SPY: Moderate Gains In Store?

Summary

- The SPDR® S&P 500 ETF Trust is primed to receive support from lower implied risk premiums amid an interest rate slowdown from the Federal Reserve.

- Credit spreads were already retreating before the Fed's interest rate decision. Moreover, par rates have stabilized.

- The Fed Valuation model and Shiller's P/E provide a juxtaposition.

- Based on the interest rate cycle, capital scarcity might abate in early 2024, resulting in a more positive outlook on corporate earnings.

- Risks remain. However, a broad-based analysis suggests that the S&P 500 and the SPDR S&P 500 ETF Trust are potentially undervalued.

- Looking for a helping hand in the market? Members of The Factor Investing Hub get exclusive ideas and guidance to navigate any climate. Learn More »

Pgiam/iStock via Getty Images

The S&P 500's (SP500) year-to-date surge might have surprised many, as the talk of the town at the turn of the year was geared toward a sustained market drawdown until an interest rate pivot occurred. Nonetheless, here we are, five months later, and the S&P 500 is up by approximately 14% year-to-date. However, the question now becomes: Is the S&P 500 still investible after its latest surge?

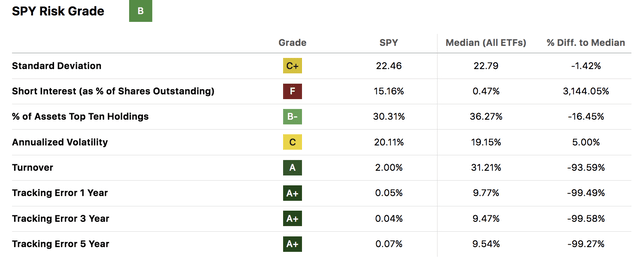

Generally speaking, assessments of the S&P 500 and the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) are one and the same. The tracking errors below substantiate my claim and provide an illustration of the proximities between the two. As such, today's article serves both S&P 500 research seekers and SPY investors/prospective investors.

SPY Vs. S&P 500 Tracking (Seeking Alpha)

Valuations

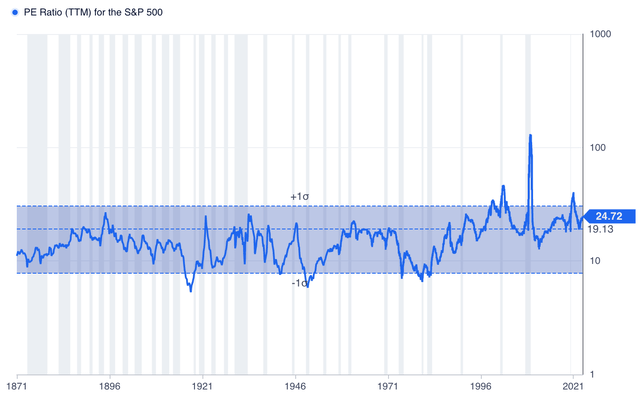

Based on a justified P/E ratio generated by the Fed Model, which uses the reciprocal of the U.S. 10-year yield (to support a Justified P/E Ratio), the S&P 500 is in undervalued territory. At the time of writing this article, the U.S. 10-year yield (US10Y) stood at roughly 3.825%, providing us with a justified P/E of 26.14, which is higher than the S&P 500's current P/E ratio of 24.72, conveying that the index still has room to run into.

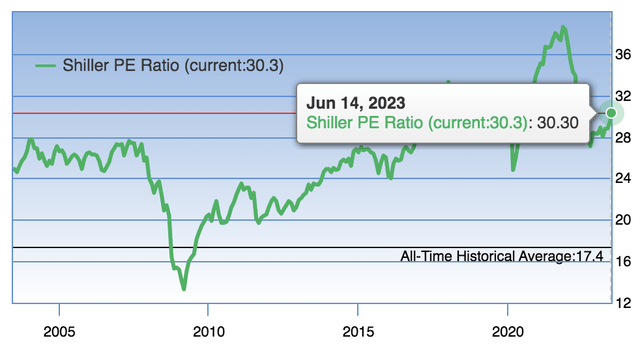

Despite the Fed Model's justified P/E's bullish case, Shiller's P/E, otherwise known as the CAPE model, provides a juxtaposition by declaring the index overvalued. The CAPE model divides the index's current price by its inflation-adjusted average 10-year earnings to find a midpoint. Based on current market data, CAPE suggests that the index is overvalued, implying that much of its earnings per share support is due to inflationary tailwinds instead of real growth.

Risk Premiums Assessed

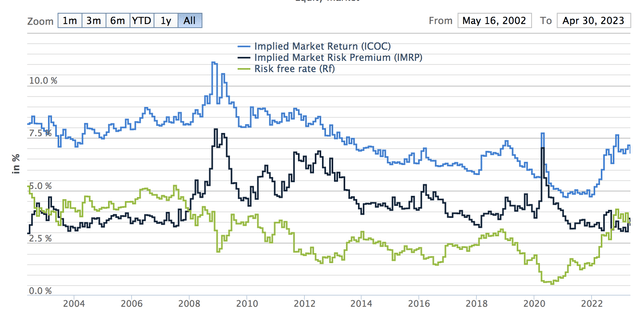

A telling event for U.S. risk premiums was the Federal Reserve's decision to halt its interest rate hikes at a range between 5% and 5.25%. In addition, the Fed stated that rates will likely peak at 5.6%, with a cut starting in early 2024.

The reason this is significant is due to the fact that benchmark rates form the basis of financial market risk premiums. A lower real risk-free rate combined with inflation, inflation uncertainty, and equity risk premiums determines much of the S&P 500's fair value. They are interlinked, and a pending stall in interest rates might allow stock market participants to adjust their risk premiums lower.

Furthermore, Par rates and CDS values have started tapering. The prior is a maturity-matched discount rate that sets a bond's value equal to zero (a risk premium in basic terms). At the same time, the latter is the credit risk embodied by a yield spread between corporate and treasury bonds with similar maturities. Stabilization of the prior and slowing of the latter shows that overall risk premiums, including the S&P 500's equity risk premium, might slow, concurrently causing upward valuation.

U.S. Par Rates (NASDAQ) CDS Spreads (worldgovernmentbonds.com)

Portfolio Analysis

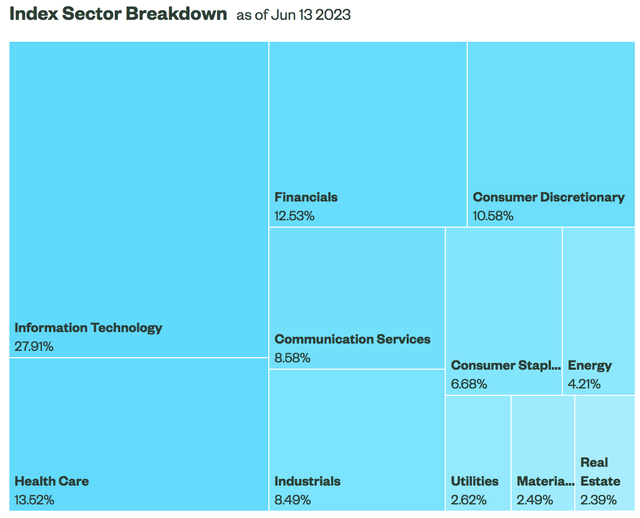

The risk-return attributes of a diversified portfolio such as the SPY can usually be characterized by three elements, namely style (i.e., growth vs value), sector, and security specific. As the S&P 500 is broadly diversified with a mixed blend of companies, your best bet is to analyze its sector and style exposure.

S&P 500 Sector Exposure (State Street)

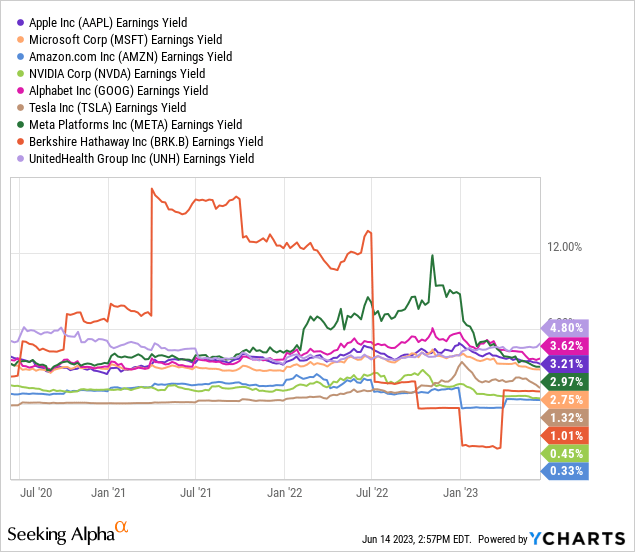

At first glance, it's evident that the S&P 500 is top-heavy, with technology stocks filling more than a quarter of its portfolio. In our view, a pending interest rate pivot will provide support to most of the S&P 500's technology names and revive the dips their earnings yields have experienced because of an assumed improvement in consumer sentiment.

Furthermore, the index's consumer discretionary constituents might also benefit from lower interest rates as more accessibility to capital might drive up the expected earnings of companies like Ford (F), Tesla (TSLA), and Nike (NKE), to name a few. Additionally, lower risk premiums might drive investors toward risk-on bets within the consumer discretionary space.

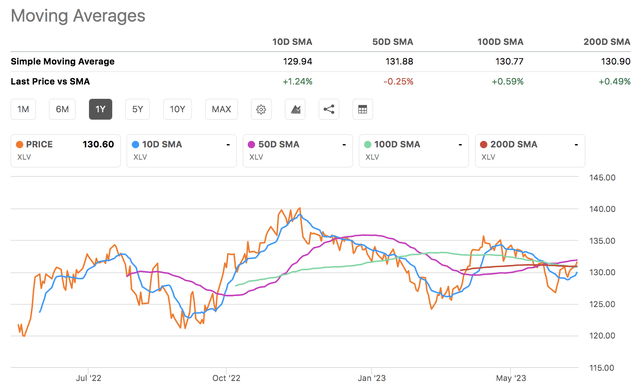

Although positives will likely exist in most pockets of the S&P 500, we are less bullish on sectors like energy and health care. In our view, a post-Russia-Ukraine scenario of a more even supply-demand of energy will get the better of the segment. Furthermore, the healthcare sector was considered a safe haven during the rate-hike cycle and a beneficiary during covid; therefore, based on those factors and the sector's technical price levels, we think it's time for a retreat.

- Sidenote: See the chart below for the Health Care Select Sector SPDR® Fund ETF's (NYSE:XLV) price levels.

XLV's Moving Averages (Seeking Alpha)

Noteworthy Risks

Although various risks were outlined within the text, additional risks relating to the S&P 500 and the SPY must be considered.

Firstly, the risk premium theory framework provided is an isolated study, and lower implied risk premiums do not guarantee higher stock prices. In contrast, risk premiums (especially equity risk premiums) surged earlier this year amid speculation of a credit crisis. Yet, stocks surged and contradicted everything we know about valuation theory.

U.S. Equity Risk Premiums Ending April 30 (marketriskpremia.com)

Another risk worth considering is that the S&P 500 and SPY alike have experienced a significant year-to-date bounce. Keep in mind that the SPY, for one has a beta coefficient of merely 1, meaning its latest surge possibly extends what an asset of its volatility should, especially considering the short timeframe.

Final Word

A pending interest rate pivot might have a chain effect on other market risk premiums, including the equity risk premium, concurrently causing higher justified valuations. As things stand, the Fed model deems the S&P 500 and SPY alike undervalued; however, Shiller's P/E argues the opposite.

Furthermore, as capital scarcity abates, the S&P 500's will likely benefit from its substantial technology and consumer cyclical exposure. In addition, lower risk premiums might adjust some of the previously overvalued stocks into undervalued territory.

Our consensus is that the SPDR S&P 500 ETF Trust and the S&P 500 are both set to illustrate solid gains in the coming quarters.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: Global Equities, Fixed Income, ETFs, and REITs.

Methods: Factor Analysis, Fundamental, Valuation, Street Gossip, and Common Sense.

Our work on Seeking Alpha consists of independent research and not financial advice.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.