Why No One Is Talking About Capital Southwest's Credit Upgrade?

Summary

- CSWC's 11% yield is safe and a great addition to every income investor's portfolio.

- Recent upgrade by Fitch and Moody's is a testament to the quality of the stock.

- The company's stellar management, 98% floating rate debt portfolio, and balance sheet has allowed them to reward shareholders in the current macro environment.

8vFanI

Introduction

Capital Southwest (NASDAQ:CSWC) is an internally managed business development company (BDC) focused on providing flexible financing solutions to support the acquisition and growth of middle market businesses. Basically, CSWC acts as a bank for small to medium-sized businesses and distressed companies. These small business development companies are very important staples in our economy. Congress created them in 1980 to fuel job growth and give small & medium-sized businesses access to capital not accessible by well-known banks like JPMorgan (JPM) and Bank of America (BAC), etc.

#1: They’re Internally Managed

BDCs can be either externally or internally managed. Internally managed companies are typically deemed “better” because the company actually hires its own internal management team to manage the company’s assets. Additionally, their pay is fully disclosed to investors, a requirement by the SEC. They also have operating expenses on its income statement, which is easily accessible to shareholders. Externally managed BDCs outsource these duties to a third party, and typically pay incremental management and incentive fees on dollars invested while internally managed BDC do not. Internally managed BDCs also seem to be more aligned with investors as they typically pursue growth and profitability benefiting shareholders. One risk to be aware of with internally managed companies is its generosity to management. Some BDCs can overcompensate to its executives, allocating upwards of 20%. This can be seen as red flags and dilute existing shareholders.

#2: Stellar Management

One of the many things I like about CSWC is their growing dividend. Over the last eight years since the spinoff, CSWC has increased the regular dividend 26 times and never cut the dividend, even during the pandemic when several companies either cut, or suspended theirs. Over the same 8-year period, they’ve also paid a special or supplemental 19 times. Something we like to say in the military during awards presentations is to mention a person’s "unwavering devotion to duty". CSWC’s management comes to mind when I think of this. They’ve continued to reward shareholders these last few years and I see this trend continuing for the foreseeable future. Management appears conservative, but also very aligned with shareholder priorities. During Q4, the company’s most recent earnings call, the board declared a $0.05 per share supplemental dividend for the month of June. This comes after raising the regular dividend by 1.9% to $0.54. The dividend is well covered by E.P.S. of $0.65 for Q4. This equates to roughly an 83% payout ratio, not including the supplemental dividend. Well below the sector average. Management also managed to grow the total portfolio by 29% to over $1.2 billion, from $957 million the prior year.

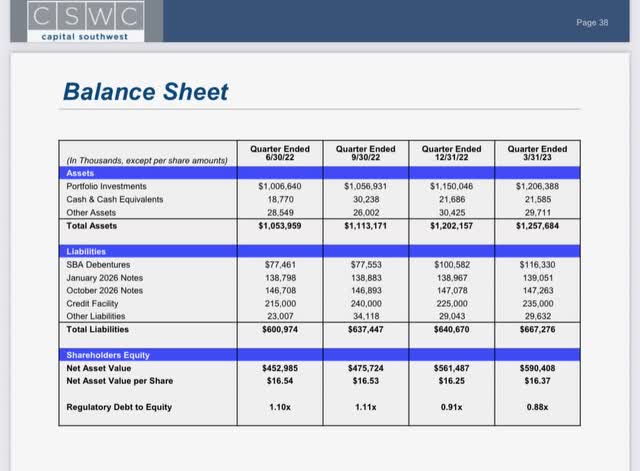

Furthermore, they also managed to strengthen the balance sheet through a variety of capital market activities. Through their Equity ATM program & as an underwritten public offering of their common stock, they raised more than $207 million in gross equity proceeds. This greatly reduced the company’s leverage to 0.88 total debt-to-equity by end of the year. Compared to 1.16 to 1 (debt-to-equity) from a year prior. In my opinion, based on management’s long-term performance, balance sheet leverage & flexibility, I believe this was instrumental in Moody’s decision to assign CSWC an investment grade rating of Baa3 back in March. Following suit, Fitch also assigned them an investment grade long-term issuer rating of BBB- with a stable outlook as of June 13, 2023. All in all, management has done a tremendous job and are some of the best, if not the best, in the BDC sector. Even though Ares Capital (ARCC) is considered by many the best quality BDC, CSWC is "giving them a run for their money". By the looks of it, Fitch and Moody’s also agree.

#3: 5-Year Total Return Doubles the S&P 500

Since the start of the pandemic in early 2020, CSWC has sustained their regular dividend. Impressively, they also paid multiple supplemental dividends: including a $0.50 end of year 2021 for a total of $0.97! Given management’s track record, I would not be surprised if shareholders received a small special dividend at the end of this year. I also can see management remain conservative and maintain the current supplemental $0.05 for the remainder of the year.

BDCs are sensitive to high interest rates, as this typically benefits them. And CSWC is no different since 98% of their portfolio is floating rate debt. Although I view this as a tailwind, investors have to keep an eye out for a BDC’s rise in non-accruals loans. This can be a headwind if rates remain too high for too long, as ARCC mentioned during their latest earnings that their non accruals rose modestly to 2.3% from 1.7% during last quarter.

With a current dividend yield of almost 11%, I see this stock as undervalued. Investors could see CSWC as a potential yield trap, and not sustainable in the long term. I believe this to be false as they have vastly outperformed both the S&P 500 and ARCC. This makes it a huge buy in my opinion. BDCs’ are often considered risky investments, but this is one of the best quality BDCs that deserves a spot in every income investor’s portfolio.

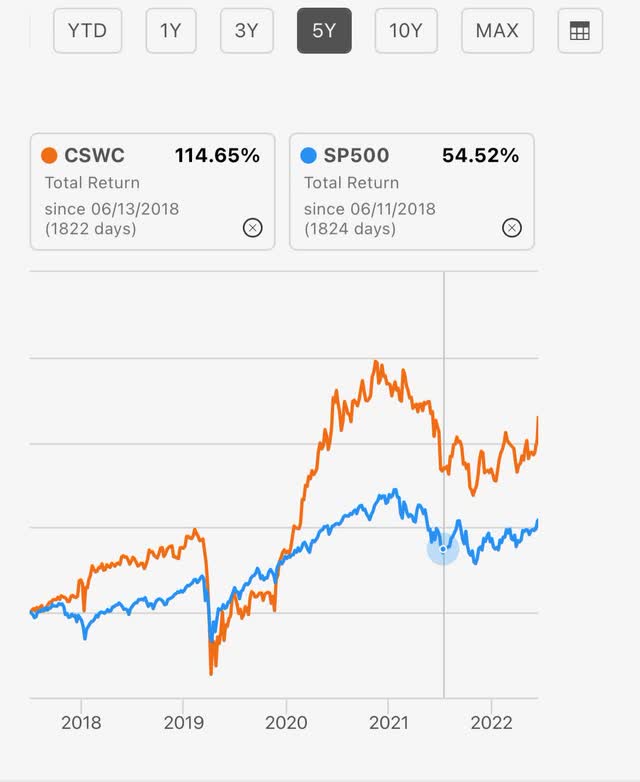

Here is CSWC’s 5-year total return vs. the S&P:

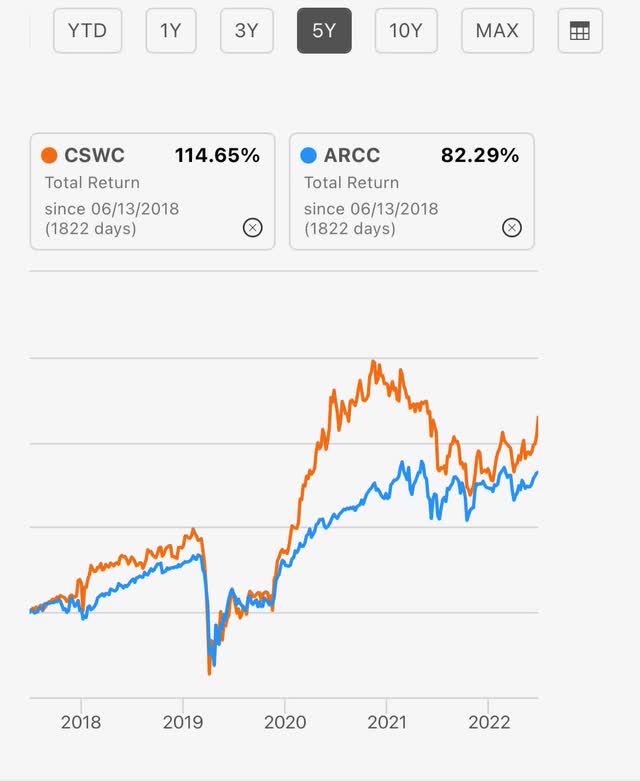

Since 2018, CSWC has more than doubled the return of the S&P. When put into perspective, that’s a tremendous ROI considering the current market state and high interest rate environment. Here is a look at CSWC compared to the largest and most well-known BDC, Ares Capital:

Even though ARCC also beat the S&P, CSWC beats ARCC, who many consider an exceptional BDC, by over 30%. In the past month the share price is up almost 12%. Many are speaking of a bull market as early as the fall of this year. With the recent CPI report showing moderation in inflation, the Fed could potentially hold interest rates here and begin to cut end of the year. If so, investors could see an upside upwards of 15%.

Investor Takeaway

CSWC is an underrated BDC in my opinion. Seeking alpha authors mention this stock but oftentimes they are overshadowed by ARCC. In the last three months, the stock has been upgraded by two out of three of the major credit agencies Moody's and Fitch. This speaks volumes to the quality of the company. I expect management to navigate the current macro environment and continue to reward shareholders with supplemental dividends in the near future. If you’re an income investor I think CSWC stock deserves a spot in your portfolio whether in a taxable account or Roth IRA. I expect the company to continue to grow its portfolio and raise the dividend for the long term.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARCC, CSWC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.