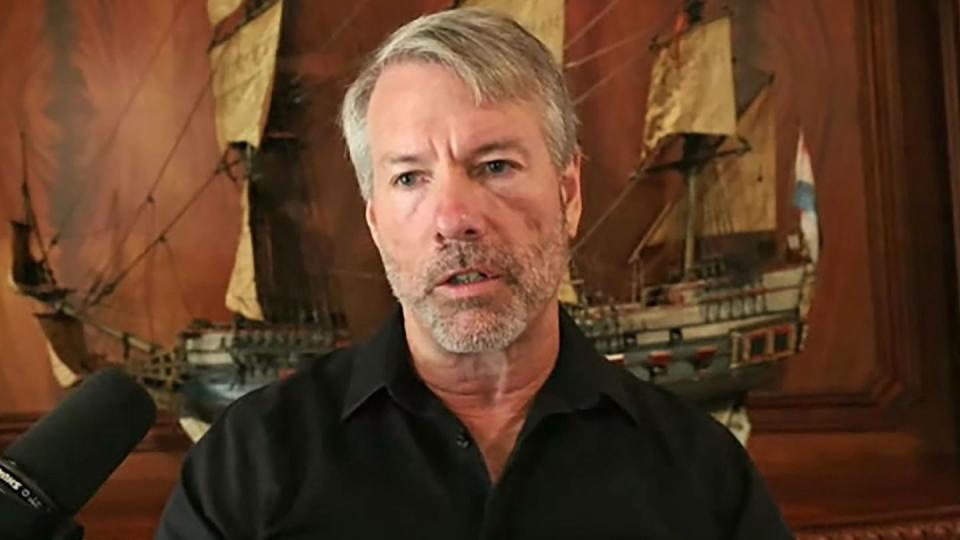

Crypto Industry Destined to Be Bitcoin Focused After SEC Actions: MicroStrategy Founder Michael Saylor

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- MSTR

- GC=F

Business-intelligence firm MicroStrategy's (MSTR) Founder and Executive Chairman Michael Saylor has said recent enforcement actions by U.S. regulators have made it clear that the crypto industry is destined to be rationalized down to a bitcoin (BTC)-focused industry.

"MicroStrategy's views since 2020 have been that the only institutional grade asset is bitcoin," said Saylor in an interview with Bloomberg on Tuesday. "It's pretty clear that the regulators don't see a legitimate path forward for cryptocurrencies ... And so the entire industry is kind of destined to be rationalized down to a bitcoin-focused industry with maybe half a dozen to a dozen other proof of work tokens."

Last week, the U.S. Security and Exchange Commission (SEC) filed lawsuits against Binance and Coinbase, the two largest crypto exchanges by market cap. A total of 19 tokens have been mentioned in the filings. Bitcoin isn't one of them. Previously, SEC chair Gary Gensler has said that bitcoin (BTC) is a commodity.

Saylor's MicroStrategy began buying bitcoin in 2020 while calling the cryptocurrency a million times better store of value than gold. The company now holds approximately 140,000 bitcoin worth about $4 billion. In March 2023, Saylor lost a bid to dismiss claims that he failed to pay personal income taxes, interest and penalties due for Washington, D.C. However, the court dismissed claims that Saylor and MicroStrategy had conspired to violate the law.

Saylor said that since 25,000 other cryptocurrencies (approximately) have been angling to position themselves as bitcoin or a better bitcoin, the public now understands that bitcoin is the next bitcoin. He said the "next logical step" is for bitcoin to multiply 10 times in value to $250,000.

"Eventually, I have confidence that the crypto exchanges will come around to realising that bitcoin really is the dominant asset in this space, and their business models are fine when bitcoin goes up by a factor of 10," Saylor said.

Read More: MicroStrategy Founder Michael Saylor Loses Court Bid to Dismiss DC Tax Evasion Claims

Yahoo Finance

Yahoo Finance