Inspire Medical Systems: Valuation, Sentiment, Fundamental Factors Call For Re-Rating

Summary

- Inspire Medical has multiple catalysts in the pipeline that could see it attract investment.

- These center around fundamental, sentimental and valuation factors.

- The company could be fairly valued at $317/share, indicating potential mispricing.

- Reiterate buy.

FrankvandenBergh

Investment Summary

Since my last publication on Inspire Medical Systems, Inc. (NYSE:INSP), several updates have been folded into the investment thesis. These centre around the company's growth outlook and approvals for its Inspire system. The stock has climbed 41% since I revised the rating to buy in August last year. This was supported by robust fundamental, market-based findings. This is attractive, and given the data presented here today, has every reason to continue at the same pace going forward. Specifically, I am reiterating INSP as a buy on earnings power and asset factors, with these additional findings:

- Approval of the Inspire system for use in children with Down Syndrome;

- Expanded use of Inspire to the upper limit of apnoeic events, up from 65 events per hour to 100 events per hour (broader market); and

- Forward earnings factors demonstrated from its latest Q1 numbers.

These points have resulted in fundamental, sentimental and valuation–based changes to INSP's investment offering. Net-net, I am reiterating INSP as a buy, placing heavy weight on the factors discussed thus far. I am looking to $317 as the next price objective.

Figure 1.

Data: Updata

Catalysts for price change

Additional data requires an additional appraisal. It's as simple as that. For INSP, the new data is a healthy combo of fundamental and econometric sources. Starting with the quarter. Numbers were strong, with an 84% YoY gain in turnover to $127.9mm. The great news is, that's the highest quarterly growth rate post the pandemic came and went. Notably, management underscored growth from capital returns (from new centres) and customers shifting up the utilization curve on its existing centres, both valuable sources of revenue growth outside of price increases and volume output.

1. Fundamental catalysts

Aside from the label expansions discussed above, the total addressable market is now widened. This should prove to be a tailwind going forward in my informed opinion. Further, there are talking points from INSP's Q1 numbers.

Looking to the critical facts from Q1:

- INSP folded in another 68 U.S. centres bringing its total to 973 centres providing its therapy.

- It bolted on an additional 17 sales territories bringing the company's total sites to 242. As a tailwind going forward, INSP expects to add 12–14 sales territories per quarter going forward. This is tremendously bullish in my opinion. Q1 FY'23 average revenue per territory came to $0.53mm. On a comparable basis, Q1 FY'22 average revenue per territory was $0.39mm.

- The number of visitors to the company's website surpassed 3.4mm, which is significant. It recognized 19,000 physician contacts from this, an extra 76 contacts per day (assuming 250 work days per year).

- As a reminder, INSP uses its website as an introduction for patients, and to the adoption of its therapies. This monthly visit is on-par with the record visits seen after it poured capital into its national media campaign.

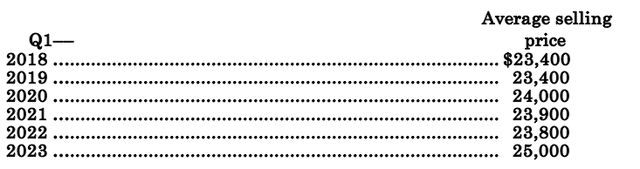

- Average selling price ("ASPs") is another tailwind moving forward. The company implemented its 5% price increase last year, recognized in Q1 [Table 1]. At this ASP, it implies the company booked 5,116 procedures, versus 2,920 on a comparable basis in Q1 last year.

It managed 84.4% gross on this, down ~100bps YoY but I am certainly not worried, as $0.84 on every $1 of revenue is one heck of a value proposition when you're looking at a near-doubling in sales projected from FY'22–'24.

Table 1. ISNP ASPs, Q1 2018–'23

Data: Author, INSP SEC Filings

Such brute underlying performance has opened the windows for more audacious forecasts. Management now sees full-year revenue to be in the range of $580mm–$590mm, calling for a 42%–45% YoY increase. Management was fairly transparent on how it intends to get there on the call, too:

- In the first quarter, it will increase capacity by adding 68 new implanting centres in the US, ending the quarter, with a total of 973 for the remainder of 2023, as mentioned earlier.

- It then expects to activate 52 centres to 56 centres per quarter.

That's about it. Simple to explain, yet boldly effective. And potentially difficult to pull off– which is why the return on the company's growth investments could pay off. It expects gross margin of 83–85% on this, again, very healthy to feed income down the P&L.

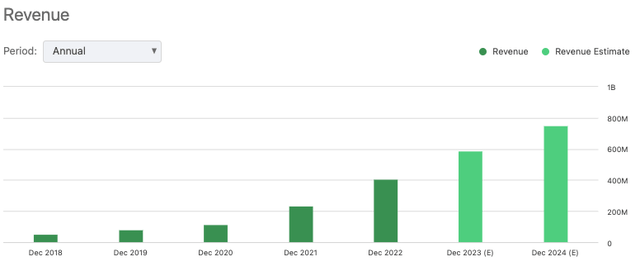

The ramp on consensus revenue estimates into FY'24 is titled at quite the axis, as you'll note in Figure 2. This would lead any intelligent investor to be immediately cautious. As is the conclusion to so many medical studies: further evidence is needed.

Figure 2. INSP consensus revenue estimates

Data: Seeking Alpha

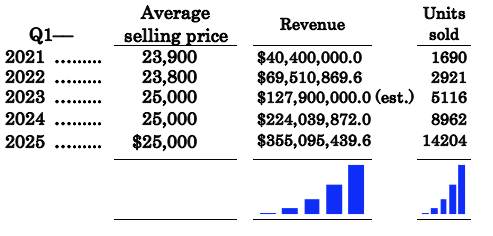

An exercise of thinking in first principles is very handy in this instance. First, the 5% price increase on ASP is bullish, as mentioned. Second, just on quarterly numbers alone, INSP has increased the number of units sold per quarter at an average 72% each period. Level 1 thinking would tell us this may or may not be sustainable going forward. Rolling these averages off at 20% per quarter into Q1 FY'24 and Q1 FY'25 respectively, the implied revenue ramp I am getting to resembles the consensus numbers, with $255mm in Q1 FY'24 and $355.4mm the year after.

Figure 3. Implied revenue estimates with diminishing growth rate to units sold

Note: Quarterly estimates shown. (Data: Author, INSP SEC Filings)

2. Sentiment catalysts

Briefly, the change in investor sentiment is reflected well in the spate of analyst revisions and the recent price action observed on the chart. For the latter, it tells me the market has revised its expectations higher for ISNP, critical to push its market valuation higher. More on this later.

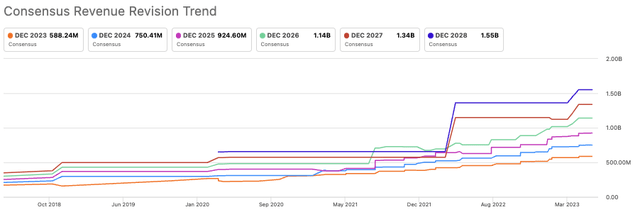

With the former, the informed investor crowd has certainly revised its outlook on INSP. There have been no less than 10 revisions to the company's revenue projections from sell-side analysts in the last 3-months. The average rating has shifted to $588mm this year, calling for 44% YoY growth in turnover.

The stock is also trading above all moving averages across all time frames, and is in the green in terms of price performance across all relevant time periods as well. The fact of the matter is INSP is getting bought hand over fist and investors are buying the company at higher multiples at each turning point in time. Options data is also strong with extreme depth in calls expiring June with strikes to $410, where most of the open interest is.

Changes in sentiment are one of the three to four catalysts needed to suggest a major change in price is to occur, or that the market has priced an equity incorrectly. This is certainly one evidence of this in my opinion.

Figure 3.

Data: Seeking Alpha

3. Valuation catalysts

The stock is changing hands at tremendous multiples that don't serve the underlying investment features well. For example, it is being sold at 14x forward sales, 16x book value, etc. To me, investors aren't looking at these multiples, instead are valuing the company in other measures. My estimation is that it is using revenue growth to value the company instead (especially seeing the attention observed in sentiment above).

The market is also an accurate judge of fair value over time. In the interims, however, it is often slow to act, and wrong in pricing. At the current market cap of $8.93Bn and a discount rate of 12%, the market expects $1.072Bn revenues from INSP over a coming period– in my view, this is a rolling 5-year period (1,072/0.12 = $8,930).

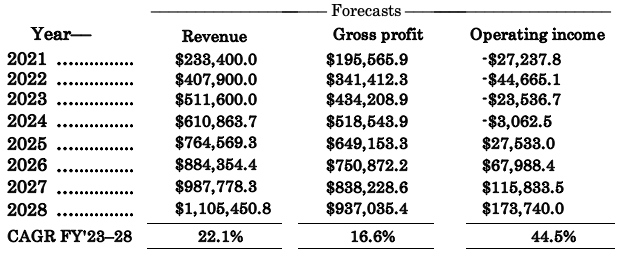

Looking to my own forecasts over the coming 5-years, I have the company to do $1.105Bn by FY'28, pulling to $937mm in gross and $173mm in operating income. Notably, this is ahead of consensus, and calls or 22% annual compounding rate in turnover into FY'28. At this comparable forecast, I am getting to $9.2Bn market valuation, or $317 per share, supporting the buy thesis.

Appendix 1. INSP forward growth estimates

Data: Author

In short

Net-net, evidence is sufficient to support buying INSP in my view. The critical facts show catalysts in fundamental, sentiment and valuation grounds– key to resulting in a price change. The company could be fairly priced at $317/share, and this would mean another leg up in the rally instigated in October. Looking to the company's remaining FY'23 results will be key to observing if it remains on the growth route. I have the company to do $511mm–$600mm in turnover this year, depending on units sold, all at $25,000 ASP. Reiterate buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INSP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.