BBDC) valuation continues to struggle. It has recently moved to a record low valuation differential vs. the sector of about 26% (70% valuation for BBDC vs 96% sector average valuation).

Systematic Income

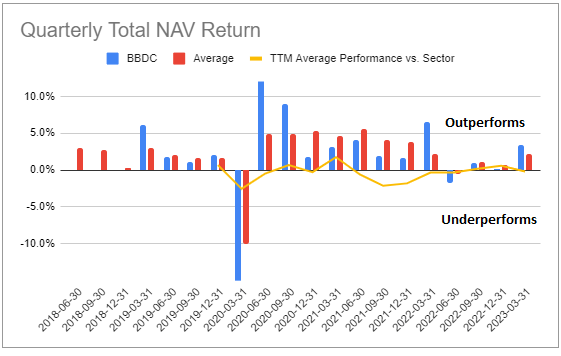

It's a holding that didn't make much sense at a tighter valuation as its performance hasn't been very consistent. Over the past couple of years however it has held its own versus the sector and has actually outperformed over the past year. At a given valuation it doesn't really have to outperform the sector to be compelling. So long it doesn't fall too much behind in total NAV terms, it can be fairly attractive.

Systematic Income BDC Tool

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.