Cal-Maine Foods: End Of Supernormal Profits An Opportunity For Patient Longs

Summary

- Cal-Maine Foods saw significant growth in 2022 due to a surge in egg prices caused by supply constraints from bird flu outbreaks.

- The company's stock price has declined in 2023 as egg prices have normalized, but long-term prospects remain strong due to balance sheet strength, M&A expertise, and investments in cage-free production.

- Investors should exercise patience in building a position in Cal-Maine Foods, as short-term volatility and cyclical industry factors may impact the stock price.

Stephen Barnes/iStock via Getty Images

As the largest egg producer and distributor in the US, Cal-Maine Foods (NASDAQ:CALM) benefited immensely from the unprecedented surge in egg prices in 2022. This is reflected in the fact that revenue for the ttm are $3.05 billion vs $1.77 billion for the fiscal year ended May 2022 and $1.34 billion for May 2021. EPS for the ttm is $15.65 vs $2.73 in the fiscal year ended May 2022. The driver of CALM’s impressive performance over this period was the unprecedented surge in egg prices.

Supply and demand economics

Egg prices in the US rose aggressively all through 2022, starting the year at around $1.2/dozen in January and reaching as high as $5/dozen in December. This huge price move was triggered by classic supply and demand economics. The supply of layers was abruptly constrained in 2022 due to the outbreak of the Highly Pathogenic Avian Influenza (HPAI) virus (commonly called bird flu) that resulted in depopulation of commercial poultry across the country. To date, more than 38.01 million reported birds have been affected by HPAI, according to USDA. With demand staying constant amid reducing supply, egg prices skyrocketed all through 2022, resulting in a banner year for major producers like CALM. Thanks to these high prices, CALM generated a record $706.5 million in net cash from operating activities for the thirty-nine weeks ended February 25, 2023, according to company flings.

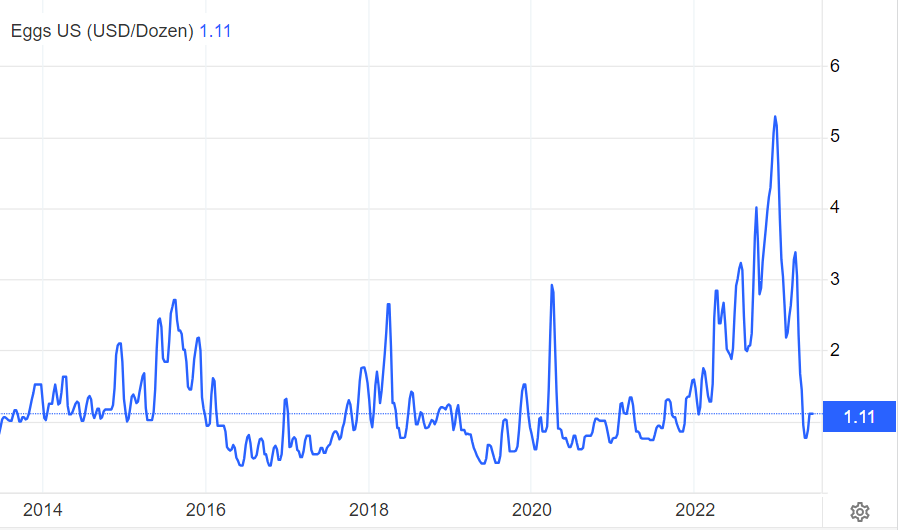

These trends have, however, reversed in the first half of 2023. With the virus now seemingly under control, supply is back on track and egg prices have fallen steadily over the past two quarters. The latest quoted price on Trading Economics as of writing was $1.10/dozen, which is more in line with the historical moving average. The chart below shows the 10 year price trend for eggs.

Egg prices surged in 2022 (Trading Economics)

Thanks to the high egg prices, CALM enjoyed a period of supernormal profits in 2022. Supernormal profits are usually followed by a sharp decline to normal profits, which is what analysts expect to happen in 2023 now that egg prices have normalized. Consensus annual revenue estimates for the fiscal period ended May 2024 are $2.2 billion vs $3.16 billion for May 2023, while annual EPS estimates are $4.41 for May 2024 vs $16.36 for May 2023.

Capitalize on investors’ bearish reaction

The conventional wisdom is that the stock price should follow earnings. In line with this, CALM is down 10.6% YTD in a market environment where major stock indices have gone up significantly. CALM’s negative stock price performance suggests that investors have in the past two quarters been exiting long positions in expectations of a slowdown in CALM’s operating performance going forward.

Moreover, CALM could have more downside risk if the short interest of 16.4% (as of writing) is anything to go by. A high short interest is an indication that investors have made an increased number of bearish bets, suggesting that the stock price could fall significantly from current levels. However, if the underlying business has strong long-term prospects and possesses unique competitive advantages, a high short interest and declining share price could present a chance to build a long-term position at a low cost over time. I believe the latter scenario more closely resembles the situation with CALM. This gives bullish investors who don’t mind buying a stock in a downtrend a chance to capitalize on investors’ bearish reaction.

The bull case for CALM is supported by several factors, but below are the three that I view as being most consequential:

Balance sheet strength and record cash flows

Demonstrable expertise in M&A in a fragmented egg market

Smart investments in future market trends such as cage-free production

Starting with the financial picture, CALM’s working capital at February 25, 2023 was $880.3 million, compared to $476.8 million at May 28, 2022. The company’s current ratio over this period increased to 3.8 from 3.6. The current ratio is calculated by dividing current assets by current liabilities. The higher it is the more liquid assets a business has to run operations or fund new innovations. CALM’s liquidity has been improving at a time when its balance sheet has gotten considerably stronger. The company had no debt as at February 25, 2023, while the value of its common equity reached $1.53 billion from $1.1 billion in May 2022.

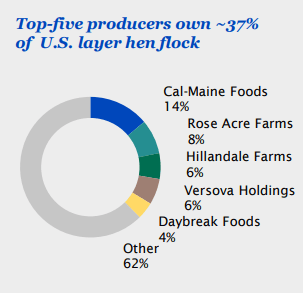

CALM’s strong balance sheet and improved liquidity puts it in a competitive position to seek M&As that could unlock future value and help it maintain its market leadership position. It's also worth noting that, though the company has no debt, it has a $250 million credit facility that is still untapped since November 2021. This gives it added flexibility in case it wants to make a deal. The company has executed 23 successful integrations since 1989, according to its recent management presentation at BMO Farm to Market Global Conference. These deals, which have resulted in strong sales growth through the decades, are partly credited to the current leadership, which includes Chairman Adolphus Baker and CEO Sherman miller, both of who have been with the company for decades. Their long tenure with the company and experience making deals in the egg industry could prove useful going forward, as CALM seeks to consolidate its position in a fragmented market. The top five producers own just 37% of the US layer hen flock, underlining the fragmentation among smaller players and the corresponding M&A opportunity.

Market dominated by smaller players, hence ripe for M&A (Cal-Maine Investor Presentation)

CALM is not only looking for possible deals to drive new growth, but also exploring the use of new farming technologies to appeal to changing customer needs. A key area of investment for the company is cage-free production. This refers to farm environments where layer hens live in open spaces. This results in increased quality of life for hens as compared with those held in cages. Thanks to pressure from animal rights groups, major retailers, and consumers, cage-free has emerged as an increasingly popular form of production. Some states are also passing laws to mandate it. CALM estimates in its investor presentation that around 36%–37% of the US flock is currently housed in cage-free conditions. To meet retailer commitments, approx. 70% flock may require cage-free housing by 2026. This calls for new investments, something that CALM is actively doing. It disclosed in the BMO investor presentation that around $123.3 million of capital had been allocated as at Q3 2022 to enhance cage-free capabilities. Overall, the company has allocated approx. $625 million to expand cage-free production capabilities since 2008.

Still trading above fair value

Despite bullish long-term prospects, CALM could fall further in the next few quarters as investors digest the news of declining performance and analysts publish new projections. Currently, the stock looks optically cheap when assessed using metrics such as P/E and EV/EBITDA, which are 3.18 and 1.71 respectively. CALM's 5 year average for EV/EBITDA (TTM) is 31.72, in contrast with the current multiple of 1.71.

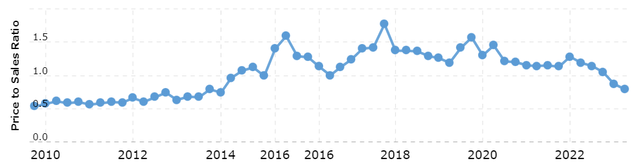

It goes without saying that the recent supernormal profits make these figures unreliable in terms of telling whether or not the stock is undervalued. As sales and earnings decline over the next few quarters, the valuation metric I will be paying the most attention to is the price/sales.

CALM's price/sales since 2010 (macrotrends)

As the chart above shows, CALM's P/S has been declining since 2022. Its currently just 0.77 vs a 5 year average of 1.35. The current low multiple is because of the huge growth in sales in 2022 when egg prices shot up. With annual sales expected to stabilize at $2.2 billion for the period ending May 2024 vs $3.16 billion for May 2023, the revenue per share will work out to $45.45 on the basis of 48.4 million outstanding shares. Assuming a P/S of 1.0 is a fair valuation (1.0 has been the lower end of the P/S range between 2016 and 2022), CALM would be selling at a discount at any price below $45. I would, however, wait for it to fall 10-20% lower than this to have margin of safety as souring sentiment in the short-term could lead to overselling. This would make $36 - $40 my ideal buy point.

Stay calm and wait

Bullish investors looking to add to their positions or initiate new ones should in my opinion wait for some clarity on future performance and the resulting valuation. The high short interest could also lead to heightened volatility in case shorts are forced to cover due to a sudden move up. To add to this, the company's dividend is not consistent, nor are its earnings, which have fluctuated wildly over the past decade. This is due to the cyclical nature of the egg industry. These factors mean that, despite bullish prospects, patience in building a position is key in this stock. The downtrend and bearish sentiment could worsen before things get better.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.