Markets React To CPI Ahead Of Central Bank Bonanza

Summary

- The somewhat muted initial reaction to CPI means the market was not expecting a hawkish surprise from the Fed anyway.

- Ahead of the US CPI data release, the US dollar index was already lower on the week after the major foreign currencies found some support in the last couple of weeks.

- The market is no longer convinced now that the Fed will deliver one final hike this summer. So, the dollar may fall further.

Orientfootage

By Fawad Razaqzada

The US dollar fell in the immediate reaction to Tuesday’s US CPI release, as the weaker-than-expected headline figure further reduced the odds of a Fed rate hike on Wednesday.

The somewhat muted initial reaction to CPI means the market was not expecting a hawkish surprise from the Fed anyway.

CPI Cools to 4%

While core CPI was a touch stronger at 5.3% (compared to 5.2% expected and 5.5% last), investors concentrated on the drop in headline inflation, which came in weaker than expected at 4.0%, down sharply from 4.9% recorded previously.

FOMC Unlikely to Hike Rates

CPI was probably one of - if not the - biggest risk events of the week. It had the potential to tilt the balance ahead of the FOMC announcement on Wednesday. Well, as it turned out, the weaker numbers did help to slash the odds of a rate hike on Wednesday to just 5% from around 25% before the data release. But it was never all just about the CPI and the rate decision itself. It is worth noting that we also have the quarterly staff forecasts, updated dot plot, and press conference to look forward to. These have the potential to move the dollar sharply.

Dollar Could Fall Further

The greenback dropped last week after the ISM PMIs, factory orders, jobless claims, and mixed non-farm payrolls report, and previously a dovish speech by the Fed Vice Chair Phillip Jefferson had all raised doubts over whether the Fed would hike interest rates again.

After Tuesday’s release of the US CPI, those doubts grew larger. The key question is whether a pause is now priced in.

With the Fed’s decision looming, and the ECB and BoJ to follow later in the week, traders shorting the dollar may be more inclined to book quick profits than would otherwise be the case.

That being said, the market is no longer convinced now that the Fed will deliver one final hike this summer. So, the dollar may fall anyway. But whether it does and how strongly will depend on (1) a surprise rate hike anyway and (2) signals about the July and subsequent FOMC rate decisions. To add another degree of uncertainty in the FX space, we also have rate decisions from the ECB and BoJ at the back end of the week to look forward to.

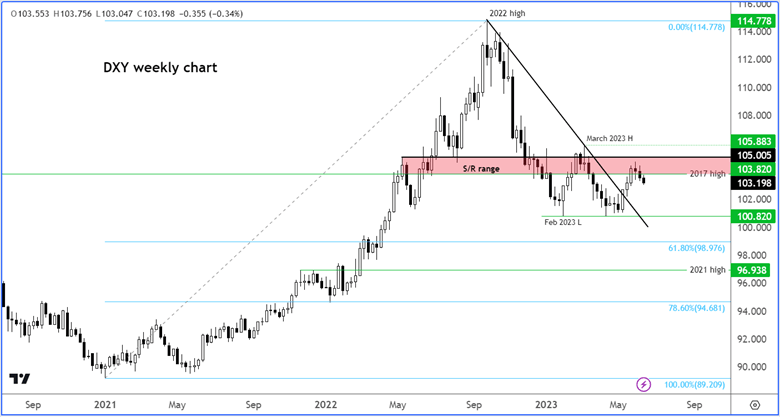

Dollar Index Extends Losses After CPI

Ahead of the just-released US CPI, the US dollar index was already lower on the week after the major foreign currencies found some support in the last couple of weeks. It then fell further once the data was released, although not significantly - at least by the time of this writing, anyway.

TradingView.com

PBOC Loosens Policy as Focus Turns To FOMC, ECB, and BOJ

The central bank bonanza was meant to start with the Fed on Wednesday, but the People’s Bank of China was the first mover overnight. In an unexpected decision, the PBOC cut a short-term lending rate for the first time in 10 months. China is obviously trying to restore confidence among investors after the post-pandemic recovery in the world's second-largest economy stalled.

The bigger moves in the markets are likely to be triggered by rate decisions from the Fed (Wednesday) and ECB (Thursday), while the potential for a surprise from the BoJ (Friday) should not be ruled out. This means that the likes of the EUR/USD and USD/JPY will need to be monitored closely this week. And don’t forget the GBP/USD, after a blowout UK jobs report earlier raised the probability of a big 50-basis point BoE rate hike to 25%, although I very much doubt the UK central bank would opt for a large hike.

ECB Set to Hike Rates By 25bps

Once the Fed’s decision is out of the way, the focus will turn to the ECB rate decision on Thursday. I agree with the consensus that the ECB will most likely hike interest rates by 25bp to lift the main deposit rate to 4%, its highest level since 2008. This would be the eighth rate hike in this cycle, with one more likely to be followed next month. It will be interesting to listen to Christine Lagarde, the ECB President, in what the central bank makes of the renewed weakness in German output and signs of disinflation across the eurozone. It could be that we will see a more dovish ECB than we are led to believe with their recent comments. But a revisit of 1.10 on the EUR/USD cannot be ruled out given the increased likelihood that the Fed will decide against a rate increase on Wednesday.

Originally published on MoneyShow.com

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by