Cango Faces Weak Chinese Economy Amid Auto Industry Challenges

Summary

- Cango reported its Q1 2023 financial results on June 8, 2023.

- The firm operates a new and used car trading platform in China.

- CANG has pulled through the worst of the auto industry downturn in China, but the near-term economic growth potential of the industry is likely muted.

- I'm Neutral [Hold] on CANG in the short term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

FangXiaNuo/E+ via Getty Images

A Quick Take On Cango

Cango (NYSE:CANG) reported its Q1 2023 financial results on June 8, 2023, matching consensus estimates for topline revenue.

The company provides Chinese consumers and car dealers with an online portal that connects them to facilitate buying and selling of new and used cars.

China’s economic performance is looking weak and the previously-expected benefits from a strong ‘reopening’ has been a disappointment.

As a result, I’m Neutral [Hold] on Cango at this time.

Cango Overview

Shanghai, China-based Cango was founded in 2010 to develop an online new vehicle purchase system by connecting car dealers to consumers.

Management is headed by Co-Founder, Director and CEO Jiayuan Lin.

The company’s business is composed of the following primary services:

Automotive Transactions

Automotive Financing

After-market Service

User car services

Cango facilitates new and used car buying and selling; it also connects financial institutions with buyers so they can afford to purchase a car; it provides connections to auto maintenance after the sale.

With regard to its financial services, Cango provides access to 3rd party financial institutions that bear credit risk.

Cango targets its services to financial institutions and car buyers using its dealer network. To the company, the dealer network is vital to acquiring more customers. Cango also uses online automotive advertising platforms to attract a larger user base.

Its in-house sales team is responsible for expanding and managing its dealer network.

Cango’s Market & Competition

According to a 2023 market research report by Mordor Intelligence, the Chinese used car market size is an estimated $57 billion and is forecasted to reach $104 billion by 2028.

If achieved, this would represent a CAGR (Compound Annual Growth Rate) of 12.68% from 2023 to 2028.

Notably, the used car market did not fall as significantly as the new car market during the pandemic and the report says the ‘market is anticipated to resume its pace in the coming years as life returns to normal.’

According to a 2017 market research report by ReportLinker, the new cars via an online marketplace market was forecasted to accelerate for the five-year period 2016 - 2021.

The Chinese additional cars sector generated revenues of $417 billion in 2016, representing a CAGR of 10.70% between 2012 and 2016.

The main factors driving expected market growth are tax cuts on the sales of small-engine vehicles and the loosening of regulations that banned pickups from circulating in main cities.

Major competitive vendors that sell new or used cars via an online marketplace include:

Yixin Group (2858.HK)

Uxin Group (UXIN)

Gauzi.com

RenRenChe

Tiantian Paiche

Souche.com

Cango’s Recent Financial Trends

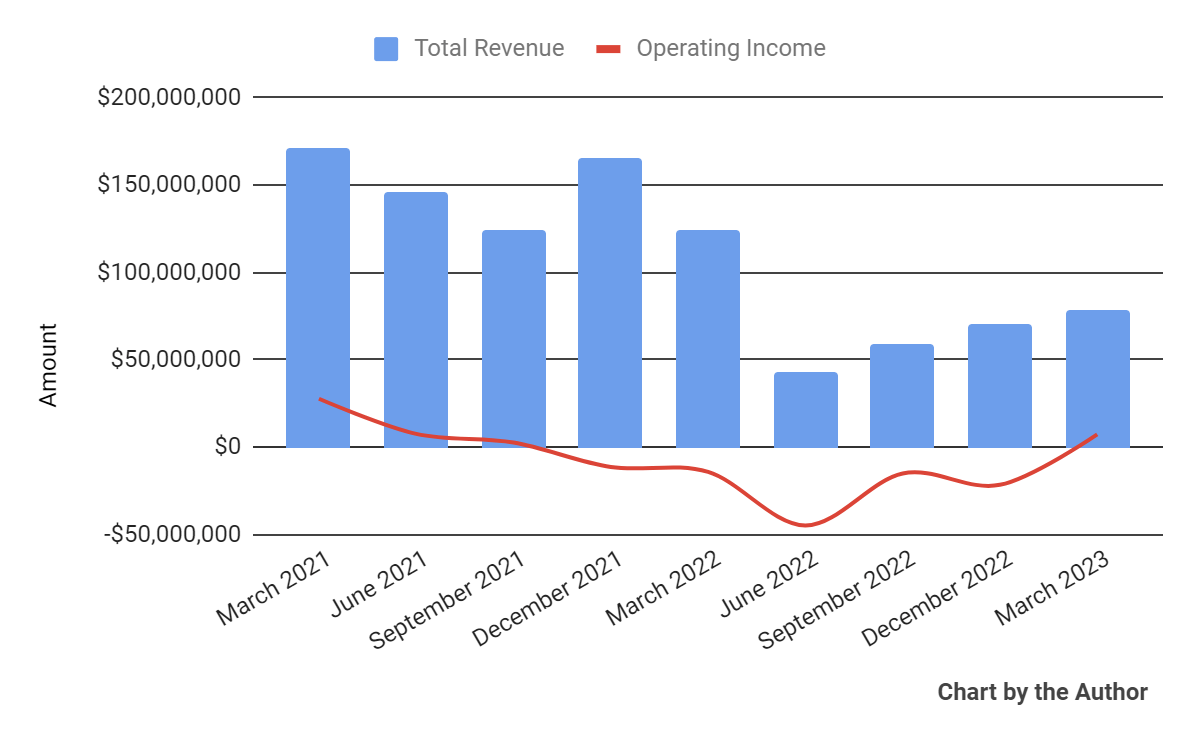

Total revenue by quarter has dropped significantly; Operating income by quarter has improved to above breakeven in recent quarters:

Total Revenue and Operating Income (Seeking Alpha)

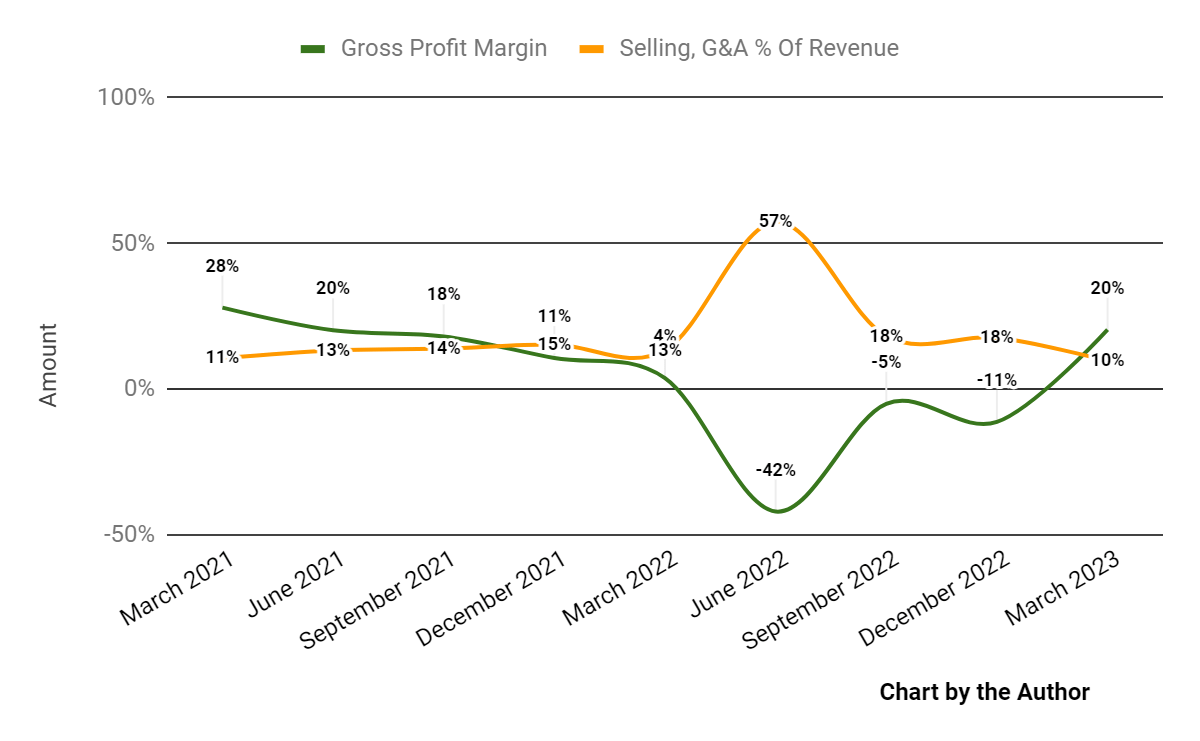

Gross profit margin by quarter has grown recently; Selling, G&A expenses as a percentage of total revenue by quarter have dropped significantly in recent quarters:

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

Earnings per share (Diluted) have been highly volatile but have returned to positive territory in the most recent quarter due in part to accounting adjustments:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

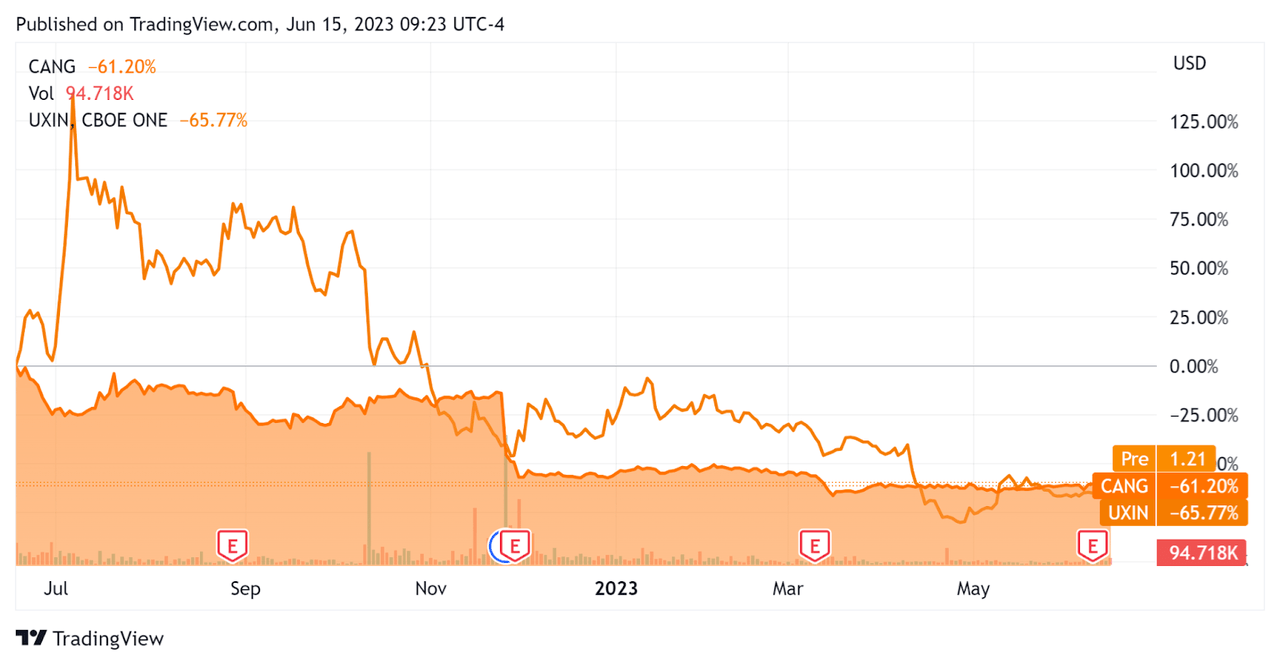

In the past 12 months, CANG’s stock price has fallen 61.2% vs. that of Uxin Limited’s (UXIN) drop of 65.77%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $395.2 million in cash, equivalents and short-term investments and $114.3 million in total debt, of which $106.8 million (93%) was categorized as the current portion due within 12 months.

Over the trailing twelve months from year-end 2022, free cash used was ($83.0 million), during which capital expenditures were $0.7 million. The company paid $23.0 million in stock-based compensation in calendar year 2022.

Valuation And Other Metrics For Cango

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | NM |

Enterprise Value / EBITDA | NM |

Price / Sales | 0.6 |

Revenue Growth Rate | -51.6% |

Net Income Margin | -51.7% |

EBITDA % | -28.9% |

Net Debt To Annual EBITDA | 3.8 |

Market Capitalization | $161,280,000 |

Enterprise Value | $107,300,000 |

Operating Cash Flow | -$82,270,000 |

Earnings Per Share (Fully Diluted) | -$0.95 |

(Source - Seeking Alpha)

A potential public comparable would be Uxin Limited (UXIN); shown below is a comparison of their primary valuation metrics:

Metric [TTM] | Uxin | Cango |

Enterprise Value / Sales | 0.8 | NM |

Enterprise Value / EBITDA | NM | NM |

Revenue Growth Rate | 67.5% | -51.6% |

Net Income Margin | 13.7% | -51.7% |

Operating Cash Flow | -$133,260,000 | -$82,270,000 |

(Source - Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

Cango’s most recent Rule of 40 calculation was negative (80.5)% as of Q1 2023’s results, so the firm has performed poorly in this regard, per the table below:

Rule of 40 Performance | Calculation |

Recent Rev. Growth % | -51.6% |

EBITDA % | -28.9% |

Total | -80.5% |

(Source - Seeking Alpha)

Commentary On Cango

In its last earnings call (Source - Seeking Alpha), covering Q1 2023’s results, management highlighted the continuing difficult conditions for the automotive industry in China due to the pandemic.

The firm is seeing signs of initial recovery in the market, with revenue increasing sequentially, but conditions remain weak and the benefits from Chinese economic ‘reopening’ expectations have been delayed.

Cango produced net profit during the quarter, but that was due to ‘an increase in gain on risk assurance liabilities, and the newly implemented accounting standards and the reversal of credit impairment loss due to asset quality improvement.’

Management did not disclose any dealer, customer or revenue retention rate metrics.

Total revenue for Q1 2023 fell 36.4% year-over-year while gross profit margin increased by 16.7 percentage points.

Selling, G&A expenses as a percentage of revenue dropped 3.7 percentage points year-over-year, a positive signal indicating higher efficiency in this regard.

Operating income turned positive for the first time in six quarters.

Looking ahead, management guided only for Q2 2023 and not for the full year. Q2 revenue is expected to be $87.5 million at the midpoint of the guidance range, or up 102.5% over Q2 2022.

The company's financial position is good, with a large amount of liquidity against a much smaller debt load. However, cash use in operations has been quite high.

CANG’s Rule of 40 performance has been poor.

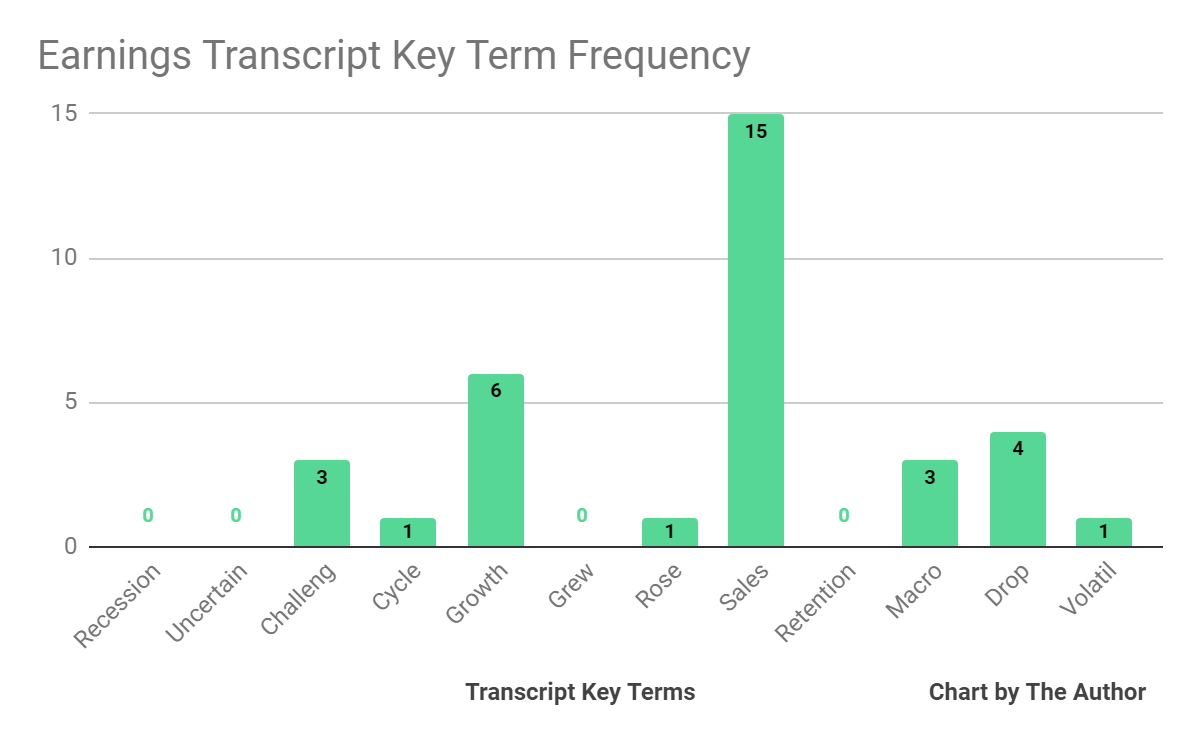

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited ‘Challeng[es][ing]’ three times, ‘Macro’ three times, ‘Drop’ four times and ‘Volatil[e][ity]’ once.

The negative terms refer to ongoing difficulties facing the Chinese auto industry and Cango’s business environment.

Analysts questioned leadership about the effects of the recent auto industry ‘price war’ due to an overhang of supply versus demand. The company reduced inventory due to China’s recent 6b emission standard changes, so it believes it is in a better position in this regard.

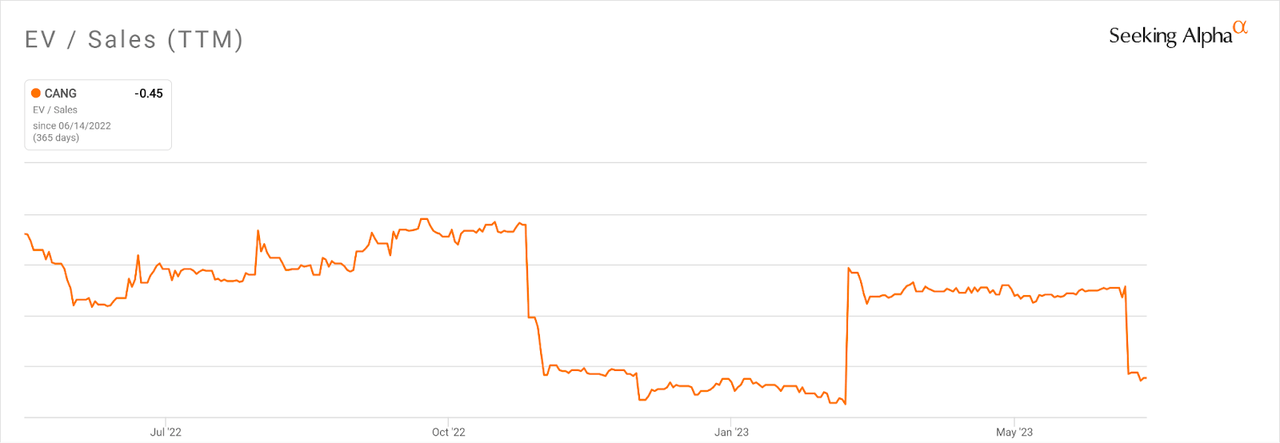

In the past twelve months, the firm's EV/Sales valuation multiple has produced significant volatility, as the chart from Seeking Alpha shows below:

EV/Sales Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include improved results from the company's transition to a car-trading platform and the launch of new related services.

However, China’s economic performance is looking weak and the vaunted ‘reopening’ has been a disappointment.

The primary risk to the company’s outlook is reduced consumer demand as they delay car purchases, whether new or used.

As a result, I’m Neutral [Hold] on Cango at this time.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.