British American Tobacco Vs. Philip Morris: One Seems More Undervalued

Summary

- Philip Morris and British American Tobacco are both giants in the tobacco market, with a focus on transitioning to less harmful alternatives and offering high dividends.

- Philip Morris has a more attractive smoke-less product portfolio and is more focused on the future, while British American Tobacco is still heavily reliant on combustible tobacco.

- One of them seems far too undervalued.

wundervisuals/E+ via Getty Images

As many may know, Philip Morris (NYSE:PM) and British American Tobacco (NYSE:BTI) are two giants in the tobacco market and come from a successful past. Both are still heavily dependent on the sale of combustible tobacco, but it is clear that they intend to move toward alternatives that are less harmful to health and more ethically and socially valued. But this is not the only common trait; in fact, both are highly indebted and issue a very high and attractive dividend.

Anyway, although there are similarities, comparing them thoroughly I will show you that they have important divergences. I personally have invested in both but not with the same weight: one of them is far more undervalued.

The article will be structured into a series of themes within which the comparison between the two companies will take place:

- Combustible Tobacco Market.

- Next-generation products.

- Valuation by discounted cash flow.

- Sustainability and dividend growth.

- Debt analysis.

Combustible tobacco market

The harms of smoking have been known for decades, and as people have become more aware, interest in this deadly vice has declined. Unfortunately, however, it is clear that the problem has not been eradicated altogether.

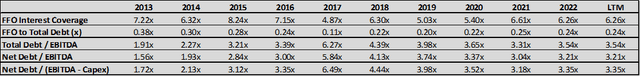

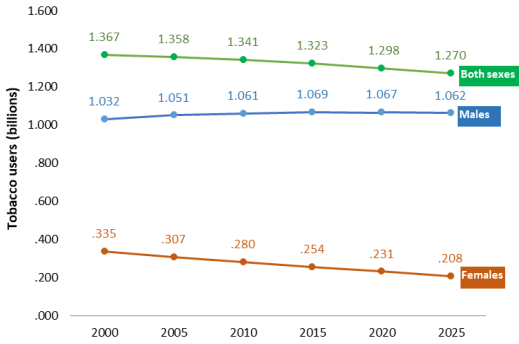

WHO global report on trends in prevalence of tobacco use 2000-2025, fourth edition

The percentage of smokers within the various countries around the world is declining for most of them and is estimated to continue to decline, however, two key aspects should be considered.

The first is that having a sharp decrease in percentage terms of smokers for each country does not mean that there are fewer smokers overall. It is important to keep in mind that the world population varies over time: in 2000 it was about 6.14 billion people, in 2000 it was 7.79 billion.

WHO global report on trends in prevalence of tobacco use 2000-2025, fourth edition

In fact, in 2020 there were about 1.29 billion tobacco users, while in 2000 there were about 1.36 billion: an almost insignificant change even though in percentage terms there are far fewer smokers.

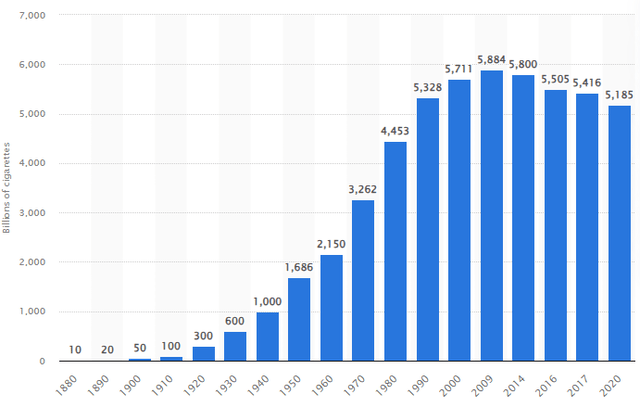

Global cigarette consumption is declining, but it remains at very high levels, and tobacco companies can still make billions and billions of dollars from this market.

Paradoxically, although their consumers are slowly declining, their revenues are following the opposite trend thanks to continuous price increases per pack. Suffice it to say that for the cigarette market alone, total revenues are expected to be $0.83tn in 2023, and annual growth of 2.30% is expected until 2027.

The second aspect that must be considered when evaluating this market is its inelastic demand because of the addictive nature of smoking. Smokers have a physical addiction to nicotine and certainly will not give up buying a pack of cigarettes if its price increases by a few cents. Moreover, it is extremely difficult for a smoker to suddenly quit smoking, which is why it is unlikely for this market to become unprofitable in the years to come. There are still too many smokers to believe that in the next 5-10-15 years tobacco companies will stop making money from this market; moreover, in the East they are still far behind in the fight against tobacco.

Having ascertained that this market although in decline is likely to remain a huge money-making opportunity, let me now show you what this means for Philip Morris and British American Tobacco. I start with the former.

Philip Morris operates in this market through the Marlboro, Parliament, Bond Street, Chesterfield, L&M, Lark, and Philip Morris brands. In 2018, the international cigarette market share was 27.40% while in 2022 it dropped to 23.70%.

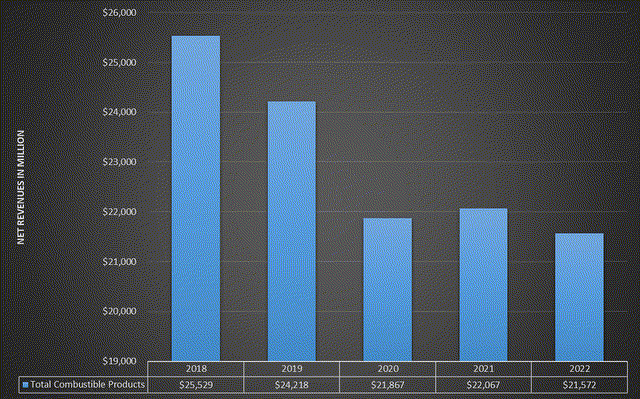

Data obtained from each Philip Morris annual report

In addition to the 370 basis point drop in market share, net revenue from combustible products is also declining, albeit at a rather slow pace from 2020 onward.

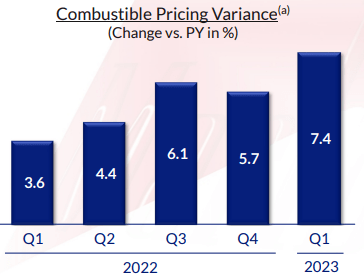

Philip Morris Q1 2023

Continued price increases in recent quarters are partially covering up declining sales volumes, which is why combustible products still remain a valuable source of revenue. Although Philip Morris seems quite far ahead in making itself independent of this segment compared to its peers, these revenues still account for about 65% of total revenues. Profit margins remain high, and from this segment the company manages to finance investments in other, less health-damaging products.

According to the words of CFO Emmanuel Babeau leveraging pricing power will be the strategy to keep revenues from this segment stable. Demand is resilient in spite of everything as does market share:

The Marlboro market share was a bit down, but I don't think that is clearly reflecting at that stage a pressure on the premium product of our portfolio. And we've been increasing price as you have seen in a very significant manner. Of course, competition not immediately or not totally responding to our price increase that can have an impact on our market share, but I would say so far, we have the feeling that in a highly inflationary environment, the consumer is ticking as normal and is not seeing as an issue to see also price increase on his tobacco product.

In short, Philip Morris's strategy seems to try to squeeze as much of this market as possible before focusing fully on selling products that are less harmful to health. Different story for British American Tobacco.

The latter operates mainly through the Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Camel, Natural American Spirit, Newport, Vogue, and Viceroy brands.

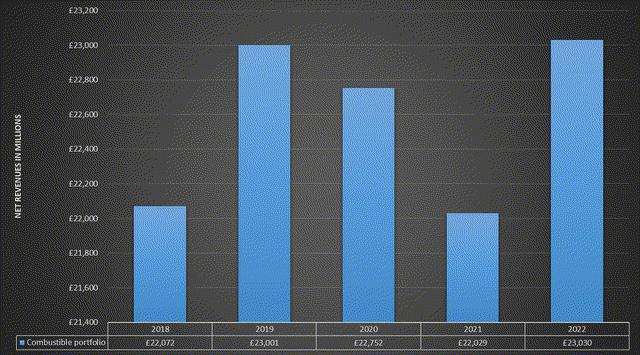

Data obtained from each British American Tobacco annual report

Unlike Philip Morris, its combustible portfolio has even generated an improvement in net revenues over the past five years. We are certainly not talking about strong growth, but we could not expect better. While this is a plus point, it should be pointed out that the combustible portfolio still has a very high presence in total revenues, namely 83%.

Overall, the two companies are trying to pursue the same goal, which is to be less dependent on combustible tobacco, but through different strategies that require different time frames:

- British American Tobacco still appears to be actively involved in its historical segment, but in recent years it is also directing its focus to less harmful products. I expect in its case that the transition will be more gradual.

- Philip Morris I believe is much more involved toward the growth of next generation products rather than consolidating its position in the combustible tobacco market. In my opinion in its case the transition will be faster and in the next 3-4 years cigarette sales may no longer be the main source of revenue.

This different approach is also reflected in the investment choices of the two companies, and British American Tobacco's shareholding in ITC is evidence of this.

ITC is an Indian fast-moving consumer goods company and its earnings come mainly from the sale of combustible tobacco. Among the leading cigarette manufacturers in India, ITC has a whopping 84% market share based on sales. British American Tobacco is its largest shareholder with 23.96% and has a significant gain from this stake as ITC's price per share has risen rapidly in recent years.

However, although this may seem to be the right time to sell at a profit, the company is not intent on doing so as it considers this participation as a long-term investment. On this aspect, the words of CEO Tadeu Marroco during the conference call a few days ago are clear:

We consider the investment in ITC at this stage more than a financial investment. We consider it a strategic one. And why do we do that? Well first of all because of the size of the Indian market, the largest population in the world today. And more importantly the established oral markets that we have in India. Volume wise, if you consider all the volume of the oral consumption in India it is higher than the consumption of oral elsewhere in the world.

In short, the growth prospects in India are enormous, and I personally think it is more than reasonable to continue to collect dividends and not sell the share. Anyway, the growth will mainly be in the combustible portfolio and oral consumption, as the Indian government has banned the sale of electronic cigarettes and heated tobacco.

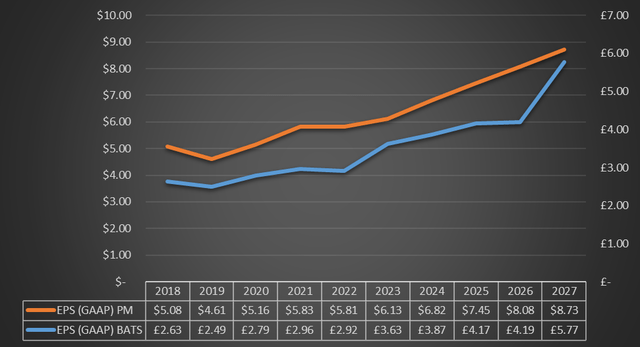

TIKR Terminal analysts expectations

Overall, from an earnings perspective it is difficult to say between Philip Morris and British American Tobacco which one is better, as both have performed well in the past and estimates for the future are sound as well. Whether EPS come from products that are less harmful to health or not matters little to the market, the only thing that matters is that they increase over time. At least for the time being, the combustible market tobacco is still flourishing especially in young high-growth countries such as India; therefore, the problem does not arise for British American Tobacco. In the future, however, 10-15 years from now, relying too much on cigarette sales may prove to be a mistake as this market in the West has been in decline for decades.

Next-generation products

As previously discussed, while still in business, the combustible tobacco market seems destined for gradual decline in the long run, and it is necessary for tobacco companies to make a transition to less health-damaging products. This move would benefit both the companies themselves and consumers:

- Consumers would gain health.

- Tobacco companies would be viewed less negatively and could count on consumers whose life expectancy is longer.

What's more, some of the new products in circulation while less harmful have even higher amounts of nicotine than classic cigarettes; this would only make it even more difficult to quit smoking completely.

In short, this is an almost inevitable transition whose foundations, however, must be built now so as not to risk falling too far behind the competition when the combustible tobacco market is already too weakened. In this respect, as I had already anticipated, I believe that Philip Morris is ahead of British American Tobacco and now I will show you why.

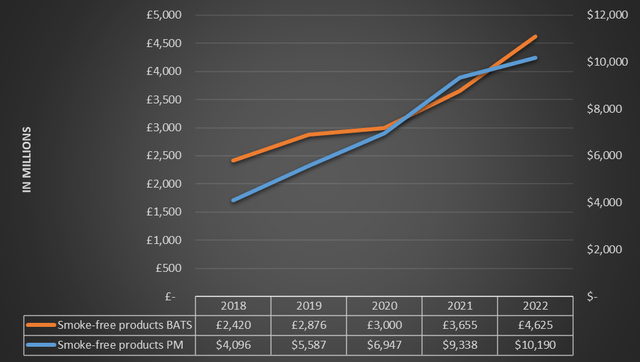

Data obtained from each annual report of both companies

For both, the growth of smoke-free products has been quite rapid, but in the case of Philip Morris, its revenues have been about twice as high. In terms of weight in total revenues, for Philip Morris about 35% is already independent of combustible tobacco, while British American Tobacco is only at 15%. Moreover, in the case of the former, this product category is already profitable, while for the latter, profitability is expected by 2024.

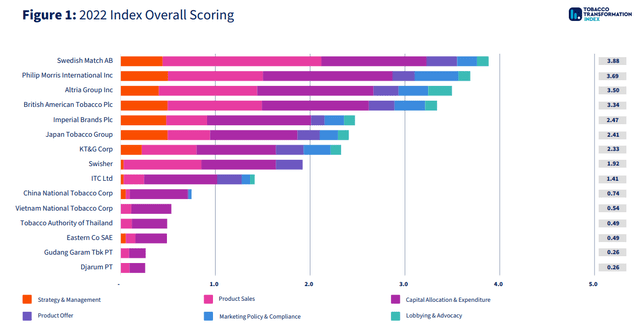

Thus, Philip Morris is more willing to innovate and the Tobacco Transformation Index® also supports my thesis. This index assesses tobacco companies' commitments and actions on tobacco harm reduction. A score of 5 represents high progress, a score of 0 no progress.

As we can see from this image, Philip Morris with a score of 3.69 is in second place, while British American Tobacco is in fourth place with 3.34. But there is more.

In first place with 3.88 points is Swedish Match, which is Philip Morris' last major acquisition costing $16 billion.

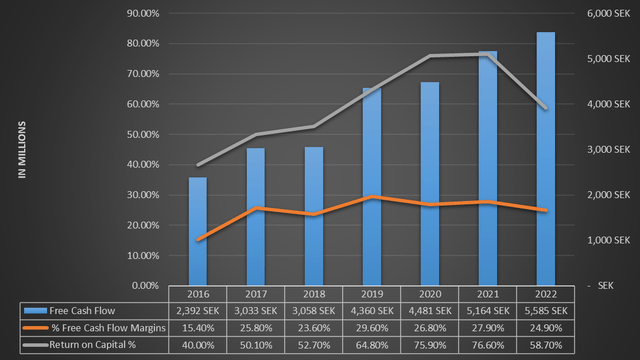

Swedish Match is not a bet but a leader in its industry. Its free cash flow has been growing year after year since 2016 and has a margin often above 25%; in addition, the return on capital is huge. Beyond these great numbers, I think one of the main reasons for the acquisition was to get ownership of Zyn, a fast-growing leading brand of nicotine pouches.

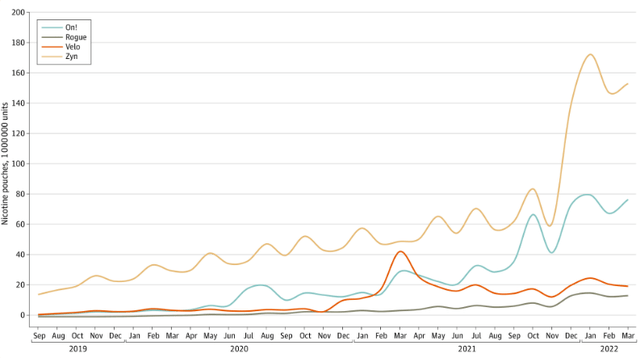

With a 58.80% market share Zyn at the beginning of 2022 dominated the market in the U.S. and has a significantly more important position than Velo, the British American Tobacco-owned competitor. In addition, given Zyn's rapidly increasing popularity, I would not be surprised if the gap widens in the future.

Huge improvements have been made since 2017 and the growth does not seem to stop. According to Q1 2023, category share has reached 67.30%; almost a total dominance.

In any case, the acquisition of Swedish Match is not the only reason that leads me to believe that Philip Morris' smoke-free portfolio is ahead of the competition.

The purchase from Altria for the IQOS U.S. rights for only $2.70 billion will greatly increase Philip Morris' exposure in the world's largest smoke-free market. This agreement will be effective as of April 30, 2024, and will further reduce reliance on the combustible portfolio.

IQOS is already a success internationally, and I expect its popularity to explode in the United States as well; its users are increasing quarter by quarter and have reached 25.8 million. This brand is now a fad and this could strengthen Philip Morris' competitive advantage. In addition, unlike classic cigarettes, this product is more widely used among middle- and upper-income people, the younger generation, and makes personalization its strong point.

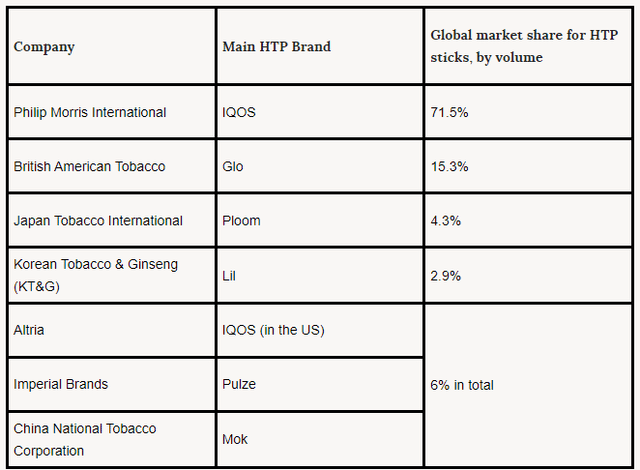

IQOS is the most popular HTP brand, and British American Tobacco still lags behind with Glo, although it has seen good improvements in recent years.

Either way, it should be emphasized that Philip Morris is not ahead of the competition in every single product that is less harmful to health. From the beginning, it was clear that the company saw HTPs as the main less harmful alternative to cigarettes, but in doing so it overlooked the e-cigarette and vaping market. The latter was worth $22.45 billion in 2022 and is expected to have a CAGR of 30.60% through 2030.

In this category, British American Tobacco is way ahead and has a 42.2% market share with the Vuse brand. In second position is JUUL with 26.10%.

Overall, I consider Philip Morris to be the best tobacco company in terms of revenue quality, as 35% comes from next-generation products. IQOS could be a gold mine, Zyn as well, which is why I am not worried if Philip Morris does not also dominate the electronic cigarette market. In my opinion, focusing on the first two is more than enough to ensure long-term growth.

On the other hand, British American Tobacco has taken a different approach by focusing more on e-cigarettes rather than for HTPs. In fact, the results are clear: Vuse is leading the market, Glo is not. For the other categories, while present, British American Tobacco does not have a dominant market share.

Valuation

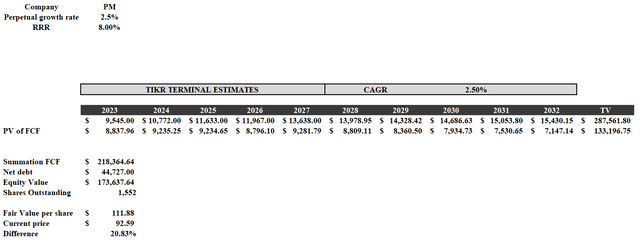

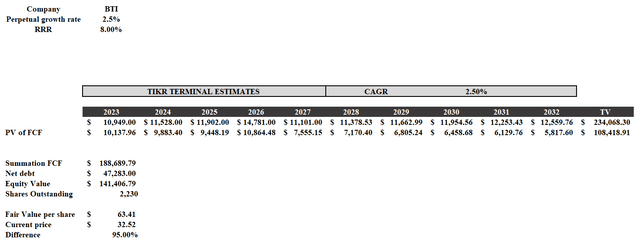

In the previous paragraphs, I focused on an income comparison; now I will calculate the fair value of both companies. I will use two discounted cash flows that will be constructed according to the following assumptions:

- Since British American Tobacco is not a U.S. company, I will conduct a number of operations to facilitate the comparison. The first is that I will convert the figures from GBP to US$; the second is that I will use an RRR of 8% for both.

- The estimates of expected cash flows from 2023 to 2027 belong to TIKR Terminal analysts. From 2028 onward, a CAGR of 2.50% will be considered for both until 2032; The perpetual growth rate will also be 2.50%.

In the case of Philip Morris, the fair value is about $111 per share, so a modest undervaluation is present.

In the case of British American Tobacco, the fair value is about $63 per share, significantly higher than the current price per share. Even considering a CAGR of 0% and a perpetual growth rate of 0%, British American Tobacco would still be undervalued, as its fair value would be about $42 per share.

Personally, since they are large, well-priced companies, I have invested in both, but British American Tobacco presents a higher weight in my portfolio. Although I prefer Philip Morris because of its long-term strategy, I believe that British American Tobacco at $32 per share is too great an opportunity to overlook: Philip Morris is slightly undervalued, British American Tobacco is on another level. Suffice it to say that the NTM Market Cap / Free Cash Flow is only 6.56x while the historical average over the past 10 years is 13.75x.

Certainly, its growth prospects are not in double digits, but as I showed you earlier the combustible portfolio still has growth prospects and the smoke-less portfolio is gradually growing albeit still little relevant in terms of total revenues. Currently, I think it is hard to find a more undervalued consumer staples.

Dividend

Another reason why I invested in these two companies is that their dividends are, in my opinion, among the best around. In the current uncertain environment, investing in consumer staples that issue a high and sustainable dividend could be a good way to reduce portfolio volatility in the second half of 2023. Personally, after the NASDAQ's strong recovery, I noticed that my portfolio had become too skewed toward the tech sector and I needed to invest in less risky companies that could reduce its volatility.

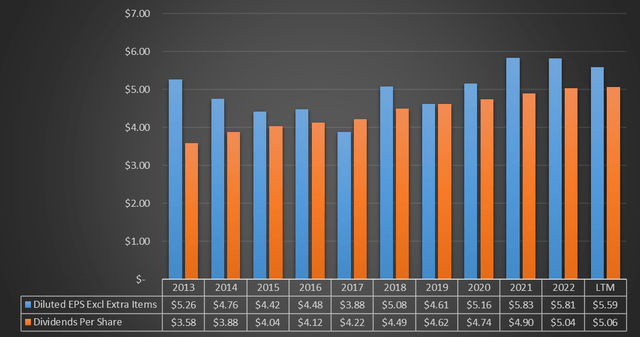

In the case of Philip Morris, the dividend yield is 5.42%, above the historical average for the past 10 years of 4.84%.

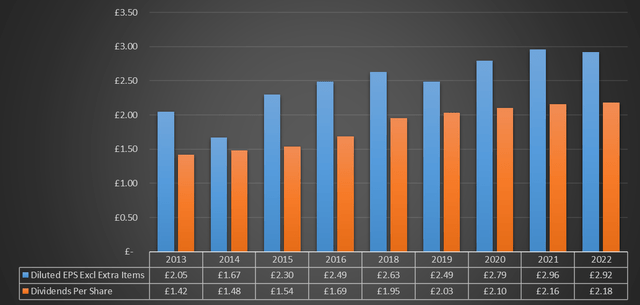

With the exception of 2017 and 2019, diluted EPS has always been higher than dividend per share, which has made dividends sustainable over the past 10 years. The payout ratio has always been quite high, but despite this Philip Morris has managed to issue an increasing dividend per share. Given the growth prospects analyzed before, I expect this to continue in the coming years.

In the case of British American Tobacco the dividend yield is significantly higher, 8.31%. Here again we can see how undervalued this company seems since the average over the past 10 years has been 5.82%.

The dividend looks sustainable, probably even more than that of Philip Morris since the payout ratio is lower. The upward trend is evident for both EPS and dividend per share. I deliberately avoided the inclusion of the year 2017 as it presented misleading data that did not allow for the best observation of long-term growth.

Overall, both Philip Morris and British American Tobacco are two companies whose dividend is their strong point. Anyway, in this respect I prefer the latter since the dividend yield is higher but no less sustainable. Finally, it is worth noting that since two companies are not from the same country, taxation will be different depending on the residence of the investor. This may make one dividend more attractive than the other.

Debt analysis

As a final aspect of this comparison between these two companies I will analyze their financial situation.

Everyone knows that tobacco companies are highly indebted as they tend to make acquisitions in the range of billions of dollars; however, it should be made clear that high debt is not necessarily a problem. It becomes so when it is not sustainable, which is probably not the case with Philip Morris or British American Tobacco at present.

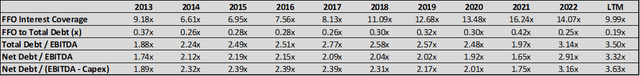

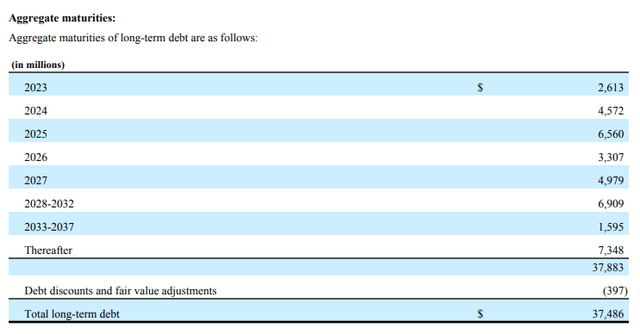

Philip Morris annual report 2022

In the case of Philip Morris much of its debt is over the long term and does not have an excessive cost. The weighted average time to maturity of long-term debt is about 8 years according to the latest annual report. In addition, fixed rate prevails over variable rate and the total weighted average financing cost of total debt is 2.5%.

Finally, as can be seen from this table, the main debt ratios seems all under control although worse than in the past. The acquisition of Swedish Match weighs on this, but as discussed, I believe in the potential of this investment.

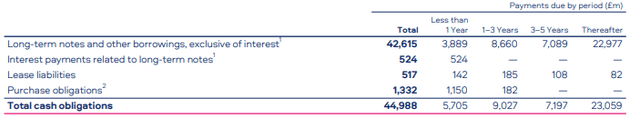

British American Tobacco annual report 2022

Similar discussion for British American Tobacco, whose average debt maturity is 9.9 years but will face maturities of about £4 billion per year over the next 2 years. This debt will be refinanced at higher rates, which will increase the cost of debt. Anyway, there seems to be no particular concern by looking at debt ratios.

Since its debt peak in 2017 following the acquisition of Reynolds for $49.40 billion, British American Tobacco has been able to improve its debt sustainability year after year.

Overall, it is true that these companies have tens of billions of dollars in debt, but it is worth putting their financial position in context with their earning capacity. Philip Morris has debt of $44.72 billion but generated free cash flow of $9.72 billion in 2022; British American Tobacco has net debt of £39.11 billion but generated free cash flow of £9.87 billion in 2022. No debt is too high as long as you earn enough to pay it back.

Philip Morris seems slightly more distressed than British American Tobacco, but then again it was quite predictable given the recent acquisition of Swedish Match for $16 billion. Gradually this debt will be repaid in my opinion; after all, the same has happened to British American Tobacco since the Reynolds acquisition.

Risks

As much as I believe that these two companies are excellent investments, it is always wise to point out that they are not without risks; on the contrary. In their specific case, I have identified three:

- The first risk is that estimates of the resilience of the combustible tobacco market are wrong. Since the latter is still their main source of revenue, if its decline is more rapid than expected there would be quite a few problems. In the case of Philip Morris, if this risk were to materialize it might have less serious consequences since smoke-less products already have a major weight in total revenues. In the case of British American Tobacco, revenues would suffer from high downward pressure.

- The second risk is related to ethical and regulatory factors. We all know how harmful cigarettes are and how many constraints the companies that produce them have to comply with. Every year the restrictions seem to get tighter and tighter, with some countries even banning smoking for future generations. At the moment combustible tobacco remains the main problem, but we cannot rule out the same happening to smoke-less products; by the way, it has already happened in India as we saw earlier. The latter are less harmful but certainly not healthy.

- The third risk is related to competition. In this article I have compared the two tobacco companies that in my opinion are the best in terms of revenue quality and undervaluation, however, competition is strong. Imperial Brands, Japan Tobacco, Altria Group are just some of the companies that will compete for the largest market share in the coming years. In particular, I am referring to the new product categories that are coming out. On the one hand, it is true that IQOS is the leading brand in HTPs, but we cannot assume that this will be the case in the future. History has taught us that whoever comes first in a market will not always be the leader in the future. The same is true for British American Tobacco with the Vuse brand.

Conclusion and final thoughts

Both companies are in my view a great investment, as leaders in a century-old market and traded at reasonable prices. Philip Morris has a more attractive smoke-less portfolio and recent investments will probably validate it even more; British American Tobacco is gradually improving it but is still very focused on the combustible tobacco market.

The dividend is high and seems sustainable for both, profit margins are high, and their competitive advantage in a low volatile market makes their future cash flows more predictable than in other sectors. While I believe both are at a discount, British American Tobacco currently has a price per share far too low relative to its fair value, which is why I am more invested in the latter. I expect as early as the next few months that the market may understand the value of this company; if not, I will still be happy to get a dividend yield above 8%.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PM, BTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.