Truist: Priced For Disaster, Set For Recovery

Summary

- Truist Financial is an undervalued regional bank with a stable deposit base. The bank's average deposits declined only 1.2% Q/Q in the first quarter.

- Truist Financial should benefit from a stabilizing deposit situation in the community bank market which could lead to a return of investor confidence.

- Truist Financial's shares are undervalued as they are still trading at a 22% discount to book value.

J. Michael Jones/iStock Editorial via Getty Images

Truist Financial (NYSE:TFC) is an underrated and undervalued financial services company that has fallen victim to the March sell-off in the community banking market. Truist Financial is the sixth-largest U.S. commercial bank by assets, according to the Fed, and the bank has started to trade at a large discount to book value in March… from which the bank has so far not recovered. With a resilient, diversified core business and a stable deposit base, I believe Truist Financial is an attractive investment for investors!

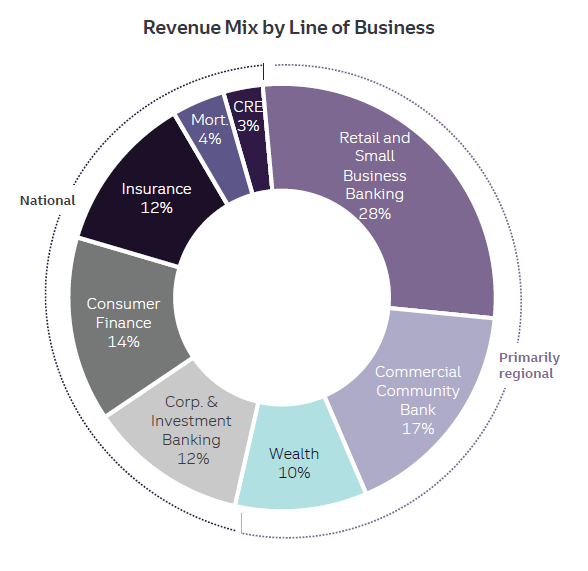

Diversified business with a regional banking focus

Truist Financial is a financial services company which is currently the sixth-largest bank in the U.S. with an asset base of $574B/ The bank is diversified and offers a variety of banking services for retail and business customers as well as wealth, investment banking and insurance services. Despite the diversified nature of Truist Financial's operations, the company has suffered from the March meltdown in the community banking market as investors feared the loss of a material portion of the bank's deposits.

Source: Truist Financial

Stable deposit base

Like most banks, Truist Financial has seen a substantial decline in its valuation after the collapse of Silicon Valley Bank more than three months ago. While the Fed has been instrumental in preventing a much deeper sell-off in the community banking market through its Bank Term Funding Program, the valuation of Truist Financial is deeply impaired.

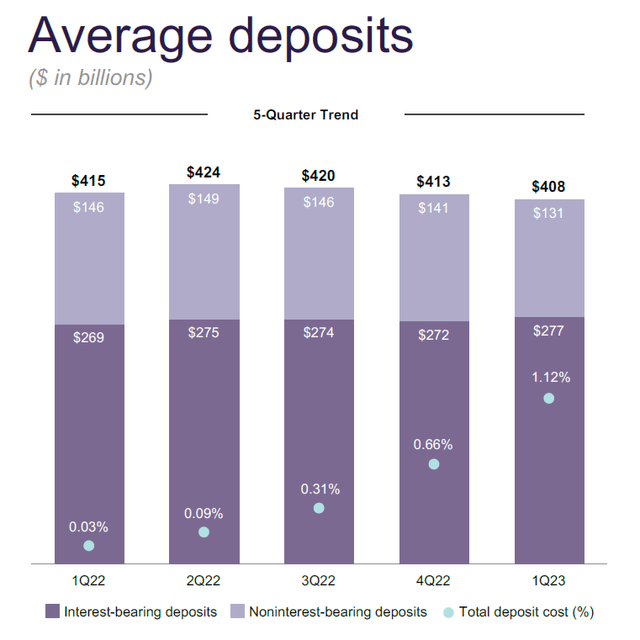

Truist Financial has a stable deposit base and the bank has not been materially affected by the crisis in the community banking market in the first-quarter. Truist Financial had $408B in deposits, on average, in the quarter ending March 31, 2023, showing a relatively minor 1.2% quarter over quarter decline in its (average) deposit base. Community banks such as Western Alliance Bancorporation (WAL) or PacWest Bancorp (PACW) have seen much larger deposit outflows. Western Alliance Bancorporation, as an example, updated the market last month and said that its deposit base has shrunk 7.5% compared to the end of FY 2022 and that $2.0B of deposits have flowed back to the community bank since the end of Q1'23, a trend that other banks are also benefiting from.

Truist Financial has said that deposit outflows in Q1’23 happened chiefly because of higher-rate alternatives for investors, not because depositors were panicking about the safety of their deposits. A lot of money has been flowing out of banks and into money market funds over the last year which offer savers a higher return on their investments. Based off of end-of-period deposits, Truist Financial only lost 2.1% of its deposits quarter over quarter.

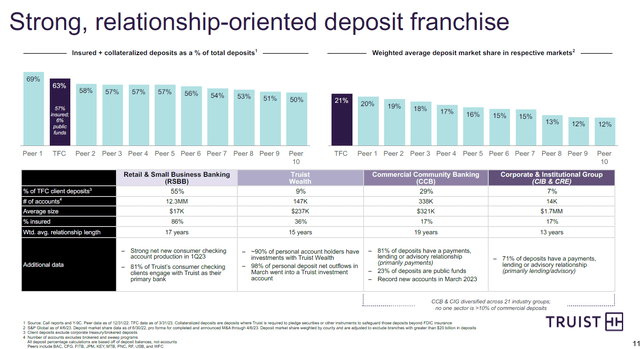

About 57% of Truist Financial's deposits are insured (with another 6% being collateralized). The majority of deposits are held at the bank by retail customers and small businesses (55%) and only 29% of deposits are held in the commercial/community banking segment. Businesses were especially at risk of withdrawing deposits during the March crisis as balances above $250,000 are not covered by the FDIC's insurance guarantee. Since Truist Financial lost only a very small percentage of its deposits in Q1'23, I believe investors really don't have a good justification for applying a large valuation discount to TFC.

Truist Financial is cheap and trading significantly below its 1-year average P/B ratio

Year-to-date, Truist Financial has lost about a quarter of its market capitalization and shares continue to trade at both a large discount to book value as well as an outsized discount to the bank's 1-year average price-to-book ratio.

Truist Financial is currently valued at a P/B ratio of 0.78X, implying a 22% discount to book value. If the bank's shares can revalue to Truist Financial's 1-year average P/B ratio of 1.03X, TFC could have about 32% revaluation upside. In my opinion, the stability of Truist Financial's deposit base is a strong reason to buy TFC on the drop and wait for the bank's valuation to move towards its average P/B valuation.

Risks with Truist Financial

If more banks fail, or are forced to sell investments in order to meet their liquidity needs, the financial sector as a whole could see a reboot of the March 2023 financial crisis which pushed Silicon Valley Bank, Silvergate Bank and Signature Bank out of business. Higher interest rates are also a risk factor as depositors are likely to continue to shift low-yielding bank deposits into higher-yielding money market funds.

Final thoughts

I believe Truist Financial is an attractive rebound play in the U.S. regional banking market, in large part because the company’s deposit base has not been very much affected by the panic in the financial system in March. The reason why the financial crisis didn't do more damage to regional banks is because the Fed stepped in and took decisive action by providing banks with an emergency liquidity window, effectively backstopping deposits of all U.S. depositary institutions. Considering that Truist Financial is still trading at a 22% discount of book value and well below its 1-year average price-to-book ratio, I believe Truist Financial’s shares have significant recovery potential!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TFC, WAL, PACW, USB, KEY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.