The Power Of Buybacks: AutoZone's Dividend-Free Advantage

Summary

- AutoZone, sometimes overlooked, presents a bright future in the auto parts industry, supported by strong cash flow and share buybacks, boosting its impressive performance.

- With rising demand for replacement parts, a growing average vehicle age, and a continuous consumer need for maintenance, AutoZone benefits from long-term tailwinds.

- As a wealth compounder, AutoZone consistently outperforms, driven by its exceptional financials and commitment to providing excellent customer service, positioning it as a leading player in the market.

Bruce Bennett

Introduction

Whenever I write articles, I always try to incorporate some macroeconomic aspects and some personal stories and experiences. In this article, I'm going to start by admitting a major mistake I've made: not caring enough for AutoZone (NYSE:AZO).

This is my first article on AutoZone, as I've ignored the company for a very long time. While I always knew what the company was about (the bigger picture), I never cared to dive deeper. Its stock price never seemed cheap, and I was always biased against car parts, as I thought: how great can it be?

Due to the emerging trend of electric vehicles, long-term demand for parts will decline. And, in general, I didn't care much for cyclical consumer stocks. I would rather own companies further up the supply chain.

While I still like to own companies further up the supply chain, I was wrong about everything else. The auto parts business is fantastic. It has a bright future, and AZO is a fantastic company. While it doesn't pay a dividend, it has boosted returns through buybacks.

Despite the current backdrop of stubborn inflation and dampened consumer sentiment, this environment of economic conditions could potentially pave the way for more advantageous buying opportunities on the horizon.

Although I prefer dividends, I have put AZO on my watchlist, as I'm interested in owning a piece of this company.

In this article, I'll give you the details!

Longer-Term Auto Parts Tailwinds

The US is a perfect nation for consumer-oriented companies. Roughly 70% of its GDP consists of household consumption.

On top of that, America is full of cars. The United States has more than 830 cars per 1,000 people, which makes it number two among major nations (excluding small countries like Monaco, Liechtenstein, and San Marino).

Furthermore, there is secular growth backed by the increasing average age of motor vehicles.

In April, the Wall Street Journal highlighted some of these trends.

Essentially, the demand for replacement parts has risen as drivers are holding onto their cars for longer periods. While used-vehicle prices have become more moderate, higher interest rates have made cars less affordable.

The average interest rate for financing a used car increased to 11.4% in March (it's still close to these levels), compared to 8.1% the previous year. This has led to an average monthly payment of $556, $13 higher than a year ago.

As a result, consumers with low credit scores are falling behind on payments, causing auto lenders to tighten their credit standards. Consequently, there is a larger pool of drivers who need to maintain their existing vehicles.

The average age of vehicles on the road has reached a record high of 12.2 years, according to S&P Global Mobility. The wear and tear on cars are expected to continue as traffic recovers.

Wall Street Journal

Furthermore, the share of vehicles in the four to 11-year range, which represents the sweet spot for the auto aftermarket, has increased annually since 2019. In 2020, these vehicles accounted for 41.4% of all US vehicles in operation, up from 37% in 2019.

In other words, even if the EV adoption accelerates, I see no threat to the longer-term tailwinds benefiting AutoZone and its peers.

AutoZone Is A Wealth Compounder

With a market cap of $44 billion, AutoZone is one of the biggest consumer stocks on the market. The company manages a network of more than 6,900 stores in the United States, Brazil, and Mexico.

The majority of each store's space is dedicated to selling automotive parts, with additional sections for maintenance items, accessories, and non-automotive products.

AutoZone's stores, which follow a standardized design to allow customers to know what they can expect in each store, are equipped with Z-net, an electronic catalog that allows employees to efficiently look up parts and provide job solutions. The stores also use a computerized Point-of-Sale System and Store Management System to improve inventory control and enhance customer service.

Furthermore, AutoZone's marketing and merchandising strategy emphasizes customer service, providing trustworthy advice, and offering quality parts at great value, which makes sense as it's a consumer business.

To achieve this, the company tailors its inventory to local market demands and strives to be the value leader in the industry. Targeted advertising, loyalty programs, and promotions are key components of their marketing approach.

Adding to that, the company has efficient supply chains.

Merchandise selection and purchasing are centralized in the store support centers. AutoZone maintains a diverse supply chain and has alternative sources of supply for most products. Its distribution centers replenish store inventory multiple times per week, ensuring product availability.

This is something smaller stores cannot compete with. We're seeing the same in other areas like DIY home improvement and consumer staples.

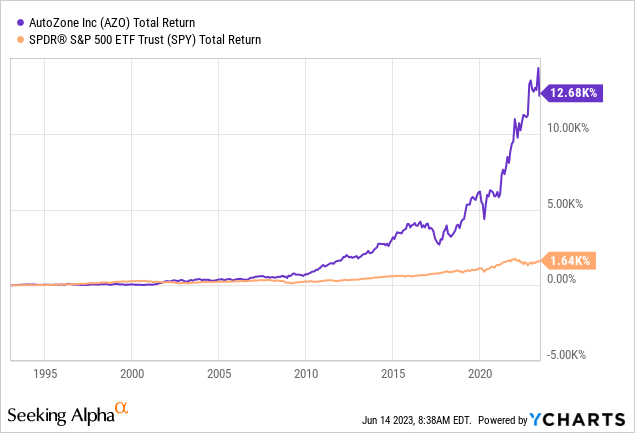

Since the early 1990s, the stock has returned almost 13,000%, which beat the market by a huge margin.

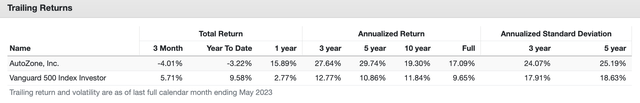

Even better, this outperformance has proven to be consistent. Looking at the table below, we see that AZO shares have consistently outperformed the market. Over the past ten years, AZO shares have returned 19.3% per year. That number has risen to a stunning 29.7% over the past three years - boosted by the pandemic. Furthermore, while the volatility is obviously higher compared to the S&P 500, it's relatively low for a cyclical consumer stock.

Portfolio Visualizer

With all of this in mind, we see that AZO is a wealth compounder.

However, what is a compounder?

In a 2016 article, Morgan Stanley (MS) discussed the value of compounders in an uncertain world. While it's seven years later now, one part of their paper stood out. The way they defined a compounder:

[...] which exhibit characteristics such as strong franchise durability, high cash flow generation, low capital intensity and minimal financial leverage, have generated superior risk-adjusted returns across the economic cycle.

As we already established that AZO has superior risk-adjusted returns, we can now work our way to its financials.

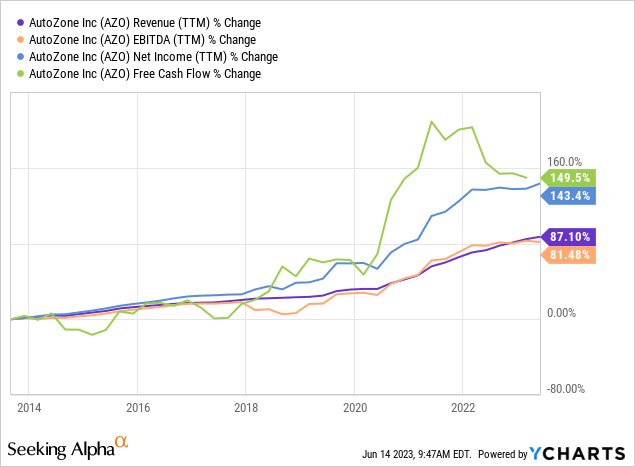

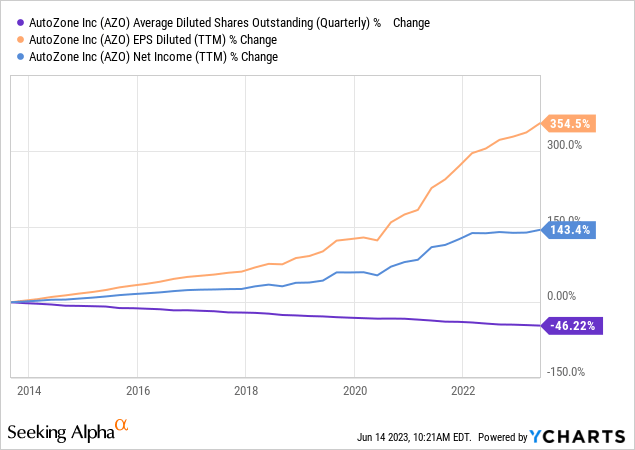

Over the past ten years, the company has grown its revenue by 88%. Thanks to higher margins, it has boosted net income by 143%. Free cash flow has risen by roughly 150%.

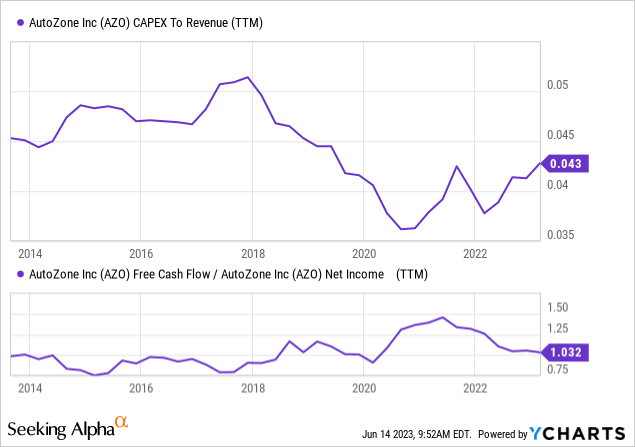

Not only that, but the company consistently generates more free cash flow than net income (>100% conversion rate). Prior to the pandemic, that number was close to 75%, which is already satisfying. Just 4% of its revenue is used for CapEx.

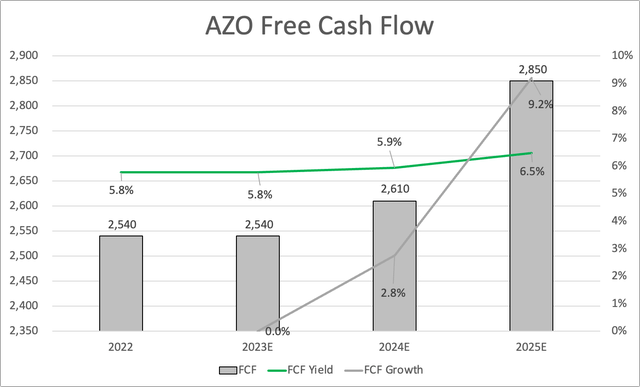

Furthermore, ignoring the expected surge in free cash flow after this year, the company is expected to generate roughly $2.5 billion in free cash flow this year, which indicates a 5.8% free cash flow yield. Next year, free cash flow is expected to grow by 2.8%. That number is expected to accelerate to more than 9% in 2025.

Leo Nelissen

Given that the company has a healthy net leverage ratio of 1.7x 2023E EBITDA, it does not have to prioritize debtholders over shareholders.

It also generates enough free cash flow to distribute a juicy dividend.

However, AZO does not pay a dividend. It repurchases shares, which has significantly contributed to its phenomenal share price performance.

Over the past ten years, AZO has bought back almost half of its shares. This has caused earnings per share to rise 350%. Total earnings rose by 144%, as we already briefly discussed.

In other words, the company has everything we're looking for in a compounder.

The problem is that the company is currently struggling a bit with consumer weakness, which is why shares are 12% below their 52-week high. That's not a lot, but it still warrants a closer look.

Valuation & Current Developments

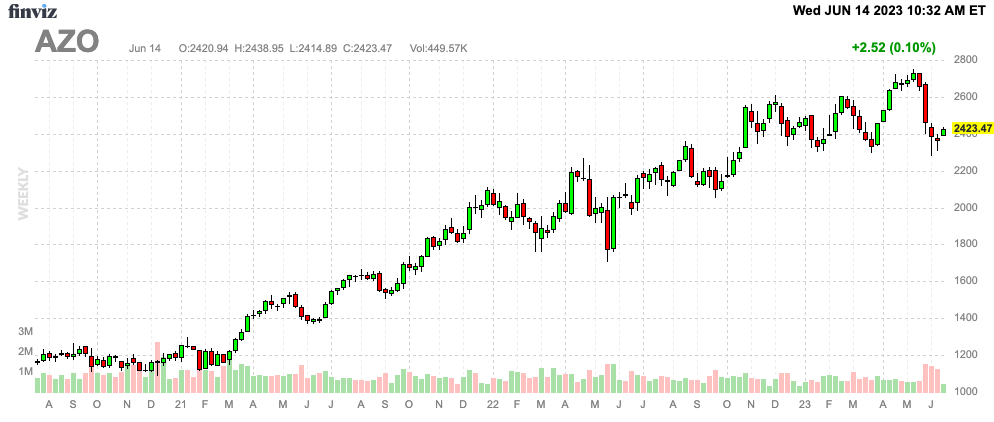

In its third fiscal quarter, the company ran into some headwinds. The earnings release and subsequent earnings call were the reason why the stock is currently trading lower. Prior to its earnings, the stock price hit an all-time high.

FINVIZ

With that said, the results weren't that bad - especially not considering how poor the consumer is doing - in general.

AutoZone's third-quarter results showed total sales growth of 5.8%, including a domestic same-store sales comp of 1.9%.

Although the topline results were slightly below expectations due to cool and wet weather in March, management noted that sales improved later in the quarter with better weather conditions.

Operating profit grew by more than 9%, while EPS increased by 17.5%, marking the highest growth rate in over a year.

March stood out as a challenging month, with cool weather impacting sales. Despite a greater than 3% comp in February, March experienced a negative 1% comp, which recovered to just under 4% in April and early May.

The Northeastern and Midwestern markets had slower growth compared to the rest of the country, affecting both the DIY and commercial businesses.

The West Coast performed in line with other markets. The average ticket grew by 4% in retail and commercial, a decrease of 1% from the previous year.

One thing that drove down the stock price was the company's comments. For example, AutoZone noted that the commercial business faced headwinds during the quarter, resulting in disappointing growth.

Factors such as rising interest rates and high used car prices affected certain sectors of the business.

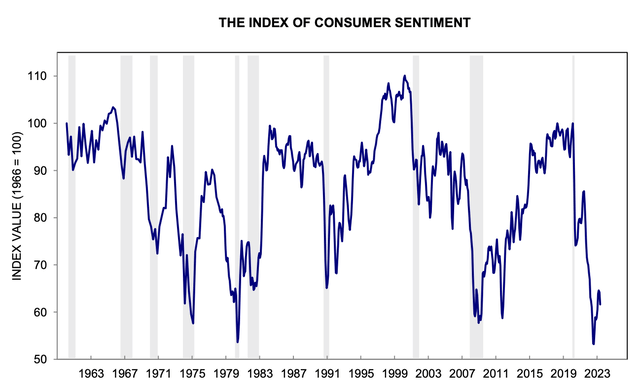

Also, with regard to my previous comments, this is what consumer confidence looks like:

University of Michigan

Additionally, rapid growth in recent years caused some tried and true disciplines to be unintentionally de-emphasized. To reignite topline growth, AutoZone aims to focus on flawless execution and implement initiatives in both the retail and commercial sectors, which is all the company can do. The rest is up to the economy.

Furthermore, the company commented on inflationary pressures.

AutoZone experienced mid-single-digit pricing inflation in line with the cost of goods in the third quarter. Both pricing inflation and cost of goods are expected to decrease in the fourth quarter as the company laps the onset of high inflation from the previous year.

Unfortunately, inflation, particularly wage inflation, is expected to persist but slow down as the economy slows, which essentially is what my macro thesis is built on. Inflation is likely more sticky than the market believes, making it likely that more economic damage is needed to get inflation rates down.

With that in mind, the company is expanding and working on its plan to consistently grow on a long-term basis.

For example, the company's commercial business benefited from its supply chain. With 85 mega hub locations and plans to open 22 to 25 new mega hubs in the fiscal year 2023, AutoZone aims to reach 200 mega hubs supplemented by 300 regular hubs.

What's interesting is that the company's aggressive growth in the past few decades has still left a lot of room for growth. During its earnings call, the company expressed its commitment to being the largest player in the commercial business over the long run, given its market share of less than 5%. The company believes it can grow ahead of the market, which historically sees a 4.0% to 4.5% growth rate.

After working my way through quite a few consumer stocks in the past few years, it's surprising how small the market share of some major players is, which they can exploit by implementing next-gen technologies, advanced supply chains, and by treating customers well.

Once companies figure out a winning strategy, they become profitable and can use free cash flow to further boost their capabilities. It's like playing Monopoly. Once you're doing well, it gets easier as you can keep buying houses and hotels. It's hard to stop these players.

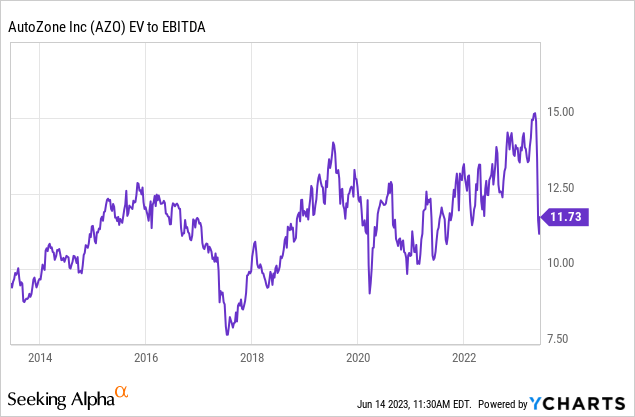

When it comes to the valuation, we're dealing with a 12x multiple using 2024 estimates. This means its $44 billion market cap, $6.3 billion in net debt, and $4.2 billion in EBITDA.

This valuation is fair but not something special for two reasons:

- I'm using 2024 numbers, which come with moderate growth expectations (8% EBITDA growth versus 2023).

- Economic growth could further pressure these expectations and result in lower-than-expected results going forward.

I'm not saying that AZO will report disappointing numbers, but the risks are elevated.

Hence, I'm not yet buying AZO shares for my portfolio or the portfolios that I manage/advise.

The current consensus price target is $2,773, which is 14% above the current price. I think that's fair, but it doesn't take away my concerns regarding the bigger picture.

I might miss potential profits if the stock does take off, but I'm willing to take that risk. It's also why my rating remains neutral for the time being. Long-term, I'm bullish and expect AZO to outperform its peers and the market.

Takeaway

My initial neglect of AutoZone was a major mistake. While I had reservations about the car parts industry and its vulnerability to electric vehicle trends, I now realize the tremendous potential of the auto parts business.

AutoZone, despite not paying dividends, has proven to be a wealth compounder through its share buybacks and impressive returns. The company capitalizes on the robust demand for replacement parts, driven by factors such as longer vehicle lifespans and affordability challenges for new cars.

With a strong market presence, customer-focused strategies, efficient supply chains, and consistent financial growth, AutoZone has all the qualities of a compounder.

However, current consumer weakness and potential risks associated with inflation and economic growth temper my immediate investment decision.

While I remain neutral for now, I expect AutoZone to outperform its peers and the market in the long run.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.