Unwrapping The Hershey's Stock: A Dividend Gem For Investors

Summary

- Hershey stock offers a compelling investment opportunity with strong dividends, market leadership, and solid performance for long-term growth.

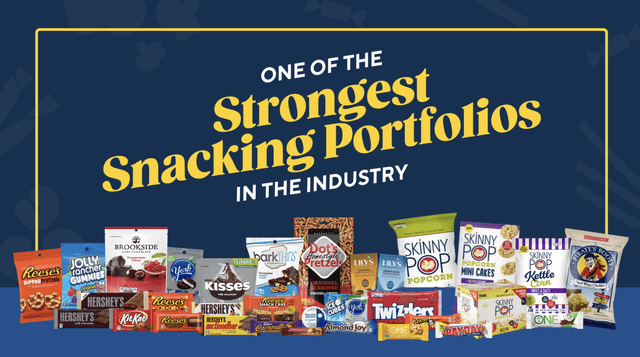

- With popular brands like Hershey's, Reese's, and Kisses, Hershey is a major player in the global confectionery market, providing a competitive edge.

- Despite potential challenges, Hershey's resilient business model and focus on innovation position it favorably for continued growth and strong returns.

arlutz73

Introduction

The only consumer staple stock in my portfolio is PepsiCo (PEP). While I am looking to buy high-quality companies like Procter & Gamble (PG), as discussed in this article, I'm extremely careful when it comes to defensive consumer stocks. While they come with different risks than cyclical consumer stocks, most tend to be very mature, making it hard to generate satisfying long-term total returns for investors. Also, as I'm not yet looking to prioritize yield over capital gains, I'm a picky investor in this sector.

With that said, one company I have never discussed before on this website is The Hershey Company (NYSE:HSY), a fantastic dividend growth stock that reminds me a lot of PepsiCo. This snack business doesn't come with a high yield. However, it has a highly successful product portfolio, pricing power, high free cash flow, and management dedicated to letting shareholders benefit from its success.

In this article, I will walk you through my thoughts as I explain the pros and cons of buying what I consider to be one of the best consumer staple stocks on the market.

So, let's get to it!

What's Hershey?

While Hershey does own brands like KitKat, it's a company that enjoys more popularity in the United States than in regions like Europe, where other brands have a larger footprint.

However, it doesn't make HSY a niche player - far from it, actually. With a market cap of $53 billion, Hershey is one of the biggest players in the consumer staples sector. Headquartered in Hershey, Pennsylvania, the company has become a global confectionery leader known for its chocolate, sweets, mints, and snacks. They are the largest producer of quality chocolate in North America and have a strong presence in the United States and international markets.

In this case, the Hershey Company isn't named after the town. The town is named after the company, as it was essentially a town built to accommodate the company's many employees.

The company operates through three segments:

- North America Confectionery (82% of 2022 sales),

- North America Salty Snacks (10%), and

- International (8%).

This breakdown supports my earlier comment that the company isn't that big on the other side of the Atlantic and Pacific oceans.

With that said, Hershey offers a wide range of chocolate and non-chocolate confectionery products under popular brands such as Hershey's, Reese's, and Kisses. They also have snack items like popcorn, pretzels, and spreads.

Their international segment includes regional brands like Pelon Pelo Rico in Mexico, IO-IO snacks in Brazil, and Sofit beverages in India.

The company's main customers are wholesale distributors, grocery stores, mass merchandisers, convenience stores, and other parties that sell to the public.

Major raw materials are cocoa, sugar, corn, dairy, wheat, peanuts, almonds, and related products.

This means that the company is prone to input inflation. For example, this is what the price of ICE Cocoa futures looks like:

While inflation is a risk, the company's competitive advantage lies in product innovation, quality, price, brand recognition, marketing effectiveness, and the ability to meet consumer preferences. They are expanding their brands to capture new snacking occasions and face competition from other snack items.

It's similar to PepsiCo. The company owns well-known brands that people have started to like because of their taste, appeal, and whatnot. Given that we're not dealing with big-ticket items like cars or houses, the company can use pricing to offset inflation, as most customers are unlikely to immediately switch to generic alternatives.

Hershey isn't immune to competition (far from it), but it does have a relatively high moat - at least relatively speaking.

What Makes HSY So Special?

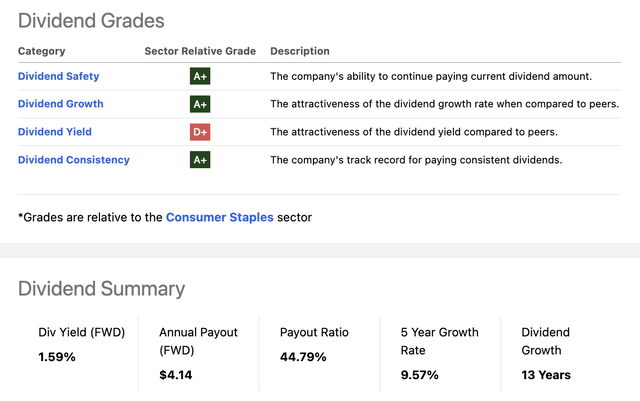

Let's start with the part that may upset a few people. The company only yields 1.6%. That is well below the sector median of 2.5%. As a lot of people buy consumer staples for safety and income, it may be a less suitable play for income-oriented investors.

That said, and looking at its dividend scorecard below, the company scores extremely high in every other category.

- The low 1.6% dividend yield comes with high dividend safety. The cash dividend payout ratio is 43%, which is below the sector median of 60%.

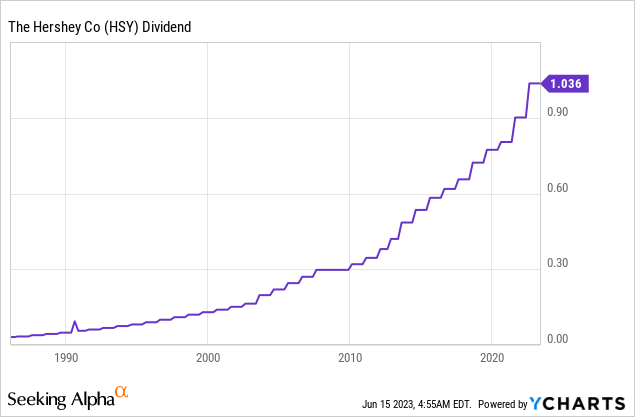

- On average, the dividend has been hiked by 10.3% per year over the past three years. The five-year average is 9.6%. The ten-year average is 9.7%. The sector median for all three-time intervals is in the 5% range.

- The company has a 1.4x 2023E net leverage ratio and an A credit rating. This means there is no need to prioritize debtholders over shareholders.

Furthermore, the company is not a dividend aristocrat. However, it would be a dividend aristocrat if it weren't for a missed hike in 2009, when the company decided to play it safe, given economic risks. As someone who doesn't care much for labels, I think that was a smart move.

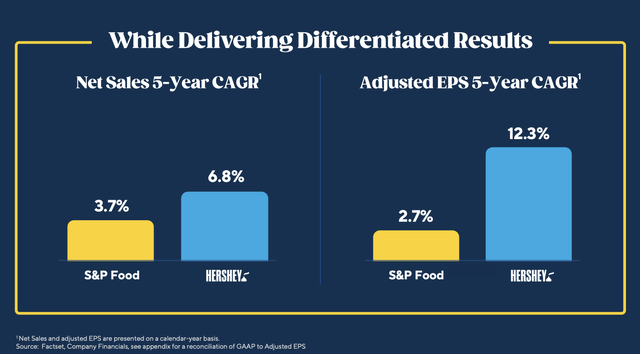

In this case, dividend growth is supported by strong sales and earnings growth. Over the past five years, sales have risen by 6.8% per year. Higher margins have pushed earnings per share up by 12.3% per year during this period.

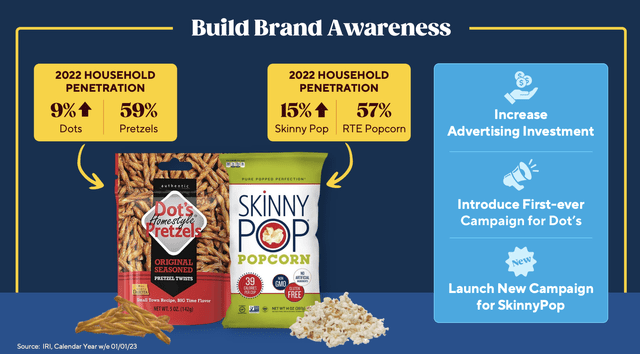

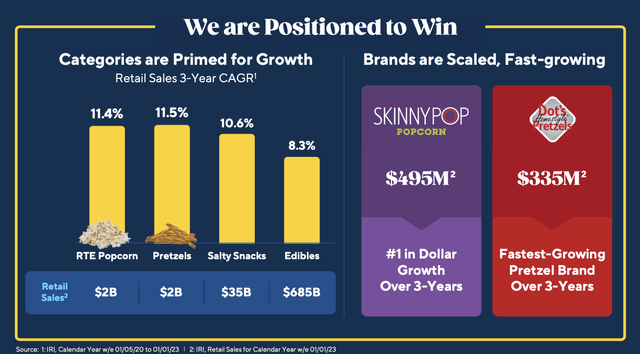

Looking at the numbers below, we see that select categories like popcorn, pretzels, salty snacks, and edibles saw outperforming retail sales growth over the past three years. Dot's Pretzels was the fastest-growing pretzel brand during that period.

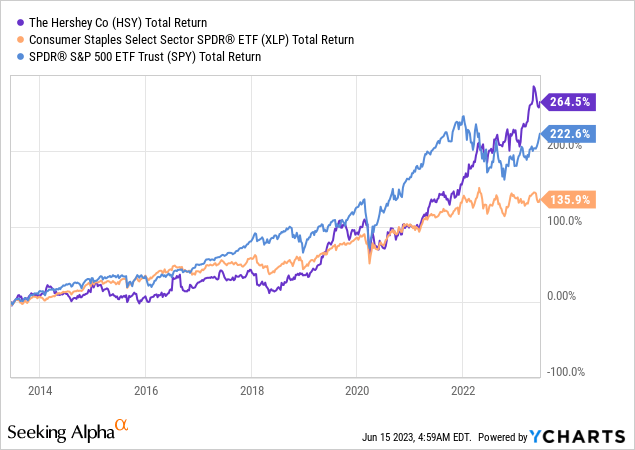

Also, the company's dividend decisions and long-term growth were rewarded by investors. The mix of a wide moat, solid dividend growth, and a product portfolio that protects investors against recessions have caused the stock to outperform both the market and its peers.

Over the past ten years, HSY shares have returned 264%, beating the S&P 500 by more than 40 points. Note that the S&P 500 benefited from tremendous tech exposure during these years, which makes this outperformance even more impressive. Furthermore, the stock left its consumer staple peers (XLP) in the dust, as the stock outperformed by roughly 130 points.

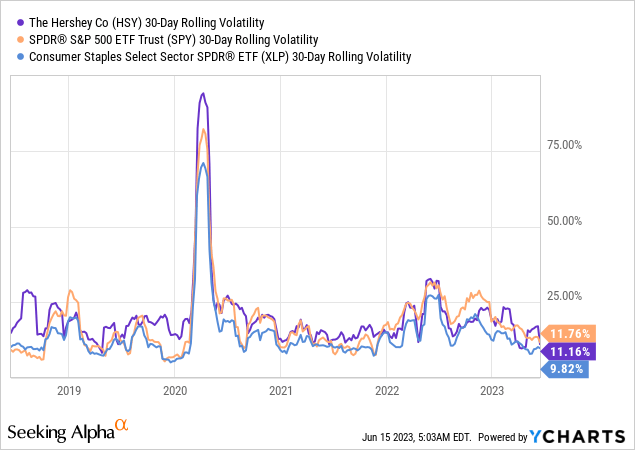

Furthermore, the company has subdued volatility. The company is often less volatile than the S&P 500, which is absolutely fantastic for investors looking for conservative dividend growth and subdued risks. So far, the mix of potential returns and low volatility of HSY shares impresses me. It's one of the best results I've seen in a very long time, and I'm not exaggerating.

So far, so good.

But what about the valuation? And how is Hershey doing in this environment of sticky inflation and poor consumer sentiment?

Recent Events & Valuation

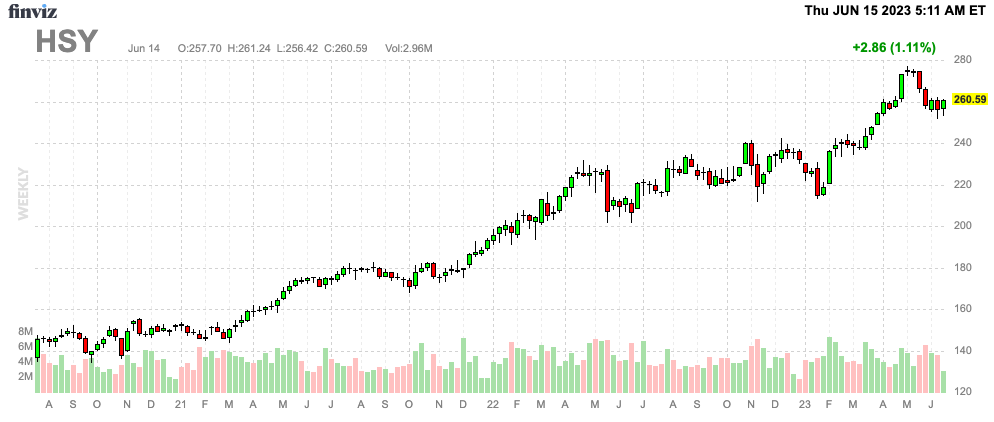

Taking a look at the HSY stock price, we see that the stock is trading just 6% below its 52-week high. In other words, without doing any research, we can assume that the company must be doing well in this environment.

FINVIZ

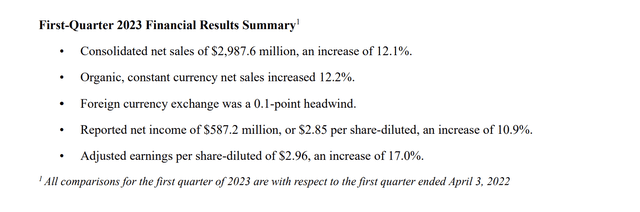

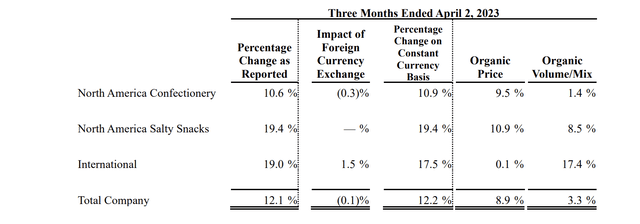

In the first quarter, net sales grew by 12.1%, attributed to both price and volume gains across segments. The North America Confectionery segment experienced modest volume growth and double-digit net sales gains, driven by price elasticities and strong seasonal sales for Valentine's Day and Easter.

Gum and mint products also saw a rebound in demand, resulting in retail sales growth and market share gains. Expanding presence in non-chocolate candy, particularly in the gummy segment, is emphasized as a strategic priority, with notable retail sales growth for Twizzlers and Jolly Rancher brands.

Overall, the sales breakdown (as seen below) is one of the best I've seen in the industry. Not only was the company able to hike prices by 8.9%, but it also saw 3.3% higher organic growth in volume/mix.

Hershey is considering pricing strategies and monitoring the commodity space, particularly cocoa, and sugar. While the impact on other categories and competitors remains uncertain, the company aims to position itself favorably by keeping an eye on pricing dynamics.

Furthermore, the company anticipates improved market share performance throughout the year and aims to strengthen its position in the market, enhance its supply chain capabilities, and secure the capacity to sustain growth.

The company also announced its intent to acquire two manufacturing plants from Weaver Popcorn Manufacturing to enhance its salty snacks supply chain network.

During the 1Q23 earnings call Q&A, the company commented on changing consumer behavior. According to the company, consumer behavior continues to evolve, with consumers adjusting their spending in response to inflation.

Food at home has performed well compared to other categories, and snacks and candy have shown stronger performance within the food sector.

Elasticities in these categories have remained strong, and the company expects them to strengthen further. Consumers are seeking affordability, considering where they shop, and exploring private-label options. Hershey is monitoring these trends to optimize media and in-store activations accordingly.

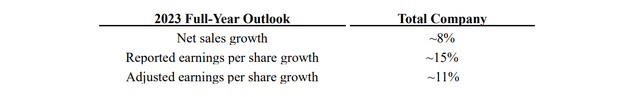

Based on this context, the company also raised its guidance to the high end of the previous range for the full year.

The company expects a slight improvement in elasticities and increased media investment in the coming period, which gives them confidence in the raised guidance. However, the second quarter is expected to be challenging due to the timing shift of shipments from Q2 to Q1, as well as tougher year-over-year comparisons in organic sales and EPS growth.

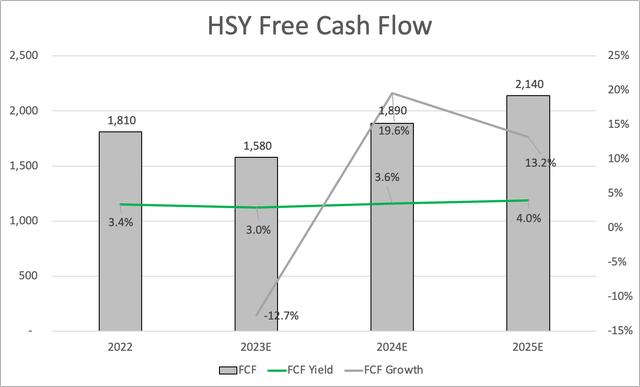

Longer-term (analyst) estimates show strong free cash flow growth after 2023. The only reason why 2023 free cash flow is expected to decline is higher CapEx to boost future growth. While the company does not comment on specific long-term targets, it believes it is in a good spot to maintain long-term growth, thanks to its products, investments in consumer awareness, pricing, and more.

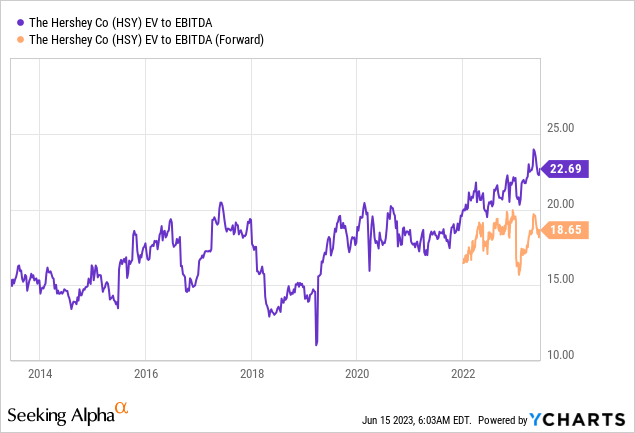

The company currently trades at 18.7x NTM EBITDA, which is a fair valuation.

The consensus price target of $276 confirms this, as it's 6% above the current price.

I agree with that.

Given the recent stock price decline, I'm giving the stock a bullish rating. However, I do not believe the stock will start a significant rally anytime soon. Inflation remains sticky and consumer-related challenges remain an issue - especially if I'm right and we face a second wave of inflation in the next 1-2 years.

Hence, if I were in the market for more defensive consumer exposure, I would start buying here. However, I would start buying gradually.

On a long-term basis, I expect HSY to outperform its peers and the market.

Takeaway

The Hershey Company is as a compelling investment opportunity within the consumer staple sector. While it may not offer a high dividend yield, the company's strong dividend safety, consistent dividend growth, and impressive financial metrics make it an attractive choice for long-term investors.

With a market cap of $53 billion, Hershey is a major player in the global confectionery market, known for its popular brands such as Hershey's, Reese's, and Kisses. The company's focus on product innovation, quality, pricing power, and brand recognition provides a competitive edge and allows for effective management of inflationary pressures.

Moreover, Hershey's stock has demonstrated solid performance, outperforming both the market and its consumer staple peers.

Despite potential challenges related to inflation and consumer sentiment, Hershey's resilient business model positions it favorably for continued growth.

While cautious due to ongoing market conditions, I believe that Hershey has the potential to deliver strong long-term returns for investors seeking defensive consumer exposure.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.