Apart from debt, equity and gold, multi asset allocation funds can also invest in silver, units of REITs & InvITs, as well as overseas equities.

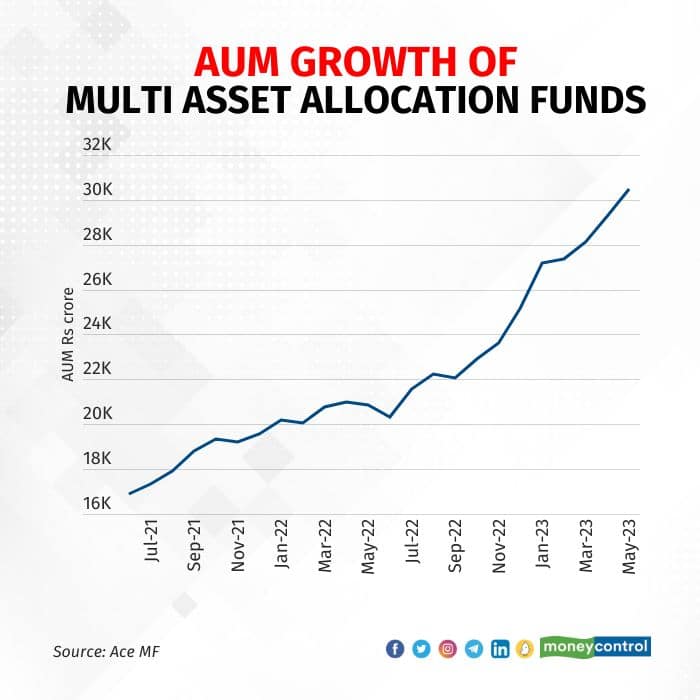

Thanks to the debt taxation change in the recent Union budget, Indian asset management companies have turned their attention to Multi Asset Allocation Funds (MAAF), with Bank of India Mutual Fund and Kotak Mutual Fund filing for schemes under this category with the regulator.

Multi Asset Allocation Funds, which come under the hybrid mutual fund category, invest at least 10 percent of their assets in at least three asset classes, with a minimum allocation of at least 10 percent to each.

Apart from debt, equity and gold, some funds also invest in silver, units of REITs & InvITs, as well as overseas equities.

Under the changes to the Finance Act, gains from investments in mutual funds, where not more than 35 percent is invested in domestic equities, will now be taxed at the slab rate of the investor.

This means that debt mutual funds no longer enjoy the benefits of long-term capital gains (LTCG) and indexation for fresh investments starting April 1, 2023.

Experts say the ultimate gainer from the changes in the taxation would be certain hybrid funds, which invest in a mix of debt and equity.

New schemes

As per the draft Scheme Information Document (SID) of the Bank of India Multi Asset Allocation Fund, the fund will invest in equity, debt, gold exchange-traded funds (ETFs), as well as units issued by REITs and INVITs.

The benchmark of the scheme would be 37.50 percent of the Nifty 500 TRI + 50 percent of the Nifty Composite Debt Index + 12.50 percent of domestic prices of gold.

The asset allocation pattern of the scheme would be Equity & Equity related instruments (35-40 percent), Debt and Money Market instruments (45-55 percent), Gold ETF (10-15 percent) and units issued by REITs and INVITs (0-10 percent).

On the other hand, Kotak Multi Asset Allocation Fund will invest in equity, debt and money market instruments, commodity ETFs and Exchange Traded Commodity Derivatives.

The benchmark of the scheme will be the Nifty 500 TRI (65 percent) + Nifty Short Duration Debt Index (25 percent) + Domestic Price of Gold (5 percent) + Domestic Price of Silver (5 percent).

The indicative allocation of the scheme is 65-80 percent to equity and equity related instruments, 10-25 percent to Debt and Money Market Securities, 10-25 percent to Commodity ETFs, Exchange Traded Commodity Derivatives (ETCDs) and any other mode of investment in commodities as permitted by SEBI, 0-15 percent to overseas Mutual Fund schemes/ ETFs/Foreign Securities and 0-10 percent to units of REITs & InvITs.

.

.

Recent launches

The Radhika Gupta-led Edelweiss Asset Management Company recently launched a multi asset allocation fund, which will predominantly be fixed-income oriented, with exposure to equities, gold and silver.

The Edelweiss Multi Asset Allocation Fund (EMAAF) is open for subscription till June 19. The objective of the fund is to have a fixed-income oriented allocation with the indexation benefit for gains on units if held for more than three years.

Experts believe that the new fund could be a reaction to the changes to mutual fund taxation, which have made debt funds less attractive on a post-tax basis.

Apart from the usual suspects, the scheme also invests in foreign equities, which is rare in multi asset allocation funds.

In total, five new funds have been launched under the multi asset allocation category over the past year.

Why the rush?

The number one reason for the influx of multi asset allocation funds is to attract money from investors with a moderate risk profile. Many such investors used to invest in a mix of equity and debt MF schemes as they were tax efficient.

However, when debt funds were brought at par with fixed deposits from the taxation point of view, the mutual fund industry started pitching hybrid funds as a tax-efficient means to take exposure to fixed income. Multi asset allocation is a relatively less volatile vehicle compared to aggressive hybrid equity schemes, and it also offers indexation benefits in case the equity allocation is maintained between 35 percent and 65 percent.

Also read | With RBI hitting a pause, what happens to your EMIs?

However, it is yet to be seen what structure the funds by Bank of India Mutual Fund and Kotak Mutual Fund will take — equity taxation or debt taxation.

Going by asset allocation, Bank of India MAAF is expected to be a hybrid fund, wherein the gains on units sold after three years will be eligible for an indexation benefit. Since Kotak MAAF wants to allocate a minimum of 65 percent to equities, it should be taxed as an equity fund.

Rushabh Desai, Founder, Rupee With Rushabh Investment Services suggests that investors shouldn’t consider multi asset allocation funds as equal to debt mutual funds.

“If someone wants to go from a tax benefit point of view, then multi asset allocation funds will come with their own set of risks. Don’t be in this category just for the indexation benefit. Keep in mind that multi asset funds will have a higher degree of risk than the traditional high credit quality debt products,” Desai said.

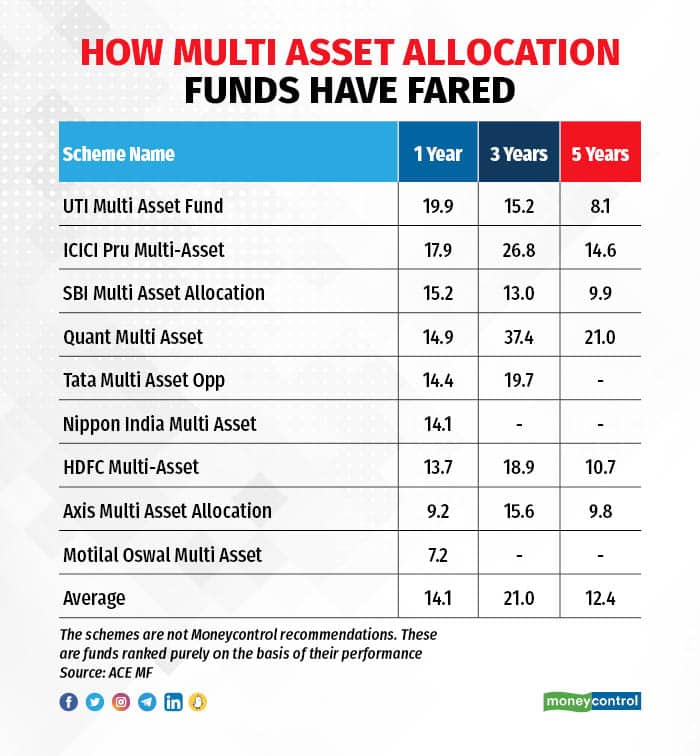

Given the allocation to risky assets such as equity and commodities, especially those schemes with minimum 65 percent to stocks, there can be high volatility in the short term. For example, in the month ended March 23, 2020 (covid-induced market crash), some MAAFs with minimum 65 percent allocation lost 22-27 percent. Though allocation to gold is expected to act as a hedge, the portfolio can exhibit volatility, which may not suit most conservative investors.