LQDW: Appreciated Addition To The Buy-Write Arena, Sell On Lower Rates

Summary

- The iShares Investment Grade Corporate Bond Buywrite Strategy ETF is a new exchange-traded fund that offers a unique approach to investing in the fixed income market.

- The fund invests in an investment-grade corporate bond ETF and then writes covered calls on the name. This strategy allows LQDW to generate income from the option premium.

- One of the key risks associated with LQDW is that its performance could be hurt by a significant rally in corporate bond prices on the back of lower rates.

- LQDW is an innovative way to monetize volatility in the fixed income space.

- LQDW is a relatively new fund, so its performance and track record are limited.

Klaus Vedfelt

Thesis

The iShares Investment Grade Corporate Bond Buy-Write Strategy ETF (BATS:LQDW) is an exchange-traded fund. As its name suggests, the vehicle is a buy-write fund. Readers might be familiar with these vehicles from the equities space, where they abound in both the ETF and CEF format. Some of the better known equity buy-write funds are:

- Global X Russell 2000 Covered Call ETF (RYLD) - ETF format.

- Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV) - CEF format.

- Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX) - CEF format.

What is particular and innovative about LQDW is the fact that this instrument addresses the fixed income market. LQDW is in effect an investment grade corporate bond buy-write vehicle. That nomenclature is fairly long, but it boils down to the fact that LQDW has a large position in the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and then goes about writing covered calls on the name. It is a capital market, liquid version of selling vol on fixed income. We applaud this innovative fund, and it is set to do well under certain circumstances.

In this article we are going to analyze LQDW's holdings, its performance drivers and our view on the forward for the fund.

Analytics

- AUM: $0.08 billion.

- Sharpe Ratio: n/a (3Y).

- Std. Deviation: n/a (3Y).

- Yield: 3.55%.

- Premium/Discount to NAV: N/A.

- Z-Stat: N/A.

- Leverage Ratio: 0%.

- Composition: Fixed Income - Buy-Write Corporate IG Bonds.

- Duration: 8.5 yrs.

- Expense Ratio: 0.34%.

Performance Drivers for LQD and LQDW.

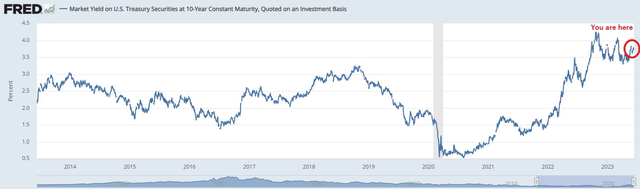

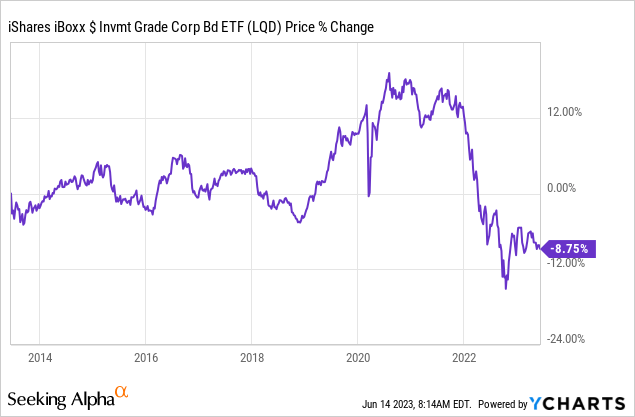

The iShares iBoxx $ Investment Grade Corporate Bond ETF has been thoroughly covered on the platform, suffice to say that interest rates and credit spreads are the main drivers. The fund has a duration of around 8.5 years, so let us have a look at how 10-year rates are looking:

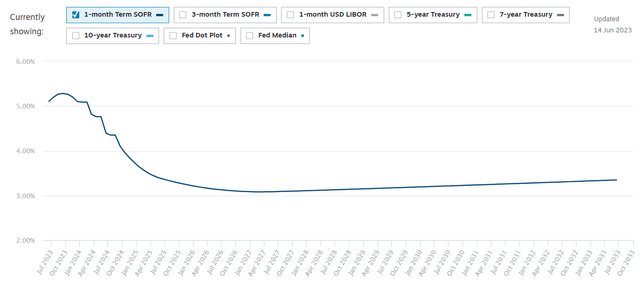

Although 10-year yields have retraced a bit since going over 4%, we can see that they spent most of the past decade under 3%! So we are somewhere around the top of the range of this point in the yield curve. The forward curve is telling us the future will yet again see lower yields:

While the above is the forward SOFR curve (as a proxy for Fed Funds), there is a concept of term premium and historic relationship between the front end of the curve and the 10-year point. We feel this summer we are going to see peak yields across the curve.

When rates start moving down (on the back of lower Fed target rates) we will get lower risk-free rates and potentially lower credit spreads. That is going to translate into a massive rally in LQD in our view:

We can see LQD having had a massive drawdown in 2022 from the above graph. Lower rates will see LQD re-capture some of the lost price.

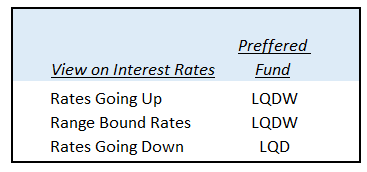

A significant and sustained rally in LQD is bad for LQDW. Why? For the same reason, sustained equity rallies are bad for equity buy-write funds. By virtue of writing calls, a buy-write fund has a capped upside. A buy-write fund does best in range bound markets. The best way to visualize the choice of funds in various interest rate scenarios is as follows:

View on Rates (Author)

As we can see from the 'Performance' section below, as rates rose in 2022, LQDW outperformed LQD, since it was able to add the option premiums to its returns. As rates decreased (and credit spreads contracted) in 2023, LQD outperformed LQDW. Ultimately, just like its equity peers, LQDW will have a capped upside in bull markets for its underlying risk factor, namely IG corporate bonds.

We find LQDW to be a great addition to the ETF universe, allowing retail investors to monetize fixed income volatility via an exchange-traded product. Volatility in the fixed income market has been suppressed for many years due to the low levels of Treasury yields. We believe we are going to have a bit of a regime change, where vol is going to be structurally higher for longer. This setup should greatly help LQDW via higher option premiums (higher vol translates into a higher premium, all else equal).

While market timing is impossible, we do think 2023 will see peak rates (the exact ultimate level is a bit debatable) and 2024 will see a healthy rally in bonds. We have been advocates of buying treasuries outright via several instruments, and feel a similar view is warranted here. Rates moving down favor LQD over LQDW here.

Holdings

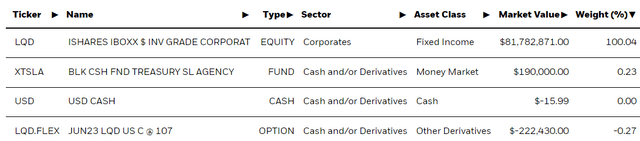

The fund has a very simple composition:

The fund holds virtually all its cash in a long LQD position, while it has a $107 strike LQD call written against its long position. If the call expires worthless, the fund pockets the premium. Otherwise, it will probably cash settle the loss.

Performance

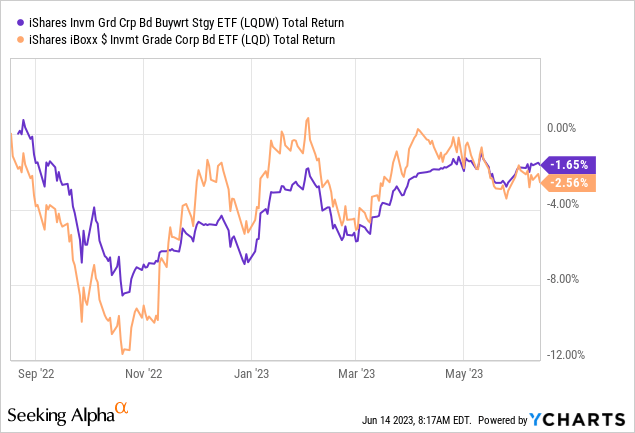

LQDW is a new fund, having IPO-ed in 2022, hence the performance data is fairly limited:

We can see LQDW hedging some of the drawdown in 2022 via the written option premium, but lagging as rates have re-traced some of the move. In fairness, we have also seen a substantial tightening in credit spreads this year.

Conclusion

LQDW is an exchange-traded fund. The vehicle is an innovative-fixed income buy-write fund. LQDW holds a large position in LQD and then writes covered calls on the name. Via this mechanism, the fund is able to monetize corporate IG fixed income volatility. Similarly to its more established peers in the equity space, the fund does best in a range bound market. LQDW IPO-ed last year so its historic data is limited, but we can see how the fund smoothed out the rise in rates in 2022, while giving up some of the upside in corporate bonds in 2023. Do expect this theme to continue, given its composition and build. We expect lower rates in 2024, hence prefer LQD over LQDW here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.