XRMI: Risk Managed S&P 500 Return, Not Worth The Trouble

Summary

- The Global X S&P 500 Risk Managed Income ETF seeks to provide investment results that correspond generally to the Cboe S&P 500 Risk Managed Income Index.

- XRMI does this by selling monthly at the money call options and buying 5% out of the money puts, while holding the Index outright.

- This structure significantly buffers volatility, but at the same time gives up most of the upside in a bull market.

- A better approach would be to use a wider collar that resets less frequently.

primeimages

Thesis

The Global X S&P 500 Risk Managed Income ETF (NYSEARCA:XRMI) is a fairly new offering in the exchange traded fund arena. The fund came to market in 2021, and represents yet another 'risk managed' flavor in the equity space.

Asset managers realized at some point that introducing ETF solutions with less volatility than the index might attract flows. The fund basically overlays options in order to contain the risk of the index. More specifically, as per its literature:

The Global X S&P 500 Risk Managed Income ETF employs a protective net-credit collar strategy for investors seeking the income characteristics of a covered call fund, while mitigating the risks of a major market selloff with a protective put. XRMI seeks to achieve this outcome by owning the stocks in the S&P 500 Index (SPX), while buying 5% out-of-the-money put options on SPX and selling at-the-money call options on the same index.

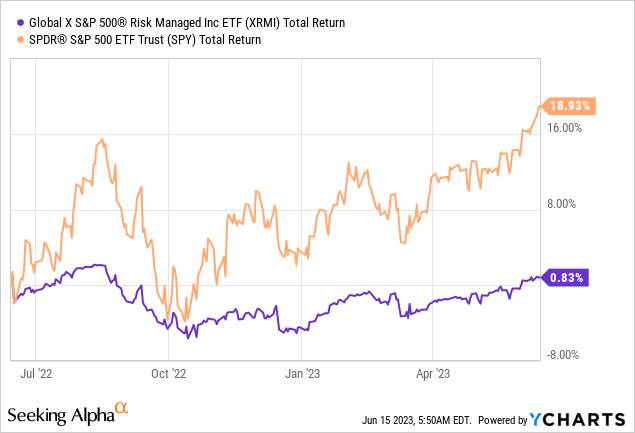

We are going to go into more detail regarding collars in the below section, but suffice to say that the option overlay serves the purpose of dampening both upside and downside for the fund, hence exhibiting a lower volatility overall. We can clearly see that from the fund's performance in the past year:

We can see how the Global X S&P 500 Risk Managed fund had a very shallow drawdown when compared to the index, but at the same time its upside has been extremely small. The reason behind this performance is the collar structuring - the sold calls are at the money, meaning there is no upside outside the premium. The structure then re-sets monthly, giving holders another set of premiums.

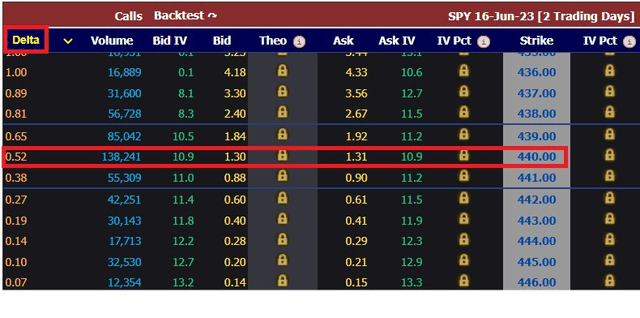

The at the money calls have the highest delta when compared to options with equal or higher strikes:

Strikes and Deltas (MarketChameleon)

As we are writing this article the SPY just hit 440, and when looking at the June expiry chain we can see that strikes at or above 440 have various deltas (delta is the sensitivity to changes in the SPY price). The at the money 440 delta has the highest one from the cohort. Selling calls with strikes below the prevailing index price obviously generates higher deltas, but that is already engaging in a different strategy because you are selling in the money options.

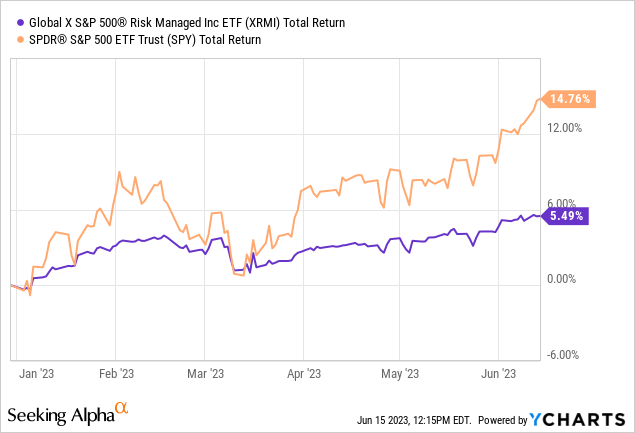

In a nutshell XRMI is designed to buffer the downside significantly, but at the same time it gives away most of the upside. As a quick, non scientific way of thinking about this consider XRMI as posting only a third of the upside from SPY:

In up markets this structure is going to hold you back a lot. In down markets it will probably protect you for 60% to 70% of the downside move. We do not like this structure. We feel a much 'looser' collar is more beneficial - we would reference here a collar with 8% upside and the downside hedged via a put spread. In its current format XRMI will never really do anything of significance for a retail investor. You are better off just going to cash if you think a recession is coming.

The structure of an option collar

As per Schwab:

A collar is composed of long stock, a short out-of-the-money (OTM) call option, and a long OTM put option, with the call and put in the same expiration. The collar's long put acts as a hedge for the long stock (potentially limiting its downside losses), and the short call helps finance the long put

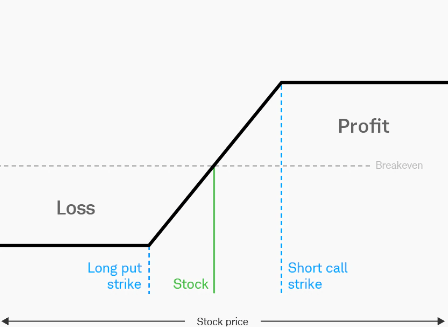

A collar essentially ensures volatility is contained for a structure, giving up a significant portion of the upside (all the upside until the collar re-sets, so frequent re-sets capture more of the upside than otherwise). It helps to have a visual representation of the structure:

Collar PnL (Schwab)

An investor can most certainly do this themselves, but XRMI does it in a systematic fashion for you.

Holdings

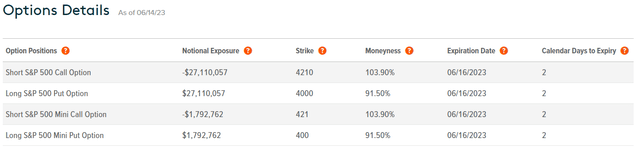

The fund has a very straightforward composition. On one hand it holds the S&P 500 outright, and then it holds a set of monthly re-setting options:

The current overlay set to expire mid June has sold calls with a 4210 strike, and bought puts with a strike of 4000. The calls are already in the money, so the fund will lose any amount from where the S&P 500 settles versus the 4210 strike (if the Index remains above 4210 that is).

Conclusion

XRMI is a new fund that aims to buffer both the downside and upside for the S&P 500 Index. The fund does this via a very tight options collar overlay, which in essence boils down to selling monthly at the money call options and buying 5% out of the money puts. This structure significantly buffers volatility, but at the same time gives up most of the upside in a bull market. We would have liked to see a much wider collar that resets less frequently (as a 'healthier' structural build). While XRMI is an innovative fund, we do not think it is worth the trouble in its current format since the upside is severely capped.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.