Guanajuato Silver: An Ultra High-Growth Mexican Silver Producer

Summary

- Guanajuato Silver is one of the sector's top producers from a growth standpoint, growing through acquisition with two acquisitions at highly attractive prices.

- The company is currently working to optimize its assets in a year of investment and plans to grow production by over 100% year-over-year in 2023, albeit at relatively low margins.

- While GSVRF is a solid growth story, further share dilution looks highly likely, and with this being a solely Tier-2 producer with high-cost mines, I see more attractive bets elsewhere.

DarioGaona

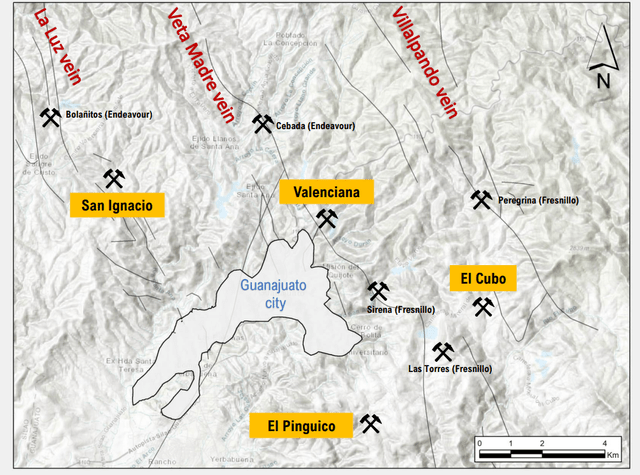

Guanajuato Silver (OTCQX:GSVRF) is one of the smaller market cap producers in the Silver Miners Index (SIL) that has had a busy couple of years growing through acquisition. This began with its acquisition of the El Cubo Mine and Mill Complex located just 8 kilometers from its El Pinguico Project in Guanajuato, and the company announced another major acquisition last year, acquiring Great Panther's (OTCPK:GPLDF) Mexican mining assets after the Brazil-focused miner fell on hard times after several tough quarters at Tucano. The acquisition of the Guanajuato Mine Complex ["GMC"] added three mines and two production facilities to give the company three producing mines and two production facilities in the same state (Guanajuato), plus the Topia Mine and Plant in Durango, giving Guanajuato Silver a similar profile to Calibre Mining (OTCQX:CXBMF) with four mines and two processing facilities in Nicaragua.

El Cubo Mill (Company Website)

These transformative acquisitions allowed Guanajuato Silver to more than quadruple its tonnes mined to ~410,300 in FY2022 (FY2021: ~89,000 tonnes) and increase silver-equivalent ounce [SEO] production by 970% from ~199,500 ounces to ~2.13 million ounces. However, this growth profile is nowhere near done yet, with FY2023 production expected to double yet again if the company can meet guidance of 4.6 to 4.8 million SEOs. Just as importantly, the company paid the right price for these deals, adding four mines and three processing facilities for barely $30 million. That said, this is a year of investment and while the company has scaled up to a more respectable production level, its cost profile is quite high, translating to razor-thin all-in sustaining cost [AISC] margins. Let's look at the company a little closer below:

All figures are in United States Dollars unless otherwise noted at an exchange rate of 0.75 CAD/USD.

Q1 Production & Sales

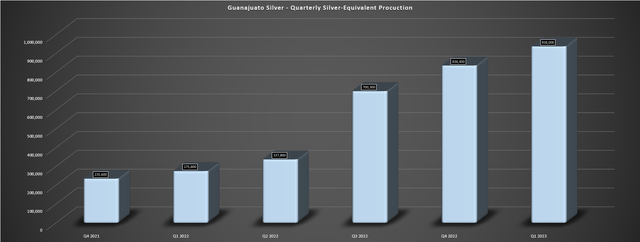

Guanajuato Silver reported mine production of ~162,100 tonnes from three separate mining assets in Q1, which included its El Cubo Mine & Mill ["CMC"], the Valenciana Mines Complex ["VMC"] made up of San Ignacio, Valencia, and the Cata Mill Facility, and its Topia Mine & Mill ["Topia"], with most of these assets near each other and directly outside Guanajuato City. This translated to production of ~458,800 ounces of silver, ~4,400 ounces of gold, ~906,700 pounds of lead, and ~1.15 million pounds of zinc or a record ~938,000 silver-equivalent ounces [SEOs]. The largest two contributors in the period were CMC and Topia, which produced ~315,600 and ~324,700 SEOs, respectively. Meanwhile, its Valenciana Mines Complex or VMC produced ~297,800 SEOs. The record production and significant growth over the year ago period (Q1 2022: ~275,800 SEOs) was related to having four mines in production vs. just one, with the Great Panther acquisition completed in H2 2022.

Guanajuato Silver Operations (excluding Topia) (Company Website)

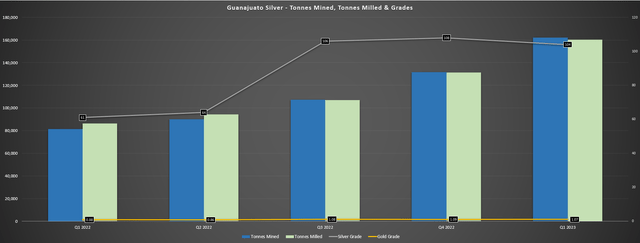

As the chart below shows, SEO production soared by ~240% over the year-ago period, with a significant increase in tonnes mined and milled given that the company added considerable processing capacity at Topia and VMC with its acquisition of Great Panther's Mexican mining assets. In addition, its average silver grade increased materially on a year-over-year basis, with the Valenciana Mines Complex and Topia having much higher silver grades than El Cubo (the only asset in production during Q1 2022). At El Cubo or CMC specifically, throughput and recoveries drove the higher production, with increased recoveries partially related to the installation of a Falcon concentrator. The result was that total production increased 14% year-over-year to ~315,600 SEOs, while all-in sustaining costs improved to $21.77/oz despite increased sustaining capital, but production costs per tonne increased moderately to $66.06/tonne.

Guanajuato Silver - Quarterly Production (Company Filings, Author's Chart)

Guanajuato Silver - Tonnes Mined, Tonnes Milled & Grades (Company Filings, Author's Chart)

Moving over to VMC, ~52,600 tonnes were milled at a grade of 104 grams per tonne of silver and 1.36 grams per tonne of gold and ~82% recoveries, translating to production of ~297,800 SEOs at all-in sustaining costs of $16.01/oz. However, production is expected to increase from an annualized run rate of ~210,000 tonnes to 400,000+ tonnes with the asset not yet operating at anywhere near its full processing capacity and it expects to realize reduced hauling costs from its newly rehabilitated Cata Shaft. In addition, the company has ordered a second Falcon concentrator that will be incorporated into the Cata Mill circuit to boost recoveries, with the combination of reduced hauling costs, economies of scale and higher recoveries set to positively impact unit costs at what's currently the company's lowest-cost asset.

Guanajuato Silver Operations (Company Website)

Finally, at the company's high-grade, albeit narrow-vein polymetallic Topia Mine in Durango, mine production was ~19,000 tonnes with ~19,500 tonnes processed at an average grade of 314 grams per tonne of silver, 1.18 grams per tonne of gold, 2.42% lead and 3.21% zinc. However, while grades are much higher at this asset, production costs per tonne are considerably higher at ~$294.00/tonne. The good news is that, similar to upgrades planned on other assets, the company will look at modernizing and expanding plant capacity over the next 18 months, with plans to increase plant capacity from ~90,000 tonnes per annum to 140,000+ tonnes per annum. The first upgrade will increase processing capacity to ~100,000 tonnes per annum, and according to the company, a larger upgrade would include:

- upgrading existing floatation cells

- adding two new floatation cells

- constructing a new reagent area

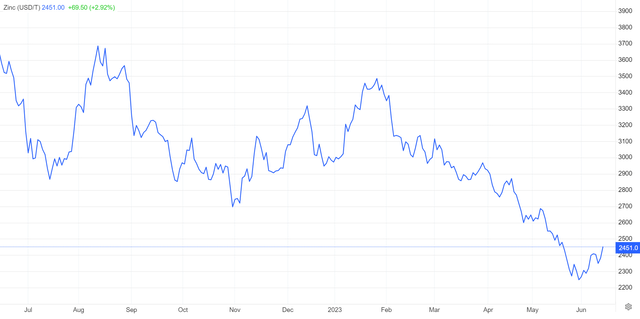

Zinc Price Per Tonne (TradingEconomics.com)

Based on Q1 production levels, the asset was operating ~13% below its annualized processing capacity of ~91,000 tonnes per annum, suggesting the potential to improve costs at this asset as well, assuming similar grades continue to be fed to the plant. That said, one negative at this asset (at least temporarily) is the significant dive we've seen in base metals prices, with zinc plunging 16% year-to-date to $1.10/lb, while lead prices have slid to $0.94/lb. And while Topia generates most of its revenue from silver and gold (~$4.9 million in Q1), zinc and lead combined for ~$2.7 million in revenue in the quarter or 35% of revenue. So, with already high production costs per tonne and AISC ($19.96/oz), the ~15% decline in zinc prices and 2% decline in lead prices relative to Q1 is not ideal and could affect profitability at this asset.

Guanajuato Silver - Quarterly Revenue, Production Costs & Transportation/Selling Costs, Operating Cash Flow (Before Taxes) & Net Loss (Company Filings, Author's Chart)

To summarize, Q1 was a solid quarter for production and investors are finally getting a better idea of what the future of the company looks like as production progressively ramps up. That said, while revenue was up sharply to $17.1 million (+168% year-over-year), production costs increased 182% year-over-year and transportation and selling costs increased materially as well with the addition of Topia. So, despite the increased production, the mine operating loss increased materially to $3.15 million, and when combined with higher G&A expenses and higher interest costs, the company's net loss soared to $8.7 million (Q1 2022: $4.9 million), and it ended the period with [-] $11.0 million in working capital. Let's look at costs and margins closer below:

Costs & Margins

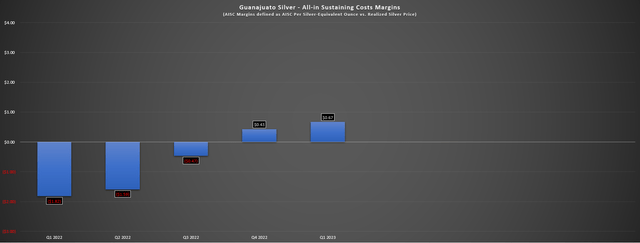

As shown in the below chart, all-in sustaining costs may have improved on a year-over-year basis (Q1 2022: $25.79/oz), but they came in at some of the highest levels sector-wide in Q1, with silver-equivalent AISC of $21.83/oz. The result was that the company reported AISC margins of just $0.67/oz in the period, and all-in costs when include share-based compensation and interest expense came in closer to $22.60/oz, resulting in negative all-in cost margins vs. the Q1 reported realized silver price of $22.50/oz. The good news is that the silver price has strengthened a little since Q1 and should average at least $23.20/oz in Q2, translating to at least a 3% improvement sequentially vs. Q1 2023 levels.

US Dollar vs. Mexican Peso (TC2000.com)

Unfortunately, we have seen some offsets, with Mexican producers continuing to cite higher costs because of inflationary pressures in their Q1 Conference Calls, and a material impact from the Mexican Peso which continues to climb vs. the US Dollar, which has especially affected miners with 100% Mexican operations. In addition, zinc prices have fallen off a cliff, affecting producers with polymetallic mines like Guanajuato Silver at Topia. Finally, producers sector-wide continue to call out labor as a challenge from an inflationary standpoint, with this being one of the stickier items that hasn't rolled over like oil and steel prices have since last year. So, while Guanajuato will benefit from optimization work underway and throughput expansions, costs will certainly remain elevated this year because of the strengthening Peso and weaker zinc/lead prices, and if the Peso can't cool off and wage pressure continues in Mexico, this could offset some of the planned benefits of its optimization/expansion work at its mines.

Valuation

Based on ~445 million fully diluted shares and a share price of US$0.30, Guanajuato Silver trades at a market cap of ~$134 million, leaving the company trading at barely 1.3x FY2023 revenue assuming it's able to meet its guidance target of 4.6 to 4.8 million SEOs. This is a deep discount to the revenue multiple for other high-cost producers like Endeavour Silver (EXK), but there are two key differences between the two companies. For starters, while Endeavour Silver has a similar cost profile, it has a transformational high-margin asset that's already in construction that will dramatically improve its cost profile overnight once it heads into commercial production. Second, the company has a strong balance sheet with ~$60 million in net cash and all of its share dilution appears to be in the rear-view mirror, with ~$180 million in total liquidity to fund Terronera construction with its new debt facility.

Guanajuato Silver - Fully Diluted Shares, Realized Metals Prices & Working Capital (Company Filings)

Unfortunately, in Guanajuato Silver's case, the company does not have a proverbial ace in the hole with Terronera that can dramatically improve its cost profile. And while this is a year of investment for the year company which should help to maintain costs below $20.50/oz, this is a much different cost profile than Endeavour Silver which trades at a premium given that its newest asset should pull its consolidated costs below $11.00/oz in FY2025. The other major difference is that continued share dilution looks likely for Guanajuato Silver, given its negative working capital position, current loans, and contingent payments during a period where it's not generating any meaningful free cash flow. Hence, the share count is a moving target and hard to rely on when we could see material additional share dilution over the next 12-18 months.

Guanajuato Silver - Share Purchase Warrants (Company Filings)

The other negative worth pointing out is that Guanajuato Silver continues to raise capital with warrants attached, with ~95.0 million warrants with a weighted average exercise price of C$0.50 [US$0.375], which could continue to be an overhang on the stock during any sharp rallies. So, while the next twelve months may bring further improvements from a business standpoint as costs stabilize at lower levels closer to $20.00/oz, there is a significant portion of warrants outstanding and what are likely to be motivated sellers that could cap the price of the stock, especially with some warrants priced as low as C$0.33 [US$0.25] and C$0.45 [US$0.34]. In summary, with a high probability of further share dilution, potential warrant overhang, and razor-thin margins, some of this discount relative to its peers looks justified.

Mexico - Investment Attractiveness (Annual Survey of Mining Companies - Fraser Institute)

Finally, while the company has done a solid job of acquiring assets at rock-bottom prices in a highly productive mining jurisdiction in Guanajuato State, Mexico's investment attractiveness rating continues to decline, which isn't ideal from a valuation standpoint as perceptions around this jurisdiction have worsened. And while Guanajuato Silver is in a better position than developers given that it has permitted asset, it's possible that some investors may look to apply higher discount rates to Mexican producers or avoid them entirely, especially with two Mexican producers having issues related to workers not agreeing with distributions as part of their profit sharing entitlement at San Jose and Penasquito.

Guanajuato Silver - All-in Sustaining Cost Margins (Company Filings, Author's Chart)

Obviously, there's no guarantee that the demands for increased profit sharing in Oaxaca and Zacatecas that led to work stoppages affects Guanajuato Silver. Still, labor inflation has been sticky, as discussed by Endeavour Silver in its Q1 results, and the strength in the Mexican Peso vs. the US Dollar (UUP) isn't helping either. I would argue that these two stoppages related to demands of higher profit sharing, doesn't help perceptions regarding investing in Mexican producers when combined with recent mining law reforms. Plus, outside of just perceptions, it's probably safer to model sticky labor inflation in Mexico, which may not be an issue for high-margin producers like SilverCrest Metals (SILV) that enjoy ~50% AISC margins, but it could be an issue for a company with sub 10% AISC margins like Guanajuato Silver.

Summary

Guanajuato Silver has solidified itself as Mexico's fastest growing silver producer, and one way to outperform peers in this sector is growth, assuming this translates to growing cash flow, production, and net asset value per share. However, while Guanajuato Silver may be successfully paving a path towards 6.0+ million SEOs per annum, it's also grown its share count at a rapid pace related to dilutive equity raises and acquisitions that may have been transformative and done at the right price but were quite costly from a dilution standpoint and brought with them high-cost debt. If the silver price can trade between $25.00/oz to $30.00/oz which would improve the margin profile here, this would certainly help the story, as should continued investments in its assets to drive costs down. However, in a more conservative $20.00/oz to $24.00/oz range for silver, I wouldn't expect any meaningful free cash flow generation and margins will remain quite slim.

Given that I prefer to avoid companies with over 50% of net asset value tied to Tier-2 jurisdictions, those with a high probability of further share dilution and low-margin miners, GSVRF doesn't meet my investment criteria. And while this story could pay off in a rising silver price environment, I see it as a high-risk, high-reward bet, and I much prefer low-risk, high-reward bets which stack the odds in one's favor, especially in a market where several opportunities are available. In the mining sector, one unique opportunity is Pan American Silver (PAAS), trading at 11x EV/FCF and less than 0.75x P/NAV. Outside of the sector, Capri Holdings (CPRI) trades at just ~5.8x FY2024 earnings, a dirt-cheap valuation for a company with ~65% gross margins. To summarize, I see much better bets elsewhere for the time being.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PAAS, CPRI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.