NIO: I Am Still Waiting To Buy

Summary

- NIO has experienced both relatively flat revenue and steadily declining gross margins since mid-2021.

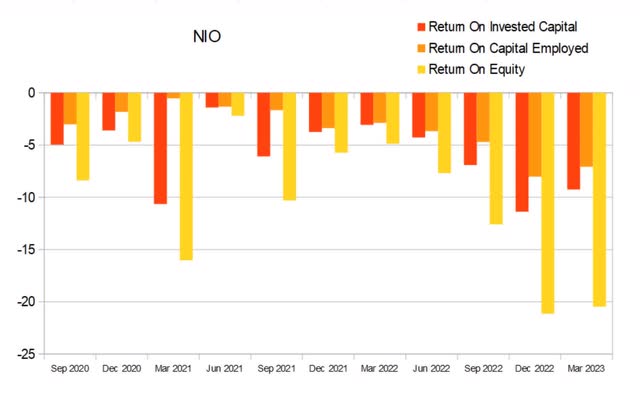

- As of the most recent earnings report, quarterly ROIC was -9.26%, ROCE was -7.07%, and ROE was at -20.47%.

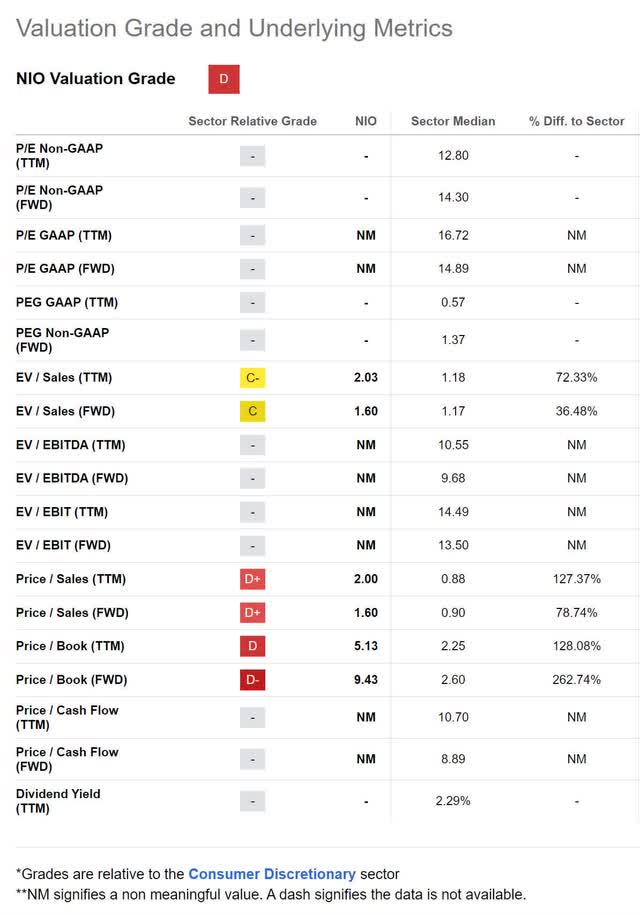

- Considering their negative returns, I view their forward Price/Sales of 1.60x, EV/Sales of 1.60x, and Price/Book of 9.43x as showing the company as currently overvalued.

- I currently rate NIO stock a Hold.

Drew Angerer

Thesis

With the EV market facing strong long-term tailwinds, I find myself repeatedly checking in on NIO Inc (NYSE:NIO) to see if they are operationally viable yet. After looking over their financials, they still need to make considerable improvements before I can become a long-term investor. I currently rate NIO stock a Hold.

Company Background

NIO is a multinational electric automobile manufacturer headquartered in Shanghai, China. Instead of coupling their vehicles to a network of recharging stations, the company is developing a system which centers around battery-swapping stations.

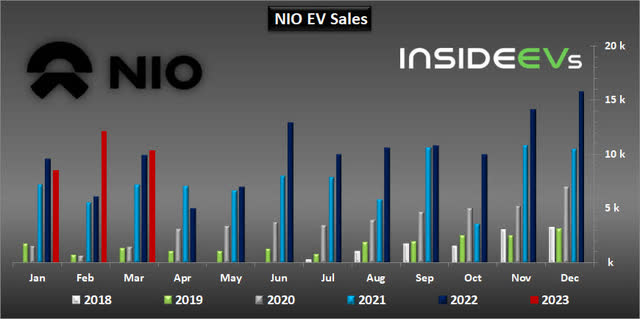

NIO is still in the process of shifting away from the startup phase and into the growth phase of its business life cycle. Their sales volumes vary significantly from month to month.

NIO Vehicle Sales As Of March 2023 (Insideevs.com)

A price war has been affecting their operations in China. Recent forward looking statements by the company during their most recent earnings call indicate that they project for sequential delivery declines to continue, and for them to fall in a range between 23,000 and 25,000 vehicles delivered in Q2.

Long-Term Trends

China's electric vehicle market is projected to experience a CAGR of 6.38% through 2028. The global electric vehicle market is expected to have a CAGR of 22.5% until 2030.

Financials

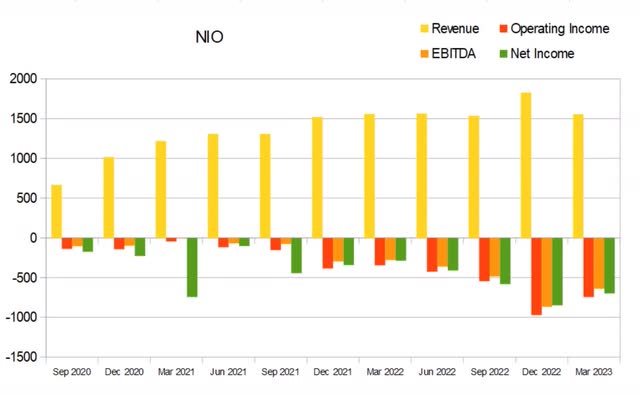

NIO experienced growing revenue in 2020 and 2021. Other than an outlier quarter at the end of 2022, it has stayed relatively flat since then. Operational losses increased through 2022, reached a peak in Q4 2022, and then retracted this most recent quarter.

NIO Quarterly Revenue (By Author)

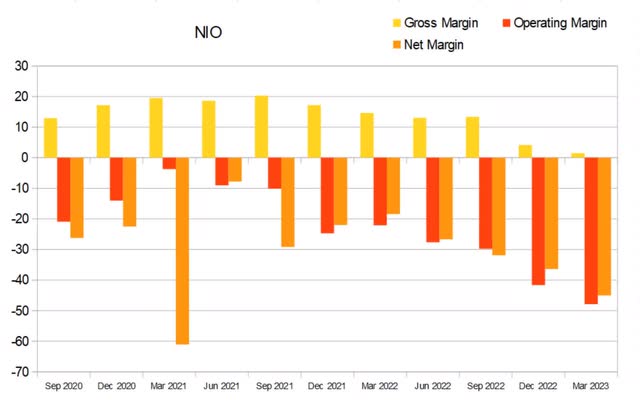

The price war the company is dealing with is showing up in their margins. Instead of improving, they have been getting worse over the last several quarters. As of the most recent quarter gross margins were at 1.52%, operating margins were at -47.88%, and net margins were at -44.99%.

NIO Quarterly Margins (By Author)

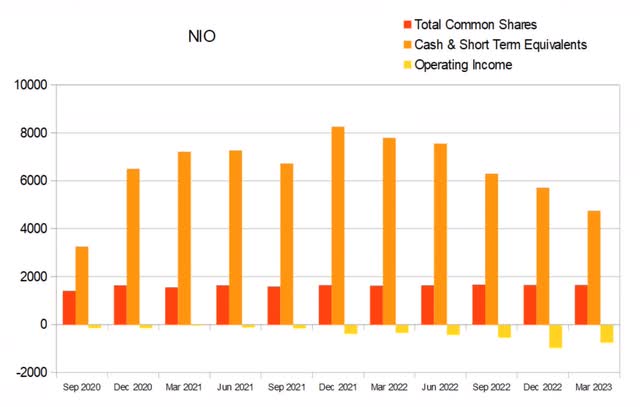

The share count has been slowly growing. In Q3 2020, total common shares outstanding was at 1.4054B; by this most recent quarter that was at 1.6493B. This represents a 17.35% rise. Over that same time period quarterly operating income fell from -$139.3M to -$744.3M. With gross margins slowly getting worse over the last several quarters, I have little faith they will be able to improve operating income in the near future.

NIO Quarterly Share Count vs. Cash vs. Income (By Author)

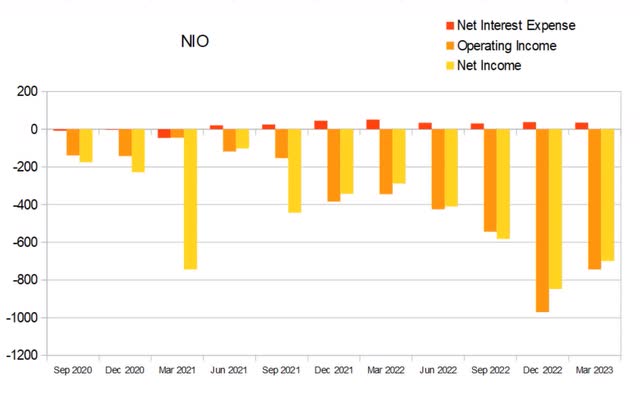

NIO has managed to increase its interest and investment income in Q2 2021. The company has maintained positive Net Interest Expense since then. As of the most recent quarter they had $1649.9M in long-term debt, $4,134.8M in total debt, $4,747.8M in cash & equivalents, and a quarterly operating income of -$744.3M.

NIO Quarterly Net Interest Expense (By Author)

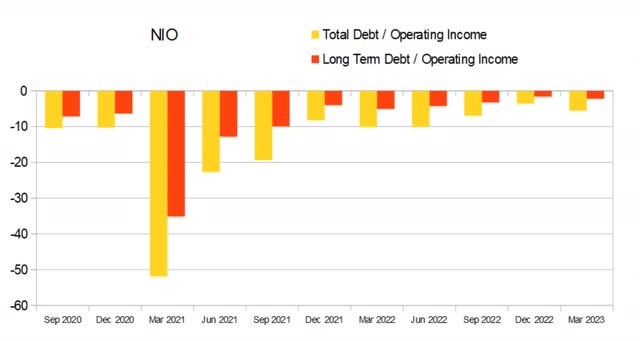

Ideally, I want to see debt to annual income below 3x, and debt to quarterly income below 12x. With the company consistently posting negative quarterly operating income, their ability to pay down debt does not look promising.

NIO Quarterly Debt vs. Income (By Author)

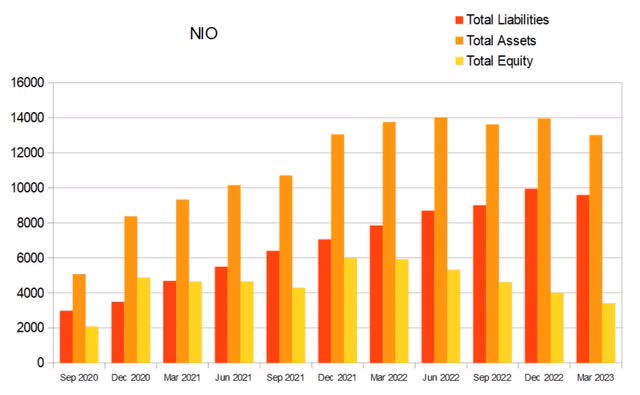

Total equity has been dropping since its high in Q4 2021.

NIO Quarterly Total Assets (By Author)

While I believe NIO has the potential to eventually produce attractive returns, they are presently far from a good investment. As of the most recent earnings report quarterly ROIC was at -9.26%, ROCE was -7.07%, and ROE was at -20.47%.

NIO Quarterly Returns (By Author)

Valuation

As of June 14th, 2023, NIO had a market capitalization of $14.84B and traded for $9.05 per share. Considering their negative returns, I view their forward Price/Sales of 1.60x, EV/Sales of 1.60x, and Price/Book of 9.43x as showing the company as currently overvalued.

Risks

With their gross margins steadily declining since mid-2021, I have to cite the possibility that the price war continues to force them lower. I cannot predict its duration, or where their margins will eventually bottom out at, but their financials will continue to suffer until it ends.

Catalysts

The obvious thing to cite here is the ending of the price war. The thing about price wars is that the survivors typically do so because they spent the entire time focusing on costs and profitability. When the price war eventually ends, NIO should be significantly stronger on the other side.

As they manage to build out their network of battery swapping stations, not only will they make their products more convenient, they will normalize their use.

Conclusions

I believe that NIO has the potential to eventually capture a significant portion of the global EV market share. A big part of this is because I think potential consumers will be drawn to NIO due to the time savings they will achieve by purchasing a battery swap EV over a recharging EV. In addition to having a long runway, they face strong sustained tailwinds, and are likely to eventually trade with a strong P/E. Because I believe in the long term viability of the company, if their present returns were less terrifying, I would consider slowly dollar cost averaging into a small position.

If a person were able to time this correctly, NIO should make an excellent turnaround play. However, the company is currently burning significant amounts of cash trying to survive a price war, so I have to avoid it from a value perspective. Also, it is still far too expensive to buy it as a cigar butt, so I am forced to wait for either the price to fall even further, or for a positive trend change to show up in their margins.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.