Dollar General, Target, And Walmart Have A Worry Costco Doesn't Have

Summary

- Many retailers are affected by shrinkage.

- Some have reported losses in the hundreds of millions, with a meaningful impact on profits.

- Costco, on the other hand, doesn't seem to have this issue because of how its warehouses are designed.

Thomas De Wever/iStock Editorial via Getty Images

Introduction

"An increasingly challenging shrink environment". This is the alarm resounding once again during Dollar General's (DG) last earnings call.

Now, what lies behind the concept of "shrinkage"? Technically speaking, it is the accounting term to define the loss of inventory. But what really matters is its cause. It may be due to an administrative or a cashier error or due to accidental damage. Or behind shrinkage there may be more concerning factors such as theft (be it employee or customer theft), shoplifting and frauds.

Since last year, it has been all over the news how the reality leading to shrinkage is unfortunately linked to the second group of causes.

Now, even though this problem needs to be solved, as an investor I am getting used to see if any particular challenge coming from the environment surround a business offers the chance to understand more thoroughly if there is a company more capable than the others to protect itself from an upcoming danger.

In this case, what I find interesting is that not every retailer is affected by it. Actually, there is one that seems immune from theft. I am talking about Costco (NASDAQ:COST).

Summary of previous coverage

This is not the first time I deal with the issue. Six months ago, I published an article Shoplifting: Issue For Target, But Not For Costco.

At that time, I was monitoring Target (TGT) versus the industry because it was in the midst of dealing with an issue that seems the opposite of shrinkage: overstocking. This issue had force Target to clear its inventory through promotions leading to margin compression, which is not ideal when inflation is already denting in a company's profitability. To my surprise, as Target seemed to be dealing with overstocking, another issue for margins was announced in the Q3 2022 earnings call. Michael Fiddelke, Target's executive VP and CFO said at that time:

A second factor that's impacting our gross margin is inventory shortage, or shrink, which is a growing problem facing all retailers. At Target year-to-date, incremental shortage has already reduced our gross margin by more than $400 million versus last year, and we expect it will reduce our gross margin by more than $600 million for the full year.

"Out of the frying pan into the fire". This is what I thought right away. At the same time, I saw Costco wasn't mentioning shrinkage as an issue at all. Therefore I started digging deeper and I found three elements why it is so.

Shrinkage across retailers

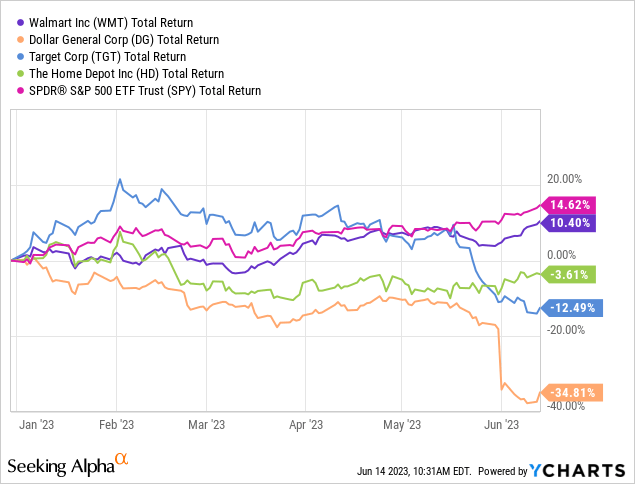

While I read the transcripts of many recent earnings calls, I couldn't help but notice shrinkage is being mentioned more and more. I think this is part of the reason why the retail sector as a whole has underperformed the S&P 500 (SPY) YTD.

Let's read now some words from different earnings calls to understand how this problem is affecting some big retailers, having an impact on profits.

Recently, Richard McPhail, CFO of The Home Depot (HD), reported how:

In the first quarter, our gross margin was 33.7% a decrease of 8 basis points from the first quarter last year, primarily driven by increased pressure from shrink.

We also heard John Furner, CEO of Walmart U.S. (WMT), say something similar during the last earnings call:

On shrink, no, it is a factor -- mix as I said a few moments ago, is affected by supply chain, it's affected by food, consumable, general merchandise mix and then health and wellness. So below that level, there is a core shrink. And as we've said in the past, it's been challenging for us. It's been challenging really.

A challenge. A many retailers don't know really how to deal with it and protect themselves from it.

Brian Cornell, Chairman and CEO at Target, revealed in the last earnings call how:

Beyond macroeconomic challenges, we continue to contend with significant headwinds caused by inventory shrink, building on a worsening trend that emerged last year. While shrink can be driven by multiple factors, theft and organized retail crime are increasingly urgent issues, impacting the team, and our guests and other retailers.

Mr. Cornell was outspoken in identifying the causes - theft and organized retail crime - implicitly stating that these issues are too big for a single retailer to deal with. Of course, it is no retailer's job to fight crime in society. However, as we will see in a moment, there are business models that are more susceptible to theft and others that are not.

But let's get to some numbers. How big is the impact of shrinkage on Target's financials? Mr. Cornell disclosed how:

worsening shrink rates are putting significant pressure on our financial results. More specifically, based on the results we've seen so far this year, we expect that shrink will reduce our profitability by more than $0.5 billion compared with last year.

Half a billion dollars of wiped-away profits. Usually, to account for a loss of inventory, it is necessary to increase the cost of goods sold (COGS) and decrease the inventory by the same amount. In fact, if a retailer loses inventory through shrinkage, it cannot recoup the cost of the inventory itself as there is no inventory to sell or inventory to return. This trickles down to decrease the bottom line.

Therefore, when Target talks about a $0.5 billion loss of profits, it should be talking about a loss on the gross profit line. In fact, gross profit is calculated by subtracting COGS from revenues. Considering Target's gross profit is around $27 billion, shrinkage has a 1.8% negative impact. It may not seem a huge percentage, but if we consider how retailers have a business model focused on high volumes and rather low margins, we can understand why shrinkage hits one of the core pillars of the industry.

In fact, Michael Fiddelke, Target's CFO, had to admit during the earnings call that "shrink reduced our gross margin rate by a full percentage point compared with a year ago".

So, the picture shows some big names of the industry concerned about an issue that is damaging the overall profitability of many companies.

Costco is countertrend

After reading these transcripts, I did the same as six months ago. I went to check and see how Costco is doing. And, once again, I came across a surprise. Costco doesn't seem to feel the issue as much as the industry. Actually, the company reports it has no real change in shrinkage. Richard Galanti, Costco's CFO, explained this himself during the last earnings call:

one other question that we've gotten a couple of times of late because of some of the companies out there reported much higher shrink. Our shrink is intact. We haven't seen any major change in shrinkage. It fluctuated a couple of 3 basis points up really before COVID as we rolled out self-checkout, and since then, it's come back down a little bit. And so it's been a very tight range and so we've been fortunate in that regard.

We are before a company going countertrend. But we have to ask ourselves if the true explanation of Costco being spared by many thieves is just that the company is fortunate. Honestly speaking, if this were the case, sooner or later the tide would change. There must be something else that belongs to Costco and that makes this company well-protected against this issue.

Four Reasons Why Costco Is Insulated From Shrinkage

As I studied Costco's business model and compared it to others, I found four main facts that seem to be noteworthy when considering why shrinkage doesn't happen at Costco.

- First of all, Costco treats its employees extremely well and, as a consequence, it has a very low turnover rate, much better than its peers. This creates a double advantage. Happy employees are less likely to steal. In addition, Costco has an easier time finding the workers it needs. Therefore, its stores are usually well-staffed. Other retailers have a harder time finding the right workers and this creates some areas of their stores that are left either unsupervised. This favors thieves.

- Secondly, Costco's shoppers are all members, whereas other companies such as Target, Walmart and Dollar General don't have a membership for their customer base. This makes Costco's guests to be well-known by the company. In addition, Costco's members keep on renewing their memberships, building a trustworthy relationship with the company and thus accepting a proper behavior code. In fact, if a member is caught stealing, his membership will be canceled for good.

- Costco sells merchandise in large packages. Clearly, these are less likely to be hidden and stolen, in particular considering every cart is checked as it goes out of the warehouse. Other retailers, such as Target stores, for example, are full of small items that can be easily taken by thieves. Items of small size are purchased at Costco in this way: the customer takes a cardboard and trades it for the item when he is paying.

- Costco's warehouses have a store layout (you can check out an example of a store layout here) which is has only one main entry, helping creating a better control over incoming and exiting guests. At the exit, Costco's staff checks the customer's receipt, look looking at the total number of items and at high value items such as jewelry and electronics.

Just to make a quick comparison, Target stores are usually built with two entrances. This is better for thieves. Furthermore, aisles at Target are not that big, helping thieves conceal themselves. In addition, the stores are packed with lots of items, often of small size and thus easy to hide.

The impact on financials

We have gotten used to running a discounted cash flow model to get an idea of how much a company is worth.

However, not always this is the way to understand the intrinsic value of a company. In fact, there are some aspects that can't be directly measured through financial numbers. For example, if Costco were to be assessed through its margins, it would seem a rather poor investment. However, these low margins is what attracts millions of members to the warehouses and makes them renew year after year their membership card. Trust is a hidden asset of Costco that doesn't appear in any financial statement.

In this article, we are finding out Costco has also some other hidden assets that protect it from shrinkage. Costco has a little less than 586 stores in the U.S. If it was hit by theft like Target, it would lose a little more than $180 million of gross profit. Actually, if we consider Costco's warehouse are about twice the size of Target's stores, we could estimate a potential loss of about $360 million of gross profit, which is around a little more than 1.2%. Considering Costco's gross profit margin is 12%, we are before a situation where Costco is able to protect around a tenth of the total gross profit it earns. This is meaningful. In particular, it is even more noteworthy because this protection from shrinkage doesn't come through additional spending in security, but it springs directly out from how the business is conceived from the beginning.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.