Kimco Realty: 6% Yielding Debt Is More Interesting Than 5.5% Yielding Preferred Equity

Summary

- Kimco Realty focuses on grocery-anchored commercial real estate.

- The preferred dividends are safe, but why would you settle for equity when the debt is safer and offers higher returns?

- The 2045 bonds have a yield to maturity of in excess of 6%.

- If you're looking for income, I'd suggest having a look at the bonds rather than the preferred shares.

- The common shares are not outrageously expensive, either.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

RgStudio/E+ via Getty Images

Introduction

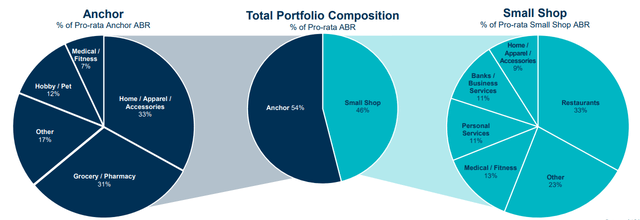

While I'm not a big fan of malls in the USA, I do keep an eye on commercial real estate companies with a strong exposure to grocery stores. Having a grocery store as an anchor tenant definitely draws in more people. And while Kimco Realty (NYSE:KIM) still has exposure to small shops (which are smaller than 10,000 square feet), it looks like the REIT is ready to deal with the current nervosity on the commercial real estate markets.

Kimco Realty Investor Relations

In this article, I will have a look at Kimco from the perspective of both a common shareholder as well as a preferred shareholder.

A strong result in Q1 makes both the common and preferred shares appealing

Before discussing whether or not a position in the preferred shares makes sense, we first need to look at how Kimco is performing in general.

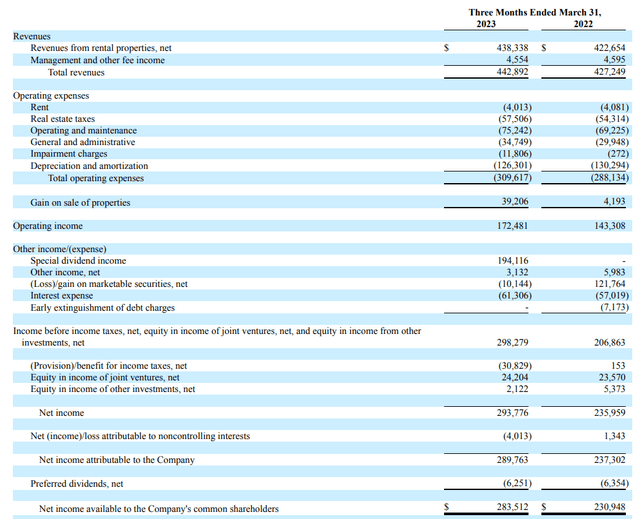

During the first quarter of the year, the total rental revenue was $438M, an increase of almost 4% compared to the first quarter of last year. The total operating income was $172.5M which is a nice $29M increase compared to Q1 2022, but this increase was mainly caused by a $35M higher gain on the sale of properties. Excluding those non-recurring games, the operating income would only have increased pretty marginally, even if you'd isolate the $11.8M impairment charge as well.

Kimco Realty Investor Relations

As you can see above, the increasing cost of debt is felt by Kimco as well as the interest expenses incurred during the quarter increased from $57M to $61M. And while Kimco remained profitable with a net income attributable to its common shareholders of about $283.5M, let's not forget that the income statement of a REIT is interesting, but the FFO performance is more important.

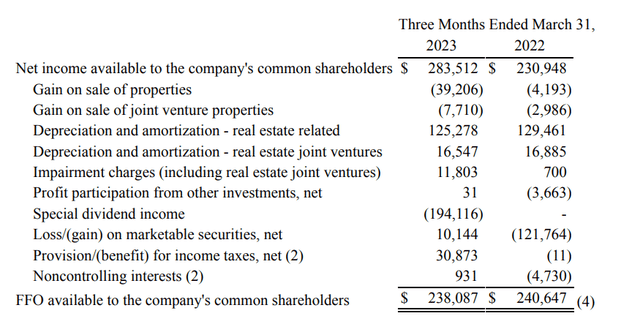

Looking at the FFO calculation, the FFO decreased slightly, by about 1% to $238M. The main reason here appears to be the higher interest expenses and the higher operating and maintenance expenses. And of course, the non-recurring gain on the sale of properties has been removed from the FFO calculation. Kimco is currently paying a quarterly dividend of $0.23 which costs the REIT just over $140M per quarter.

Kimco Realty Investor Relations

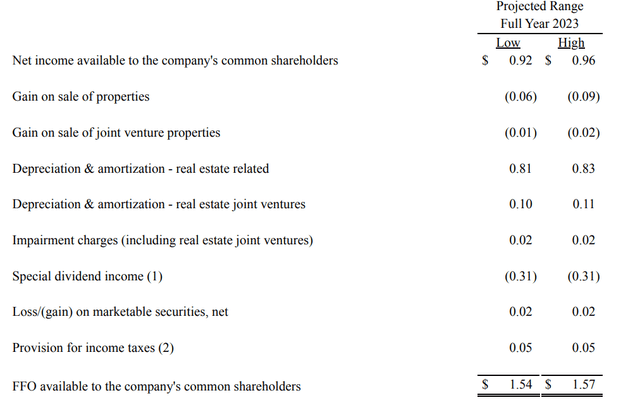

At $238M, the FFO/share is approximately $0.39. This means the distribution is pretty well-covered and even if you'd take $200M per year in improvement capex into account (including redevelopment-related costs), the AFFO/share would still come in above $0.30 per quarter. For the entire year, Kimco expects an FFO of $1.54-1.57 (with an anticipated AFFO of at least $1.25/share). This excludes the special cash dividend from Albertsons. Additionally, the REIT sold a bunch of stock during and subsequent to the first quarter, raising cash proceeds of approximately $280M after selling 14.1M shares.

Kimco Realty Investor Relations

The proceeds from those sales will strengthen the balance sheet and help mitigate the impact of increasing interest rates. The debt market doesn't seem to be too worried about Kimco as for instance a three-year bond (maturing in August 2026) is currently yielding 5.4%.

The terms of the preferred shares

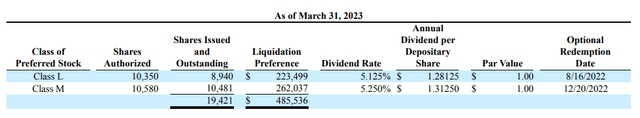

Kimco has two series of preferred shares outstanding, the L-series and the M-series. The L-Series are trading with (NYSE:KIM.PL) as ticker symbol while the M-Series have (NYSE:KIM.PM) as ticker symbol.

The L-Series have a 5.125% preferred dividend (which is $1.28125 per share, payable in four equal quarterly tranches) and is callable since August last year. Trading at just under $23, the yield on the L-Serie sis approximately 5.57%.

The M-Series has a 5.25% preferred dividend ($1.3125/share per year, once again payable in four quarterly installments) and is callable as well. The M-Series are currently trading at $23.7 per share, resulting in a yield of 5.53%. This means both preferred share issues have roughly the same yield - which makes sense - and the main consideration is now how likely it is the preferred shares will be called. The M-Series is costing the REIT a little bit more but the 0.125% difference in preferred dividend yields is negligible in the greater scheme of things.

Kimco Realty Investor Relations

There are currently 19.4M preferred shares outstanding for a total amount of preferred equity of just under $500M. The total amount of preferred dividends per year is approximately $25M. That's around $6.25M per quarter.

Knowing the Q1 AFFO came in at around $190M and knowing that already includes the preferred dividends, I think it's safe to state the REIT needs just around 3% of its pre-preferred dividend AFFO to cover the preferred dividends. Or in other words, even if the AFFO would fall by 50%, the preferred dividend coverage ratio would still exceed 1,500%.

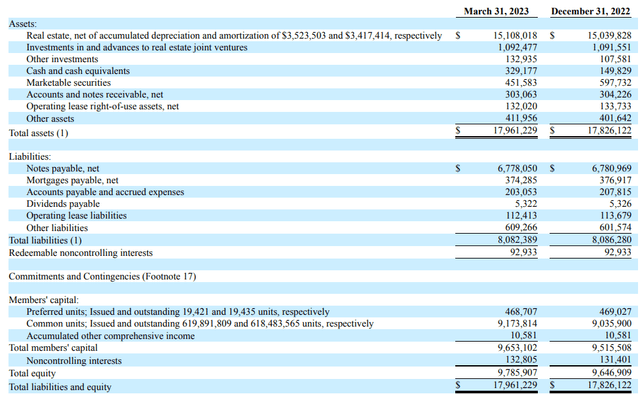

And looking at the balance sheet below, there is about $9.1B in common equity, which ranks junior to the preferred equity. Considering this also already includes in excess of $3.5B in accumulated depreciation expenses and considering the current book value of the real estate assets represents less than 12 times the current NOI, I don't think the book value of Kimco Realty is exaggerated.

Kimco Realty Investor Relations

Investment thesis

Kimco is currently trading at approximately 12.5 times this year's FFO and about 15-15.5 times the anticipated AFFO (taking $200M in improvement capex into consideration). That's not exceptionally cheap, but it's also not expensive given the recent operational and financial performance of the REIT. The interest expenses will increase but this will happen very gradually as most of the debt consists of fixed rate bonds and the higher cost of debt will only kick in once those will have to be refinanced. Considering in excess of 60% of the total debt only has to be refinanced from 2028 on, I don't expect to see any sharp increases in the interest expenses and rent hikes may actually completely mitigate the impact of higher interest expenses.

I currently have no position in the common shares or the preferred shares of Kimco. I am interested in the preferred shares but not at a sub-6% preferred dividend yield. The common shares are actually more interesting than I thought but because of that implied level of safety, the yields are not that great. The preferreds are interesting for a conservative portfolio and the 5.5% yield will for sure appeal to some investors. But considering some of the debt securities are also yielding around that level, I'd probably prefer to focus on owning a debt security rather than a preferred share. The February 2033 bonds are for instance trading at a 5.7% yield to maturity (based on the current asking price) while the 2045 bonds have a yield to maturity of in excess of 6%.

The book value per common share is just under $15. And as this includes in excess of $5/share in accumulated depreciation, Kimco is trading at a valuation I could perhaps be interested in. I'm in no rush and I will likely try to write some out of the money put options in an attempt to secure a better price.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may write put options on Kimco, but I'm in no rush.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.