Delta Air Lines: Ready For Takeoff

Summary

- Delta Air Lines stands out amongst its peers due to its large size, solid financial results, and robust operational execution.

- Delta boasts better ROA, ROE, and ROTC metrics than competitors.

- The airline continues to pay down debt aggressively, which improves the risk profile of the company considerably.

- Selling put options on Delta Air Lines can generate immediate income for investors, increase margin of safety in the stock if assigned, and allow investors to profit even if the share.

Lukas Wunderlich

Delta Air Lines (NYSE:DAL), the largest domestic player in the commercial airline industry, stands out amongst its peers due to its large size, solid financial results, and robust operational execution. Despite the highly volatile market conditions of the last few years, the company has consistently demonstrated stability and an ability to produce profit, cementing its status as top dog in the sector. Currently, the company trades at an attractive valuation, both in comparison to pre-pandemic levels, but also compared to industry peers. With a hot travel season around the corner, DAL is poised to deliver great results and build on the momentum it has gained coming out of the pandemic.

However, we don't think buying shares in Delta directly is the best way to play it. Rather than purchasing shares outright, a less risky and potentially more profitable strategy may be in play: selling put options. This strategy can generate immediate income to investors, increase margin of safety in the stock if assigned, and allow investors to profit even if the share price remains stable or decreases moderately.

Financial Results

A look at Delta's financial performance reveals strong overall results.

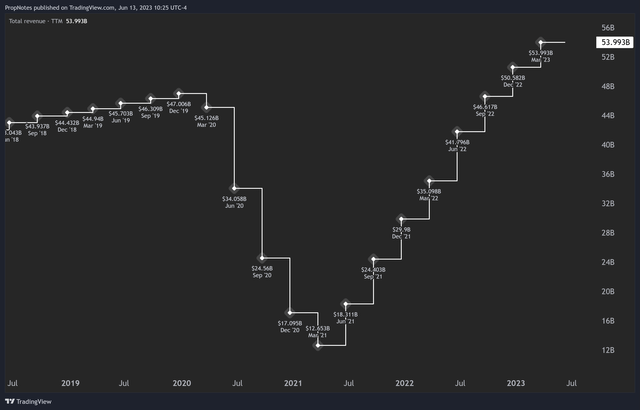

Recently, the company has shown rapid top-line growth as it has emerged from the pandemic slump, with recent TTM revenue soaring to an all-time high at $54 billion, a 53% increase year-over-year:

TradingView

This growth appears to be driven by a 23% rebound in load factor post pandemic, in addition to increased flight capacity of more than 18%. While the company guided a bit higher on flight capacity than it was able to deliver in the most recent quarter, more flights and more people on each flight equals the robust top line revenue growth we're seeing on the chart above.

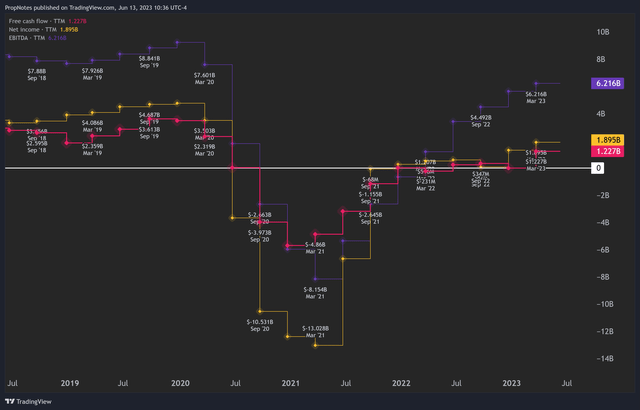

Revenues mean scant little without profits, however. Has the company been able to translate this surge into retained earnings? Indeed, it has:

TradingView

Whether you’re looking at Net Income, EBITDA, or FCF, profits have recovered from pandemic lows. While they haven’t recovered to the degree that revenue has as a result of higher input costs (Labor and Fuel); as those pressures ease, investors should see continued progress on this front.

Additionally, management sees more opportunities to sell premium seats in the coming quarters, so this should boost margins and unit economics as well.

Liquidity

On the liquidity front, the company maintains a solid cash balance of $6 billion, and continues to use cash flow to pay down debt. In the last quarter alone, the company produced 2.2 billion in unlevered free cash flow, $1.2 billion of which it used to pay down its large debt burden. This included almost $700 million in accelerated debt repayments, in addition to normal responsibilities.

However, the balance sheet is where we do see some issues for Delta. While assets and solvency are good, and cash flow remains well ahead of financing costs, the company does carry a significant amount of overall debt. This includes $18.5 billion in long term debt, in addition to ~$20 billion in other non-current liabilities.

Sure, running an airline is a capital-intensive business, there's no way around that. However, assuming the company doesn't pay off all of this debt at once, it's likely that the company will issue more over time as it manages its liquidity.

This is the issue. Currently, rates are rather high, which means that Delta may end up adding a LOT of expensive debt to its balance sheet. This hasn’t shown up on the cash flow statement yet, but it may hamper the company’s ability to return capital to shareholders in the medium/long term.

The silver lining here is that management has historically proven adept at managing these issues. However, higher interest rates will likely end up having some sort of impact here.

Valuation

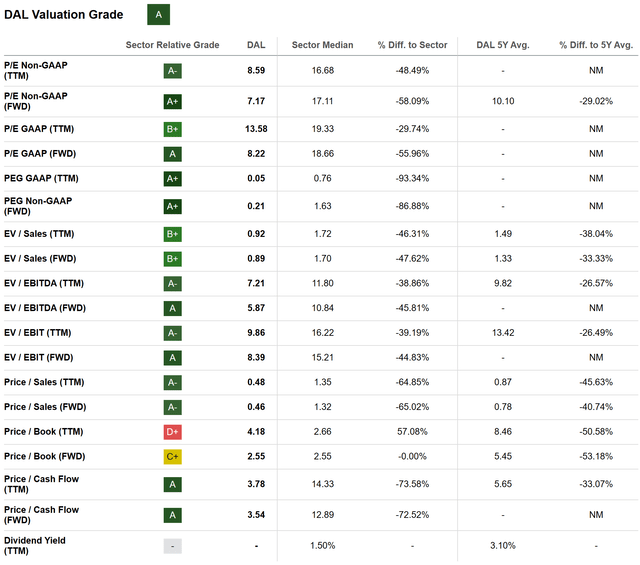

While the company is on solid financial footing and continues to execute from an operating perspective, the company’s current valuation, at only 8 times forward GAAP earnings, is what really has our mouths watering.

Seeking Alpha’s Quant Rating system grades Delta's current value at an “A”, a rating we wholeheartedly endorse:

Seeking Alpha

Delta is currently trading at, in some cases, more than 30% discounts vs. historical revenue and profit multiples. Price to Cash Flow sits a 33% discount to past years, along with 45%, 26%, and 29% discounts for Price to Sales, EV/EBITDA, and FWD Non-GAAP P/E, respectively.

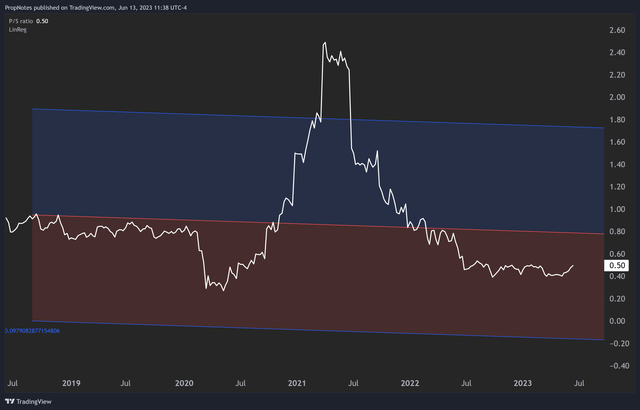

You can see this illustrated here by looking at Delta's Price to Sales over the last 5 years:

TradingView

One could argue that COVID skews the results here, but even so, it’s still trading firmly below where it was pre-pandemic at only 0.5x revenue.

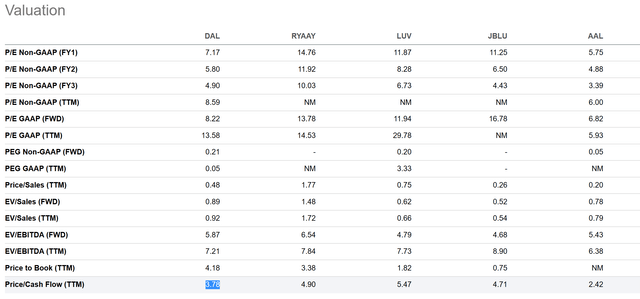

However, it’s not only historically cheap, but also attractively positioned compared to its competitors:

Seeking Alpha

Here, Delta scores the cheapest or second cheapest marks on almost all of the metrics above, including P/CF, Non-GAAP P/E, PEG, and more.

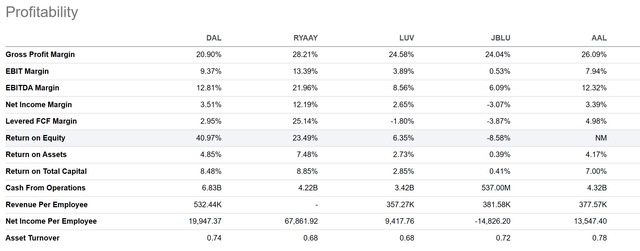

This doesn’t make a lot of sense when you compare the company’s relative Return on Equity, Return on Assets, and Return on Total Capital, which are all head and shoulders above peers:

Seeking Alpha

Taken together, the company’s solid operations and attractive historical/relative valuation and performance make this a juicy looking setup for investors.

The Trade

What if there was a way to generate returns immediately, while still getting exposure to Delta?

You can - with a strategy called put selling. We think it’s the best way to take advantage of DAL's stock and underlying operations. Company stability isn’t really in question here, so what we should be asking ourselves is how to get a return on capital as quickly as possible for our risk. Selling puts seems like the best way.

How does selling puts work?

When you sell a put option, you're essentially agreeing to buy the underlying stock at a certain price (the strike price) before a specified date (the expiration date). If the stock price remains above the strike price, the put option will expire worthless, and you keep the premium you received for selling the option. If the stock price falls below the strike price, you will be obligated to buy the stock, effectively at a discount when factoring in the premium received, and vs. today’s fair market value.

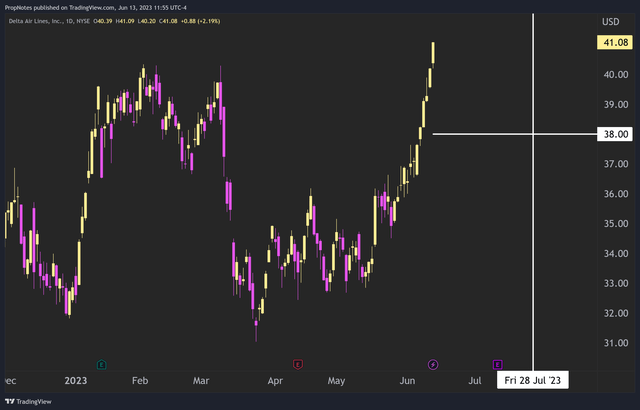

In the case of Delta, which is currently trading around $41 per share, one might consider selling a put option with a strike price of $38, expiring on July 28th:

Expiration & Strike (TradingView)

Right now, premiums for this option are around $0.62 per share. This means that for every contract you sell, you get $62 in cash immediately. As each contract requires $3,800 in capital to sell, a $62 cash premium earns you 1.66% over the next 45 days, which annualizes to a cool ~13.4%. This is a great way to generate cash off of Delta immediately, while still having the opportunity to purchase shares should they drop over the next 6-7 weeks.

Risks

This trade idea presents a potential return, but there are some risks to think about as well:

Earnings: This option expires after the earnings report on July 13th, where anything could happen. If the stock drops 9% or more, as a result of earnings, or as a result of an event between earnings and late July when the option expires, you may be assigned shares at an unfavorable price vs. where the market is trading. This isn't any worse than simply owning the stock, but being short puts could result in put sellers acquiring share significantly above the market, which could cause losses.

Debt: Although Delta's debt levels are manageable, any significant deterioration in financial performance or company execution could make servicing debt more challenging and increase the risk of default.

Macro: Delta is subject to broader macroeconomic risks, including interest rate fluctuations, economic downturns, and changes in government policies that could impact the Airline sector. Downturns could hamper demand and slow growth, and labor laws could increase labor costs.

Commodity-linked: Delta relies on fuel as a main variable cost of revenue. Volatility in the price of fuel could directly impact the company's profitability and, ultimately, its stock price.

Technical Sentiment: DAL stock is almost overbought according to the weekly RSI, which means that there is a heightened risk of a medium-term pullback. This could cause option assignment or losses.

Summary

In summary, Delta Air Lines presents a compelling opportunity for investors due to its solid profitability and attractive valuation. Delta's operational plan, improving financial performance, and adequate liquidity offer a stable platform on which we can sell puts for an attractive yield. Ultimately, even if assigned stock, the company presents a great value proposition for long-term investors, given the positive characteristics we’ve discussed.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DAL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.