REM: High-Yielding MREIT Fund Suitable For Income-Seeking Investors

Summary

- iShares Mortgage Real Estate Capped ETF invests in all major mortgage-based real estate investment trusts, and generates strong yields, averaging in double-digits over a long-term horizon.

- REM is a top-heavy fund (60 percent of assets invested only in 7 stocks) with a relatively high-risk profile. Fund is more volatile than the overall market.

- As interest rates have moved up, there lie strong opportunities for mREITs. The residential real estate sector has also started posting strong recoveries.

- REM is also trading almost at par to its NAV, and its price multiples are much lower than that of its benchmark index. The fund may be due for a correction.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Kativ

~ by Snehasish Chaudhuri, MBA (Finance).

iShares Mortgage Real Estate Capped ETF (BATS:REM) is an exchange-traded fund ("ETF") that invests in stocks of mortgage real estate investment trusts ("mREITs"). This fund has an asset under management of $603 million with an expense ratio of 0.48 percent. Turnover ratio is comparatively low at 28 percent, and that's understandable. It has made significant investments in all the major mortgage REITs, and there is not enough room to significantly recompose its portfolio.

The fund suits the needs of income seeking investors as it generates strong yield, averaging in double digits. As the interest rate has moved up, there lies strong opportunities for the mortgage REITs. The residential real estate sector has also started posting strong recoveries, which will provide further impetus for this mREIT ETF. REM is currently trading almost at par with its net asset value.

REM Offers Quarterly Pay-Outs on a Consistent Basis and Generates Strong Yields

iShares Mortgage Real Estate Capped ETF is managed by BlackRock Fund Advisors. It benchmarks its performance against FTSE Nareit All Mortgage Capped Index [FTFNMRC] and uses representative sampling techniques to create its portfolio. FTFNMRC index measures performance of companies engaged in the business of commercial and residential mortgage real estate, mortgage finance and savings associations. The fund has been in operation for the past 16 years, and has paid consistent quarterly dividends. REM generates strong yields, averaging in double-digits over a longer time horizon. Year-end yield for 2022 was 11.13 percent, whereas average yield generated during 2023 is 11.1 percent. Average yield since 2013 was almost 11 percent.

However, REM’s total return has not been that impressive. Total return during 2023 is 4.85 percent, and over the past 12 months was only 0.06 percent. Good news is, the fund has started registering strong price growth. Over the past month, REM’s price grew by 10.66 percent, and the fund was able to register a total return of 13.38 percent. Valuation of iShares Mortgage Real Estate Capped ETF seems to be cheap, too, despite the fact that the fund is trading almost at a marginal premium to its net asset value. REM's average price to earnings (P/E) ratio is 6.33 and its price to book (P/B) ratio is only 0.82. If we compare to that of its benchmark index, FTFNMRC (P/E of 28.87 and P/B of 2.08), we can be rest assured that the fund is not at all overvalued.

REM’s Portfolio Consists of All Major Mortgage REITs in US Equity Market

iShares Mortgage Real Estate Capped ETF invests almost 85 percent of its assets only in 16 stocks - Annaly Capital Management, Inc. (NLY), AGNC Investment Corp. (AGNC), Starwood Property Trust, Inc. (STWD), Rithm Capital Corp. (RITM), Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI), Arbor Realty Trust, Inc. (ABR), Blackstone Mortgage Trust, Inc. (BXMT), Apollo Commercial Real Estate Finance, Inc. (ARI), Ready Capital Corporation (RC), Two Harbors Investment Corp. (TWO), Chimera Investment Corporation (CIM), Ladder Capital Corp (LADR), Franklin BSP Realty Trust, Inc. (FBRT), MFA Financial, Inc. (MFA), PennyMac Mortgage Investment Trust (PMT) and New York Mortgage Trust, Inc. (NYMT). RITM, ABR, ARI, LADR, FBRT, MFA and NYMT all recorded double-digit price growth during the past twelve months.

Risk Associated with Investments in Mortgage REITs and in Funds like REM

mREITs are believed to be a decent hiding place under a rising interest rate environment, which is again preceded by rising inflation. Mortgages are highly tied to the economic and credit cycles. As the economy is on the path of recovery, I think this may be the right time to own mortgage REITs. However, if we invest in one or two mREITs, we may face an unnecessary risk out of the operative success and earnings of that particular mortgage REIT. Residential mortgage and commercial real estate loans are highly dependent on the credit cycle, and tighter lending standards pose a significant risk for such business.

That's why it's advisable to invest in a fund that consists of most of the renowned U.S.-based mREITs. REM is perhaps the only fund that caters to this specific requirement. However, investing only in 30 mortgage REITs, iShares Mortgage Real Estate Capped ETF lacks diversification. Moreover, almost 60 percent of the fund’s assets are invested only in 7 stocks. The fund by default has a high volatility and has an equity beta near 2.

REM has witnessed significantly higher price volatility over the years. The equity market (represented by S&P 500) witnessed a long-term standard deviation of around 16 percent, while REM's standard deviation has been about 23 percent. Thus, it's imperative that investors understand this ETF's biggest company positions.

Investment Thesis

iShares Mortgage Real Estate Capped ETF invests in all major mortgage based real estate investment trusts, and generates strong yields, averaging in double-digits. REM’s portfolio structure suggests that it is a top-heavy fund with a high-risk profile. The ETF's managers on average flip 28 percent of its portfolio every year. The ETF's long term annualized volatility is about 23 percent, which suggests that the fund is more volatile than the overall market.

As interest rates have moved up, there lie strong opportunities for the mortgage REITs and thus iShares Mortgage Real Estate Capped ETF. The residential real estate sector has also started posting strong recoveries. Although, we don't expect any extraordinary growth in demand for mortgage assets, the market condition is suggestive of a healthy or decent growth. REM is also trading almost at par to its NAV. In my opinion, iShares Mortgage Real Estate Capped ETF is a good option for long-term income-seeking investors who are happy with an inflation-beating returns.

About the TPT service

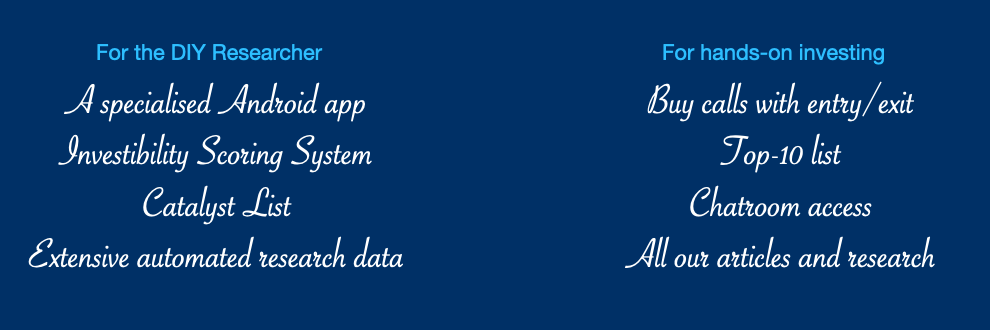

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.