SL Green: A Short Squeeze Idea With Serious Undervaluation

Summary

- SL Green may be the most oversold and shorted office REIT available to participate in a sector-wide recovery over the next 12 months.

- Still solid fundamental results overall and cash flow generation in particular should support the dividend and some balance sheet improvement.

- Lower U.S. interest rates could encourage a large round of short covering, creating outsized price gains vs. other REITs.

- An upfront 13% dividend yield is worth taking on NYC office property risk, as pandemic return-to-office trends have been slow developing.

cmart7327

I wrote an article in February here on Douglas Emmett (DEI) in the office REIT space focused on southern California and Hawaii. My effort at bottom fishing in the decimated office real estate subsector was a few months early, but this name is starting to recover nicely. Fears that return-to-work trends after the pandemic's end are fizzling have appeared everywhere in 2023. Of course, the office ownership and rental space is under pressure from both rising interest rates and tenants canceling or scaling back lease arrangements.

I am not arguing the sector will be exactly the same as before the pandemic, or long-term new builds are about to explode. It may even take 5-10 years to fully rebalance existing supply with office rental demand. However, trust prices for office building ownership have plummeted, perhaps overshooting any and all future realities.

Two REITs focused on New York City, Vornado Realty (VNO) and SL Green Realty (NYSE:SLG), have been some of the biggest losers for investors, as the pandemic situation pushed many citizens into relocating. Today's estimate is the city's population has declined by - 5% overall since 2019.

My feeling is a large reversal higher in price could happen soon for the industry, following the wickedly bad 3-year underperformance span since February 2020. And, if you want to play a rebound, zeroing in on the highest dividend yielder, lowest book value, greatest short position in the sector may be a smart way to ride a reversion-to-the-mean up move. You can accomplish all of the above with an investment in SL Green. The opposite of risk-off beating down its quote, a risk-on environment for office REITs could create a substantial rally in shares of +20%, +30% or more over months or even weeks.

SL Green owns 61 buildings in NYC, and is Manhattan’s largest office landlord. I believe a gradual recovery in office space demand after the pandemic and a more-fair valuation of the business will help this REIT to outperform the majority of other equity investments for years to come. And, for income-minded investors, a dividend yield of 13% is now available as a tailwind for future total return gains (13.4% trailing yield vs. 12.5% forward indicated).

Company Homepage – June 14th, 2023

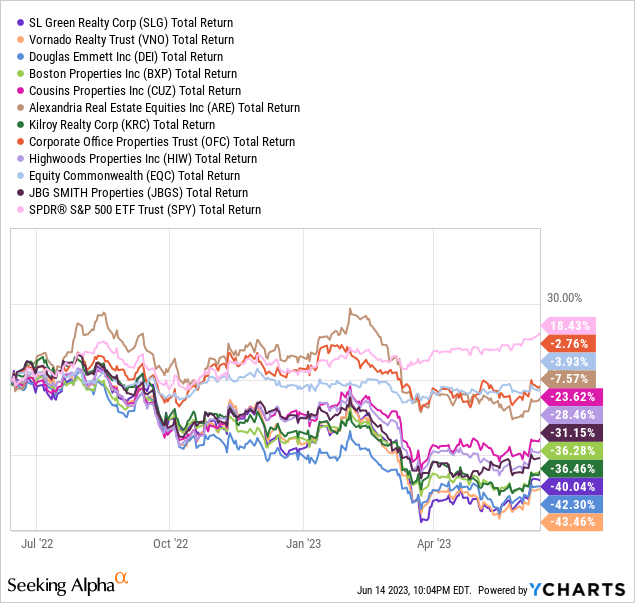

Radical Sector Underperformance

Below are 1-year and 3-year total return graphs to illustrate the damage done to these businesses from pandemic-related selling. Investors have lost around -50% in value owning office REITs vs. an equivalent period +50% gain for the S&P 500 including dividends. My blue-chip, large-cap office REIT peer list includes SL Green, Vornado, Douglas Emmett, Boston Properties (BXP), Cousins Properties (CUZ), Alexandria Real Estate (ARE), Kilroy Realty (KRC), Corporate Office Properties (OFC), Highwoods Properties (HIW), Equity Commonwealth (EQC), and JBG Smith Properties (JBGS). I have also added the SPDR S&P 500 ETF (SPY) for comparison.

YCharts.com - SL Green vs. Major Office REITs & U.S. Market, Total Returns, 1 Year YCharts.com - SL Green vs. Major Office REITs & U.S. Market, Total Returns, 3 Years

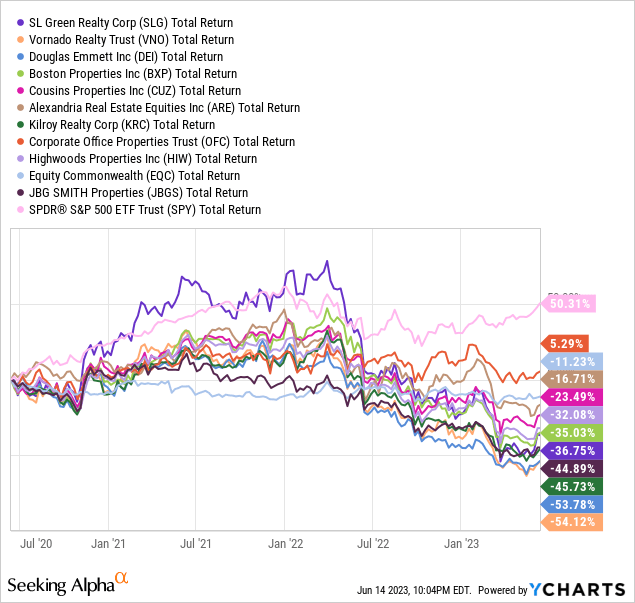

Short Sale Interest

Because of the company’s focus on Manhattan real estate, SL Green has been a target of short sellers since the pandemic started. With the largest concentration of people in the country, and orders to work from home during the pandemic in NYC, the logical choice as the worst-positioned office REIT is this name. The open question remains, will long-term lease rates and demand be permanently altered? Or, will office rental health return over the next few years?

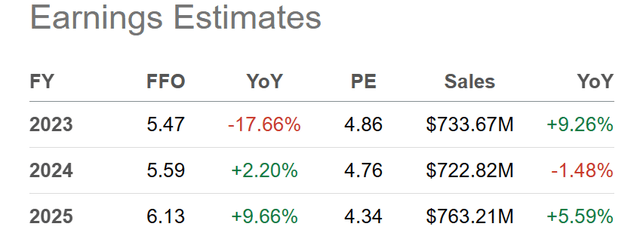

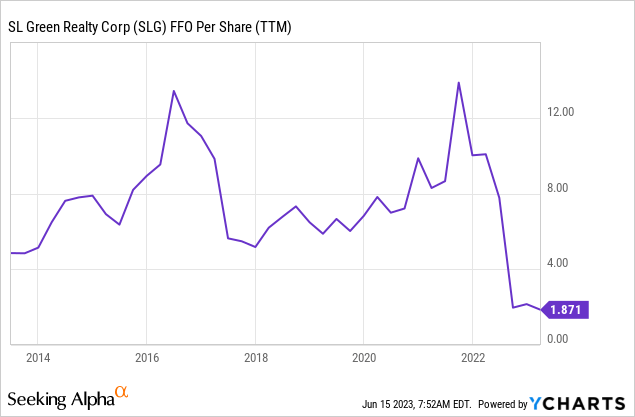

So far, SL Green’s business results have been dented, with analysts now calling for relatively flat annual FFO readings between $5.50 and $6 per trust unit between now and 2025 vs. results of $8 to $13 in the years before the pandemic hit. However, on a $26 quote presently and 5x ratio on remaining annual cash flow generation, is it possible short sellers have already overplayed their hand?

You can review on the comparative graph below, SL Green is the most heavily shorted of the largest U.S. office REITs, with a whopping 27% of trust units presold into the marketplace, that will have to be covered/bought into the future (assuming the office landlord sector recovers). This pent-up buying “fuel” is more than DOUBLE the rate of others, including closest peer Vornado. Typically, a short position above 5% of outstanding shares is considered high.

My thinking is a rebound in investor interest (from low valuations vs. net long-term assets and falling interest rates in the second half of 2023 crossed with super-high dividend yields in the industry) could lead to significant short covering. When this happens, extra buy volumes exiting the massive short position could completely wreak havoc with the supply/demand balance in daily trading. We could easily witness total buy volumes outnumbering sell volumes by 2 to 1, 3 to 1, or greater on a good news Fed rate cut day or better-than-expected earnings announcement later in the year, for example. My view is overzealous shorts will get nervous over time and swing to large net buyers at some point during the summer, as a recession becomes fully discounted in SL Green operations.

YCharts.com - SL Green vs. Major Office REITs, Short Position vs. Outstanding Units, 3 Years YCharts.com - SL Green vs. Major Office REITs, Average-Volume Trading Days to Cover Shorts, 3 Years

Low Valuation

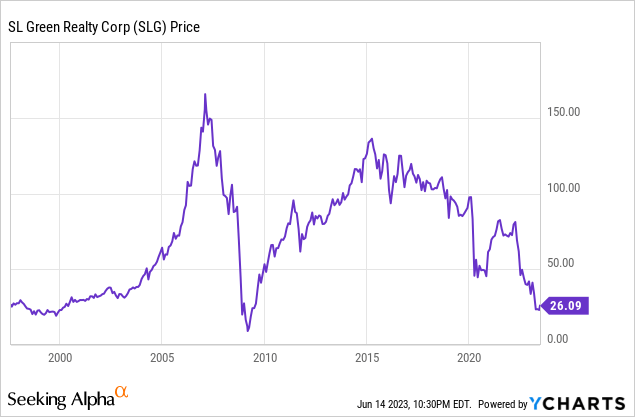

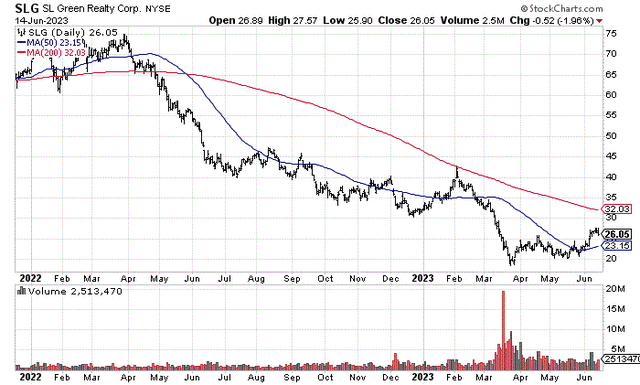

On the price graph since 1997 below, you can see SL Green’s quote peaked close to $170 before the Great Recession began in late 2007. Price almost recovered to $140 during 2015, but has zigzagged lower to $26 today ($18 at the low in March). Since the pandemic began in early 2020, the stock has plummeted from $100, with the help of short sellers dumping trust units borrowed from others.

YCharts.com - SL Green, Weekly Price Changes, Since 1997

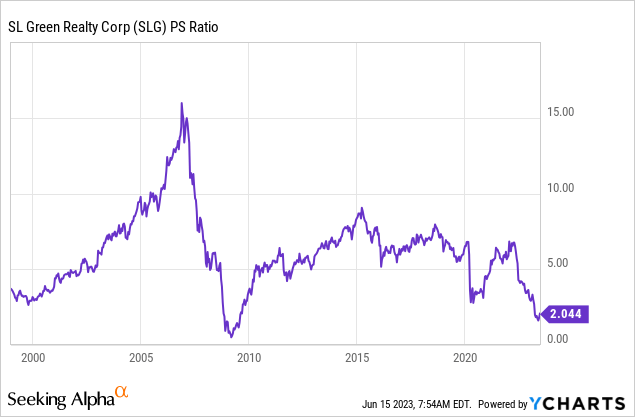

The easiest way to look at the complete bust in investor enthusiasm for Manhattan real estate is through a simple price to sales graph. I have plotted this ratio since 1997 below. Only the bust bottom of the Great Recession in early 2009 traded any lower than today. And, this instance proved the best long-term entry point for investment in the history of the company. Has the pandemic short-selling dump opened a similar opportunity? The current 2x multiple on trailing sales is a 70% discount to the 25-year average of 7x.

YCharts.com - SL Green, Price to Trailing Sales, Since 1997

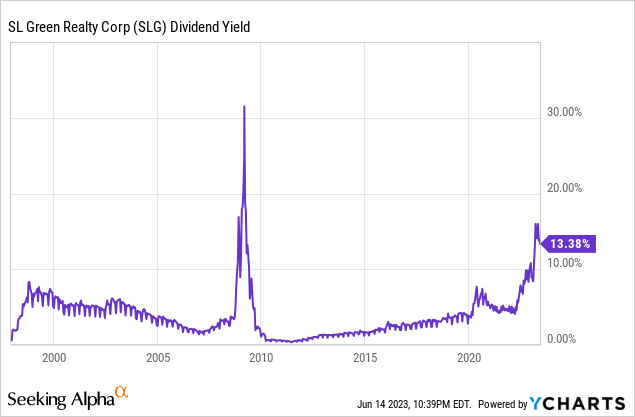

Effectively, the monster drop in price has been matched against operating results that have only mildly deteriorated, creating all types of “value” for investors. Today's dividend yield above 13.3% on a trailing basis and nearly 16% rate at the March low price represent the strongest income story since the depths of the Great Recession. This yield is also 4x greater than long-term Treasury bond yields between 3.5% and 4% currently, while 8x greater than the S&P 500 dividend yield of 1.5% paid over the last 12 months.

YCharts.com - SL Green, Trailing Annual Dividend Yield, Since 1997

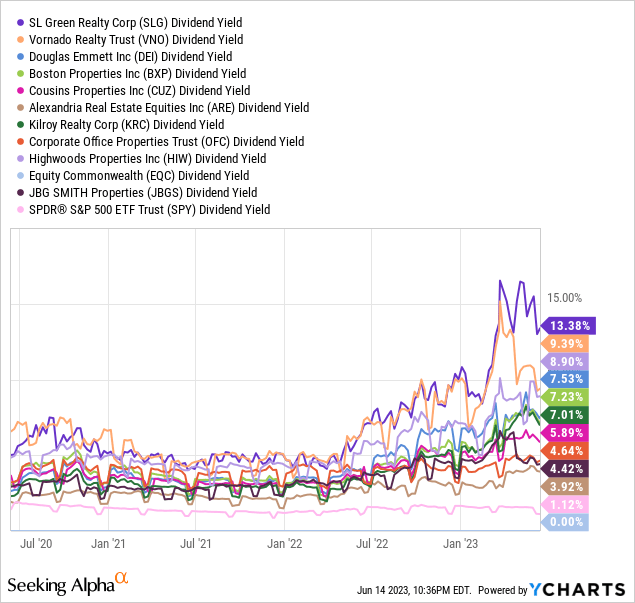

Again, short sellers have punished SL Green well beyond other office REIT names. So, the cash distribution yield available now is the highest by far vs. peers, more than DOUBLE the sector median average.

YCharts.com - SL Green vs. Major Office REITs, Dividend Yields, 3 Years

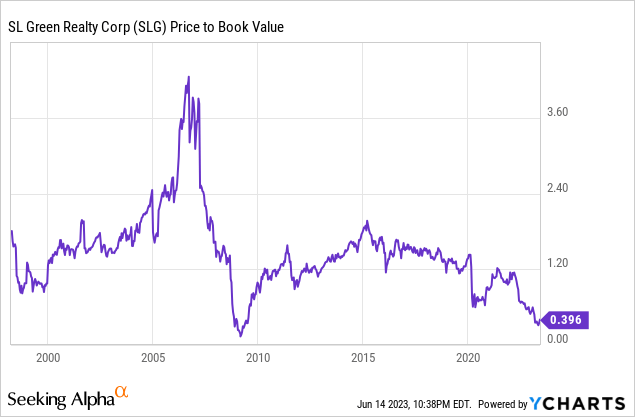

If Manhattan real estate occupancy and lease rates recover in the years ahead, the single data point telling investors how cheap SL Green has become is the price to book value calculation. Today’s 0.4x ratio is quite extreme vs. a 25-year average of 1.4x, or the 2015 high approaching 2x.

YCharts.com - SL Green, Price to Book Value, Since 1997

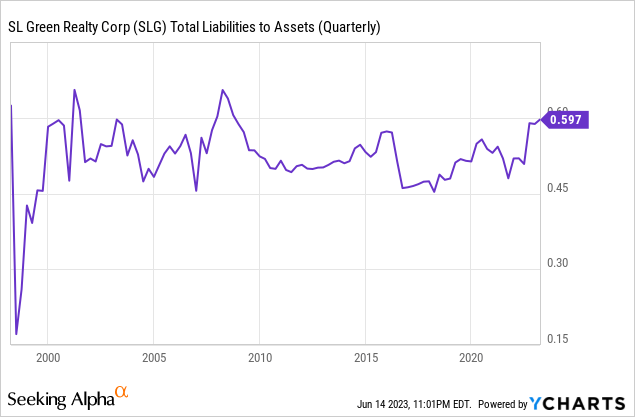

More good news is debt and overall leverage on the balance sheet is consistent with long-term financial settings, although somewhat on the high end of normal. Total liabilities are roughly 0.59x the underlying value of depreciated, cost-accounting real estate assets. This compares to a 25-year average of 0.53x.

YCharts.com - SL Green, Total Liabilities to Assets, Since 1997

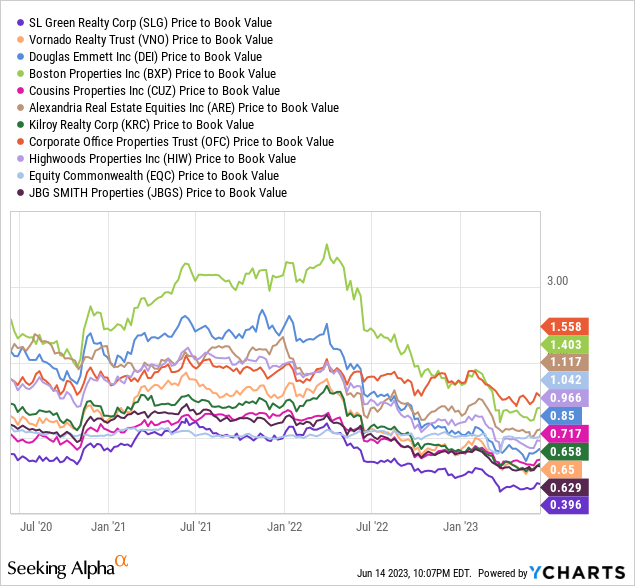

Because of the mania-like conviction by analysts and investors, everyone is assuming NYC real estate health will not recover to previous levels. Short sellers have confidently pushed the price to book value reading well under the level of other office REITs. SL Green’s 0.4x multiple on book value is HALF the median sector average currently, leaving enormous long-term upside in the trust quote for owners, assuming Manhattan’s doldrums prove relatively temporary in nature.

YCharts.com - SL Green vs. Major Office REITs, Price to Book Value, 3 Years

Final Thoughts

I personally have been adding positions in many office REITs over the last couple of weeks, feeling a significant bottom has been reached between March-June. At the very least a major bounce higher in price may be next to relieve the extreme bearish sentiment that now exists in the office REIT sector.

In terms of immediate risk, there is a decent chance one last move lower could hit during the summer and autumn months, if a long-heralded U.S. recession shows up. I am thinking a downturn in SL Green back under $20 cannot be ruled out, but would almost surely be accompanied by a material selloff in the S&P 500 index and stocks generally. The days of rotten underperformance of Wall Street equities could be ending sooner than the average analyst or investor believes possible.

StockCharts.com - SL Green, 18 Months of Price & Volume Changes

One potential trading outcome is thousands of U.S. stocks decline in price with the advent of recession, while office REITs begin to “outperform” the overall market in percentage terms. Perhaps another -20% rout in the S&P 500 into October is unable to drop office REITs more than -10% or -15% from today. Why? Logic revolves around the likelihood the Federal Reserve will slash interest rates in quick fashion to prevent a deep recession. Smart investors may begin to front-run a better economy by the middle of 2024, locking in the high dividend yields available from REITs, while piling into undervalued hard asset ideas before serious price reflation cycles into the economy by late 2024.

Investors are also nervous about a dividend cut. But if current analyst estimates prove correct for 2023 and beyond, there will be ample cash flow to both pay cash distributions and extinguish some debt. In my view, even a slight dividend cut will not change the bullish outlook now in place. Where else can you find a similar hard-asset blue chip, delivering an underlying cash flow return on investment of better than 20% annually (estimated 2023 FFO of $5.50 on current trust price of $26), priced well below accounting book value?

Seeking Alpha Table - SL Green, Analyst Estimates for 2023-25, Made June 14th, 2023 YCharts.com - SL Green, Trailing Annual FFO, 10 Years

If the real estate market in NYC does not implode, upside targets of $50 by the end of 2023 (last June's price level), and $100 again in 2-3 years are not farfetched. That’s exactly where the stock should be headed if the world does not end, and the notoriously cyclical Manhattan market swings unexpectedly in a positive direction during 2024. With a book value of $66 per ownership unit and FFO of $6, a market price of $100 makes perfect sense when sunnier days return 12-24 months from now. Using the 25-year average of 1.4x for price to book value, and long-term price to FFO average approaching 20x (not pictured), coming up with price targets above $100 is not rocket science.

My conclusion: $26 may be a true bargain in June 2023, with 13% for your annual dividend yield an upsized reward for taking on the risk of owning the most-feared office marketplace in America – New York City.

The oversold price of $26 could not have been reached without an incredible amount of short selling. If we flip the script and a short squeeze develops, mountains of buy orders could shoot price dramatically higher over the next 12 months to find the necessary supply to create transactions. SL Green could even morph into one of the "top" total return picks to own between today and the summer of 2024. Don’t say it cannot happen. Nobody believed the real estate market would ever rebound at the depths of the Great Recession. Then it did.

That’s my common sense, contrarian-based review of SL Green. I rate shares a Buy, with a Strong Buy setting under $20.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLG, DEI, VNO, BXP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. When investing in securities, investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but the author’s opinion written at a point in time. Opinions expressed herein address only a small cross-section of data related to an investment in the securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.