Can Hedged Equity Complement The 60/40? 2022 Says 'Yes'

Summary

- In 2022, investors faced a tumultuous year of market volatility, driven by inflation, rising rates, and geopolitical events.

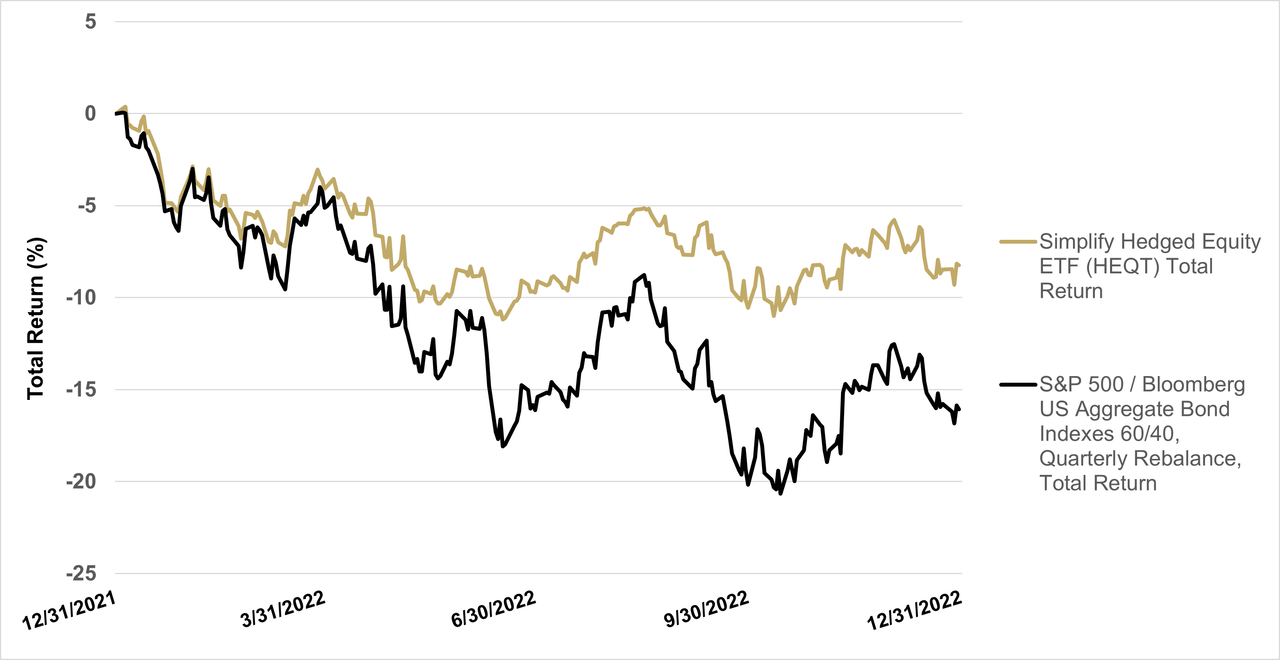

- Simplify’s HEQT ETF experienced a lower max drawdown than a traditional 60/40 portfolio in 2022 while also delivering lower volatility and a superior calendar year total return.

- A hedged equity strategy using laddered option strikes can provide an alternative to traditional stock/bond allocations and may deliver relative advantages during rising rate environments, among other potential scenarios.

tadamichi

Introduction

In 2022, investors faced a tumultuous year of market volatility, driven by inflation, rising rates, and geopolitical events. During such times, alternative diversification strategies such as hedged equity, managed futures, or rate-hedging strategies offered effective diversification benefits to the traditional 60/40 stock/bond portfolio. In this blog post, we review how a direct hedge via a hedged equity exposure to US equities provided a better return and drawdown profile than a proxy-hedged portfolio that uses bonds to hedge stocks.

When Correlations Flip

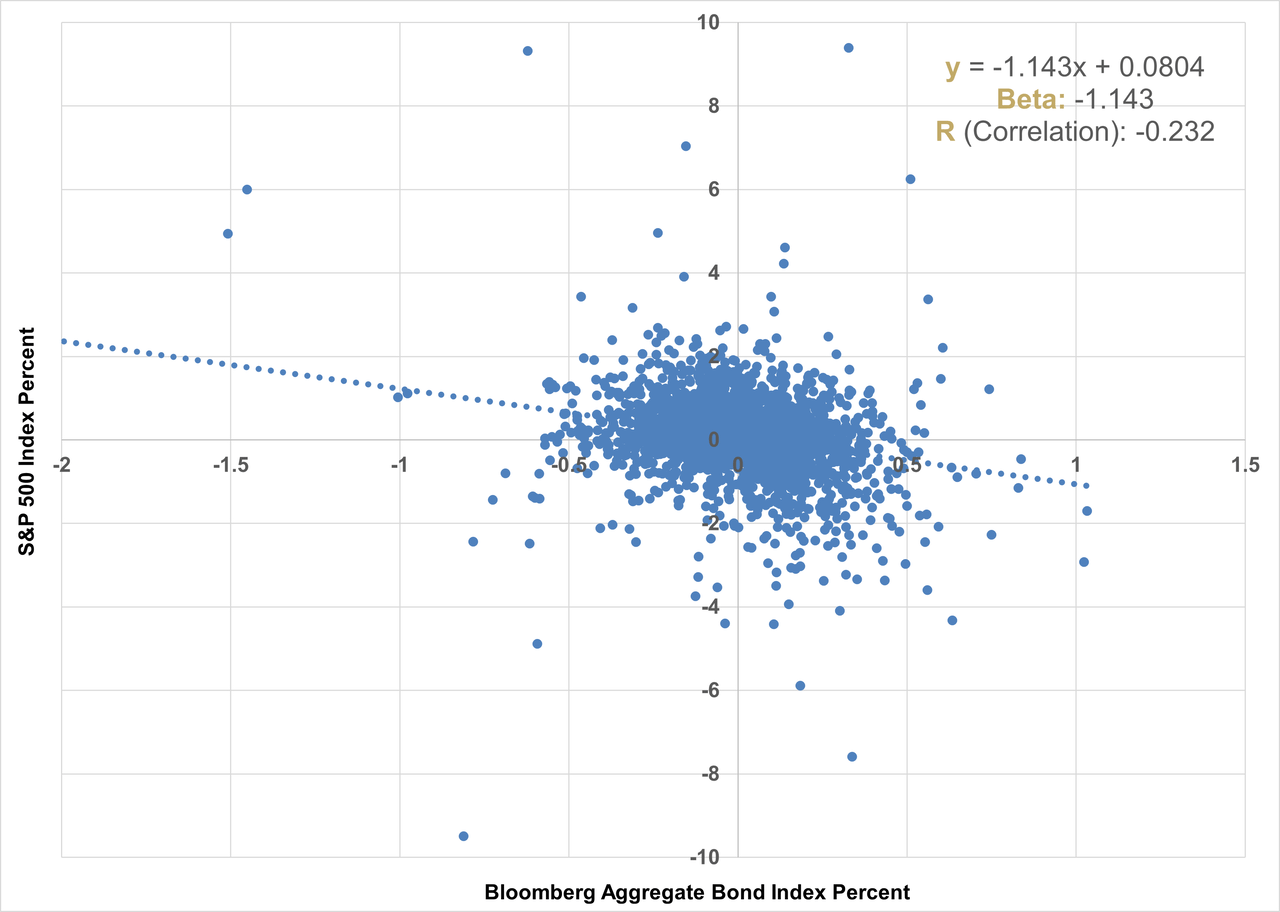

Last year was an extremely difficult environment for traditional asset allocation investors. In the decade prior, the assumption of balanced risk offered by negative correlations between stocks and bonds held true, as shown in Figure 1.

Figure 1: S&P 500 Index vs. Bloomberg Aggregate Bond Index12/31/2011 – 12/31/2021

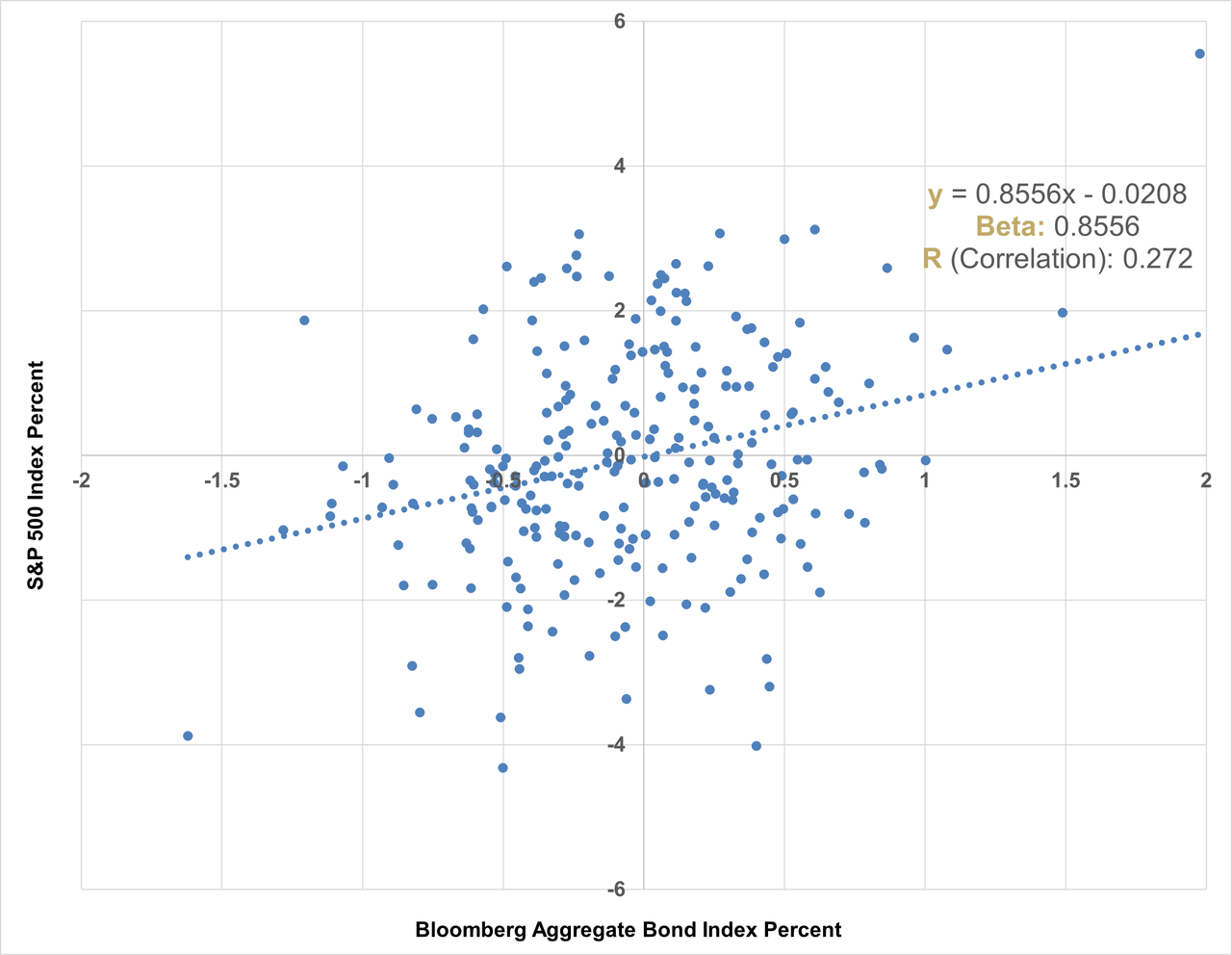

Figure 2: 2022 S&P 500 Index vs Bloomberg Aggregate Bond Index12/31/2021 – 12/31/2022

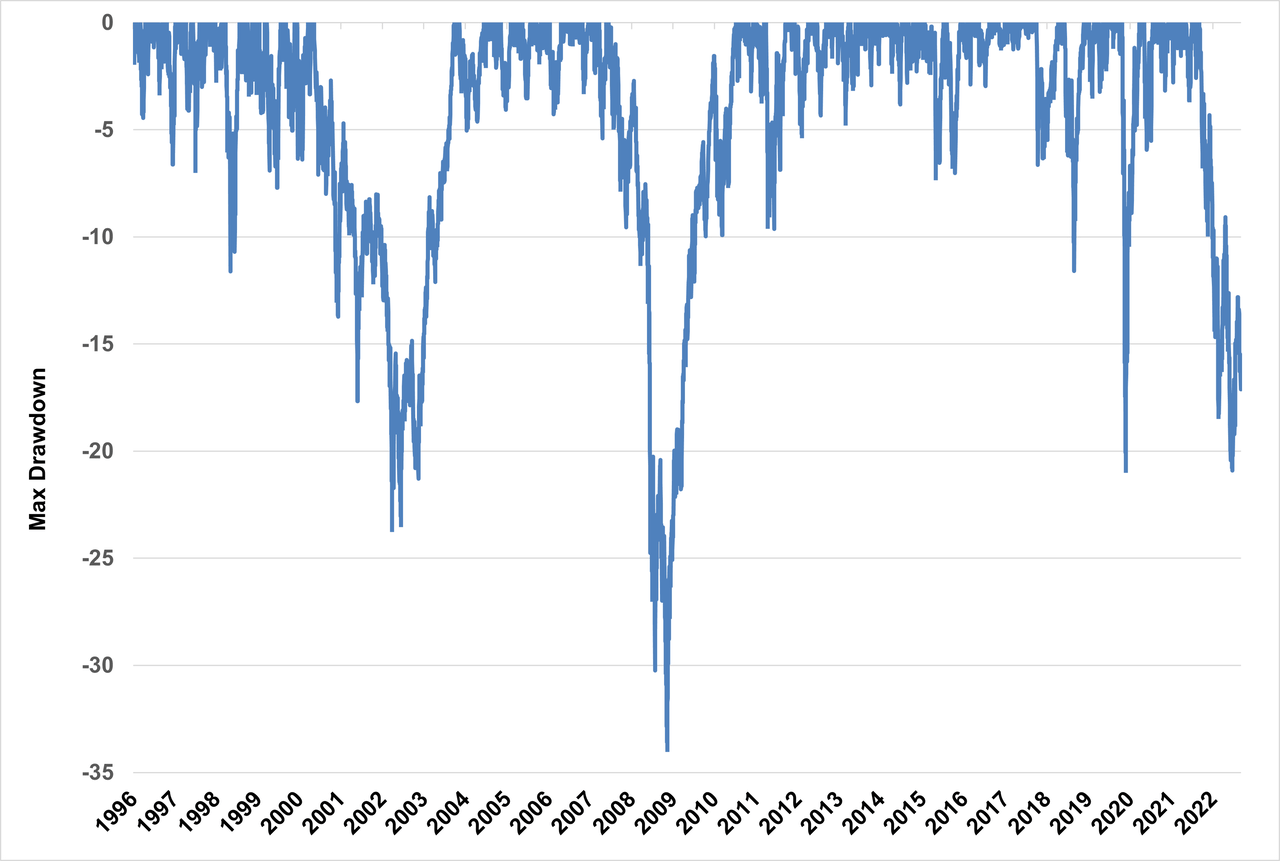

Figure 3: 60/40 Portfolio Max Drawdowns12/31/96 – 12/31/22

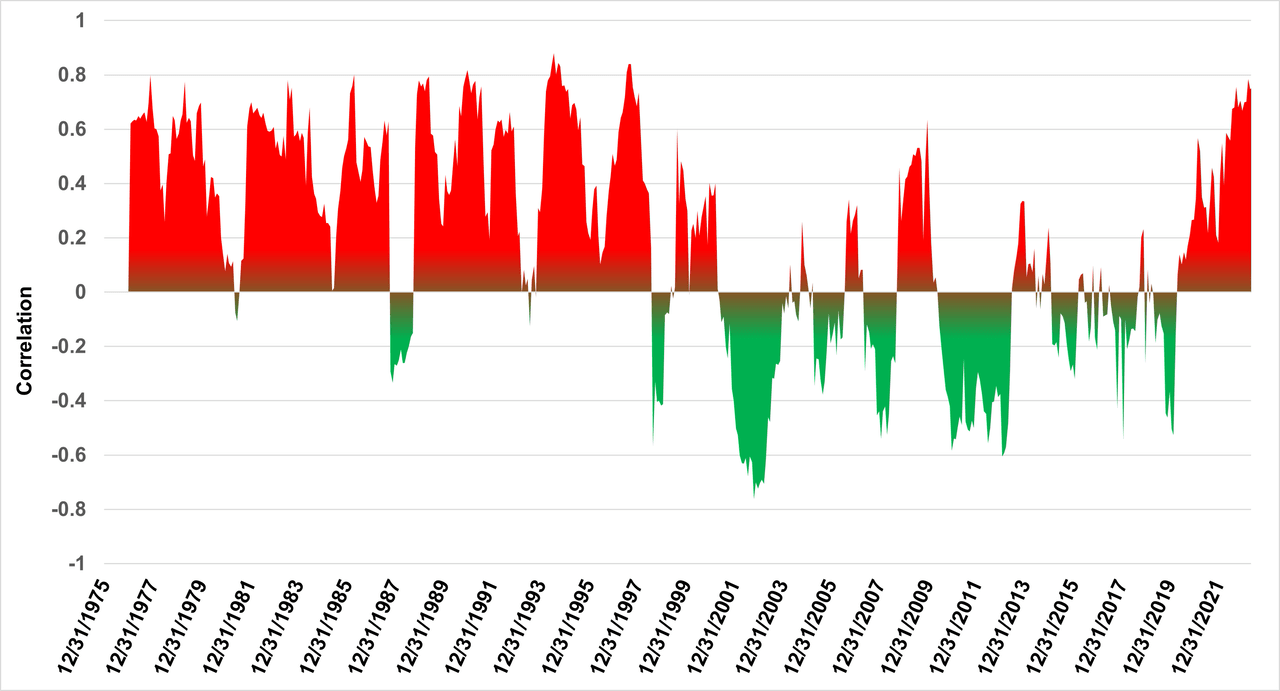

But was 2022 a one-off in an otherwise reliably balanced relationship? Not quite. Since the inception of the Bloomberg Aggregate Bond Index in 1973, stocks and bonds have been positively correlated most of the time. It wasn’t until the turn of the century that the 60/40 portfolio became a reliable portfolio construction in terms of offering diversification benefits. With the end of the bond bull market, are positive correlations here to stay, or simply a fleeting event? Figure 4 shows the historical relationship between the two asset classes.

Figure 4: S&P 500 Index vs Bloomberg Aggregate Bond Index, Correlation, Trailing 12 Mo.12/31/75 – 12/31/22

An Alternative to 60/40

One alternative to hedging equity-focused portfolios with bonds is a hedged equity strategy. A hedged equity strategy is designed to provide downside risk mitigation while still participating in the market's upside by employing a combination of long and short options, most often in the form of a costless collar, with an underlying equity exposure to manage risk and volatility. This affords the strategy a direct, explicit hedge exposure using put options rather than the typical proxy hedge offered to stocks by bonds.

Simplify’s Hedged Equity ETF (HEQT), which holds a low-cost passive equity ETF and ladders monthly spread collars to cover the portfolio over the forward three months, experienced a lower max drawdown than a traditional 60/40 portfolio in 2022 while also delivering lower volatility and a superior calendar year total return. Figure 5 shows this single-year comparison.

Figure 5: HEQT vs. 60/4012/31/21 – 12/31/22

The performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month-end please call (855) 772-8488 or go to https://www.simplify.us/etfs. The fund’s gross expense ratio is 0.53%. For the fund’s standardized performance, click here.

In Conclusion

Stock/bond correlations are not static, and investors should consider alternative ways to diversify equity-focused portfolios. A hedged equity strategy using laddered option strikes can provide an alternative to traditional stock/bond allocations and may deliver relative advantages during rising rate environments, among other potential scenarios. 2022 is a sobering reminder that there is no one-size-fits-all portfolio hedge and that proxy hedging equity exposures with bonds can be complemented by other diversification methods.

Glossary

Beta: Slope coefficient of a linear regression between the S&P 500 Index and the underlying asset

Bloomberg Aggregate Bond Index: A broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

Spread Collar: A strategy that involves buying a downside put and selling an upside call that is implemented to protect against large losses, but that also limits large upside gains.

S&P 500 Index: The index includes 500 leading US large cap companies and captures approximately 80% coverage of the available market.

Investors should carefully consider the investment objectives, risks, charges and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF's prospectus containing this and other important information, please call (855) 772-8488 or view/download a prospectus online. Please read the prospectus carefully before you invest.

An investment in the fund involves risk, including possible loss of principal.

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. The use of leverage by the Fund, such as borrowing money to purchase securities or the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. The earnings and prospects of small and medium sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Small and medium sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience. The funds are new with a limited operating history.

The information on this website does not constitute investment advice or a recommendation of any products, strategies, or services. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Simplify Asset Management Inc. or its affiliates, nor Foreside Financial Services, LLC, or its affiliates accept any responsibility for loss arising from the use of the information contained herein.

Simplify ETFs are distributed by Foreside Financial Services, LLC. Foreside and Simplify are not related.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by