ICU Medical: Challenges To Profit Growth Clearly Identifiable

Summary

- ICU Medical has caught a bid into FY'23, curling up 21% off lows.

- The economic characteristics of ICUI remain in situ, in my opinion.

- Therefore, the investment opinion gravitates towards a neutral view.

- Net-net, reiterate hold.

hapabapa

Investment Summary

A 22% rally since the last publication on ICU Medical (NASDAQ:ICUI) means the investment thesis must be revisited. Last time, I found several conflicting investment points that suggested ICUI was a hold at the time. At the time of this analysis, my findings indicate this may be the same for the company going forward. I am keeping a close eye on ICUI into FY'23 given its heavy investments into future growth, investments it upheld in its Q1 FY'23 numbers, posted early last month.

Plainly and simply, there are headwinds to ICUI's re-rating in market value above long-term highs. For one, there is a lack of fundamental data to suggest the company will outperform its peers in terms of sales, earnings growth, or the like. Second, sentiment, whilst improving (as indicated in recent market price gains) remains stagnant, and is yet to convey any bullish signals, further shown in the lack of economic value created by the firm. Third, valuations are unsupportive, and I find it challenging to see ICUI rating higher based on the market's reward of its invested capital in recent years.

Without at least one of these three factors in our corner, it is difficult to stand up in the ring and face off to defend a buy thesis on ICUI. Instead, its prospects are neutral to me, warranting a hold call.

Net-net, there are insufficient findings in my analysis to warrant ICUI as a long-term buy. This report will discuss the critical facts needed in forming an investment opinion on the company. Reiterate hold.

Figure 1.

Critical facts for ICUI hold rating

A full breakdown of the contributing factors to the reiterated hold rating follows. Before that, consider that my firm belief is that ICUI has to create economic value for its shareholders in order to attract investment, and investors pay a higher price to buy its stock. This is central to the investment thesis of hold, yet, there are positive factors that suggest it will be attractive to some buyers.

1. Economic characteristics

As a reminder, this investment research channel focuses on identifying companies with durable economic characteristics. The best way in which to benchmark this– compare the way in which the firm recycles capital into additional market valuation over time. In other words, let the market do the talking.

Consider that a firm is simply a conduit between its investors and the capital/equity underpinning its operations. If you're going to invest in any company, you'd want to know two things– 1) what you're buying, in terms of assets factors, and 2) what earnings power these assets possess. As 'owners' of the business capital, your investment is tied against the company's market valuation, which is to be decided by the market.

The market is an accurate judge of fair and intrinsic value over time. It will eventually lean towards names that can reinvest their earnings into growing the business. If invested at high rates of return (profit growth), above the market's return, this creates economic value, which is valued tremendously highly by investors– more than accounting values. So it is the economic earnings, those profits generated above a certain hurdle rate, that are of value to a company's valuation. Now you have a relevant measure to benchmark the company and its intrinsic valuation against as well.

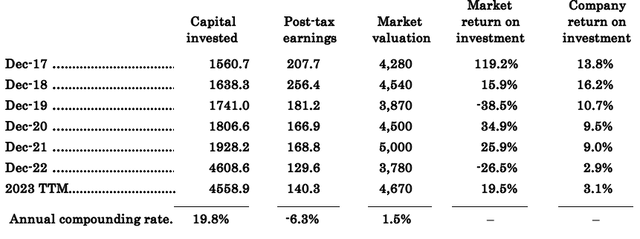

For ICUI, capital recycling has yet to turn in the investor's favour. We can rewind to FY'17 to observe these trends as a fruitful exercise [Figure 2]. Note, the hurdle rate in this report is 12%, reflecting the long-term range of the benchmarks. Note, the company has been generally profitable over this time. However, a few points to consider:

- In both '17 and '18, economic earnings were in the realms of 1–4% (13.8% and/or 16.2% – 12% = 1.8% and/or 4.2% respectively). The market was generous and rewarded it with strong economic gains.

- Shift to '19 it missed the hurdle rate and the market revised its valuation accordingly by 38% to the downside.

- In FY'20–'21, the cost of capital was revised, and was far lower. Whilst the benchmark was vertical, the actual hurdle rate to beat was much lower, given the risk-free rate and equity risk premium shrinking to all-time lows. Hence why you see a 9–9.5% return on capital catch a 25-35% market return.

- In FY'22 this all changed, cost of capital back to heights, retail liquidity dried up, etc. The 2.9% capital return saw a heavy re-rating in the bear market.

The above events come as no surprise given the discussions on business economics earlier. The market will efficiently allocate capital where it is most valuable. If a company doesn't beat what investors could get elsewhere, forget attracting serious investment. This is exemplified for ICUI in that it has compounded earnings at a negative 6% since 2027. This is perhaps one reason why its market cap has compounded at just 1.5% over the testing period, whilst it has increased its investments by c.20% per year to the TTM.

Table 1.

2. Fundamental factors

ICUI reported mixed financial results for the first quarter of FY'23. Revenues pulled 4% higher to $556mm, on adj. EBITDA of $102mm, and adj. earnings came in at $1.74. Additionally, ICUI clipped 200bps decompression in gross margin thanks to the combination of (1) less frictional supply chain, (2) normalized service levels, and (3) an improving macro landscape. Breaking the quarter down into its contributing factors is telling, as noted below. As a reminder ICUI operates through 3 business units: consumables, infusion systems, and vital care.

- The consumables segment is the largest and most profitable, generating $236mm in revenue in Q1. This is just 100bps upside on Q1 last year.

- The Infusion Systems segment, which is a consolidated entity made of the ICU LVP pump business, and the Smiths syringe and ambulatory pump businesses, reported $162mm in revenues. This is no "Frankenstein" business, mind you. Revenue was up 17% on a reported basis, with 5% of FX headwind. The core message I pulled from the earnings call is that each product line within the consolidated operations is expected to push higher in FY'23.

- Vital care printed $158mm in revenue, up 3% YoY.

There are investment implications drawn from the company's portfolio setup and operations. These are, on the whole, quite positive. I would group these into 3 categories:

1. Revenue diversification:

Readers of mine will know the benefits of distributing the top-line across a multitude of sources. I am therefore a fan of ICUI's newly formed 3 business units. One, it provides revenue diversification and mitigates concentration risks associated with overreliance on a single segment. The consumables segment contributes the highest revenue, followed by infusion systems and Vital Care, in that order. This diversified revenue stream reduces the company's vulnerability to market fluctuations moving forward.

For example, you can see this directly in Q1. While the consumables segment experienced a slight decline in reported revenue, the infusion systems segment showcased significant growth to offset this– just as a correctly hedged portfolio does.

2. Operational efficiency:

From June FY'22 lows in quarterly gross margin of 29.8%, the company has regained ~400bps on this. It came in with 33.7% gross in Q1. ICUI's sequential improvement in gross margin reflects the points raised just earlier. In particular, the points on supply chain freeing up could be a tailwind going forward. Moreover, ICUI has the goal of returning to a historical gross margin of over 40%. To get there– management project price increases, operational synergies from the Smiths Medical integration, and a more normalized macroeconomic environment. This is correct, in my view, but 7 points of gross margin is no easy task and will take some time. Definitely keep an eye on this section though going forward.

3. Strategic investments:

Related to points raised earlier on the company's growth capital, there are 3 avenues I see the company allocating investment toward. Strategic investments in inventory levels, quality improvement initiatives, and the integration of the Smiths Medical business could position the company for a more lucrative path of future growth. Two main reasons for this. One, by bolstering safety stock and onboarding new customers, the focus is on no-hiccups in manufacturing, to hit demand consistently. Two, the investment of ~$50mm in additional raw materials and finished goods is purported to be a hedge against supply disruptions and to meet demand going forward as well.

These factors suggest fundamental drivers may be of potential value for the company, but that there is uncertainty in the same journey forward.

Valuation and conclusion

Investors are selling their ICUI stock at 27x forward P/E and 15x forward EBITDA, quite the ask. In order to pay that, I'd be expecting fairly heavy investment from ICUI into new growth avenues, and profits to be growing faster than the overall market. This simply isn't the case, as discussed at length here today. In particular, the lack of earnings growth in the last 2-3 years despite heavy capital allocation is telling. The market has been agnostic to the company on this, amongst other grounds in my view.

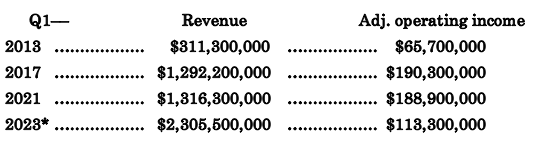

Looking forward, there is a lack of fundamental basis to see ICUI's valuation rating higher in the medium term. For FY'23 in the TTM, sales are above FY'21 values, but it hasn't come through at the operating line. In fact, the company's operating income, adjusting for R&D investment by capitalizing it on the balance sheet as an intangible asset, has decreased off $190mm highs in FY'17.

To pay 15x forward I'd be expecting strong earnings growth and this to be backed by an identifiable driver, either on sentiment, or valuation, or some special situation. The sector multiple of 13x EBITDA suggests ICUI would be more fairly priced at $141 per share, off the current market value as I write. This supports a neutral view.

You'll see the quant system is supportive of all these findings as well, providing an objective layer of reasoning to remove cognitive and emotional biases from the analysis. It has been said to ignore these ratings at one's own peril, and that might be a fair argument.

Figure 2. ICUI long-term revenue, adj. operating income

Note: 2023 is shown as the TTM to Q1 FY'23 (Data: Author, ICUI SEC Filings)

Figure 3.

In conclusion, there are insufficient findings to suggest ICUI is an immediate long-term buy. The data instead shows that it has numerous challenges to overcome. In that vein, I am reiterating my hold rating on the company for now. Watch out for the outcomes from its strategic investments going forward, they could be a catalyst, in my view. Reiterate hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.