Easterly Government Properties: Not Enough Catalysts For Outperformance

Summary

- Easterly Government Properties owns and operates properties leased primarily to agencies in the United States Government.

- Shares in the stock provide investors with a dividend yield of about 7.3%. Though attractive, I view the sustainability of the payout with skepticism.

- The risk of cut is viewed to be already priced into the stock, given 1-YR share price declines of over 20%.

- Despite the pullback, a limited upside is seen due to the lack of meaningful catalysts.

designer491/iStock via Getty Images

Easterly Government Properties (NYSE:DEA) owns and operates properties that are primarily leased to agencies in the United States Government ("USG").

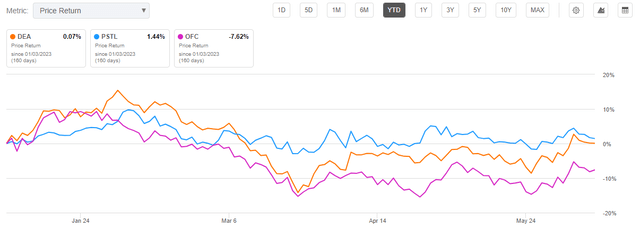

Other noteworthy names that maintain similar levels of exposure to the USG include Postal Realty Trust (PSTL) and Corporate Office Properties Trust (OFC). All three names are lagging broader indexes on a YTD basis, with more pronounced losses noted in OFC.

Seeking Alpha - YTD Returns Of DEA Compared To Peers

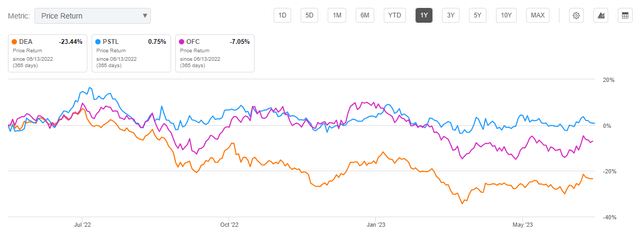

Over the past year, on the other hand, DEA is down over 20%.

Seeking Alpha - 1-YR Returns Of DEA Compared To Peers

Shares in the stock offer investors an attractive dividend yield. At today's prices, the payout is about 7.3%. This compares favorably to the yield offered by both PSTL and OFC. The stock also trades in between PSTL and OFC from a valuation perspective. In prior coverage on the stock, I noted disappointing guidance as one factor for remaining neutral. The stock has since lost nearly 4%, though it is up 3% on the month. Despite the gains, I continue to view shares as a "hold." Muted Q1 results and a dividend that appears at-risk leave investors little to get excited about in the coming months.

DEA Key Portfolio Metrics And Recent Results

The overall portfolio remained consistent with expectations through Q1. Leased rates stood at 98% and their existing leases had a weighted average remaining lease term of 10.4 years.

Some would point to their office exposure, which accounts for over 50% of their annualized lease income, as one concern. But their portfolio is built around mission-critical properties, which are inherently geared towards in-person work. As such, the threat of hybrid/remote working arrangements is mostly a non-factor. This is evidenced further by their high overall leased rate.

Overall activity during Q1 was generally muted. They did, however, execute one large lease renewal in their Jackson, Tennessee market for a new 20-year term.

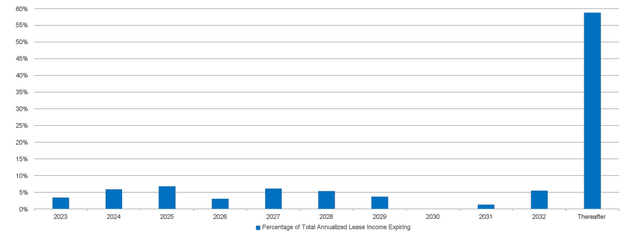

Looking ahead, DEA has two expirations to address in 2023. This equates to about 2.8% of annualized rents. Their 2024 expiration schedule is more active, at 5.7%. This should provide DEA an attractive opportunity for rental mark-up.

Q1FY23 Investor Supplement - Lease Expiration Schedule

Aside from the renewal activity, DEA further improved their capital structure via the reduction of their variable rate exposure. At the end of 2022, floating rates represented 6.5% of their total stack. This has since been reduced to 4% via swap agreements.

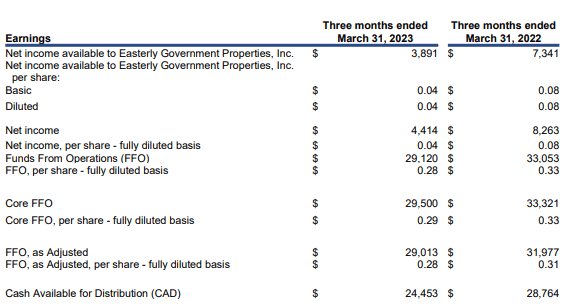

Despite the reduced exposure, interest expense still runs high and is one contributing factor to the decline in YOY core funds from operations ("FFO"), which came in at $0.29/share. This compares to $0.33/share in the same period last year.

Q1FY23 Investor Supplement - Summary Of Quarterly Results

Looking ahead, management maintained their full-year guidance. This sees full-year core FFO at a midpoint of $1.14/share. In addition, the guidance assumes the dilutive effect of the closing of one property and assumes up to +$15M in development-related investment for the year.

Is DEA Stock Dividend Safe?

The current quarterly payout stands at $0.265/share. At current pricing, this represents an annualized yield of about 7.3%. On their recent call, management reaffirmed their commitment to the payout when questioned, noting the strength and staying power of their cash flows.

From a coverage standpoint, the payout appears covered through core FFO. In Q1, for example, DEA generated $0.29/share in core FFO. That would indicate a payout ratio of over 90%. High but still fully covered.

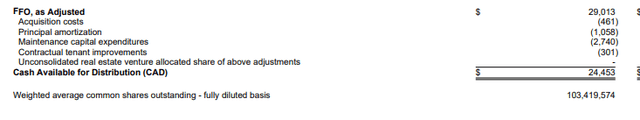

I am more skeptical, however. Their cash available for distribution ("CAD"), which incorporates recurring maintenance expenditures ("capex"), landed at $0.236/share in Q1.

Q1FY23 Investor Supplement - Breakdown Of Cash Available For Distribution In Q1

The +$2.7M capex was the driving factor in this. YOY, it was up +$1.8M. This most likely pertains to their ongoing FDA development project in Atlanta, which is estimated to run through the third quarter of 2025. At present, it's their only active development. But it already appears to be a drain on cash, despite still being in the design phase.

On the Q1 earnings release, management also alluded to the possibility of further opportunities in the development front in future periods. This could potentially come in the form of taking over distressed projects from privately held competitors who may have become over-levered in recent periods.

DEA had over +450M in debt capacity, as well as nearly +$40M in unsettled forward equity at the end of Q1. Their overall leverage position is on the higher side at 7.2x, as measured by their net debt/EBITDA ratio. But nearly all their outstanding debt is fixed, either through the stated terms or through swaps.

While their capital structure could likely support the additional developments, the dividend is viewed more at risk, given more stressed overall coverage levels.

Is DEA A Buy, Sell, Or Hold?

Easterly doesn't offer a lot to get excited about. In one sense, that's a positive. After all, portfolio leased rates are holding at 98%. Cash flows are resilient due to the USG exposure. And extended lease terms minimize non-renewal risks. From this perspective, the stock would make sense as a defensive addition to an investor's portfolio.

Yet the stock is down over 20% over the past year. This underperforms both their niche counterparts, PSTL and OFC. In my view, the declines could be reasonably attributable to skepticism surrounding the dividend. In other words, the market is pricing in an impending dividend cut.

At 7.3%, the yield is attractive but, in my view, unsustainable. For one, the payout currently exceeds CAD. That, itself, is an issue. Next, DEA appears committed to developments. This is not a negative, per se. But it, nevertheless, serves as a competing use of cash.

Furthermore, there is one large maturity coming up in 2024. While the current capital structure appears conducive to a roll, the Board may opt for cash preservation out of an abundance of caution. Though management affirmed their commitment to the payout on their last earnings release, I remain more skeptical.

If a cut is already priced in, would shares, therefore, be a buy? In my view, they aren't. Though they trade at a discount to PSTL, they command a sizeable premium to OFC. And in a period where investors are inevitably choosier about where to allocate investment dollars, I'd prefer to employ capital to OFC over DEA. Consensus estimates on DEA see upside potential of just 2.5% from current trading levels. The upside in OFC, on the other hand, is seen at nearly 20%.

Though DEA may turn higher on positive market sentiment, I don't see enough catalysts to propel shares to market beating levels. Shares, therefore, are viewed as a "hold."

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.