FREL ETF: Just Hold On A Bit Longer

Summary

- FREL's price has remained unchanged for 8 years, but the cumulative CPI of the period suggests potential future appreciation.

- FREL has a lower expense ratio compared to VNQ, making it a better option with almost-equal performance and holdings.

- The real estate market is slowing down, but the likelihood of a crash is low due to stricter lending standards and regulatory measures from the previous housing crisis.

- Despite market uncertainties, investing in FREL with a medium to long-term perspective and implementing dollar-cost averaging is the best bet.

anyaberkut/iStock via Getty Images

Investment thesis

The Fidelity MSCI Real Estate Index ETF (NYSEARCA:FREL) presents a great investment opportunity in the real estate sector for those who would like to expose themselves to this market through a diversified portfolio. Even though FREL's stock price performance may have been lagging in the previous years (see SA chart below), it's also a significant indicator for its long-term potential for share appreciation. The cumulative Consumer Price Index (CPI) of approximately 30% over the past eight years suggests that prices may undergo a correction and potentially appreciate in the future.

Frel's snapshot at time of writing (Seeking Alpha)

As such, holding or opening a position in FREL now might be an interesting idea since it not only offers the potential for capital appreciation but also provides you with recurring income through satisfactory dividends. With a current distribution yield of 4.01%, FREL offers a generous dividend payout, making it an attractive option for income-focused investors and for those patient enough to stick to them for a while before the better future ahead.

A brief description of FREL

FREL is the ticker symbol for the Fidelity MSCI Real Estate Index ETF. This ETF is offered by Fidelity Investments and is designed to track the performance of the MSCI USA IMI Real Estate 25/25 Index. This index is designed to measure the performance of the real estate sector in the United States, focusing especially on companies such as real estate investment trusts (REITs) and real estate development and management companies.

Henceforth, the goal of FREL is to provide you with exposure to the U.S. real estate sector. The fund invests in companies across various segments of the real estate industry, including developers, owners, and operators of commercial properties, residential property management companies, among others.

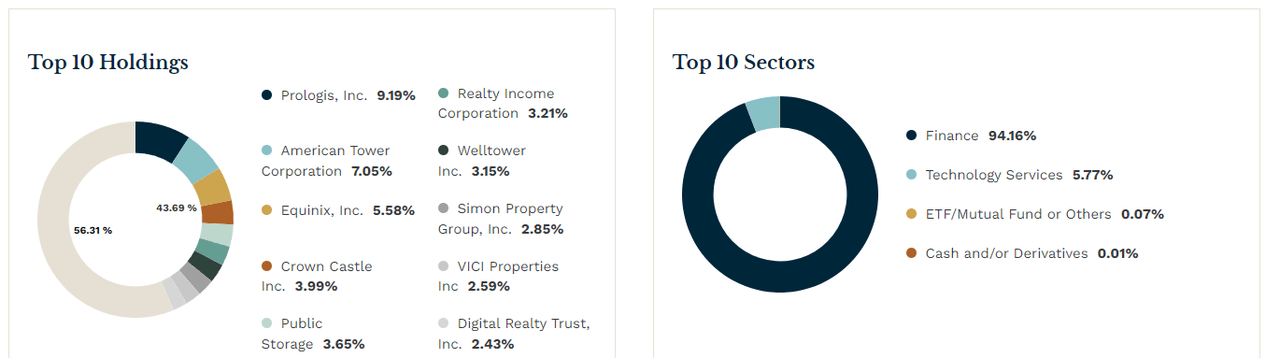

By investing in FREL, you don't need to purchase individual stocks to be exposed to some of the top companies in the sector, such as: Prologis, Inc. (PLD), American Tower Corporation (AMT), Equinix, Inc. (EQIX), and Crown Castle Inc. (CCI).

Top 10 holdings and sectors from FREL (etf.com)

FREL and VNQ are pretty much the same, but FREL is slightly better

The Vanguard Real Estate ETF (VNQ), one of the most well-known and popular exchange-traded funds focused on the real estate sector, and it seeks to track the performance of the MSCI USA IMI Real Estate 25/50 Index. The Vanguard Group, a renowned investment management company, offers this ETF as part of its lineup.

FREL stands out for its relatively lower expense ratio compared to other real estate ETFs, such as VNQ. Fidelity, the provider, has been known for its focus on offering competitive pricing to investors, and having a low expense ratio is advantageous because it means a smaller portion of your returns is eroded by management fees.

As I write this article, VNQ charges an annual fee of 0.12%, slightly higher than FREL's management fee of 0.08%. Although the difference may look modest to you at first glance, we all know that this sums up pretty well in the long run, and I do believe most ETF investors have a holder approach instead of trading it frequently. Anyhow, it just makes no sense to pay more for the same product just because one of them is issued by a slightly more popular investment company, in the end, we all know both are in good hands.

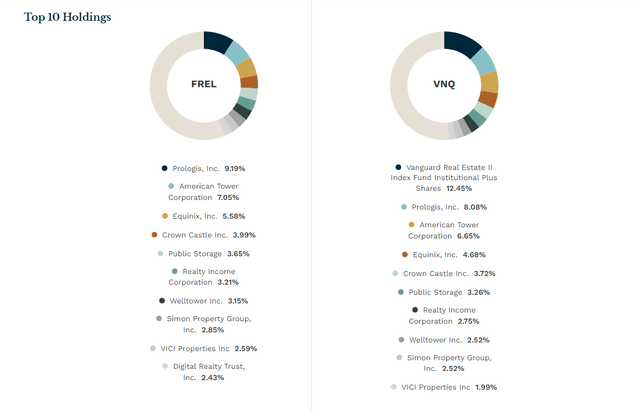

Just to make things a bit clearer, the first graph below shows the holdings and their respective weight in each fund. As you can see, the companies on both of them are pretty much the same and, although VNQ has another Vanguard fund inside (VRTPX), this extra fund also invests in the same companies from the list (see second image).

Top 10 holdings of both FREL and VNQ (etf.com)

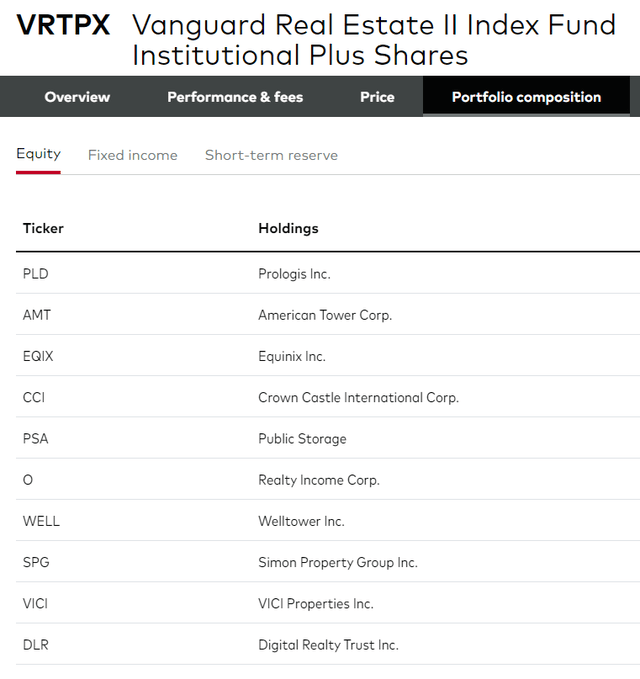

Top holdings from VRTPX (investor.vanguard.com)

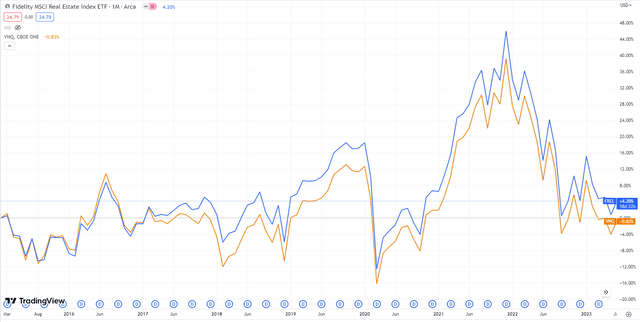

Now, to wrap this comparison up, the third image below shows the performance of both funds since February 2015, FREL's inception date. Since then, both had the same ups and downs and generated just about the same returns. FREL even managed to perform a tiny bit better, but I will just ignore it, considering the timespan assessed. I understand that the funds' descriptions are not the same, actually, they implement different methodologies regarding capping the weight of each holding and FREL even includes some non-REITS inside it, yet, overall, they both have the same goal and deliver it wonderfully, which is proved by their almost-equal returns.

Then again, why pay more for the same product? If you are still in doubt, just pick FREL.

FREL x VNQ performance since FREL's inception. (TradingView)

FREL and Real Estate: assessing price, CPI, and potential appreciation

According to the etf.com platform, FREL has assets under management totaling $1.05 billion, is trading at $24.79, and has a price-to-earnings (P/E) ratio of 31.36 (TTM). Looking at the indicator alone, it's easy to spot that it's not exactly a bargain right now, but as we saw before, it's not the price that is distorting the multiple, but the poor results delivered in the past. This is a systematic drought for the market, as all other similar real estate ETFs, such as VNQ, XLRE, IYR, and NETL, are also trading with a P/E of around 30.

But that doesn't mean holding FREL or other real estate at the moment is a bad idea, after all, FREL has the same price as 8 years ago, and the cumulative CPI for this same period is around 30%, which means it's just a matter of time for the share price to be adjusted and possibly appreciated further. Unless you believe that the US will dive into a housing crash similar to Japan's in the 90s.

Of course, the overall house prices have been quite high recently, but sales started to cool down now, in my view, mostly due to the multiple increases in the interest rates that never seem to end. This scenario also raises recessionary ideas from market analysts, but, if you invest for the long term like I do, you've probably noticed as well that there is no better time to hold/purchase an ETF like FREL at the moment.

In my opinion, some form of real estate should be present in every long-term investor's portfolio. Land is one of the few things that have been time-tested and that always deliver great results if you are patient enough to hold them for a few years. Again, Japan is a perfect example that we should never put all our eggs in the same basket, and that also goes for the US, so it's wise to diversify your real estate geographically too.

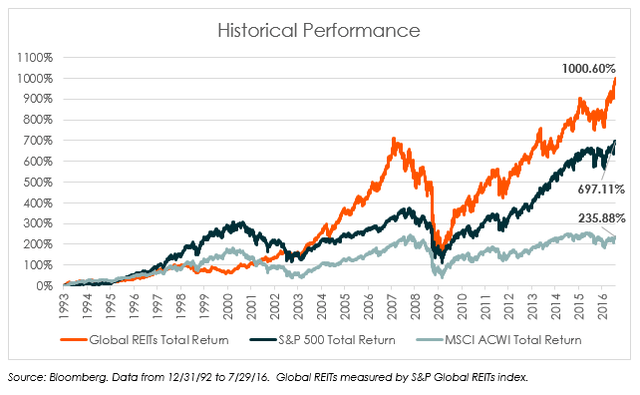

Comparison of Global REITS and S&P 500 performances over the years. (Bloomberg)

Friendly tip: If you are interested in diversifying your lands across the globe, I'd recommend taking a look at ETFs like the Xtrackers International Real Estate ETF (HAUZ) and the Vanguard Global ex-U.S. Real Estate ETF (VNQI). Both have low management fees and are also trading at historically low prices right now - even lower than FREL's - so it might be a good time to do some international shopping.

Despite its high multiples, FREL is actually paying you well to wait

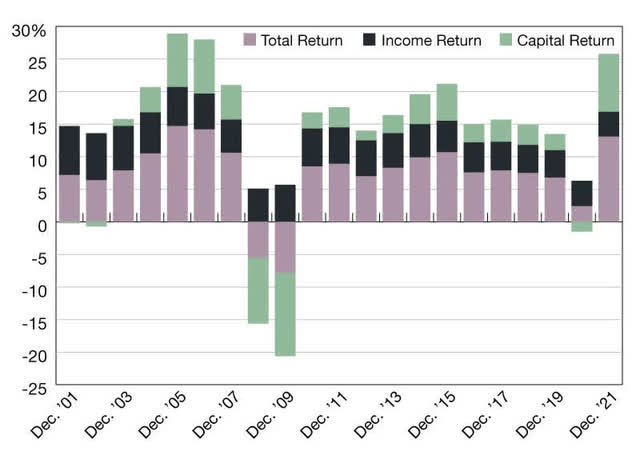

Many investors decide to have a slice of real estate in their portfolio not only because they are a great asset type, but also because of the generous dividends they normally pay. Just in case you don't know, by law, REITs are required to distribute a significant portion of their taxable income to shareholders in the form of dividends, and this seems to be the case in most countries, after all, recurring cash flows are the trademark of the real estate business. In the image below, you can get an idea of the impact the dividends can make on one's portfolio. Sometimes the income is all you'll get in a specific year, showing how great it is to have a recurring distribution.

MSCI Global Annual Property Index (MSCI)

FREL currently has a distribution yield of 4.01%, which in my opinion is superb, considering its high multiples of 31.36 for P/E and 2.30 for Price/Book Value. This means that you'll have a satisfactory reward even if you patiently wait for the share appreciation, not to mention that, since you are mostly invested in tangible assets like property, your dividends tend to be adjusted by inflation, preserving your purchasing power.

If you are into this fund for the medium/long run and expect at least the CPI upside correction of 30%, buying FREL now and DCA-ing it will also give you the benefit of having a lower average cost per share. So, holding the fund now will have a very positive effect on your yield on cost, after all, you believe the companies inside the ETF will increase their revenue within the following years.

The market might still trend down for a while before it bounces back

The real estate market has been showing signs of slowing down, but I believe the likelihood of a crash is very low. It's worth noting that lending standards in the current market are significantly stricter compared to those during the housing bubble of 2008. Regulatory measures and lessons learned from the previous crisis have led to more prudent lending practices, reducing the risk of widespread defaults. While certain regions or sectors may experience adjustments in the following months due to the imminent market cold down, I sense that the overall conditions are indicating a more stable trajectory.

As I mentioned earlier, the rising interest rates are indeed affecting the real estate market, but I expect it won't take more than three Fed meetings for them to start dropping again. This anticipated shift could bring relief to borrowers and potentially stimulate demand in the sector.

Inflation, although decreased from a recent peak, still remains relatively high at and is far from the Federal Reserve's target of 2%. This scenario will still generate ongoing challenges in achieving price stability and will demand extra caution from investors in various asset classes, especially real estate.

Considering all the above, I'd recommend investing in FREL with a medium to long-term perspective. The current downtrend might persist for a while as the market adjusts and stabilizes. Therefore, buying FREL with the intention of holding it and implementing a dollar-cost averaging strategy is probably the best bet.

Conclusion

Considering FREL's historically lagging price, potential for share appreciation, attractive dividend distribution, and diversification benefits, it emerges as a compelling and diversified investment opportunity in the real estate sector. While the short-term market trend may be uncertain, as interest rates are high and the housing market seems to be slowing down a bit, investors with a medium to long-term perspective can benefit from holding and DCA-ing FREL shares at what seems to be an interesting price.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FREL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.