Russell 2000: All-Time Highs Ahead

Summary

- Many market participants anticipate an upcoming recession.

- I am concerned about the consensus on this prediction.

- I believe the recession may still be a year or more away.

- With the economy continuing to be strong and while rates are flat, value stocks will outperform.

Spencer Platt

Market Thesis

Over the last year, I've been hearing so many market participants saying that a recession is coming. In fact, many have called it "the most anticipated recession ever". As a contrarian anytime I see that everyone is on one side of the market, especially if that is the side I'm on, it gets me worried. Although I do agree with the multi-year narrative that eventually we'll have a recession, I believe that it is still a year or potentially further away. The reality is that over the last year or longer many bears have been saying a recession is coming and that earnings will dump lower, but we've consistently seen higher rates, a resilient economy, and stable earnings. For now, the narrative just isn't playing out.

Now I believe we're entering a Goldilocks period, as I've called it in previous write-ups. The last time I heard the term Goldilocks was in 2019 when inflation was low and the Fed was doing a "mid-course correction". This meant lower rates and low inflation, which is bullish for both duration assets and risk assets, of which equities are both the longest duration asset and a risk asset. The term Goldilocks was meant to describe something as just right; in that, an economy that is too hot has high inflation, which is a problem, and one that is too cold has an economic contraction, which is also a problem. A Goldilocks economy has low inflation, low rates, and economic growth. While rates aren't currently low, the Fed could pause causing rates to stabilize here, all while the perception is that inflation is falling, and the economy is still standing strong. A Goldilocks economy and market is really a head fake since it doesn't last long as eventually one of the pillars of the trade break and it heads in the other direction, but for the time being, we haven't seen that.

I find this to be the most convincing 6-9 month bull case for the market, and that's coming from someone who does eventually believe that a recession will occur, just way later than what the market is pricing in.

Fed Funds Rate

The market has widely priced in a that the Fed pauses for the next few months and then lowers rates. My view differs in that I do believe that the Fed will keep rates stable for the next few months, but afterwards I believe they will raise rates again. The reason I think this is that while inflation has come down from its highs it's nowhere near 2% and if it continues to stay at elevated levels the Fed might be forced to do some more rate hikes to show that they are trying to fight it even though it might not do much as this inflation is fiscally driven. Regardless, in the short term, the Fed is likely to pause due to inflation coming down to 5% and to avert a banking crisis. I believe this will be a boon to the equity market.

My main disagreement with rates is actually with the bond market. For a long time, the view by market participants has been that higher rates = a strong economy, so the long bond goes lower, and rate cuts = a bad economy, so the long bond does well. The reason for this is that rate cuts normally happen after the economy has tanked, and vice versa for higher rates. Even though the bond market is pricing in rates staying flat for the next few months, I disagree with the bond market as it sees this as a bad sign, while I actually see it as a good sign. We know the bond market sees this as a bad sign for the economy as the yield curve is inverted; whereas equity traders are actually looking at rates staying flat as a positive sign that will provide a boon to the economy. Even though the bond market is often seen as the "smart market" I would have to agree with the equity market here, as the economic data has consistently proven the bond market wrong over the last year.

Economic Data

The biggest positive I see is that economic data consistently comes out well above expectations. This really tells us that the "real economy" isn't being that impacted by higher rates. I believe that the "real economy" isn't that impacted by rates, as wages continue to go up and unemployment is low. When the labor market is doing well, the average Joe and Jane don't have to worry about consumer debt as they are making enough from their work to pay expenses. The only area where I do see things that are more pricy is the housing market, which is due to higher mortgage rates, otherwise, wage inflation seems to be outpacing consumer inflation making it so that the average Joe and Jane aren't that impacted by higher rates. The other thing to keep in mind is that loose fiscal policy started the high inflation, and we still have loose fiscal policy with the very weak negotiations that the Republicans put up during the debt ceiling hike. This loose fiscal policy will continue to act as a boon to wage inflation.

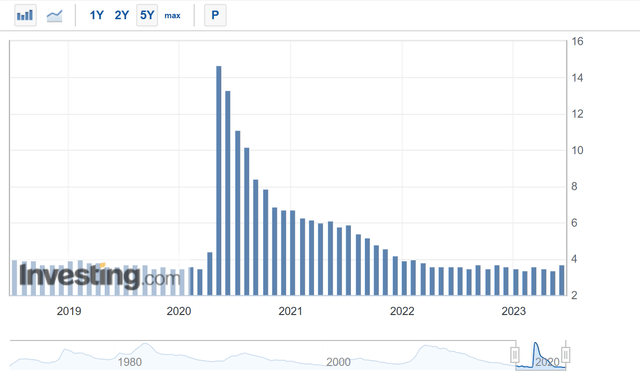

We see this playing out in the unemployment rate:

unemployment rate (Investing.com)

As can be seen, the unemployment rate is back down to 2019 levels and is staying there even with tighter monetary policy. As I've mentioned in previous write-ups unemployment has gone from a lagging indicator to a leading indicator. Whereas previously we would see the market bottom, then unemployment top, now we're seeing that consumer spending is driving the economy. Consumer spending is of course driven by the labor market. On top of that flows into equities are now more passive than in the past, so instead of active managers pricing in the far-out future the equity market is trading on flows from passive vehicles. Investment in these passive vehicles is driven by the strength of the labor market.

S&P 500 earnings are stable and even starting to trend higher:

This really goes to show that the consumer isn't deterred by fears of a potential recession or higher rates; seeing as though consumer spending impacts earnings and the wealth effect, until we see consumer spending and consumer sentiment go down the equity market will continue to rise.

Why The Russell 2000?

Throughout the rally over the last few months, we've seen that tech companies have outperformed. This firstly is due to the hype around AI, which I feel at this point has been fully priced in. The second reason is that tech companies are long-duration assets in that when interest rates go down these companies perform well due to a lower discount rate.

My belief is that we're going to go through a sector rotation where "real economy" stocks will outperform tech stocks or highly financialized stocks. This is because the economy continues to be strong while rates are high. As I mentioned earlier in the article I believe that rates will be flat for a few months then there will be a start of a new hiking cycle. In that environment long-duration stocks also known as "growth stocks" won't perform well due to higher rates, but companies that are directly tied to consumer spending in the economy, which most would refer to as "value stocks" would perform well due to higher earnings along with the fact that "value stocks" are not very impacted from interest rates.

The Bottom Line

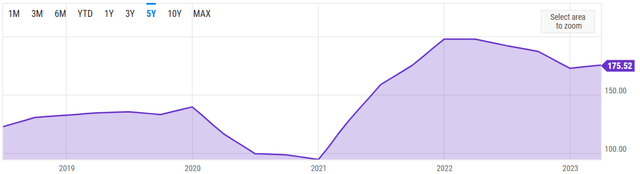

The bottom line here is that over the next few months, the market will go through a Goldilocks period whereby rates will stay flat and economic data will stay positive. This creates a great environment for equities and out of all the indices, the Russell 2000 is the one which I'm most bullish on due to having direct exposure to the consumer without the duration risk. With where the price action has consolidated over the last year, there is a direct pathway to all-time highs in the index.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.