REM: I Don't See The Appeal In This Underperforming Fund

Summary

- REM is an ETF focusing specifically on Mortgage REITs.

- The fund has a long history of underperformance, and there is little reason to expect this to change.

- The fund even underperformed all 8 of its top holdings anywhere from 15% to 95% in the last decade.

phototechno

iShares Mortgage Real Estate Capped ETF (BATS:REM) seems to attract attention of a lot of dividend focused investors seeking high yields. While the fund's 10% dividend yield is impressive, its long term performance isn't both in terms of total return and dividend growth.

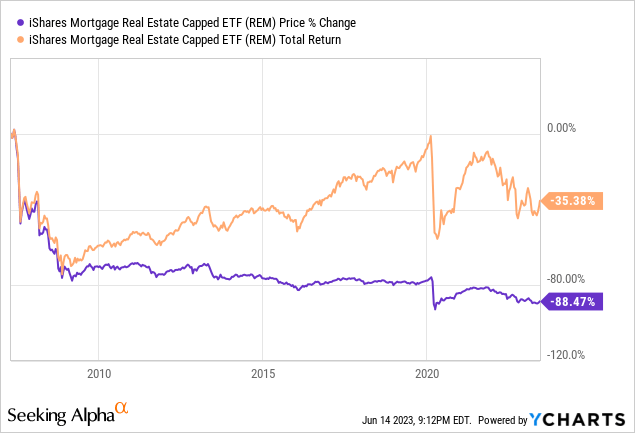

The fund has been around since 2007 and it resulted in share price return of -88%. If you were to reinvest all dividends your total returns would rise to -35% (yes negative 35%) which is far from impressive.

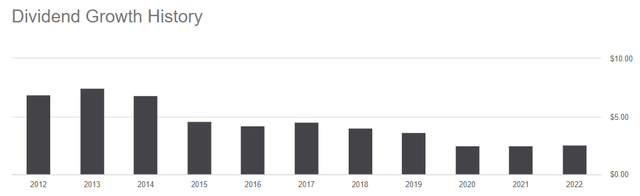

Many times I hear high-yield seeking investors saying that they don't care for share price appreciation because they don't plan on ever selling their shares and that they only care about dividends since they plan on living on dividend income. This is a fair argument if we are talking about stocks and funds that sustain or grow their dividend payments but not when their dividend also continues shrinking along with their share price. This fund's dividends have been shrinking year after year. Ten years ago the fund was paying $7.40 per share in annual dividends, five years ago it was paying $4.00 and now it's paying about $2.50. If you bought this stock 10 years ago in hopes of living off its high yield, your income already shrank by two thirds even before inflation.

What accounts for this massive underperformance? Well the fund holds 36 stocks and top 10 stocks account for almost 70% of its total weight so its performance will be highly skewed towards those 10 stocks. We also know that mortgage REITs tend to be highly volatile and risky because they employ high levels of leverage. That's how they were able to offer 10-12% dividend rates even when mortgage rates were around 3-4% for much of the last decade. This also comes with tremendous amount of risk, especially when the economy's overall performance is less than ideal.

People usually say that most mortgages offered by MREITs are backed by the government (also known as Agency MREITs) and that they are virtually risk-free but this doesn't mean that funds that trade agency MREITs themselves are risk free especially when they are bad at managing capital, make bad trading decisions, leverage too much and suffer from unfavorable yield curves. A company or fund trading mortgage REITs can still lose money or underperform by a large margin even if none of the mortgages it holds fails.

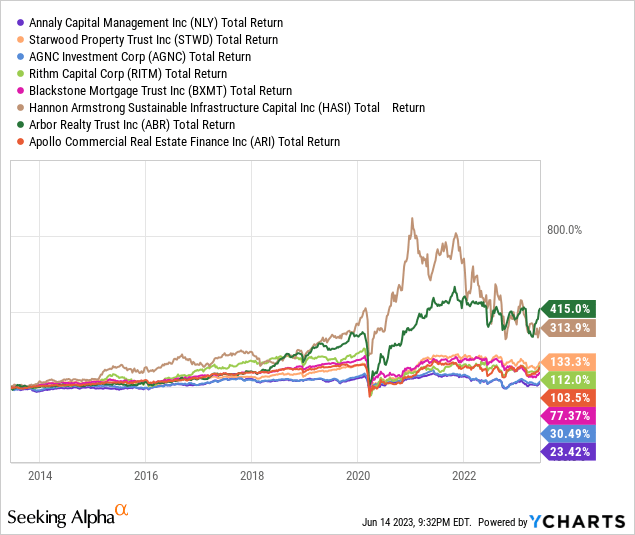

Interestingly enough, if we look at REM's top holdings, which account for more than 50% of the fund's total weight, we find out that most of them have outperformed the fund in the last decade in total returns. In the last decade, REM's total return (including dividend reinvestments) was 18% while most of its top holdings had much higher returns than that, some as high as 400%.

I find it very concerning and disturbing when a fund vastly underperforms not only the overall market but also the very sub sector it was meant to represent. Of the top 8 stocks in this fund (again representing more than 50% of the fund's total value), the fund didn't outperform a single one in total performance. It underperformed every single one of its top holdings anywhere from 15% to 95%. At that point you might as well ditch the fund and just buy its top 5-6 holdings.

This fund looks like a typical yield trap where investors buy in hopes of receiving large dividend checks but soon they find out that those dividends were never sustainable in the first place and they keep shrinking and getting smaller year after year. At times the fund will look like its oversold or possibly even cheap or at a significant discount to its book value but this is usually for a good reason because it is not designed to outperform in the long run and in its history it has never outperformed the markets, not even for brief periods of time.

From 2009 to 2022, markets enjoyed free money as Fed kept rates practically at 0% and launched one massive QE program after another. This also helped mortgage rates stay at historically low levels around 3-4% for the most of the last 15 years and home prices rose tremendously. It's safe to say that the easy money in mortgage industry has already been made. Moving forward we are likely to see tighter money conditions not just from the Fed but also from regional and large banks who will want to be more careful about their money. Having tighter credit standards means having less money to go around and less liquidity overall. This isn't an ideal situation for MREIT funds.

If MREIT funds like this one struggled so much while money was free and flowing, how will they perform when standards are much tighter? Many people think that we will return to high liquidity status once again as soon as the Fed pivots and starts changing its tightening policies but bank credit tightening cycle tends to lag the Fed's cycle by about 12-18 months which means even after the Fed "pivots", banks might continue tightening credit for another 12-18 months before they loosen their standards again.

To be fair and completely honest, we don't have any concrete proof that tighter credit standards will immediately cause a drop in MREIT values for sure but we have no reason to expect MREITs to perform well in an environment with tightened credit standards which almost always comes with inversed yield curve. Also, keep in mind that most of the mortgage lending comes from regional banks and these banks tend to be the first ones to get scared and tighten their standards and last ones to loosen their standards when things start improving. Not to mention, regional banks are already in trouble themselves as it is right now even without the economy being in a recession.

Even if we ignore all the troubling signs in the economy and credit conditions, it still makes no sense to hold onto a fund that loses more in value every year than it pays in dividends. When you hold this for its high dividend yield, you are basically paying a "tax" for the fund to return your own money to you while your money continues to shrink year after year. It serves no point. If you really must buy and hold a MREIT, you can look into individual MREITs that have a track record of outperforming such as Arbor (ABR) and Hannon Armstrong (HASI). That way at least you will know that you have a chance of making money in the long run.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.