Stem: On The Right Track With All Eyes On H2 2023

Summary

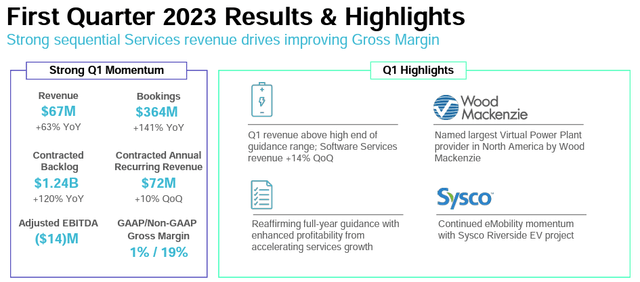

- Stem reported Q1 revenues of $67 million, beating estimates, and reaffirmed its 2023 guidance with solid bookings growth and increasing software service revenues.

- The US should install an energy storage capacity of approximately 160GWh by 2030. This long-term trend cannot go unnoticed.

- The $16 target price is based on a growing market and the company's capital-light business model.

Fly View Productions/iStock via Getty Images

Since our last update released in mid-April, Stem (NYSE:STEM) seems to be back on track, and on a stock price performance basis, the company delivered a plus 30% appreciation. Last time, we decided to lower our target price; confirming a long-term buy rating. Despite that, Stem's management forecasted a positive H2 EBITDA; however, we were more cautious about 2023 numbers, deriving a yearly EBITDA estimate of -$25 million with an order backlog of $1.5 billion. Based on our internal model with lower top-line sales and a lower EBITDA projection, we decided to reduce our EPS estimate to $0.75 and $0.5 in 2023 and 2024 respectively and our buy rating decreased from $20 to $16 per share. In Q2, Stem announced a new Green Convertible Senior Notes, presented the Q1 numbers, and unveiled the Sysco eMobility Riverside EV project.

Very briefly, the company exceeded Wall Street estimates both at top-line sales and gross margin ($67 million vs. consensus at $63 million). GM reached 19% compared to an average consensus of 13%. The turnover beat was mainly due to higher-than-expected hardware revenues. In detail, hardware revenue reached $53 million in the quarter, while service software sales were at $15 million. After a solid Q1, we should say that sales represented only 11% of the 2023 estimated turnover.

Source: Stem Q1 results presentation

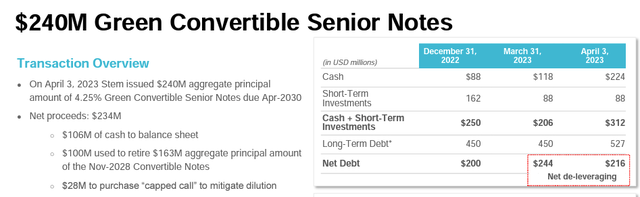

What is important to emphasize is that the company issued a $240 million convertible in April 2023. In numbers, this green bond has a 4.25% interest payment. On a balance sheet basis, this results in approximately $106 million higher cash and cash equivalents. At first sight, this is a lower number than the amount raised. Why? Stem is using the green bond to retire a $163 million November 2028 convertible note. In addition, there were $28 million capped call fees and additional service costs. To sum up, the new green bond will reduce Stem's net debt by only $28 million to $216 million. Here at the Lab, we believe that Stem's management is likely to not use the surplus capital due to the ongoing macro concerns.

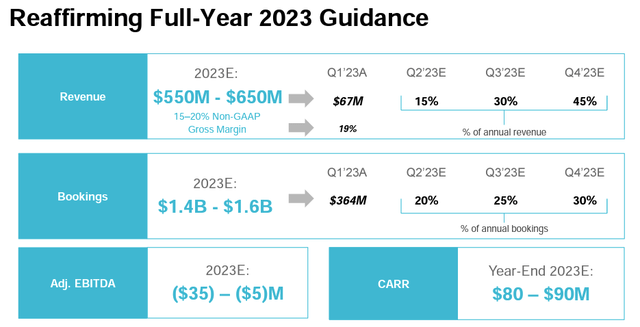

In addition, Stem reaffirmed its 2023 outlook with revenue in the range between $550 and 650 million, implying a +65% growth on a yearly basis and a non-GAAP GM of 15-20% (it was 13% in 2022). More importantly, the company confirmed their expectation to be adjusted positively on EBITDA H2. This is a key milestone, in our view.

Changes to our Estimates

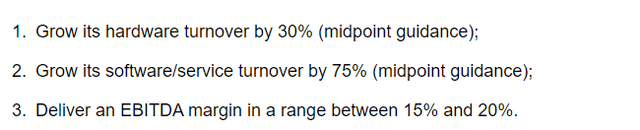

We are forecasting H2 2023 revenue at a plus 75%. This is supported by management targets and by the fact that the company also broke out software and storage revenue. In Q1, the former sales delivered a plus 7% on a quarterly basis, while the latter was up by 22%. Therefore, the company is pursuing more software-only contracts. This is an asset-light business that is not requiring higher working capital commitments. This is also emphasized by Stem's long-term segment growth rates expectation:

Conclusion, Valuation, and Risks

Looking at the industry opportunity, the US should install an energy storage capacity of ~160GW by 2030. Our Stem model forecasts an installed capacity of 8.5GWh by the end of 2025. Considering the company's competitive position, here at the Lab, we believe that this is a reasonable assumption. In addition, on top-line sales, we see that a significant portion of Stem sales will be software-only. For the above reason, we continue to see 2025 sales at $1.1 billion, with an EBITDA of $150 million. On the short-term horizon, Wall Street's focus remains on the company's ability to turn an adjusted EBITDA in positive territory in 2023 second half-year. Order backlog is still solid with $1.2 billion, with $364 million of new bookings in the quarter, in line with the communicated target. Therefore, following the quarter released, we slightly revise our 2023-25 adj. EBITDA estimates to $(21)/75/150 million from $(25)/60/150 million. As a reminder, we value Stem on a forecasted 2025 EV/EBITDA due to the fact that the company is not currently profitable. Given the small changes in 2023 numbers, we decided to leave unchanged our target price at $16 per share. On the downside, our risks include higher customer acquisition costs, long sales cycles, higher-than-expected corporate expenses, higher competition, supply chain constraints, and Athena software reliability with dependency on Amazon Web Services.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.