INDS: Future Growth Prospect Of Industrial REITs Makes This ETF Attractive

Summary

- Due to a surge in e-commerce, strong supply & demand dynamics for logistics assets should mean the Industrial real estate investment trust sector will be a long-term outperformer.

- As the only exchange-traded fund investing in industrial REITs, specifically in self-storage REITs, INDS thus becomes a lucrative option for long-term growth-seeking investors.

- INDS generates decent total returns, and performance of its overall portfolio can be termed quite satisfactory. The fund is currently trading almost at par.

- The stocks included in the portfolio of INDS have a reasonable price multiple.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Torsten Asmus

~ by Snehasish Chaudhuri, MBA (Finance).

Pacer Benchmark Industrial Real Estate SCTR ETF (NYSEARCA:INDS) is a strategy-driven exchange traded fund that aims to offer investors exposure to companies from developed markets that generate a significant amount of their revenue from real estate operations in the industrial sector. 70 percent of its assets are invested in the U.S. equity market, while the remaining fund is invested in some of the strongest equity markets around the globe such as the United Kingdom, Singapore, Japan, Australia, Canada, Belgium and Sweden. INDS is the only fund that focuses only on industrial real estate investment trusts, or REITs, specifically in self-storage REITs. As demand for logistics assets continues to increase, INDS seems to be in a position to leverage on this increasing demand due to its unique portfolio.

INDS Is A Relatively New Industrial REIT Fund With Low Yield But High Total Returns

Pacer Benchmark Industrial Real Estate SCTR ETF is an exchange traded fund that invests in stocks of companies operating across all types of equity real estate investment trusts. It fully replicates the composition of Solactive GPR Industrial Real Estate Index. This index is primarily composed of stocks listed in various developed equity markets that derive at least 85 percent of their revenues or net incomes from real estate operations in the industrial real estate sector, including self-storage real estate operations. INDS has an asset base of $218M, with a relatively high turnover ratio of 43 percent. However, the expense ratio is under control at 0.55 percent. The fund is only five years old and has been paying quarterly dividends for the past eight quarters. INDS generates a reasonably low yield, but comparatively high average total return.

Performance Of INDS's Overall Portfolio Can Be Termed Quite Satisfactory

Pacer Benchmark Industrial Real Estate SCTR ETF invested 65 percent of its total assets in ten of the most reputed self-storage REITs such as Prologis, Inc. (PLD), Public Storage (PSA), Life Storage Inc. (LSI), EastGroup Properties Inc (EGP), Segro PLC (OTCPK:SEGXF), Extra Space Storage Inc. (EXR), First Industrial Realty Trust Inc (FR), CubeSmart (CUBE), Stag Industrial Inc (STAG), and Terreno Realty Corp (TRNO). Six of these stocks (PLD, LSI, EPG, FR, CUBE and STAG) generated price growth between 12 to 30 percent during the past one year. This is incredible because the S&P 500 index (SP500) grew by 16.5 percent during the same period. PSI and TRNO also generated positive price growth.

Remaining 35 percent was invested in another 14 stocks, and half of these stocks recorded positive price growth during the past 12 months. So, the performance of INDS's overall portfolio can be termed quite satisfactory. Pacer Benchmark Industrial Real Estate SCTR ETF itself registered a positive price growth and a total return of almost 3 percent over the same period. This return surely is not impressive. But we have to consider the fact that REITs had a very poor 2022. If we consider the year-to-date return, INDS had a price growth and total return in excess of 7 percent. This return is expected to increase at the end of 2023, as the equity market is on the recovery path and demand for industrial real estate spaces keeps increasing.

Growth Of e-Commerce Should Boost The Demand For Industrial Real Estates

In the short term, e-commerce businesses were partially hit due to the rising level of inflation, as that has adversely impacted purchasing habits. But, in the long term, inflation will hardly have any impact and may become beneficial, too. Rising costs have already resulted in buyers sourcing directly from producers, removing as many layers of middlemen as possible. Moreover, inflation has started to slow down and the high base effect will also benefit the ecommerce industry in the months ahead. This will only add up to the existing demand for industrial infrastructure. Newmark's research publication, titled "The Future of Industrial Real Estate: Trends for 2022 and Beyond," revealed that e-commerce set-ups require almost thrice the level of industrial space when compared to traditional brick-and-mortar retail businesses.

E-commerce businesses create additional demand in the form of returned products. Products returned in such businesses are more pronounced than the traditional retail mode. This would require a deeper thrust toward reverse logistics operations. INDS largest holding - Prologis estimates that approximately 1.2 million square feet of warehouse space would be required for every $1 billion of e-commerce sales. In the United States, e-commerce activities are expected to grow at double-digits through 2025. This ensures there will be a huge need for additional capacities. Moreover, the aging infrastructure will mean creation of more warehouse space. It is estimated that almost one-third of the existing industrial inventory is more than 50 years old, while more than 70 percent was constructed in the twentieth century.

Investment Thesis

Strong Supply and Demand dynamics for logistics assets mean the Industrial REIT sector will be a long term out performer. Various industrial REITs are also lured and targeted by private equity investors. During the time of economic disruption, where globalization is being unwound, the best way to invest in this sector is through a portfolio consisting of industrial REITs. As the only ETF investing primarily in the industrial REITs, Pacer Benchmark Industrial Real Estate SCTR ETF thus becomes a lucrative option for long term investors.

The fund generates strong total returns and is currently trading at a marginal premium of 0.13 percent. Between 2019 and 2021, INDS generated an annual average total return of 18.25 percent. 2022 was a poor year for the REITs and also for the broader market. This year, the fund has started showing signs of recovery and is poised for a decent enough growth. INDS invested in the right set of stocks, and the stocks included in its portfolio have a reasonable price to earnings (P/E) and Price to Book (P/B) ratio. So, overall, Pacer Benchmark Industrial Real Estate SCTR ETF doesn't seem to be overvalued, either.

About the TPT service

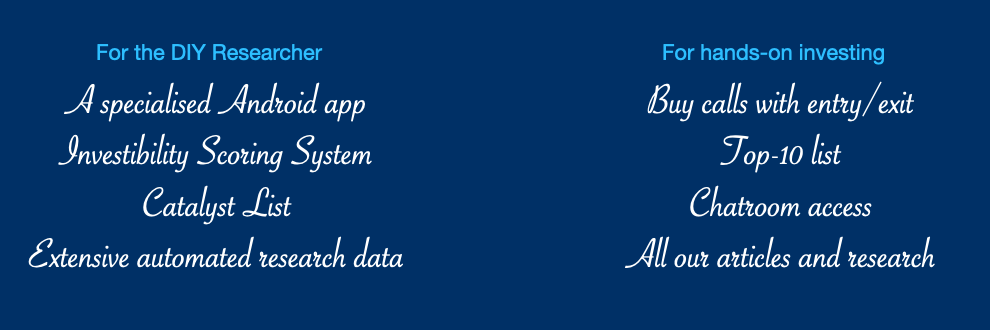

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.