The market has seen a correction for the first time in the last four consecutive sessions, on June 15, after the Federal Reserve's hawkish commentary hinting at the possibility of two more rate hikes in the coming period. Selling was seen in banking and financial services, and technology stocks.

The BSE Sensex fell 311 points to 62,918, while the Nifty50 dropped 68 points to 18,688 and formed a Bearish Engulfing candlestick pattern on the daily charts, indicating the possibility of bearish sentiment in the short term, but the index defended 18,600 levels.

"The formation of a High Wave pattern on Wednesday and Bearish Engulfing pattern on Thursday indicate short-term top reversal pattern for the Nifty," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He believes that Thursday's high of 18,794 levels could now be considered as a new higher top of the sequence. Hence, one may expect further weakness in the short term to form a new higher bottom at the lows, he said.

The near-term uptrend of the Nifty remains positive and present weakness is expected to find support around 18,500 levels in the next few sessions, he said, adding that a decisive move below 18,500 is expected to open sharp weakness in the near term.

However, the Nifty Midcap 100 and Smallcap 100 indices continued to trade in positive terrain for the fourth straight session, rising around 0.2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

According to the pivot point calculator, the Nifty may find support at 18,669, followed by 18,640 and 18,592. If the index advances, then 18,765 will be the key resistance, followed by 18,794 and 18,842.

The Bank Nifty corrected for yet another session, declining 1.24 percent to 43,444 and formed a long bearish candlestick pattern on the daily scale, with above-average volumes.

"This suggests increased selling pressure in the index. The index has breached the support level at 43,700, which was expected to provide a level of price support. This breakdown below support indicates a potentially bearish signal for the Bank Nifty," Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities said.

If the index sustains below 43,500, it is anticipated to face further selling pressure, potentially driving the index towards the next support level at 43,000, he said.

As per the pivot point calculator, the Bank Nifty is expected to find support at 43,380, followed by 43,219 and 42,960, while the resistance is likely to be at 43,899, then 44,060 and 44,319.

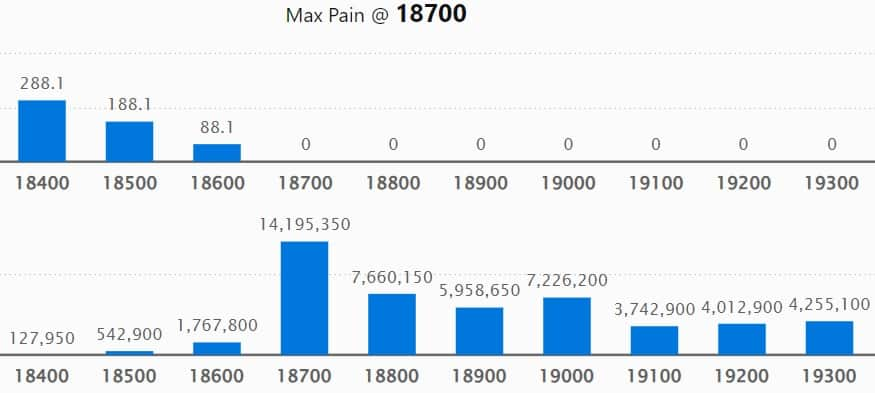

On the weekly options front, the maximum Call open interest (OI) was seen at 18,700 strike, with 1.41 crore contracts, which is expected to be a crucial resistance level for the Nifty.

This was followed by 76.6 lakh contracts at 18,800 strike, while 19,000 strike has 72.26 lakh contracts.

We have seen Call writing only at 18,700 strike, which added 59.14 lakh contracts, within the range of 17,500-19,500 strikes.

Maximum Call unwinding was at 18,900 strike, which shed 57.49 lakh contracts, followed by 18,800 and 19,200 strikes, which shed 21.69 lakh and 19.10 lakh contracts, respectively.

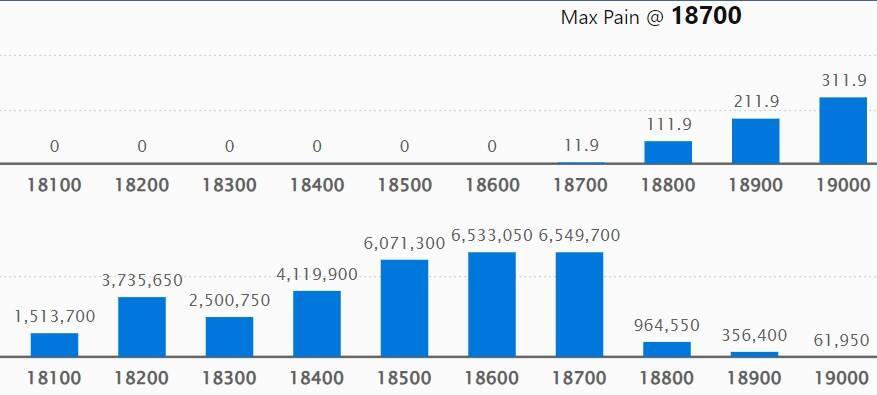

On the Put side, we have seen the maximum open interest at 18,700 strike, with 65.49 lakh contracts, which is expected to be a crucial level for the Nifty50 in the coming sessions.

This was followed by the 18,600 strike, comprising 65.33 lakh contracts, and the 18,500 strike, which has 60.71 lakh contracts.

Put writing was only seen at 17,800 strike, which added 17.42 lakh contracts, within the 17,500-19,500 strikes.

Put unwinding was seen at 18,700 strike, which shed 95.74 lakh contracts, followed by 18,600 and 18,000 strikes, which shed 47.08 lakh and 34.37 lakh contracts, respectively.

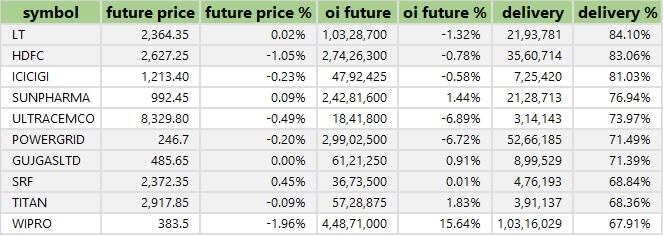

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Larsen & Toubro, HDFC, ICICI Lombard General Insurance Company, Sun Pharmaceutical Industries and UltraTech Cement among others.

An increase in open interest (OI) and price indicates a build-up of long positions. Based on the OI percentage, 39 stocks including Metropolis Healthcare, Apollo Hospitals Enterprises, Zydus Lifesciences, Alkem Laboratories and L&T Finance Holdings saw a long build-up.

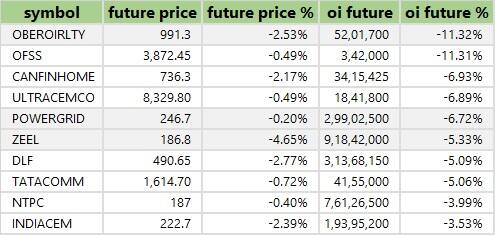

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 53 stocks including Oberoi Realty, Oracle Financial, Can Fin Homes, UltraTech Cement and Power Grid Corporation of India saw a long unwinding.

63 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 63 stocks including Tata Chemicals, Dr Lal PathLabs, Wipro, Federal Bank and State Bank of India saw a short build-up.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 34 stocks were on the short-covering list. These included JK Cement, Godrej Properties, Ipca Laboratories, Crompton Greaves Consumer Electricals and PVRInox.

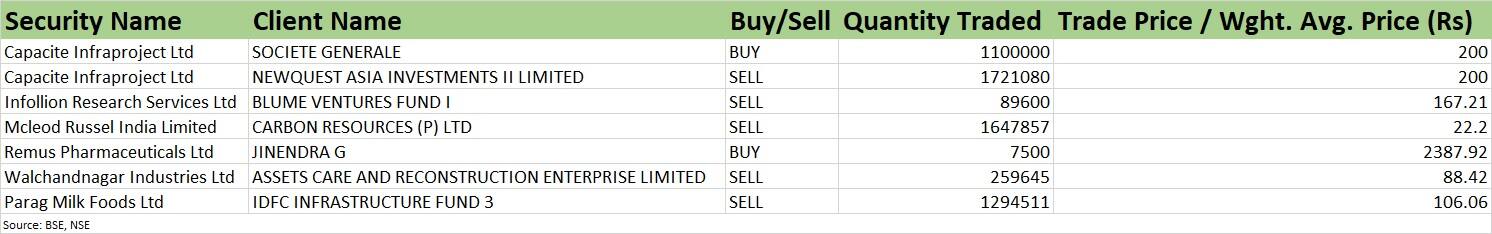

(For more bulk deals, click here)

Investors Meetings on June 16

Metropolis Healthcare: The company's officials will be meeting investors and analysts in a non-deal roadshow in the UK.

Home First Finance Company India: Officials of the company will be participating in non-deal roadshows organised by Kotak Securities in the US.

Mahindra & Mahindra: The company's officials will meet several funds and investors in a non-deal roadshow in the UK and Ireland.

Poonawalla Fincorp: Representatives of the company will be meeting investors at Investec Asia CXO Conference 2023 in Singapore and Hong Kong.

Dixon Technologies: The company's officials will interact with DAM Capital and Stallion AMC.

Meghmani Finechem: Officials of the company will be meeting Tree Line Investment Management in Singapore.

Blue Star: The company's officials will interact with Indsec Securities, HDFC Securities, GreenEdge Wealth and BNP Paribas.

Trent: Officials of the company will meet BOB Capital Markets.

UltraTech Cement: The company's officials will interact with Invesco, Jennison Associates LLC, Fidelity Management & Research Company LLC, Boston Partners Global Investors Inc, Graticule Asset Management, Redwheel LLC, Oaktree Capital Management, Bayard Asset Management, and Lord Abbett & Co. LLC.

Isgec Heavy Engineering: Officials of the company will meet MK Ventures Investment Advisory, and TATA Asset Management.

Stocks in the news

IKIO Lighting: IKIO Lighting will make its debut on bourses on June 16. The LED maker’s maiden public issue was subscribed 66.30 times during June 6-8 with qualified institutional buyers' reserved portion being booked 163.58 times, high networth individuals 63.35 times, and retail 13.86 times. The issue is trading with a premium of 32 percent in the grey market.

Motherson: Samvardhana Motherson Automotive Systems Group BV, a step-down subsidiary of Samvardhana Motherson International Limited, through one of its European subsidiaries, has signed a binding undertaking to acquire a 100 percent stake in Cirma Entreprise from Vinci Energies France. The value of the deal is 7.2 million euros.

TVS Motor: TVS Motor Company said it has sold its entire stake in Emerald Haven Realty for Rs 166.83 crore. The automaker held a 43.54 percent stake in Emerald Heaven Realty. The buyer is TVS Holdings Private Limited, a part of the promoter group. That makes it a related-party transaction.

Balaji Telefilms: Abhishek Kumar has resigned as chief executive officer of the company with effect from June 16.

Arihant Capital Markets: Arihant Capital Markets said its Board of Directors has approved raising of funds through the issuance of secured unlisted non-convertible debentures (NCDs) up to Rs 100 crore in one or more tranches on a private placement basis.

BHEL: Bharat Heavy Electricals and Volvo Eicher Commercial Vehicles signed an MoU for taking up a 'Joint project for the development and deployment of type–IV cylinders (Hydrogen or CNG) in the commercial vehicle segment.

Power Finance Corporation: PFC has incorporated a special purpose vehicle – Tirwa Transmission Limited – for the construction of Tirwa substation with associated lines. The SPV will be placed under PFC Consulting Limited, which is a wholly owned subsidiary of Power Finance Corporation.

Natco Pharma: The company has announced the successful closure of inspection and received Establishment Inspection Report (EIR) from the US Food and Drug Administration (USFDA) for its drug formulations manufacturing facility at Visakhapatnam for an inspection conducted during January 30 and February 3.

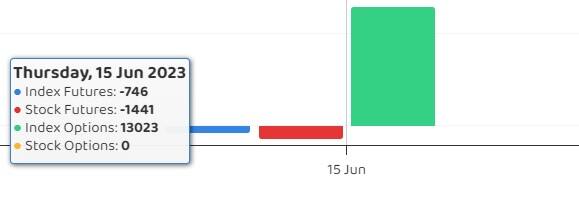

Fund Flow

Foreign institutional investors (FII) purchased shares worth Rs 3,085.51 crore, whereas domestic institutional investors (DII) sold shares worth Rs 297.88 crore on June 15, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has added L&T Finance Holdings, and Tata Chemicals to its F&O ban list for June 16 and retained BHEL, Delta Corp, Indiabulls Housing Finance, Indian Energy Exchange, India Cements, Manappuram Finance, and Zee Entertainment Enterprises. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.