IUSV: Growth Is Still A Better Choice

Summary

- Value investing may provide better downside protection in a bear market, but may not be the best strategy for long-term investors.

- iShares Core S&P U.S. Value ETF has an inferior growth profile compared to growth stocks and a lower exposure to growth sectors such as information technology.

- Long-term investors should consider growth stocks instead, as IUSV's inferior growth profile may lead to lower returns in the long run.

Galeanu Mihai

Introduction

Value investing is always an interesting concept as it usually includes stocks with lower valuation than growth stocks. Therefore, in a bear market, it may provide better downside protection. However, is this really a good strategy, especially for investors with a long-term investment horizon? In this article, we will analyze iShares Core S&P U.S. Value ETF (NASDAQ:IUSV) and provide our analysis and recommendations.

ETF Overview

IUSV owns a portfolio of U.S. large-cap and mid-cap value stocks. These stocks may trade at a lower valuation than growth peers but has inferior growth profile. In addition, its valuation is currently higher than its historical valuation range. Therefore, we think investors with a long-term investment horizon should seek opportunities elsewhere.

YCharts

Fund Analysis

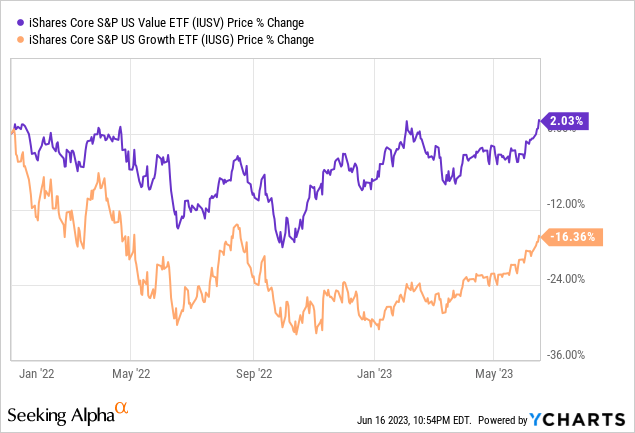

IUSV has outperformed its growth peer since 2022

Value stocks has outperformed growth stocks since the stock market reached the peak in late 2021 and early 2022. This is true also with IUSV as its portfolio consists of 700 mid-cap and large-cap value stocks. As can be seen from the chart below, value stocks have dropped only about 16% from the beginning of 2022 to the low reached in October 2022. This is much better than the drop of about 32% of its peer iShares Core S&P U.S. Growth ETF (IUSG), which invests in a portfolio of growth stocks. While IUSG has done very well since the low reached in October 2022, its total return of negative 16.4% since 2022 is still much worse than the positive 2% return of IUSV.

YCharts

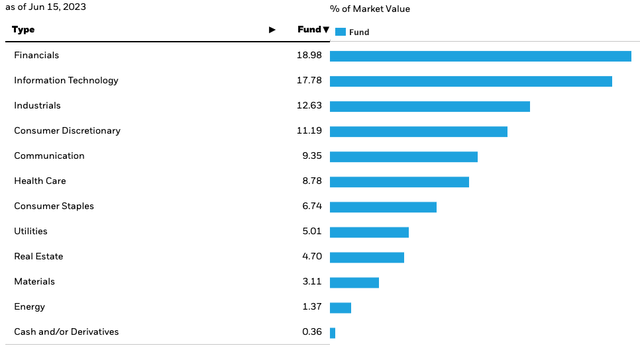

Lower exposure to growth sectors

Now, let us analyze IUSV and its growth profile. Unfortunately, it has a low exposure to information technology sector. This is a sector that is set to grow at a fast pace in the upcoming few decades due to several important growth trends such as artificial intelligence, Internet of Things, electric vehicles, cloud computing, etc. As can be seen from the chart below, information technology sector only represents about 17.8% of its total portfolio. On the contrary, IUSG's exposure to information technology sector is very high. In fact, information technology sector represents about 35.2% of IUSG's portfolio.

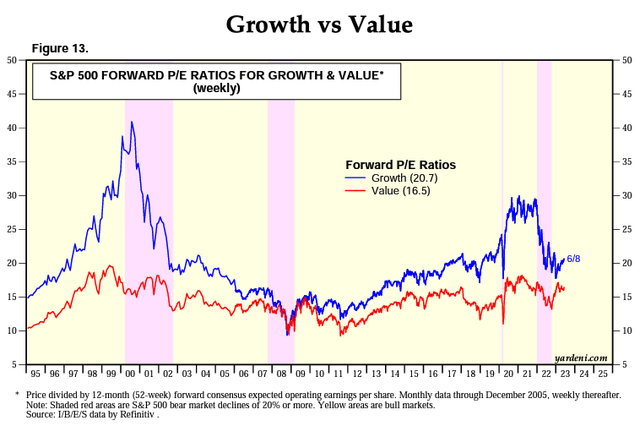

While valuation is cheap relative to growth stocks, it is still higher than its historical range

Below is a chart that shows the valuations of growth and value stocks in the S&P 500 index. Although IUSV's portfolio includes both mid-cap and large-cap stocks, large-cap stocks represent nearly 70% of its total portfolio. As we know, S&P 500 index are mostly large-cap stocks. Therefore, we believe value stocks in the S&P 500 index can give us a good representation of the IUSV. As can be seen from the chart below, value stocks in the S&P 500 currently have an average forward P/E ratio of 16.5x. This is much lower than the 20.7x average of growth stocks. However, value stocks' average valuation of 16.5x is still high since the Great Recession. As can be seen from the chart below, its valuation range is typically between 10x and 15x since the Great Recession in 2008/2009.

Do you really need to own IUSV in the long run?

While IUSV's valuation appears to be trading at a relatively lower valuation than growth stocks, its long term growth profile may be much weaker. As we have mentioned previously, it has a lower exposure to growth sectors such as information technology sector. As can be seen from the table below, IUSV's weighted average sales growth rate, cash flow growth rate and book-value growth rate are much inferior than IUSG's growth rates.

IUSV | IUSG | |

Sales Growth | 8.21% | 17.92% |

Cash Flow Growth | -4.17% | 22..20% |

Book-Value Growth | 2.92% | 8.85% |

Source: Morningstar; Created by author

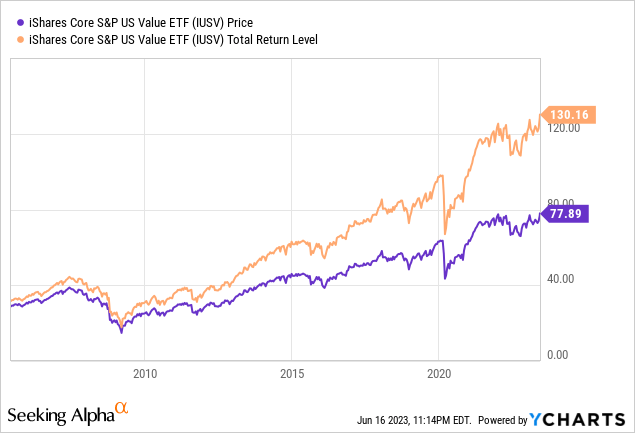

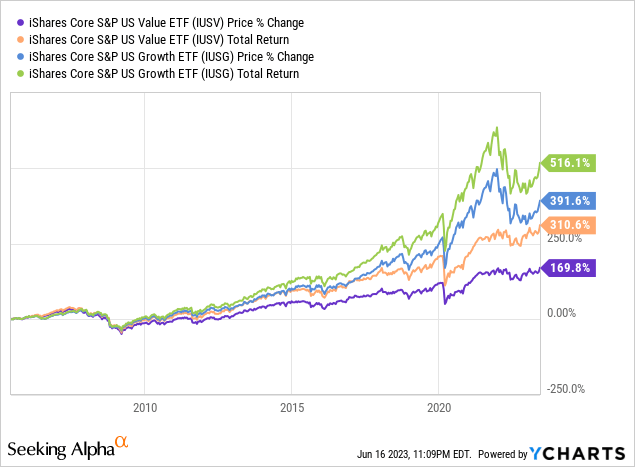

Because of IUSV's inferior growth profile than growth stocks, it is reasonable that it trades at a lower valuation than growth stocks. In addition, IUSV's inferior growth profile may lead to lower returns in the long run. Therefore, the fund may not be a good long-term core holdings for investors. As can be seen from the chart below, IUSV's total return of 310.6% since 2005 is much lower than IUSG's total return of 516.1%.

YCharts

Investor Takeaway

Value investing is an interesting investment strategy. However, due to its inferior growth profile it may not be the best way to go especially if the investment goal is to simply to invest for the long-term. Therefore, we think investors with a long-term investment horizon should consider growth stocks instead.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.