FXC: Canada Has Potential As China Looks To Expand Its Influence

Summary

- A stable trend since 2016 – The Canadian dollar is a dollar index component.

- A correlation with commodity prices- Canada is a raw material exporter.

- Canadian politics have weighed on the currency- A constitutional monarchy with a leftist Prime Minister.

- Close ties to the U.S.- Canada’s leading trading partner- De-dollarization could help or hurt Canada.

- Invesco CurrencyShares® Canadian Dollar Trust ETF is the Canadian dollar versus the U.S. dollar ETF product – A trading range with upside potential.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

pawel.gaul

Canada is the world's second-largest country by total area, with the world's longest coastline. Russia has the most territory, while Canada, China, and the U.S. are close in land area.

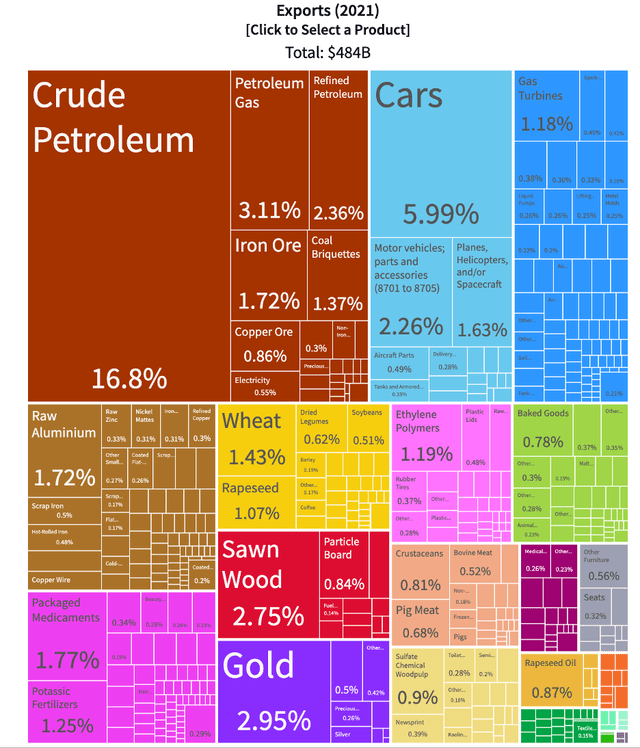

Canada ranks thirty-ninth in population, with just under forty million people. Meanwhile, climate and geology cause 90% of Canada's population to live within 150 miles of the U.S. border. Canada is a vast country with a low population, but its landmass is rich in natural resources, with the leading exports of crude oil, gold, wheat, aluminum, and rapeseed. Canada is also a significant wood and iron ore exporter.

The Canadian dollar is a reserve currency, and its value tends to move higher and lower with its leading trade partner, the United States. However, as a commodity producer with a low population, the Canadian currency can reflect rising or falling raw material prices as they determine corporate and tax revenues yearly.

The Invesco CurrencyShares® Canadian Dollar Trust ETF (NYSEARCA:FXC) measures the C$'s value against the U.S. dollar. Given its sensitivity to commodity prices, the Canadian currency has lots of upside potential in the current inflationary environment.

A stable trend since 2016

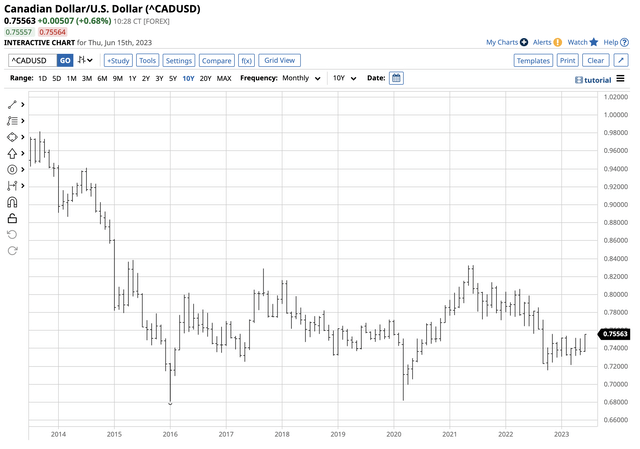

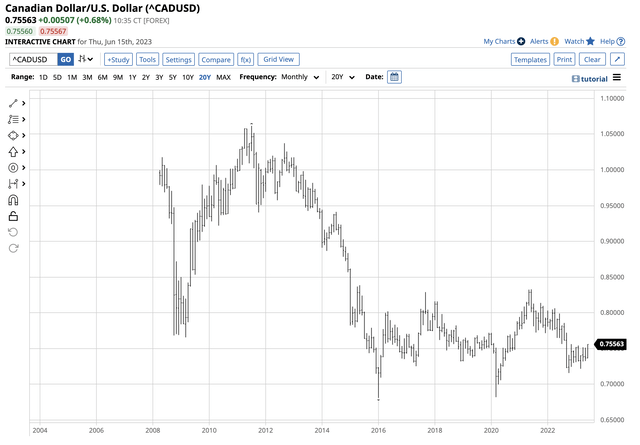

The Canadian dollar has traded around a $0.75 pivot point against the U.S. dollar since the 2016 low.

Canadian Dollar versus the U.S. Dollar Chart (Barchart)

The chart highlights the range, with two spikes, in 2016 and 2020, below the $0.7000 level, and two above the $0.8000 level in 2017 and 2021.

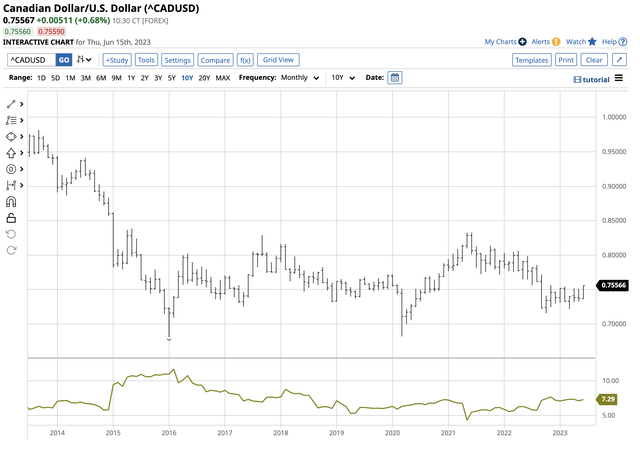

Historical volatility in the dollar index, measuring the U.S. currency against the other world reserve currencies, was at the 8.64% level on the ten-year chart on June 15.

Canadian Dollar versus the U.S. Dollar Chart with Historical Volatility (Barchart)

The chart shows that the historical price variance in the Canadian dollar versus the U.S. dollar currency pair was lower at 7.29%. The C% is a component of the dollar index, with a 9.1% exposure to the U.S. currency.

A correlation with commodity prices

Canada produces many raw materials, with its leading exports crude oil, petroleum gas, gold, wood, metals, and agricultural products.

Canadian Exports 2021 (www.oec.world)

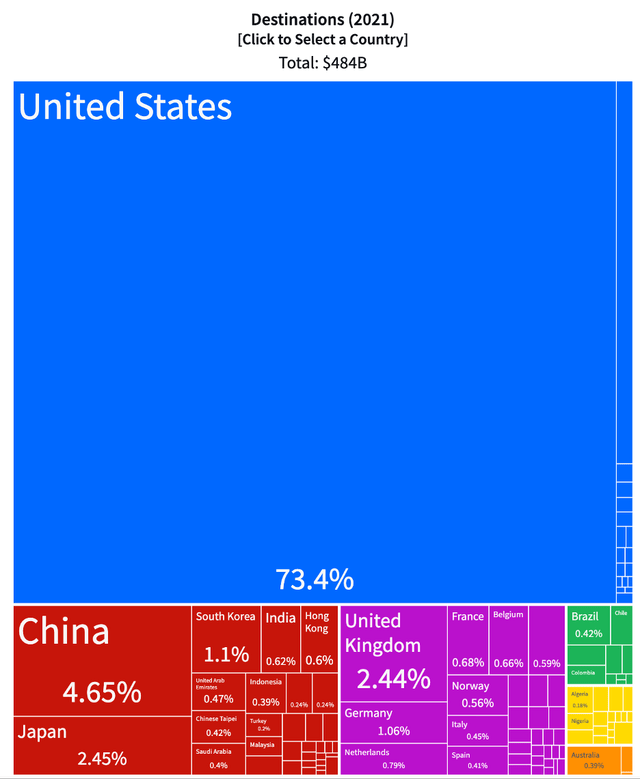

The United States is, by far, Canada's leading trading partner.

Canadian Export Destinations 2021 (www.oec.world)

The geographical proximity to the U.S. and its common border makes Canada a commodity supermarket for the U.S. China is Canada's second-leading trade partner, which is no surprise, given China is the world's leading commodity consumer and most populous country. Japan and the U.K. are leading trading partners, but the U.S. dominates Canadian exports.

The last significant rally in commodities' prices occurred in 2011 when many raw materials reached record or multi-year highs.

Long-Term Canadian versus the U.S. Dollar OTC Forex Change (Barchart)

This made the currency pair hit a $1.06164 high in July 2011. In 2011 and 2012, agricultural and other commodity prices reached peaks. Canada's raw material output increased profits and tax revenues, pushing the currency to over parity against the U.S. dollar. The rally in 2011 shows the correlation between the C$ and commodity prices.

Canadian politics have weighed on the currency

Three political and economic factors have weighed on the Canadian dollar's exchange rate against the U.S. dollar over the past years:

- A series of scandals have caused instability in the Canadian government, undermining faith. Prime Minister Justin Trudeau invoked the Emergencies Act in February 2022, causing fears that foreign capital would move south to the United States.

- In the U.S. home buyers can lock in mortgage rates for thirty years, but in Canada, most borrowers can only mortgage property for five years, with adjustments based on current rate levels. The mortgage structure makes increasing the Canadian rate to combat inflation more challenging, as it immediately impacts homeowners with mortgages. The lack of central bank flexibility puts pressure on the Canadian dollar versus the U.S. dollar, as the Bank of Canada cannot keep pace with U.S. rate hikes.

- The rally in the C$ in 2011 came as oil and gas prices moved higher starting in 2008, increasing revenues and tax receipts. Land-locking energy policies to combat climate change in high-carbon-emitting projects like the oilsands have weighed on capital inflows into the energy sector and production revenues.

Canadian politics and economic shifts have weighed on the Canadian currency over the past years.

Close ties to the U.S.

Canada's close ties and border with the United States have provided benefits over the past decades. The U.S. is the world's leading economy and military power. Meanwhile, China's rise that threatens the U.S.'s dominant position is also a threat to the Canadian economy. De-dollarization, as China leads the initiative for a BRICS currency to challenge the U.S. dollar, could weigh on the dollar's global role as the reserve currency. As Canada is the U.S.'s leading ally, any decline in the U.S. dollar's worldwide dominance would likely weigh on Canada's currency value.

While the exchange rate between the U.S. and Canadian dollars may remain stable, both currencies could lose purchasing power if a BRICS currency erodes the dollar's position in the global financial system. However, since China is Canada's second-leading trade partner, Canada is strategically located north of the U.S., China has an unending appetite for raw material imports, and China has made significant investments worldwide, a warming of Chinese-Canadian relations at the U.S.'s expense could cause the Canadian currency to rise versus the U.S. dollar over the coming years.

FXC is the Canadian dollar versus the U.S. dollar ETF product

China has not been shy about expanding its sphere of influence. President Xi's comment to Russian President Putin that "Right now, we are seeing a change we have not seen in 100 years, and we are driving this change together" validates the Chinese leaders' plans to replace the U.S. as the leading economic and military power. Canada is strategically critical because of its raw material output and its border with the United States. China will likely look to improve trade and other relations with Ottawa over the coming months and years. If Canada increases its exposure to China, and a BRICS currency challenges the U.S. dollar for reserve currency status, the Canadian dollar could rise versus the U.S. dollar.

The most direct route for a risk position in the C$ versus the U.S. dollar is via the over-the-counter foreign exchange market or the Chicago Mercantile Exchange futures and futures options. The Invesco CurrencyShares® Canadian Dollar Trust ETF product provides market participants with an alternative to the OTC or futures products.

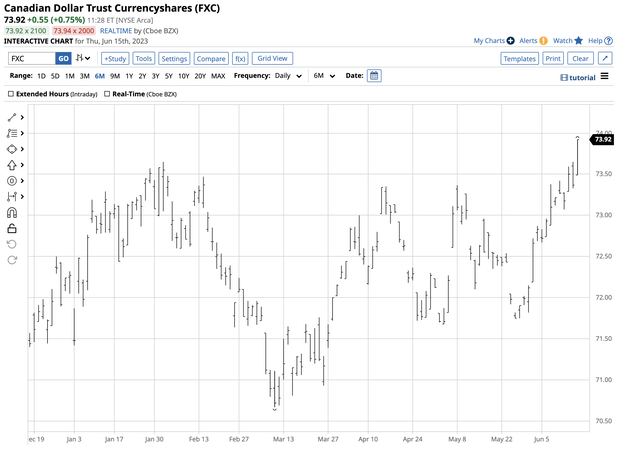

At $73.92 per share on June 15, FXC had around $99.4 million in assets under management. FXC trades an average of 32,858 shares daily and charges a 0.40% management fee. Canadian interest rate allows FXC to pay shareholders a 1.20% annual dividend.

The Canadian dollar versus the U.S. dollar currency relationship rose 4.7% from $0.72146 on March 10, 2023, to its latest $0.75569 high on June 13, 2023.

Chart of the FXC ETF Product (Barchart)

The chart shows over the same period, FXC rose 4.6% from $70.67 to $73.92 per share as FXC does an excellent job tracking the currency pair.

One of the drawbacks of FXC and other ETFs is they only trade when the U.S. stock market operates. Since the international foreign exchange market trades around the clock, the ETFs can miss highs or lows when the U.S. stock market is not open for business.

The Canadian economy depends on natural resource exports, so a bull market in commodities tends to support the Canadian dollar. Meanwhile, the changing geopolitical landscape could cause China to make significant overtures to Canada, given its strategic location bordering the United States.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex. and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount to new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.