MicroVision Stock: Recent Volatility Explained

Summary

- MicroVision has almost doubled its value this year, given improved clarity on its longer-term roadmap, reinforced by its recent acquisition of Ibeo Automotive Systems GmbH.

- Yet, MVIS stock's eye-popping intra-day declines and gains within the mere 24 hours just passed underscore its vulnerability to significant volatility ahead.

- In addition to downside risks in tandem with the uncertain market climate, we view the lack of longer-term clarity on MicroVision's capital structure a key company-specific multiple compression risk ahead.

- Looking for more investing ideas like this one? Get them exclusively at Livy Investment Research. Learn More »

Chesky_W

Despite the steep intraday decline of more than 27% earlier this week on news of a proposed share offering and the reiterated hawkish Fed stance on forward monetary policy, MicroVision (NASDAQ:MVIS) stock has swiftly pared most of the losses, still doubling its value this year. Much of the stock’s resilience this year amid the uncertain market climate comes from consistent gradual progress in MVIS’ efforts in recent quarters to put its name back on the map by shifting into automotive lidar applications after being in the non-automotive lidar industry for more than two decades. This is further corroborated by MVIS’ streak of earnings outperformance in recent quarters, with ongoing developments in its automotive lidar hardware and software efforts slowly overtaking its previous linkage to Microsoft Corporation (MSFT), which was a key partner for its legacy business on the provision and licensing of high-definition display systems technology for the HoloLens.

In our previous coverage on the broader ADAS industry and related lidar opportunities, we had identified consolidation as the near-term theme due to capital and regulatory restraints over the development of fully autonomous mobility. While we had initially viewed MVIS as a potential candidate for being consolidated into a larger lidar system company or auto OEM due to its technology and go-to-market strategy’s lack of differentiation, the company has actually emerged as a consolidator in the industry with the acquisition of Ibeo Automotive Systems GmbH (“Ibeo”) completed in late January. The combination is expected to work synergistically as observed via MVIS’ recent introduction of its MOSAIK validation suite for lidar systems, which would allow the company to further penetrate opportunities stemming from momentum in the adoption of L2+ and L3 ADAS features as auto OEMs look to differentiate their offerings in the era of increasingly connected vehicles.

Working Synergistically With Ibeo

MVIS completed its acquisition of Ibeo in late January for total consideration of €19.9 million ($21.6 million), and recorded a bargain purchase gain of $1.7 million based on total identifiable net assets acquired valued at $23.3 million. The business consolidation is expected to accelerate MVIS’ penetration into and beyond the automotive vertical with its lidar systems by reinforcing its full stack hardware and perception software capabilities.

As discussed in our previous coverage, MVIS’ latest “MAVIN DR” sensors currently boasts in line proficiencies with rival offerings currently available, lacking differentiation in a market where affordability and price considerations remain a priority for auto OEMs looking for lidar integration to enable L2+ and below ADAS features. But with its acquisition of Ibeo, the company effectively bolsters its ability to also deliver a complementary perception software offering to the MAVIN DR sensors, providing a full stack solution to efficiently address L2+ ADAS requirements.

Specifically, Ibeo has long exhibited expertise in providing both lidar hardware and software with its legacy SCALA sensor system, which had been in series production with “premium OEMs”, spanning Audi, Mercedes (OTCPK:MBGAF / OTCPK:MBGYY), Stellantis (STLA), BMW (OTCPK:BMWYY), and Volkswagen (OTCPK:VWAGY / OTCPK:VLKAF / OTCPK:VWAPY). The transaction will allow MVIS to leverage Ibeo’s “mature perception software” and offer a turn-key lidar solution with the MAVIN sensors beginning in the current quarter.

In addition to technological synergies, the acquisition of Ibeo will also help further MVIS’ reach beyond automotive applications – a strategy it has prioritized in recent years after its ailing legacy business in the provision of non-automotive sensors and display systems. Specifically, the Ibeo transaction is expected to expand MVIS’ “multi-market strategy focusing on industrial, smart infrastructure, robotics, and commercial vehicle segments,” which taken together with passenger vehicle applications would represent a combined total addressable market, or TAM, of $115 billion by the end of the decade.

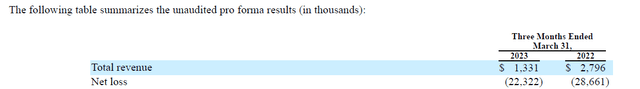

This represents significant headroom for longer-term growth. MVIS expects the business combination to drive incremental growth, with full year consolidated revenue to reach as much as $15 million, which would represent y/y growth of almost 22-fold. To better gauge the extent of consolidated revenues from Ibeo, we had turned to pro forma disclosures pertaining to the transaction in MVIS’ 1Q23 10Q filing.

Specifically, the company projected first quarter revenues totaling $1,331 million had the business combination completed in the beginning of the year. Based on MVIS’ standalone first quarter revenue of $782 million, this would imply Ibeo standalone first quarter revenue of about $549 million. Extrapolating that for the year would total approximately $2,196 million in incremental full-year revenue from Ibeo. Considering a lower extent of annual sales historically observed at MVIS, the company’s full-year revenue forecast of $10 million to $15 million considers substantial growth synergies from its “expanded product portfolio.”

However, extrapolating the implied Ibeo standalone first quarter revenue of about $2,446 million in 2022 (i.e., pro forma consolidated revenue $2,796 million, less MVIS standalone 1Q22 revenue $350,000) for the full year would total an approximate $9,784 million – a figure much closer to MVIS’ full year 2023 revenue projections with consideration of its own prospective standalone contributions. The divergence between Ibeo’s implied first quarter revenues in 2022 and 2023 potentially suggests a deterioration in the company’s growth profile over the past year, which is in line with “advanced funds” totaling $7.75 million from December 2022 through February 2023 from MVIS to ensure continued operations “while in insolvency during the period between signing and closing” of the business combination.

Taking this into consideration, we view significant risks over the immediate-term pertaining to MVIS’ prospects of both integrating Ibeo and adequately realizing growth synergies in the first year of combination to drive full year consolidated sales of $10 million to $15 million by the end of 2023.

A Differentiated Go-to-Market Strategy with MOSAIK

That said, the longer-term outlook is much brighter for MVIS, which is corroborated by the roll out of its proprietary MOSAIK validation suite. The offering is expected to differentiate MVIS’ positioning and go-to-market strategy within the increasingly crowded lidar industry, especially for automotive applications, and further complement its expanded hardware-software product portfolio enabled by the integration of Ibeo.

MOSAIK will help auto OEMs>

“validate their ADAS and [autonomous vehicle] systems [by allowing] them to efficiently process high volumes of reference data against ground truth data to validate a wide range of sensors and solutions.”

The development will enable MVIS to better capture opportunities arising from increasing urgency for OEMs to incorporate L2+ ADAS features, and help the company better differentiate itself within the increasingly competitive race in providing lidar systems.

As discussed in our previous coverage, MVIS’ current lidar systems remain primarily in test and sampling environments, which trails peers like Luminar Technologies (LAZR). Its lidar system has already transitioned from R&D to high-volume serial production with auto OEMs. This is consistent with updates from management that reveal its MAVIN and MOVIA sensors remain in RFQ phase, with additional R&D pertaining to MAVIN still in B sample phase (i.e., fully functional prototype).

We remain on target for our 2023 milestone of OEM partnerships…We remain on target to complete RFQs in the second half of the year as I've stated before. To support future MAVIN revenue stream, we look to launching our analog and digital ASIC, new contract manufacturing partnership and completing a B sample design by the end of the year…Beyond our current 2023 engagements, we are starting to see RFIs for 2024 RFQs from OEMs as well. As I've stated before, some of the views announced in the past from our competitors are not for the entire fleet. OEMs are active in sourcing more advanced LiDAR solutions for larger projects…We are also seeing RFI and RFQ engagement for MOVIA sensor for high volume now.

Source: MVIS 1Q23 Earnings Call Transcript.

MVIS’ lagging go-to-market timeline for its lidar systems relative to rivals in the industry underscores the critical role of ramping up deployment of its new MOSAIK validation suite offering. Although competitors like Luminar boasts in-house validation testing capabilities for OEMs using its lidar systems, there remains a void in the market for addressing third-party validation requirements. MVIS estimates an annual TAM in the range of “hundreds of millions of dollars” from auto OEMs and Tier 1 vendors alone, underscoring its growth prospects over the longer-term as MOSAIK deployment ramps up. And the company has kicked off the new service to a strong start with OEM engagements counting BMW, Vietnamese EV maker VinFast [PRIVATE: VFS], and more recently, Jaguar Land Rover.

The partnerships provide validation to both MOSAIK’s technological competency, as well as the demand environment for third-party lidar system validation suites. This reinforces the long-term growth frontier for MVIS on the go forward.

Lidar Opportunities

Circling back to MVIS’ core lidar offerings, the company has recently expanded its product portfolio from just the MAVIN DR with the addition of MOVIA. The MOVIA sensors will complement MVIS’ expanded reach into non-automotive lidar applications enabled by its recent acquisition of Ibeo.

Specifically, the MOVIA sensors are designed for agriculture, logistics, robotics, and other industrial applications. And this will represent a significant long-term growth opportunity for MVIS, with management outlining a combined TAM of $115 billion through 2030 for related lidar system applications. Further penetration into non-automotive verticals will be key for the company to optimize its market share gains in the emerging industry.

The industrial, we expect this market to be at $2.5 billion in 2025 and grow at an estimated 20% CAGR. If we sum up the total by every year through 2030, we estimate that the total sales in the industrial market will be a cumulative $32 billion by 2030. Extending the same model to non- automotive smart infrastructure, we expect this market to be at $2.8 billion in 2025 and grow at a 30% CAGR. If we sum up similarly the total by every year, we estimate the total sales in this vertical to be a cumulative $46 billion by 2030. For robotics, we expect this market to be at $1.8 billion in 2025 and grow at a 50% CAGR and summing all these things up, it adds up to $37 billion. Now, if we add these three sub-verticals, we get to $115 billion market potential for all the LiDAR players.

Source: MVIS 1Q23 Earnings Call Transcript.

Meanwhile, MAVIN will remain MVIS’ core automotive offering, which management seeks to differentiate by integrating Ibeo’s expertise perception software. However, as discussed in detail in our previous coverage, MVIS’ far-, mid- and near-range MAVIN sensors – though technologically competitive – lacks pricing appeal for automakers who do not yet need such high levels of sophistication for its L2+ ADAS offerings.

This goes back to the fact that Level 2 and L2+ ADAS lidar demand and application is rather cost-driven than performance-driven…Today, MicroVision's lidar system – including the latest "MAVIN DR" – may not be trailing too far behind its peers in terms of proficiency, offering long-range high-resolution detection of up to 250-meters. However, this technological efficiency is currently not required for powering Level 2 or L2+ applications, making it less attractive than less costly offerings by peers, though could potentially benefit from greater demand and scale later in the decade with Level 3 adoption potentially gaining momentum.

Source: “Luminar, Aurora, MicroVision: Who Wins In The AV-ADAS Tug-Of-War?”

As addressed by management during MVIS’ latest earnings call, its peers continue to offer lidar systems at an average selling price in the $1,000-range – a figure which the company aspires to reduce by half for its MAVIN offerings through scale. Specifically, management cited prospects for the price on its long-range MAVIN lidar sensors to come down to the $500 range. But that would depend on “volumes greater than 10 million” – an astronomical figure compared to its current state of pre-serial production.

While the “lidar market for the automotive and the ADAS sector will generate at least $82 billion of cumulative potential revenue for the entire industry through 2030,” or based on MVIS’ aspired ASP of $500 would imply cumulative unit sales of 164 million through the end of the decade, the company remains a long way from realizing its price differentiation ambitions considering its core automotive lidar sensor offerings remain in sampling stage. This underscores substantial execution risks ahead still.

MicroVision Stock Valuation Considerations

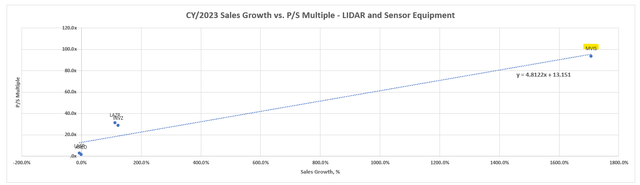

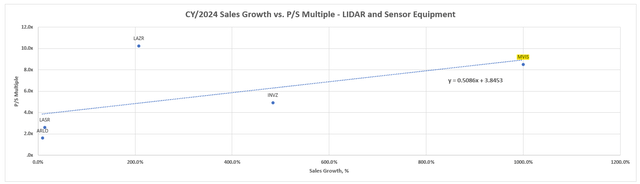

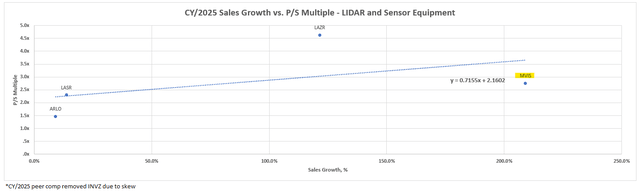

Based on a multiple-based approach, MVIS’s valuation at current levels remains largely in line with its lidar peers relative to their growth profiles.

i. Sales Growth vs. P/S Multiple – LIDAR

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

The stock’s current price implies a slight discount based on the underlying business’ longer-term growth prospects, which likely reflects investors’ concerns over the longer-term execution risks facing MVIS ahead as discussed in the foregoing analysis. Currently trading at just under 3x 2025E sales, market is pricing in growth estimates of just under 100% for the period, which is in line with uncertainties over the realization of MVIS’ longer-term growth roadmap.

In addition to execution risks to the company’s longer-term growth roadmap, despite greater clarity on its go-to-market strategy going forward with the recent roll-out of MOSAIK and expanded product portfolio and TAM via its acquisition of Ibeo, its ongoing growth initiatives will likely increase uncertainty to its longer-term capital structure. This would represent another multiple compression risk. While management has indicated MVIS’ current liquidity position of $67 million would be sufficient to fund its operations through 2024, there remain significant outlays within the near term to support ongoing growth initiatives, spanning a €5 million remaining payment as well as other integration and restructuring costs for the Ibeo acquisition due in the current quarter, as well as R&D costs for the MAVIN and MOVIA sensors, and ramp-up costs pertaining to early stages of deployment for the MOSAIK validation suite.

The capital-intensive outlays is further corroborated by MVIS’ recent proposal for a $75 million common stock offering, which is incremental to the $44 million available under its existing at-the-market program. While management has swiftly retracted the proposal citing “market volatility,” which is reflected in the stock’s quick rebound following declines of more than 27% in the prior session, related uncertainties to the company’s longer-term capital structure will likely drive incremental pressure to the stock’s performance within the foreseeable future. This is consistent with the rollercoaster-like performance in the stock over the past 24 hours, with losses of more than 27% to a rebound of almost 30%, then pared gains at the teens-range in pre-market trading Thursday (June 15).

Specifically, we expect the lack of clarity on MVIS’ longer-term capital to further exacerbate company-specific execution risks already priced in. This is in addition to the impact of broader market downside risks pertaining to persistent macroeconomic uncertainties.

The Bottom Line

Historically, there have been multiple shifts in MVIS’ business model and go-to-market strategy over its more than two decades in business – from consumer electronics application, to a shift in focus to the automotive vertical, and now a deeper reach into industrial use cases. The Ibeo acquisition represents one of MVIS’ greatest commitments in recent years, and a substantial diversion from its dire growth narrative just a year ago when management was considering a sale due to its unprofitable nature and lack of breakthrough in the business.

Given Ibeo’s existing customer base, which consists of premium OEMs, as well as its technological expertise, particularly in perception software, the acquisition is expected to drive meaningful growth synergies by complementing MVIS’ existing lidar system offerings, providing greater clarity to the company’s longer-term growth roadmap. The recent deployment of MOSAIK is provides a differentiated go-to-market strategy for the company within the increasingly competitive, yet still emerging automotive lidar industry.

While the recent developments increases optimism on the company’s longer-term growth profile, we expect incremental pressure to its cash flows within the foreseeable future given ongoing ramp-up costs as well as significantly capital outlays to fund ongoing growth initiatives. This leaves substantial uncertainties over the company’s longer-term capital structure, especially given its widening losses still, which is further corroborated by the recent share offering debacle and the related impact on the MVIS stock’s performance.

While MicroVision stock is currently trading at levels in line with the broader peer group, we expect the elevated execution risks and fundamental uncertainties to remain a company-specific multiple compression risk, second to persistent macroeconomic pressures weighing on the broader market’s performance. Given the stock’s vulnerability to continued market volatility ahead, given evolving macroeconomic conditions and company-specific execution risks, we see little conviction and limited catalysts for material upside for MicroVision stock within the foreseeable future.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service's key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!

This article was written by

Boutique investment research shop providing professional coverage on disruptive thematic equities. Our analysis provides a deep dive on growth drivers present in the secular market to identify outperforming investments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.