PROG Holdings: I Wouldn't Be Surprised To See Profit Taking

Summary

- The stock rallied over 100% this year, which may trigger some profit taking if any bad news comes through.

- The outlook is not looking too good with uncertainties in the global economy, which may increase delinquency rates.

- I assign a hold rating for now and I would add on any substantial drop in the share price if I was already invested.

praetorianphoto/E+ via Getty Images

Investment Thesis

After PROG Holdings (NYSE:PRG) rallied more than 100% YTD, I believe that the future macroeconomic headwinds will bring in higher delinquency rates and investors will start to take profits soon enough. I believe that the revenue growth does not justify the company’s stock price and I assign a hold rating for now.

Outlook - Not Too Rosy

The higher interest rates in the recent past have driven higher delinquency rates. That is the big reason that the company’s share price hasn’t gone anywhere in the last 5 years. However, with the recent cooling down of the economy, which led the Fed to calm down with aggressive interest rate hikes as the inflation has come down off its 9%+ peak, the stock price has rallied over 100% YTD, which is slightly too extended for my liking.

The company serves customers who have less-than-perfect credit scores. That is a double-edged sword. On the one hand, this means that the addressable market is quite large, on the other hand, during the hard times in the economy, these customers are more likely to default on their payments and delinquency rates might continue to go up as it has in the recent past. The interest rates are still high and will stay elevated at these levels for a little while longer because the Fed is most likely not going to start cutting them just yet. There may not be many more interest rate hikes, however, these rates will stay where they are in my view, which does hurt a big chunk of the company’s customers.

BNPL Model

It’s not all doom and gloom for sure. I believe that when the company purchased Four Technologies Inc recently, the company started to diversify its offerings. The Four platform has started to see a significant increase in revenues, and time will tell how well this segment will perform in the future. The BNPL market is forecasted to grow at 20% CAGR until ’27, and if the company can capture more of the market share, it will benefit greatly from the popularity of these types of transactions.

Financials

Just to note here, I will be presenting yearly graphs below as these show a fuller picture of where the company is heading. I will include the latest quarterly numbers if I think they are needed for extra color.

At the end of Q1 ’23, PRG had around $250m in cash and $591m in debt. Many investors aren’t big fans of leverage; however, I believe that if it is used correctly and is manageable then there is no need to be upset. EBIT more than covers the annual interest expense and with that amount of cash, the company is not at any risk for now, even if we are going to experience some headwinds in the near future.

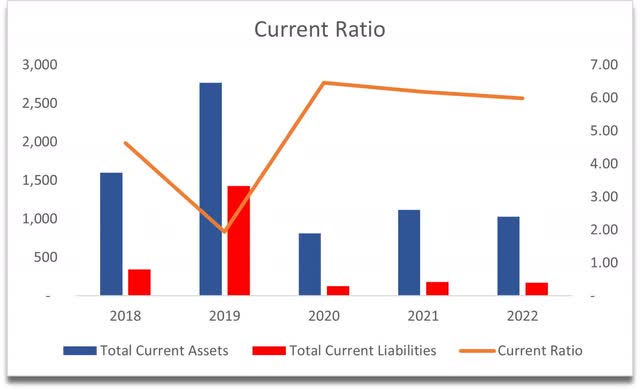

Continuing on liquidity, the company’s current ratio is very high, which can be attributed to the company’s Lease Merchandise/ Inventory. This can be a drawback because it means that the company has a lot of capital tied up to inventory that can be used elsewhere. It is safe to say that the company has no short-term liquidity issues as it can easily cover its short-term obligations.

Current Ratio (Own Calculations)

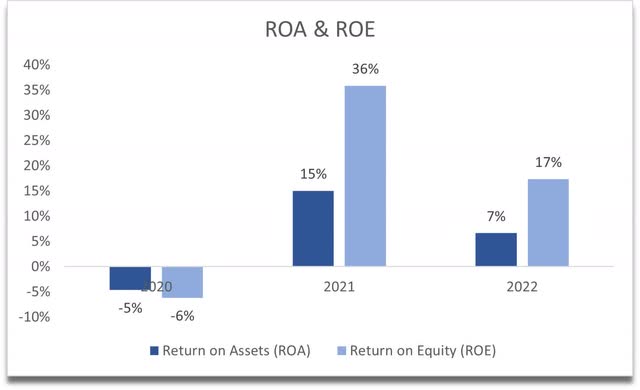

In terms of efficiency and profitability, the company has recovered very quickly from the COVID bottom, however, the most recent fiscal year came in much lower than the year before. ROA and ROE are still at quite acceptable levels, meaning that the management is able to utilize the company’s assets and shareholders’ capital efficiently, which creates value.

ROA and ROE (Own Calculations)

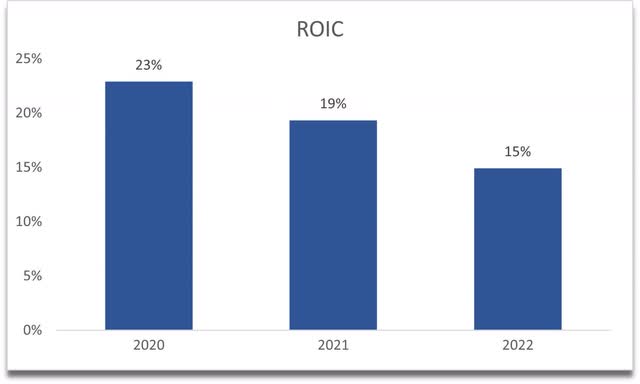

Return on invested capital or ROIC has been going down in the last three years which may be alarming if it continues to go down in the future, especially if the macro headwinds do show up in the remainder of the year, however, ROIC is still quite decent even after going down for three years in a row. This suggests that the company has a competitive advantage and a decent moat but may be losing ground.

Overall, the financials look solid to me with a couple of negative trends in some metrics, which if continued, may turn into something really negative and put me off from investing but only time will tell how the management is going to go about these issues.

Valuation

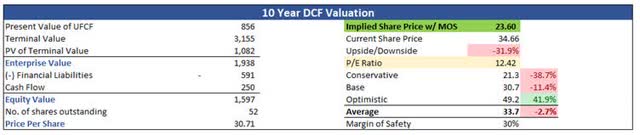

I decided to take a conservative approach to the valuation model for the company, mainly because the analysts aren't predicting very high growth in the future and because the stock price already went up over 100% in the last half a year, so I would like to be on the safer side.

In terms of revenue growth, the company is projecting to bring in -10% for ’23, which will be around $2.3B. From then on, I decided to grow revenues by around 5%-6% per year for the base case, giving me around 4% CAGR for the next decade. For the optimistic case, I went with 7.8% CAGR, while for the conservative case, I went with around 2% growth until ’32.

In terms of margins, net margins have decreased by around 500bps or 5% from ’21 to ’22. I decided to improve margins to around 9% by ’32 as I assumed that the company would manage to achieve better efficiency going forward.

I decided to also add a 30% margin of safety to my intrinsic value calculation to be on the even safer side. I usually add a 25% margin of safety if the financials are spotless, however, the downtrends are slightly concerning.

With that said, the intrinsic value for PRG is $23.6, implying a 32% downside from current valuations.

Intrinsic Valuation (Own Calculations)

Closing Comments

I believe that the share price has gone a bit too high this year and any bad warning from the management in the next couple of reports will force a lot of investors to lock in some profits and bail. The macroeconomic headwinds that we are likely to see in the next year or two, coupled with the high-interest rate environment, and the sticky inflation may keep bringing delinquency rates up further which will not be good for the company.

The financials aren't bad, however, if the company isn't going to grow at a faster pace than I assumed, the company is slightly expensive right now and I will assign a hold rating because even though my model says it's a little expensive, it is still trading at only 12x earnings and I wouldn't suggest long-time investors selling right now. If I was a current investor in the company, I would add on any reasonable drops to average down further. If I don't have a position already, then I would hold off because risk/reward isn't where I want it to be.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.