Davide Campari: Growth Engines To Outperform Peers

Summary

- Davide Campari has a clear growth trajectory in underpenetrated markets incomparable to peers, with scale enabling margins to become in-line with them.

- Its product portfolio benefits from several monopoly-brands that are synonymous with their spirit category.

- Consumer tastes are changing in favor of its largest brands' taste profile.

- Disciplined and proven acquisition strategy will add to the value of the current portfolio.

- Current valuation shows significant upside.

Nirian/iStock via Getty Images

What They Do

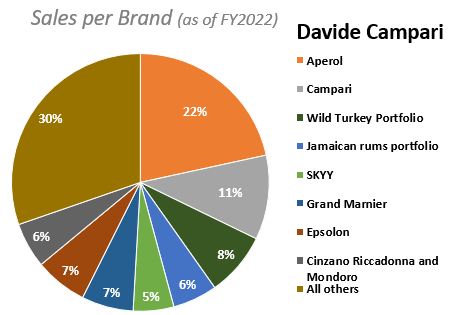

Davide Campari-Milano (OTCPK:DVDCF) (OTCPK:DVCMY) ("CPR") owns, markets, and distributes several brands of (mostly) alcoholic beverages across the world. While an old company (est. 1860) a large part of its identity and product strategy has come to revolve around Aperol, an aperitif brand only acquired in 2003 which now accounts for 22% of their sales:

Company Filings

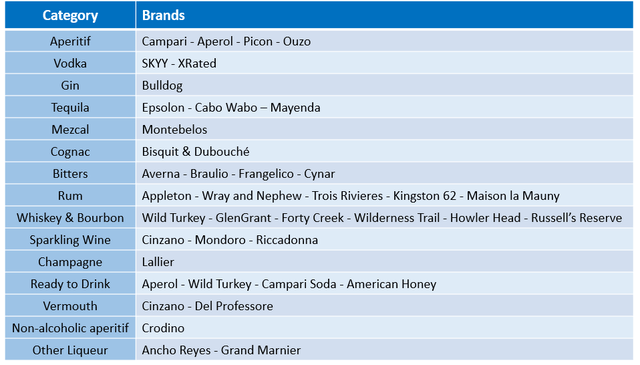

While 67% of sales are concentrated among its top 7 brands, CPR owns at least 40 brands outright. This helps explain the large share of revenues that all other brands represent. Below is a full list of brands, categorized by type of alcoholic beverage.

Acquisition Powerhouse

To leverage its distribution network and marketing abilities, CPR operates like many other of its large peers through what are, in essence, brand roll-up acquisitions. For CPR specifically, Aperol and Campari are the biggest brand names with which it can initiate distribution and, through the strong interest in its brands, make the distribution agreement conditional to also include many other brands within different categories of its portfolio. For example, an Aperol Spritz is only really made with Aperol and popular cocktails like the Negroni require Campari. We'll return to how cocktail preference trends are specifically benefitting these brands later.

Its large brands therefore serve as a sort of Trojan horse which, in addition to individual brand marketing, enables successful execution of brand acquisitions.

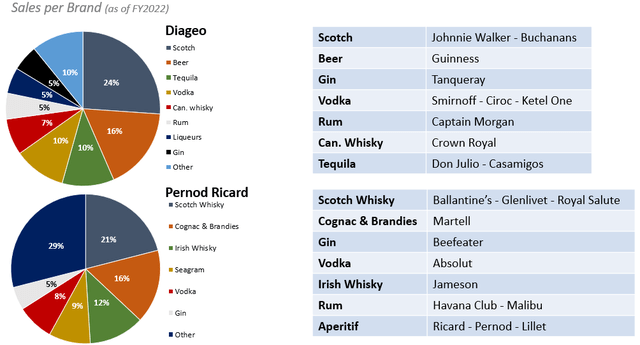

This is not to say that this strategy has led CPR down the path of a company dependent on a single product. Looking at its two largest peers (Diageo (DEO) and Pernod Ricard (OTCPK:PDRDF) (OTCPK:PRNDY)), we see that CPR is not an outlier in product concentration.

Not all brands are destined to be superstars, but some acquired brands can undoubtedly stand on their own and have their own loyal consumer base. For example, Aperol was an acquired brand, the Jamaican Rums portfolio dominates its local market, and the Espolon brand is generating 30%+ annual growth rates.

For these brands and others, CPR's stars serve more as boosts for them to enter more markets than would otherwise be the case, were they on their own.

Acquisition Samples

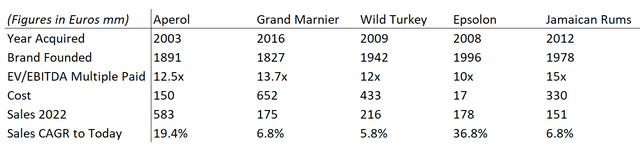

With this in mind, let's look at how a few of CPR's notable acquisitions from the timeline below performed:

CPR Acquisitions (Company Filings) Company Filings

In an environment where brand equity is valuable, CPR has remained conservative in the valuations at which it pays for acquisition targets. Its ability to pay lower multiples is likely increased by its focus on older brands that are not already on a large growth trajectory.

There is currently a lot of growth priced into the company's stock, and while most could come from its present brand portfolio, some degree of faith is implied in management's ability to execute on growth acquisitions. The less optimistic on the runway for growth of current brand one is, the more confidence must be placed in future successful acquisitions in existing or new product categories (such as NoLo Alcohol, for which we'll discuss CPR's positioning)

Spirits Market Tailwind Trends

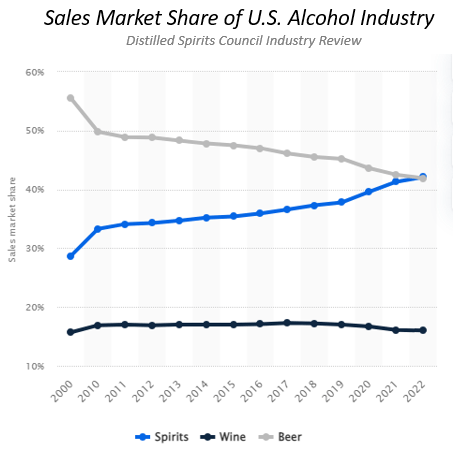

You'll notice from the brands table in the introduction that CPR owns no beer brands and a small number of sparkling wines: their product portfolio is currently concentrated in the spirits and aperitifs categories.

This positions them to benefit not only from the current growth across spirits categories' consumption, but also from a growing preference for their largest brands' unique taste profile.

Mixology and Classic Cocktail Revival

These trends are well-known and highlighted by management. During the FY 2022 earnings call, CEO Bob Kunze-Concewitz said the following:

Again, here we have a combination of classic cocktail revival in the on premise as well as at-home mixology, which also enables us to put into the market some strong pricing.

In the U.S. specifically, we can see a sustained rise in spirits' market share of the alcohol industry by sales, at the expense of beers':

Statista

Return of the Bitter

Reading CPR transcripts or presentations, you are likely to see IR or management discuss how a revival in customers' appreciation for bitter tasting food and drinks is fueling some of their growth. Their two biggest brands, Aperol and Campari, are classic bitter liqueurs.

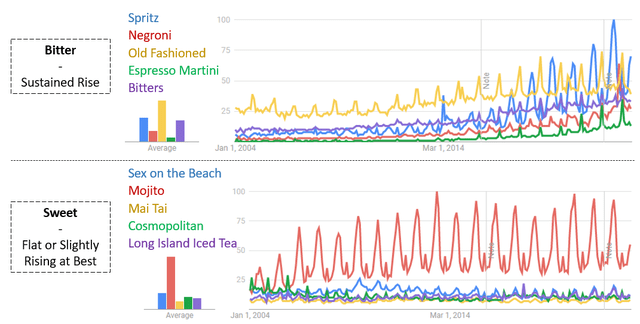

The trends in bitter vs. sweet is quite visible when comparing Google Search Trends worldwide since 2004 for some of the most popular cocktails of both categories. We can approximate an inflexion point around the early 2010s:

Google Search Trends (formatted by author)

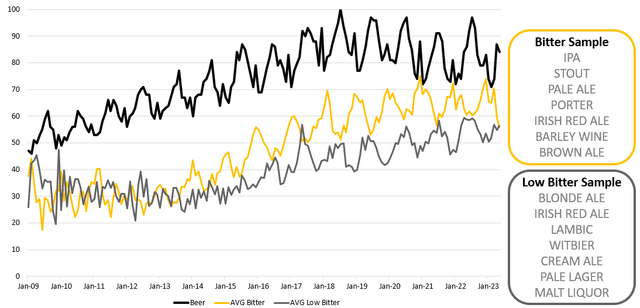

It is also visible when comparing Search Trends between high-IBU (bitter) and low-IBU (least bitter) beer categories. This time, the categories clearly diverge around early 2014:

Google Search Trends (formatted by author)

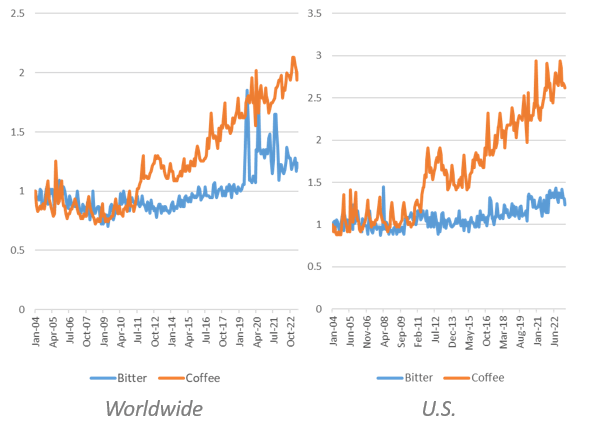

The cause of this trend is arguable, but the most frequent argument for bitter taste acquisition revolves around the spread of more refined coffee-drinking experience in the U.S. and worldwide. We can indeed see an inflexion point close to the 2014 mark which could reasonably imply that it has been a contributing factor:

Google Search Trends (formatted by author)

No matter the cause, consumers' affinity for bitter has put wind in CPR's sales. What the table below shows is the most popular cocktails according to (on the left) the 2023 Drinks International Cocktail Report which surveys 100 of the world's top 100 bars across 33 countries and (on the right) Google Search Trends.

While the table on the left is not representative of all consumers, it is very reliable consumption data from an albeit small sample. While the table on the right uses worldwide data, it is likely skewed for easy-to-make drinks and is only an approximation of consumption. The truth lies somewhere in-between.

Drinks International Cocktail Report, Google Search Trends (by author)

Many of the top cocktails above are not only bitter, but 2 of those (highlighted in orange) are specifically made with CPR products; the Negroni (Campari) and Aperol Spritz (Aperol). While you could substitute these with another similar liqueur (many are clear imitations), the cocktails are synonymous with the ingredient brand, something rare, especially within this top-11 list, that ensures that as long as the cocktail thrives so will CPR's liqueur brand. Competitors do not enjoy the same level of product differentiation among their top brands.

There is no competition between Campari or Aperol and their respective substitutes in consumers' share-of-mind.

International Growth Potential

United States

CPR presents the united states as a relatively underpenetrated market, and expects its marketing efforts to continue to yield significant growth.

The company recently disclosed per capita consumption figures for specific countries (FY22):

At less than 3% of Italy's per capita consumption ("PCC") and just 0.02% of beer's PCC, it's difficult to argue against the fact that there are significant inroads to be made in the United States.

While we don't expect it to grow to double digit percentages of beer PCC, it is by far the lowest of the selected countries, but nearly tripled since 2018. At that time, the 2012-2018 PCC CAGR in the U.S. was of 33.4%.

Therefore based on definite consumer interest and CPR proving its ability to reach new markets outside of Italy since its 2003 acquisition of the brand (when it was still very local), I expect Aperol to grow at double digit rates over the next years in the United States.

Capacity Investments

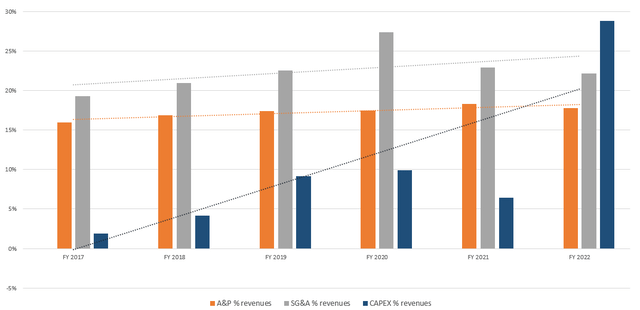

Wherever the growth comes from, in anticipation of future demand, CPR is planning to invest heavily in its production and supply chain to double its production capacity (notably in aperitifs, bourbon, and tequila).

The recent investment trends show the beginning of the progression:

Company filings (formatted by author)

Tequila and bourbon especially face capacity realization delays; the agave plants used to make tequila must be of at least ~7 years and most of CPR's Wild Turkey bourbon products must be aged for many years, obviously longer for the most premium bottles.

While this implies we won't see the results of these investments in the near-term following, it is a good signal that demonstrates that CPR is experiencing sustained growth and is reinvesting to not be capacity-strained in the coming years.

Margin Expansion Opportunity

With scale should come operating margins that come to rival its peers.

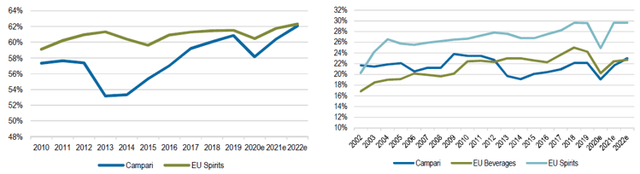

Gross Margin (Left) & EBIT Margin (Right) (Company Filings)

After having caught up to its large European Spirits peers in terms of gross margin, it lags behind them in operating margins. In fact, the gross margin gains are not visible on the operating line, which implies that variable expenses increased as a percentage of revenue while gross margins were improving.

As of the latest annual filing, the EBIT margin difference is mostly attributable to operating expenses, which exclude advertising expenses that only account for a margin difference of ~1.5% of revenues at most.

The difference in operating expenses represent 6% of CPR's revenue than it does for its largest Euro peers (Diageo, Rémy Cointreau (OTCPK:REMYY) (OTCPK:REMYF), and Pernod Ricard). Therefore, I believe it is reasonable to expect that scale will allow CPR to attain operating margins closer to its peers, as it did with its cost of goods sold.

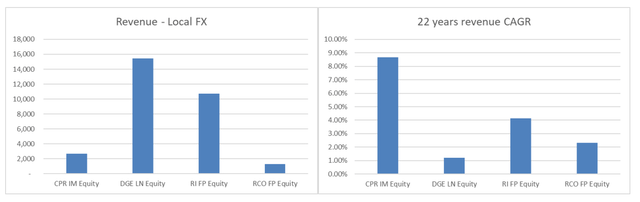

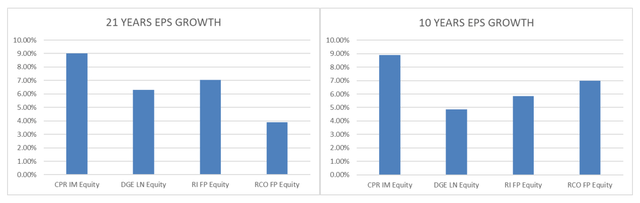

CPR is smaller than its competitors but has been growing much faster over the past 20 years. While its revenue growth has not translated 1-to-1 in its bottom-line, I expect continued growth above peers to allow for margin expansion and outperformance relative to Euro peers.

CPR and Peers Revenue and Growth (Company Filings formatted by author)

CPR and Peers EPS and Growth (Company Filings formatted by author)

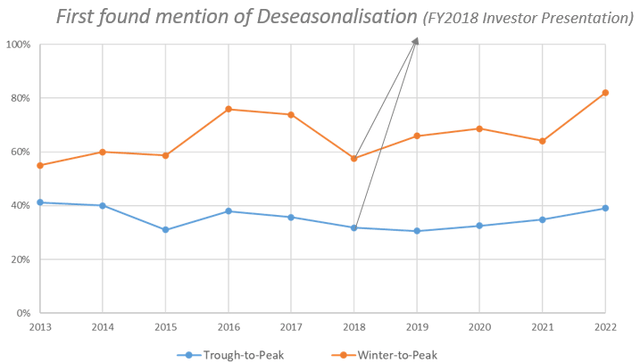

Deseasonalisation of Consumption

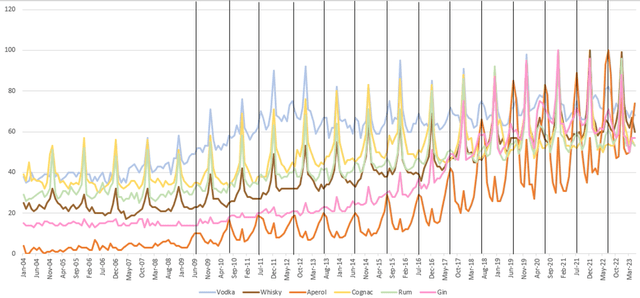

CPR has put a lot of effort in breaking Aperol's seasonal consumption pattern. While most spirits categories see a spike in interest and consumption around the winter months, Aperol peaks in the summer:

Google Search Trends for large spirits categories (Google)

The peak strength of nearly all these categories coming at Aperol's trough, the period it is trying to penetrate, stacks it against serious competition.

While Aperol benefits from the fact that it is a more casual product, not associated with special occasion consumption as some spirits categories are, it has been bound in association with summer consumption, perhaps the only barrier to make it truly versatile in its contexts of consumption.

Advertising is the way to go to change the positioning. CPR is currently focused on doing this through experiential marketing in the winter months, for example through Après-Ski events.

The result has been (and can be seen in the previous interest graph) a second peak of interest for Aperol in the winter months, as other spirits categories peak, but which remains well below the summer one.

To quantify CPR's deseasonalisation progress, I took the winter peak's interest as a percentage of the summer peak's (shown with the orange line in the graph below) and the absolute lowest point as a percentage of the summer peak:

Google Search Trends (formatted by author)

While this data is only search interest and not consumption, I estimate with some confidence that CPR has succeeded in bringing Aperol's winter consumption closer to that of the summer, but has not shown the same degree of progress outside of the winter peak season.

The level for both is relatively close to what it was in 2016, so before claiming absolute success in winning consumers' share-of-mind outside of summer, we should see the trend sustain and continue to rise.

Therefore, while I cannot currently put much weight on the near-term expectation that CPR will have a more even distribution of sales during a calendar year, its progress should be monitored and positive trends will only strengthen my confidence in its brand portfolio.

Valuation

Relative

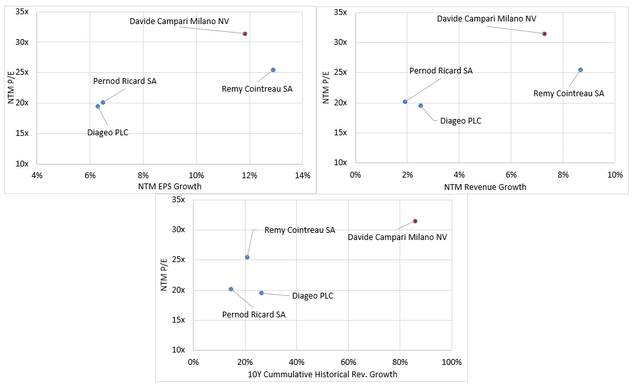

Looking at where CPR's valuation relative to peers is not grounds to judge it investable (that's absolute valuation's job) but I'm including it as context; that if we find CPR attractive on an absolute basis, we're unlikely to find better within its direct peer group.

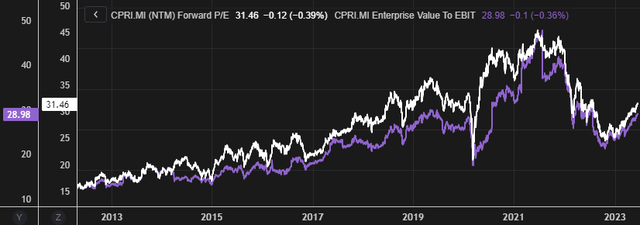

Relative to historical levels, CPR's NTM implied EV/EBIT and P/E are not historically elevated but elevated nonetheless.

In terms of relative valuation and growth compared to peers, I collected the following data on estimates and valuation:

Company Filings and Analyst Estimates, formatted by author

While the estimates on which this is based are not mine but the street's expectations, this very crude first-look shows that there is no obvious disconnect where much higher growth is expected while valued at a discount to peers.

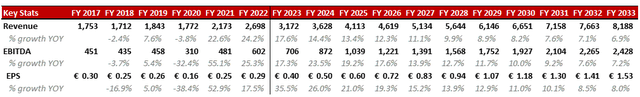

Absolute

Without going too much in the details of each assumption driving this output, I forecasted the revenue growth by brand and the margins by geography, as CPR reports. The outputs below are for the revenue base case and margin accretion bear case. Here, the overall operating margin stagnates at about 26% versus Euro peers' margin at approximately 30%+, as discussed earlier.

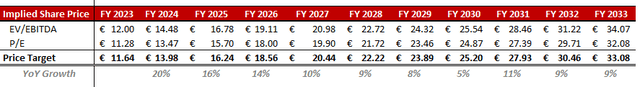

Output of bottom-up forecast (Author)

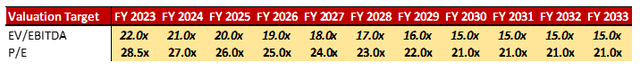

In a quick bridge to valuation, I set target multiples that I expect/ would be comfortable with the company reaching. I forecasted some multiple compression to something more in-line with CPR's more mature peers, Diageo and Pernod Ricard.

Putting everything above together, and blending the implied price targets for every year, we obtain the following price target progression:

This is all a question of inputs, so if you disagree with the forecast growth or fair multiple at which this will settle, you'll obviously come to a different answer, so this output is not the end-all-be-all and I myself have built many cases sensitized on the revenue and margin trajectory, which I've described above.

In any case, I come to the conclusion that there is a comfortable margin of safety in CPR's current valuation given my assumptions.

Risks

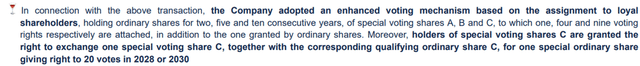

Ownership structure

It's important to note that Lagfin, an investment company which manages the assets of the Garavoglia Family, owns over 50% of the outstanding shares and over 65% of the voting rights.

As Luca Garavoglia is CPR's chairman and as the family retains control over the company investors are "along for the ride" to some degree, even if Mr. Garavoglia does not occupy an executive position.

One positive is that CPR offers a unique loyal shareholder rewarding program that awards more voting rights to shareholders depending on how long they've been owners, announced in 2020:

Details to the loyal shareholder program (Company filings)

I expect the family to retain the voting control, so the degree to which extra voting shares are useful is questionable.

NoLo Alcoholic Market Positioning

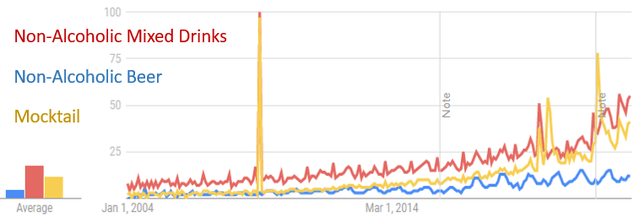

In most western countries, non-alcoholic drinks are defined as having less than 0.5% ABV and Low less than 1.2% ABV. The non-alcoholic/low-alcoholic ("NoLo") market has been growing fast, observable by both past Google Trends data worldwide and industry forecasts.

Google Trends (Formatted by author)

Looking only at the chart above first, we see, unsurprisingly, that NoLo popularity is increasing and equally relevant to non-alcoholic mixed drinks. Yet we must be mindful that this trend is only a proxy for consumption, and that people are more likely to search for mocktails they can make than beer they can simply buy.

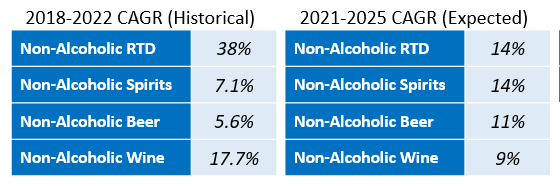

In any case, industry data shows the historical and expected growth of the NoLo market.

Statista (formatted by author)

The Caveat here is that the growth is starting from a much lower base, so while high growth rates indicate consumer enthusiasm, they are no indication of where these rates will settle with respect to "regular" ABV drinks once the market is more mature.

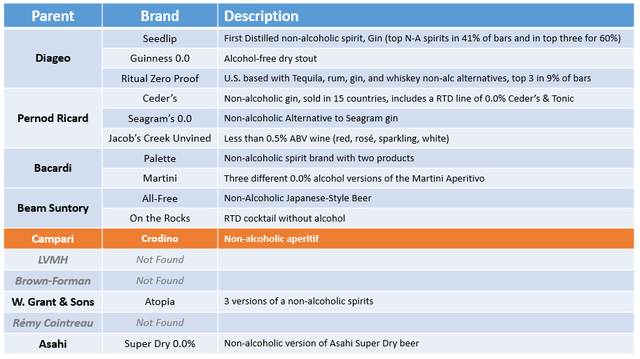

NoLo popularity is not a doomsday scenario for large spirits companies like CPR; they're better positioned than anyone to provide these products thanks to their already-established and optimized marketing and distribution channels. Yet CPR's NoLo product portfolio has been lacking its 9 largest peers':

NoLo brands (Company Filings, Drinks International 2023 Brands Report (by author))

Most competitors have added their NoLo products through acquisitions, so the opportunity will be there for Campari but may shrink with time: as we saw CPR is diligent in the amount it pays in acquisitions, and the hype surrounding this product category may prevent it from making acquisitions at what it judges to be reasonable valuations.

This would only increase competitors' opportunity to solidify their market positioning ahead of CPR in the nascent category, which could turn what is now a growth opportunity into a competitive threat.

Product Mix & Margin Dilution

Due to a combination of unique product, high brand equity, and low ABV for Aperol, CPR is able to charge prices closer to a high-ABV spirits bottle, making Aperol Aperitif one of its most profitable products.

Given that success in other spirits categories (such as Espolon Tequila) could reduce Aperol's share of sales, we should expect that this to be a margin headwind.

The first caveat is that CPR does not disclose margin by product so we may be overestimating the margin delta between Aperol and other spirits. This is especially true if Aperol's contribution to total sales drops not because of volume declines but by being outpaced in growth by another product; that other product's successful brand building would likely create an opportunity for premium pricing which would in turn contribute to reducing their relative gross margin difference.

Second, this dynamic goes both ways; if Aperol does encounter a success story in a large market like the United States and grows its share of total revenues , all else equal, that would be margin accretive.

Aperol Spritz RTD Execution Issue

I repeatedly highlighted the importance of Aperol in CPR's brand portfolio, but Aperol Ready-to-Drink ("RTD") seems to be in the middle of a problematic product strategy that could dilute the brand equity of Aperol itself.

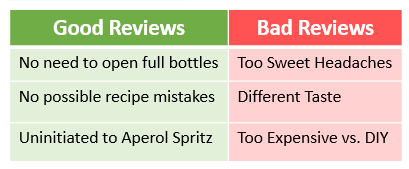

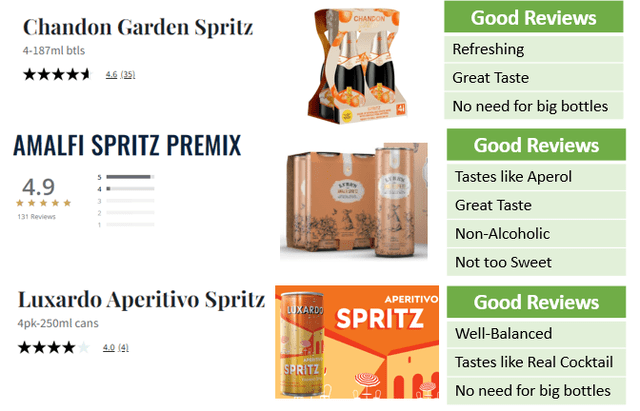

Aperol RTD is a pre-packaged aiming to recreate the Aperol Spritz cocktail, synonymous with the drink itself. While the cocktail recipe is (unsurprisingly) highly-rated with near 5 stars, the RTD product is rated around 2.5/3 stars on the review platforms/liquor chains I've consulted (I expect that you'd find similar reviews on your local retail distributor's website). Here are some of the recurring positives and negatives points highlighted in the RTD reviews I've seen:

Customer Product Reviews (by author)

According to one of CPR's former Director of U.K. Marketing (Tegus Interview) the product is also internally polarizing:

There's an Aperol ready-to-enjoy product that probably was released sort of 5 or 10 years ago. It's not in many markets, it's in Italy and some of the airlines and it's in Belgium. And if Luca cold roll back the clock and not have been developed, he would happily do that

(Recall that Luca refers to Mr. Garavoglia, CPR Chairman and controlling shareholder).

Surprisingly, Aperol RTD has been moved up over the past two years from "Rest of the Portfolio" classification to "Regional Priority" classification in their annual filing, the second most important product category. There therefore seems to be a disconnect between the account of internal perception of Aperol RTD and its treatment in CPR's financial statements.

In any case, we should assume the financial statements to more reliably convey management's internal goals: the poorly reviewed product is clearly gaining importance within their broader product strategy. This could potentially be a short-sighted move aimed at increasing profit margins (RTD products are very profitable) but there seems to be a disregard for how it could risk damaging the brand equity.

This is especially true given that this product is an easy introduction to CPR's flagship cocktail and product; you don't want new customers, say in the U.S., to be introduced to it through a "bad" product. They would likely not be as willing to try Aperol.

Since Aperol Spritz is such a popular cocktail, there have been several alternative (some closer to imitations) of Aperol RTD. According to the reviews I've found, they are consistently better rated than CPR's product:

Similar Product Reviews (Customer Product Reviews (by author))

This indicates that Aperol RTD's struggles are an issue of substance over form: a RTD alternative is not a bad idea as it increases consumption occasions, opens the product up to a larger TAM, and makes trial and adoption more accessible, on top of being margin accretive.

This product could therefore represent a headwind to CPR's growth and marketing efforts for Aperol in new markets if its formulation is kept as is.

Conclusion

Davide Campari undoubtedly has a strong brand portfolio and opportunities for growth and margin expansion. These opportunities present themselves to me as clearly more attractive than its peers in the spirits industry. Based on relative and fundamental bottom-up valuation, I believe there is double-digit upside to be found in CPR equity, despite the risks laid out above.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.