Loews' Prudent Capital Deployment And Decentralization Promote Value Creation

Summary

- Loews remained discounted below tangible book value, calculated through the sum of its subsidiary values and cash on hand.

- The firm has also demonstrated operational strength across a suite of highly stable, cash flow-generating businesses.

- The confluence of undervaluation and secure, residual growth leads me to rate Loews a 'buy'.

JHVEPhoto

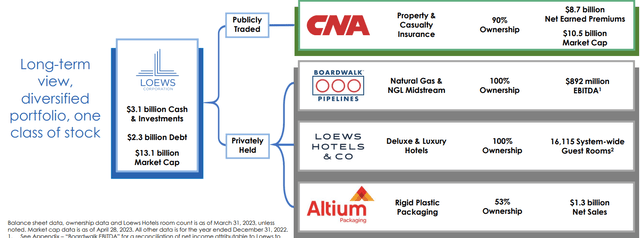

Loews (NYSE:L) is a New York City-based US conglomerate with majority ownership over four primary businesses: CNA Financial is the company's largest holding, being a major public P&C insurer, Boardwalk Pipeline Partners operates in the midstream liquified natural gas business, with Loews Hotels and Altium Packaging rounding out the group.

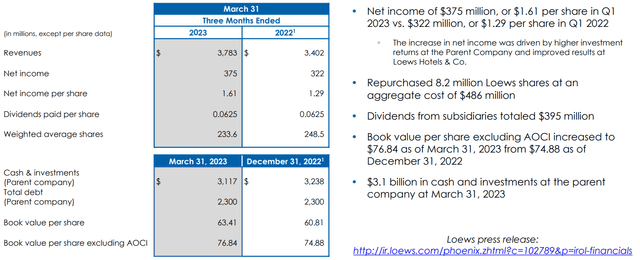

Through these activities, in the past quarter, Loews has seen $3.78bn in revenues alongside a net income of $375mn. This scale growth is accompanied by an increase in the company's book value, to a price of $63.41 per share.

Introduction

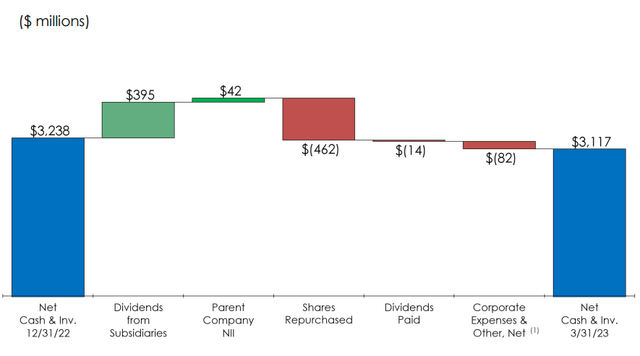

The company's directional objectives can best be described by how the company uses its cash flows; Loews essentially receives revenues from subsidiaries in the form of dividends and whatnot, as well as net interest income from its treasury activities, and then deploys capital, either as returns to shareholders or towards operational expenditures.

The company's diverse and stable cash flow generation in the face of macro headwinds, as well as a slight undervaluation and strong capital deployment strategy, leads me to rate Loews a 'buy'.

Valuation & Financials

General Overview

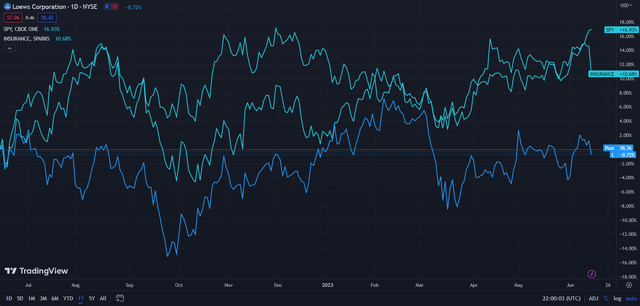

In the TTM period, Loews- down 0.72%- has trailed both TradingView's Insurance Index- up 10.68% and used since Loews' largest holding is in insurance- and the general market, as represented by the S&P 500 (SPY)- up 16.93%.

Loews (Dark Blue) vs Industry & Market (TradingView)

I believe this reflects one of Loews' glaring weaknesses, inherent to diversified conglomerates; the different industries the company operates within react differently to macro events. While this leads to share price stability, it inhibits growth.

That said, my view is that Loews' ability to grow free cash flows in this environment means the company is nonetheless underpriced.

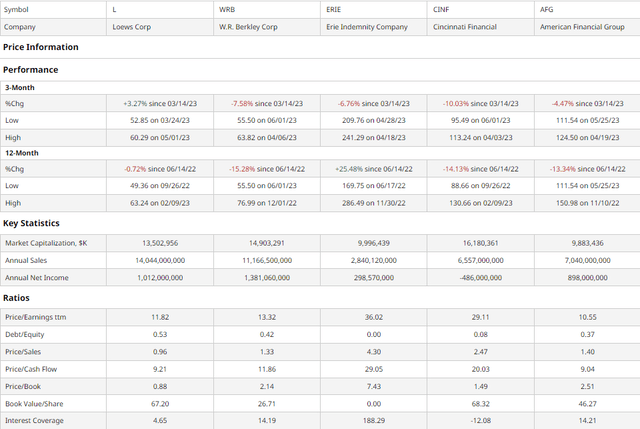

Comparable Companies

The highly diversified nature of Loews' businesses means that there are no direct competitors with similar enough operations to accurately gauge a valuation. However, similarly sized insurance companies are most comparable, with most of Loews' subsidiaries being stable, inelastic cash flow generators, not dissimilar to insurance in general. As such, international P&C firm W. R. Berkley (WRB), Midwest-centric Erie Indemnity (ERIE), multi-line Cincinnati Financial (CINF), and the insurance and investment firm, the American Financial Group (AFG) are the most comparable companies.

As demonstrated above, although Loews has seen a TTM price decline, it still sustained the second-best performance, likely a product of the firm's diversification efforts, meaning economic events had less influence over the firm's financial performance. With growing free cash flow, Loews' relative overperformance extends into the past quarter in which the firm has seen superior growth.

Regardless, the firm remains undervalued on a multiples basis and when considering Loews' tangible book value. For instance, the conglomerate maintains the second-lowest trailing P/E- even among insurers, who historically have lower P/E ratios- and the second-lowest P/CF, and lowest P/B. This comes alongside the highest BV/share.

Although the company maintains the highest debt/equity of the peer group, at 0.53, Loews still has a high level of fiscal room available.

Valuation

According to my discounted cash flow analysis, at its base case, the fair value of Loews is $70.22, meaning, at its current price of $58.12, the firm is 17% undervalued.

My model, calculated over 5 years without perpetual growth, assumes a discount rate of 8%, a benchmark rate which captures Loews' relatively average debt levels and relatively low implied volatility. To air on the side of caution, I estimate real revenue growth of 2%, mirroring the company's cash flow stability and gradual growth.

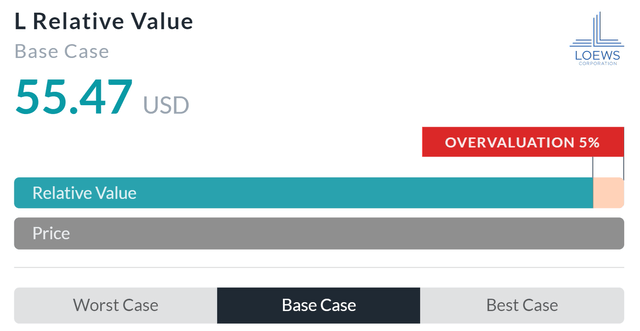

Alpha Spread's multiples-based relative valuation tool calculates an overvaluation of 5%, meaning Alpha Spread's fair value for the stock is $55.47.

However, the fact that Alpha Spread primarily compares Loews to insurance firms, which historically maintain lower multiples, fails to holistically capture the entirety of Loews' business, which remains highly diversified.

Movement Beyond Insurance Augment Stability & Growth Prospects

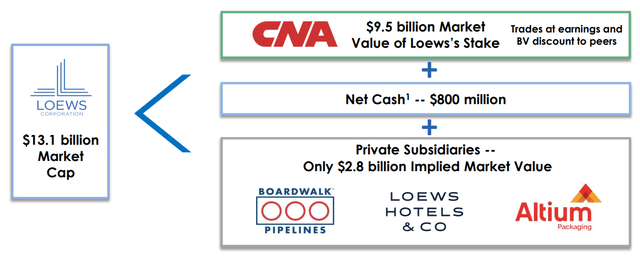

Loews' value is fundamentally derived from the activities of its subsidiaries and therefore should adequately reflect the combined value of said subsidiaries. However, the sum of CNA's value, Loews' cash on hand, and private subsidiaries supersede the market capitalization of the firm, further proving the discounted price Loews is trading at.

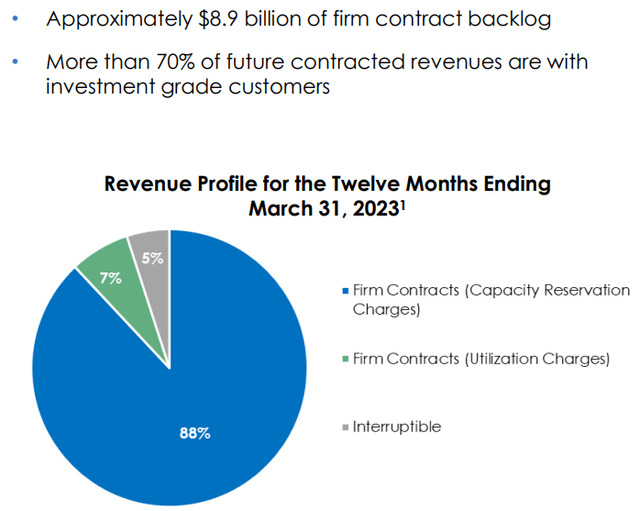

In the hands of its range of businesses, Loews is able to secure long-term revenues and predictable cash flows. Case in point, the conglomerate's Boardwalk pipeline business maintains a contract backlog of ~$8.9bn, practically guaranteeing long run cash flows.

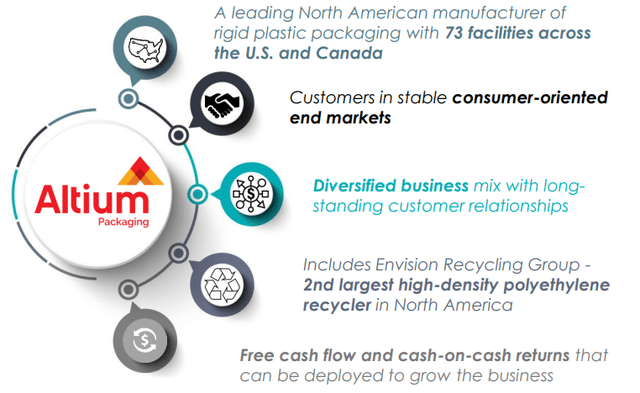

These predictable cash flows go hand-in-hand with Loews' firmwide strategy of operations in inelastic product categories and protecting investor returns through revenue stability. For example, Altium Packaging operates within stable retail segments, producing household chemical, pharmaceutical, food and dairy, etc. packaging products.

The aim of the business is to utilize the stable cash flows of the firm in its growth-intensive capital deployment strategy. Loews prioritizes shareholder returns and lowering the cost of equity through opportunistic share repurchases, followed by reinvestment into subsidiary firms to promote organic growth, and disciplined M&A given the ideal candidate.

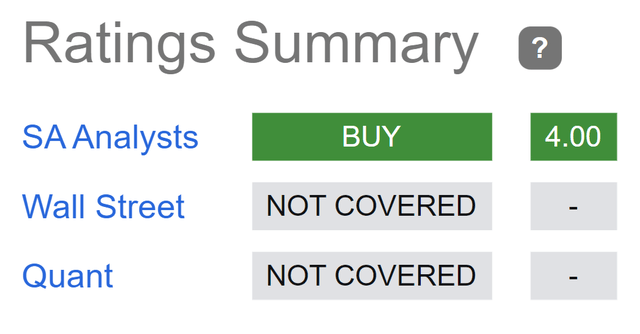

Wall Street Consensus

Although the company lacks Wall Street or Seeking Alpha quant analysis, previous Seeking Alpha analysts have rated the company a 'buy', in line with my own rating.

Risks & Challenges

Interest Rates Diminish Loews Ability to Expand

Though Loews does not maintain a high debt level, higher interest rates nonetheless increase the cost of capital and reduce the company's ability to expand inorganically. Given that Loews operates as an integrated investment conglomerate, this can harm the firm's ability to generate maximal future cash flows.

Subsidiary Returns & Reinvestment Balancing Act

Loews principally generates revenues through dividends and returns from its subsidiary companies, though these businesses are under no necessary obligation to return capital. As such, both for subsidiaries and the parent company, the tradeoff between reinvestment for organic growth and shareholder return is particularly complex.

Conclusion

With broad-based cash flow generation across a suite of stable industries, investors can expect price appreciation driven by a return to fair value and a premium for the company's stability-orientation.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.