Nutrien: Navigating Investor Disappointment And Fertilizer Challenges

Summary

- Nutrien Ltd. stock has fallen due to mismanaged expectations and hesitation from farmers to purchase expensive fertilizer.

- Nutrien's potash segment's EBITDA guidance has been revised downward, and there are concerns about stagnant potash prices.

- Despite challenges, Nutrien's valuation presents an attractive risk-reward opportunity, with the stock priced at around 9 times this year's EPS figures.

- We discuss that analysts forecast stagnation for Nutrien in 2024.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

MaYcaL

Investment Thesis

Nutrien Ltd. (NYSE:NTR) stock has demonstrably fallen out of favor with investors. And there's ample reason to be bearish on Nutrien. Indeed, as I look at it, I believe that Nutrien's management poorly mismanaged investors' expectations. Perhaps they, too, were overly hyped in 2022? I don't know.

But as I attempt to appraise how 2024 is likely to unfold, I believe there are reasons to be bullish that the bottom for NTR stock is very close. And this is not blinded bullishness. But rather, an objective consideration that Nutrien's valuation right now provides the best risk-reward opportunity in a long time.

Why Nutrien? Why Now?

Nutrien is one of the largest producers of fertilizers in the world. Back in 2022, there was a thesis. The thesis was that farmers would be having to buy fertilizer. The thesis surmised that if farmers didn't buy en masse in 2022, by 2023 it was a near-enough "certainty" that farmers would be crawling over each other to purchase fertilizer.

After all, farmers need fertilizer, this is just common sense. And yet, it transpired that farmers were unwilling to pay up for what they believed was expensive fertilizer.

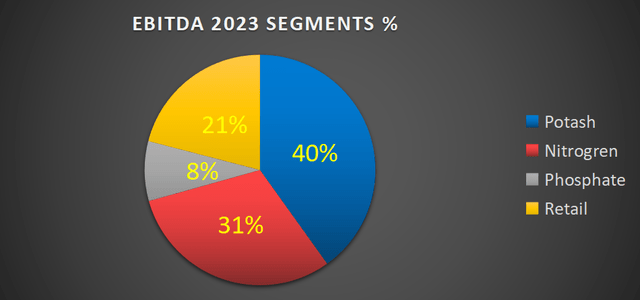

What follows next is a very approximated profitability breakdown of Nutrien's EBITDA guidance for 2023.

What you see above, is that by far, Nutrien's most significant component is potash.

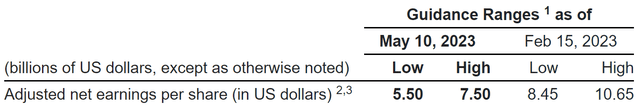

There had been so many hopes for the potash segment to be a significant positive needle mover. And yet, alas, it turned out that the EBITDA guidance for Nutrien's potash segment is now expected to end 2023 down nearly as much as 40% y/y at the high end.

That is, if we presume Nutrien's newly downwards revised estimate has left itself room later in 2023 to be once again upwards revised.

dtnpf.com

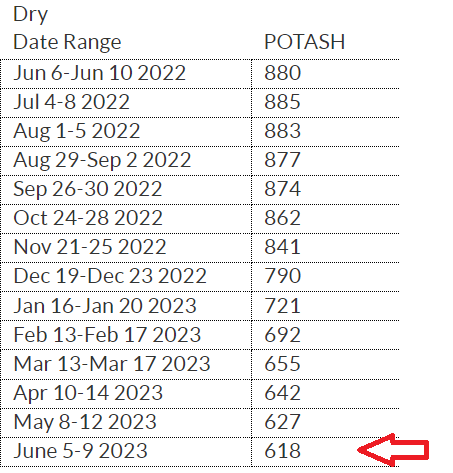

However, if we consider the most recent prices for potash that farmers are buying at retailers, I don't see much, if any firming up of potash prices.

It would be utterly shocking if the price of potash in 2023 wound up lower than in 2021 (pre-Russia's invasion). And yet, the reality is that this now seems to be a possibility.

NTR Stock Valuation - Roughly 9x EPS, But What's Next?

Here's my thought process on Nutrien.

If we presume that Nutrien's adjusted EPS figures come towards the low end of its guidance, at around $6 per share, this leaves the stock priced at around 9x this year's EPS figures.

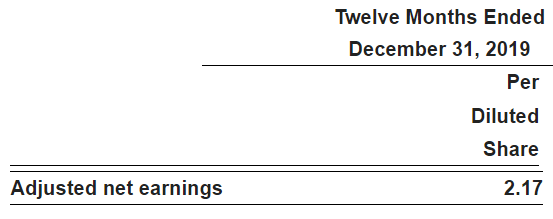

Now, let's get some context. Let's rewind the clock all the way back to 2019. You'll ask, why 2019? Because 2019 was the "last normal" year. 2020-2021 had the pandemic. And 2022, well, I'm sure I don't need to remind you of 2022.

NTR press release

Nutrien's 2019 adjusted EPS finished at $2.17. And throughout that year, its share price averaged approximately $50 per share.

In other words, Nutrien's EPS this year is expected to be more than double higher, even possibly triple its EPS of 2019, and yet, the share price has practically gone nowhere in this time period. Essentially, the share price moved around substantially, but it's back to practically where it was in 2019.

And I fully understand why investors are despondent. There are a lot of tired legs out there. Too many investors jumped on Nutrien in 2022 and now gave up on Nutrien. I get it. I was long Intrepid Potash (IPI), and that didn't work out positively for me.

However, I will rapidly retort that Nutrien is not the same as Intrepid. Nutrien's management team and assets are in a totally different league to Intrepid.

So we now reach the point of reality. 2023 is poised to be a bad year for Nutrien. But my question is this: what about 2024? After all, we are already halfway through 2023. There's no point thinking about 2023 anymore. How will Nutrien's 2024 shape up?

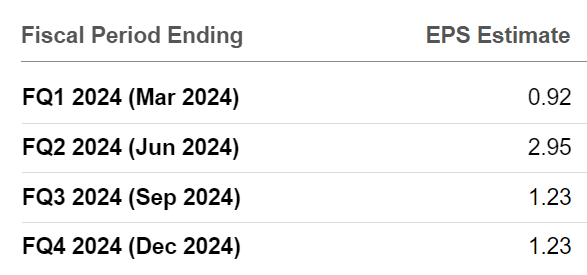

SA Premium

Above, we see what analysts presently estimate Nutrien's 2024 will shape up to be. Essentially, the underlying assumption that analysts have is that Nutrien's 2024 will be no better than 2023.

Simply put, Nutrien's profitability from this point forward will stagnate. However, I struggle to believe these estimates. Why?

This assumption presumes that farmers will continue to put off being mass buyers of fertilizer. Additionally, after several years of inflation, these 2024 EPS figures presume that fertilizer prices don't move higher from this point.

All in all, there's a lot of uncertainty right now, but the valuation already more than encapsulates this uncertainty.

The Bottom Line

Nutrien's stock has fallen out of favor with investors due, in part, to mismanaged expectations by the company's management.

However, there are compelling reasons to be bullish and believe that the stock is nearing its bottom.

But context matters. Farmers are hesitant to purchase expensive fertilizer, resulting in a downward revision of the company's potash segment's EBITDA guidance, which is expected to decline by nearly 40% y/y.

Despite these challenges, Nutrien's valuation presents an attractive risk-reward opportunity, with the stock priced at around 9 times this year's EPS figures. Comparing it to 2019, when the stock traded at similar levels despite lower EPS, there is potential for a Nutrien Ltd. turnaround.

As a whole, there are uncertainties surrounding these assumptions, but I argue the current valuation already reflects such uncertainties.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.