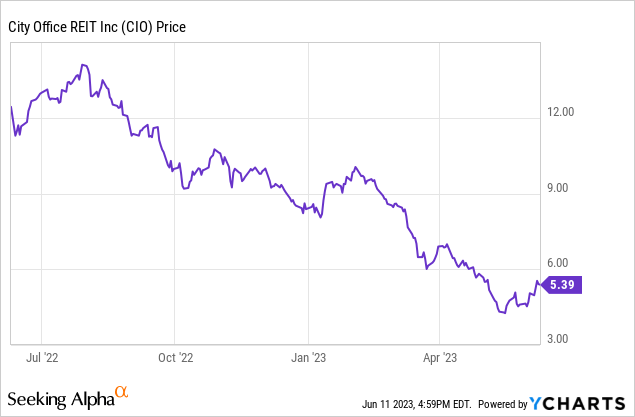

City Office REIT: I'm Holding Onto My 9.7% Yielding Preferred Shares

Summary

- City Office REIT has recently cut the dividend on its common shares, and that's good news as the payout ratio will now drop below 100%.

- The preferred shares are still in good shape thanks to a safety net of almost $700M in common equity on the balance sheet.

- The book value of the unencumbered properties exceeds $800M. Plenty of value to cover the $270M in debt on the corporate level and the $112M in preferred shares outstanding.

- I have a long position in the preferred shares as I think the risk/reward ratio is still pretty good.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

Mindaugas Dulinskas/iStock Editorial via Getty Images

Introduction

Almost exactly one year ago, I started to follow the preferred shares issued by City Office REIT (NYSE:CIO) as I was surprised the REIT didn't call these preferred securities but rather decided to spend its $500M+ war chest on the acquisition of new properties. While I wasn't a big fan of office REITs, I liked the preferred shares and I still have a decent-sized position in City Office REIT's preferred shares. And that's a good enough reason for me to keep track of the REIT's performance to make sure the preferred dividends are still fully covered.

An okay AFFO thanks to low maintenance capex

So, my main concern in the past few quarters has been the erosion of the equity value on the balance sheet. City Office is still generating a very positive FFO and AFFO (which includes the maintenance capex spent on the office assets) but as the REIT was paying outsized distributions on the common units, it was tapping into its equity reserves by paying a dividend it couldn't really afford. In my previous article I commented on how the REIT paid a total dividend of $0.80 per share in 2022 although the AFFO was just $0.67 per share.

Just five weeks after my article was published, City Office REIT slashed the dividend by 50% to just $0.10 per share. That's great news for both the common unitholders (as it will make the balance sheet safer due to a lower net debt level (which will subsequently make it easier to refinance the existing debt)) but even more so for the preferred shareholders as City Office is no longer paying a dividend it cannot afford.

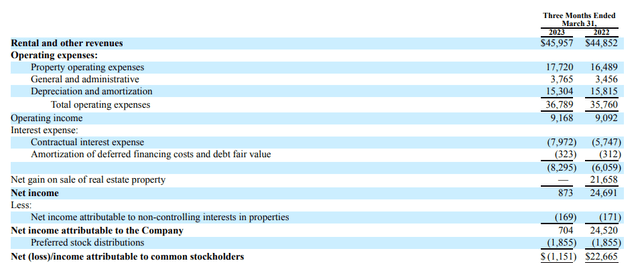

In the first quarter of this year, City Office REIT reported a net loss attributable to its common shareholders. Before making the preferred dividend payments, the REIT was actually profitable to the tune of $0.7M.

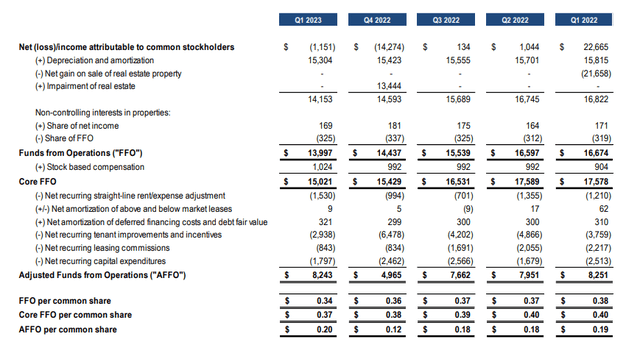

While that's interesting to see, what really matters is the FFO and AFFO. As you can see below, City Office reported a Core FFO of $15M and an AFFO of $8.2M in the first quarter of this year. This result already includes the $1.85M in preferred dividends as the starting point is the net loss of $1.15M attributable to the common shareholders of City Office REIT.

On a per-share basis, the AFFO came in at $0.20. Which means the 'old' dividend of $0.20 per quarter would have been covered (although that would barely be the case) but keep in mind the first quarters tend to be pretty light on maintenance capex. As you can see in the image above, the total Q1 tenant improvements & recurring capex was approximately $4.7M compared to $6.3M in Q1 2022 and $8.9M in Q4 FY 2022. So I'm not sure how sustainable the AFFO result of $0.20 per share is, and I still think it is a good move to have cut the quarterly dividend to $0.10. That wasn't a surprise as I had already called the distributions 'unsustainable' in my March 2023 article.

The preferred shares will benefit from the dividend cut

Would I buy the common shares? No, not yet. But I do own the preferred shares at a substantially higher share price than where they are trading at these days.

As a reminder, there are currently 4.5M preferred shares outstanding. The A-series, trading with (NYSE:CIO.PA) as ticker symbol, offer a 6.625% cumulative preferred dividend which works out to $1.65625 per year, paid in four equal quarterly installments. These preferred shares are callable at any time. As these preferred shares are currently trading at just $17/share, the yield is currently approximately 9.7%.

Based on the AFFO result in Q1, the preferred dividends enjoy strong coverage. We know the AFFO, which includes the preferred dividends, came in at $8.25M. Which means that the total AFFO before the preferred dividend payments is approximately $10.1M and less than 20% of that result was required to cover the preferred dividends. So that's still more than fine.

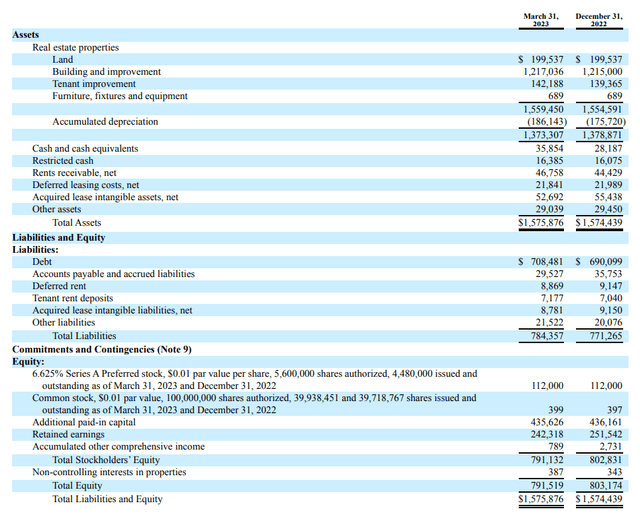

As of the end of March, the REIT had about $791M in equity on the balance sheet, of which about $680M was common equity and junior to the preferred shares. That's a very nice cushion but it obviously also depends on how the real estate assets are valued.

The book value of the assets was estimated at $1.37B. Considering the REIT expects a full-year NOI of $109-111M, the current book value of the assets represents about 12-12.5 times the anticipated NOI. That's okay. Not great, but definitely okay. Especially if City Office hands back the keys of one of the properties to the lender as the total size of the mortgage on one specific property now exceeds the fair value of the asset (subsequent to the end of Q1, CIO has indeed defaulted on the loan).

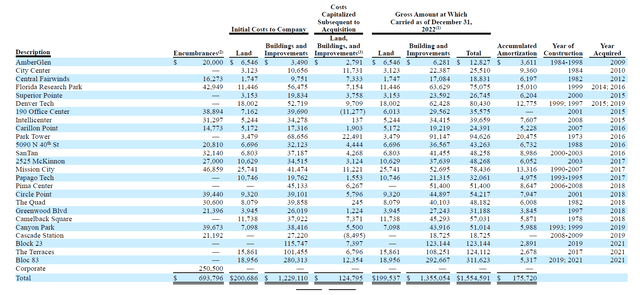

But here's what's interesting. Even in a scenario wherein the fair value of the real estate assets would be 40% lower than the book value, the preferred shareholders could still be made whole. Let's assume an a worst case scenario where the REIT surrenders all properties with encumbrances to its lenders. It would still have about $250M of debt on the corporate level but there would be 10 assets that aren't encumbered to offset that. The book value of the unencumbered assets is $828M (as of the end of 2022, see below but don't mind the total corporate debt, which has increased since the end of last year).

This means that even If City Office would take a 50% haircut on the unencumbered assets, it would still realize enough cash ($414M) to cover the corporate debt and the repayment of the preferred shares ($270M + $112M). And that's why I'm sticking with the preferred shares.

Investment thesis

Perhaps I'm stubborn but I am sticking with my investment in the preferred shares of City Office REIT. I don't like office assets all that much and if the CIO management would not have cut the distribution on the common units, I probably would have bailed. But City Office did the right thing by cutting the distribution as it will now actually be able to retain some cash on its balance sheet rather than spending every dollar (and then some) on the distribution.

City Office REIT has structured its debt commitments pretty well. And although I can't be sure the common shareholders don't have anything to fear, I'm still relatively satisfied with how the preferred shareholders are protected by the almost $680M in equity ranked junior to the preferred shares and the fact that in excess of half of the portfolio isn't encumbered by mortgages.

I have a long position in City Office REIT's preferred shares, and I am not selling.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CIO.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.