Wizz Air Stock: Fairly Valued For Now, But Long-Term Growth Ahead

Summary

- Wizz Air Holdings Plc has significantly grown its capacity compared to pre-pandemic levels.

- The company has prioritized growth, as it will help the company execute its long-term cost-efficient vision.

- Wizz Air stock is fairly valued at present, but more growth likely lies ahead.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Todorean Gabriel/iStock Editorial via Getty Images

In April 2023, I issued a buy rating for Wizz Air Holdings Plc (OTCPK:WZZAF), and the stock has gained since then but underperformed the market. Last week, the low-cost carrier reported its full year results and guidance, which I will analyze next to a discussion of some of the risks and opportunities that are currently ahead of us.

Wizz Air: A Conscious Focus On Growth

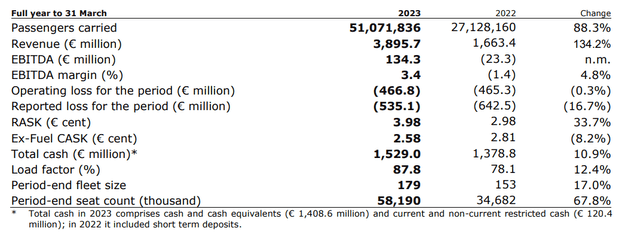

If we look at the full year results for Wizz Air, we clearly see how things come together, as well as a different mindset on growth compared to the legacy carriers. The number of passengers increased 88.3%, which was driven by an increase in load factor, continued growth of capacity of 76% year-over-year, and operating at 140% of pre-pandemic levels. Revenue per available seat-kilometer grew by 33.7%. While many airlines have increased their base fares, Wizz Air, just like many low-cost carriers, is seeing little to no growth on the base fares. While this does affect the profitability, it is a conscious decision of Wizz Air to prioritize growth and market share capture.

So, the operating loss does not reflect favorably compared to many legacy airlines and low-cost carrier Ryanair, (RYAAY), but we see a significant focus on fleet expansion. I would say with all of that in mind, the results certainly are not bad, with Wizz Air realizing that its 17% fleet growth as compared to 8% for Ryanair will enable long-term unit cost reductions and a stronger position on the market. Wizz Air is still a lot smaller compared to Ryanair, which has over 500 airplanes, and also easyJet (OTCQX:EJTTF), which has over 300 airplanes. Capturing growth at this time will make the airline more efficient and more competitive going forward. I would say that for the time being, the airline is paying the price for that.

We also see that in the unit cost reduction. Wizz Air achieved a unit cost (excluding fuel) reduction of 8% despite the inflationary environment we are currently facing, and with that, Wizz Air stays true to a low-cost mindset.

Wizz Air Eyes 2024 Profit

For FY2024, Wizz Air targets a 30% capacity increase, which should further boost the results by means of unit cost reductions. Coupled with a strong demand environment for air travel, the company expects profits in the range of €350 million to €450 million, which will also favorably impact the company's leverage.

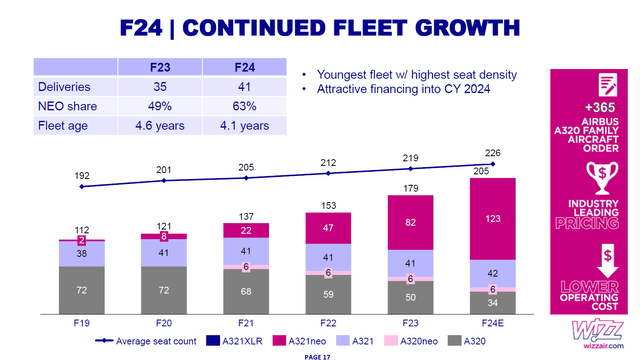

A Future-Proof Fleet

One thing I definitely like about Wizz Air is their fleet transformation. The company expects to reduce its fleet of 180-seat A320ceo airplanes by 16 while increasing its Airbus A320ceo fleet with 230 seats by one unit. It also is reducing the Airbus A320neo fleet with 239 seats by 41 units, resulting in the new engine option share in the fleet to grow to 63%. The combination of redeliveries of airplanes with fewer seats and deliveries of new airplanes with more seats will boost the average seat per airplane by 3%, meaning that fixed costs can be amortized over 3% more seats, which will benefit the unit costs.

Moreover, the fuel consumption of these new airplanes is superior, bringing the fuel costs down on unit level on top of the already declining fuel prices. By up-gauging with new airplanes, Wizz Air is significantly improving its cost-efficient growth trajectory, which I believe provides a big opportunity for the airline.

The Risks For Wizz Air

In its growth trajectory and the efficiency of the growth vehicles, I do see significant opportunities ahead for Wizz Air. There are, however, also risks involved. With the clear focus on growth, the obvious risk is that any softening in demand for air travel would hit Wizz Air hard, as its growth to reduce unit costs would no longer be supported by demand.

As the company grows, another challenge is to get enough pilots to fly the airplanes. While that is a risk that needs to be highlighted, Wizz Air believes it is positioned attractively for pilots, as its path from first officer to captain is shorter compared to competitors. I would say that the company is also doing OK in attracting flight crews. The picture above was taken from my office and shows an Airbus A321neo that Wizz Air dispatched from Budapest to my local airport in Romania to do touch-and-goes to train crews, and they have done so several times in the past months.

Another risk is the engine selection for the new airplane deliveries and any delays in overall airplane deliveries. Airbus is having some challenges meeting delivery schedules, and more and more airplanes with Pratt & Whitney turbofans have been grounded over part shortages. This provides a clear risk to Wizz Air, which also makes use of the so-called GTFs. The airline, however, does believe that it has stocked enough parts and has not been forced to ground any airplanes so far.

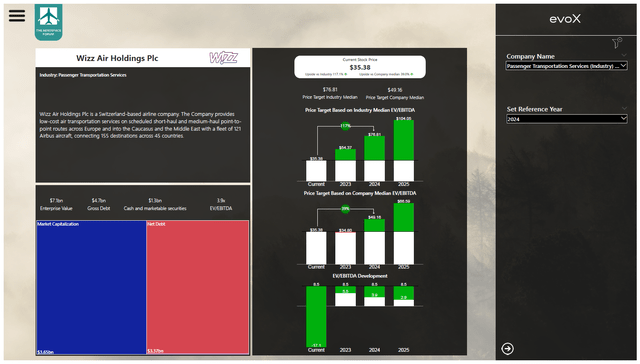

Wizz Air Stock, A Buy For 2024 And Beyond

While I have a buy rating on Wizz Air stock, the reality is that the company is fairly valued, with FY2024 (year ending 31st of March 2024) in mind. So, if you are looking for a fundamentally driven opportunity for the current financial year, then Wizz Air offers no upside. However, with its FY2025 earnings in mind, around 40% upside exists. While the company has no appeal for 2023, I do believe the long-term growth trajectory justifies maintaining a buy rating on WZZAF stock.

Conclusion: Efficient Growth Trajectory Ahead For Wizz Air

Wizz Air Holdings Plc might be behind in terms of margin recovery, but the company has consciously chosen to focus on growth as a way to drive down unit costs, which is of significant importance for low-cost carriers. The increased scale should give the company lower costs and a bigger competitive strength to become an even stronger power on the European mainland, one to be reckoned with. While WZZAF stock offers no upside for the current year's expectations, I do believe Wizz Air Holdings Plc remains a buy as it embarked on a cost-efficient growth trajectory that should benefit the company over the longer term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.